Donald Trump speaks at the Nashville Bitcoin Conference. (Danny Nelson/CoinDesk)

Donald Trump speaks at the Nashville Bitcoin Conference. (Danny Nelson/CoinDesk)

Despite popular narrative suggesting a strong positive correlation between Bitcoin’s (BTC) recent price performance and Republican candidate Donald Trump’s odds of winning the U.S. presidential election, market data suggests otherwise.

Crypto market experts have been linking the Republican candidate’s performance on the betting markets to the price of Bitcoin since Trump met with Bitcoin miners in mid-June. This narrative gained strength after Bitcoin came under pressure earlier this month after Trump escaped assassination in July and due to a resurgence in betting markets for Democratic candidate Kamala Harris.

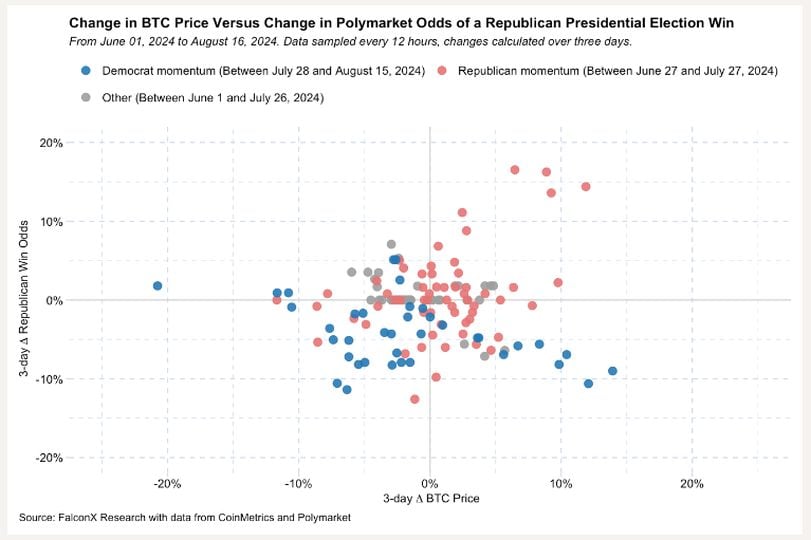

However, an analysis by prime broker FalconX of the three-day change in BTC prices and the three-day change in Polymarket odds of Trump winning the presidential election between June 1 and August 15 showed a lack of a clear trend or significant correlation between the two variables.

The chart shows a lack of clear correlation between changes in Republican odds and changes in BTC prices. (FalconX)

The chart shows a lack of clear correlation between changes in Republican odds and changes in BTC prices. (FalconX)

The X-axis shows the three-day percentage increase or decrease in BTC prices between June 1 and August 15. The Y-axis shows the increase/decrease in the probability of a Republican victory. Data is sampled every 12 hours. Red dots represent the period between June 29 and July 29 when the odds of Trump winning the White House spiked on Polymarket. Blue dots represent the so-called Democratic momentum period. Gray dots represent the rest of the period between June 1 and August 15. The red dots show a scattered pattern, indicating that there is no connection between changes in Republican odds and changes in BTC prices. The blue and gray dots show a similar pattern. "Interestingly, there is no clear relationship between election odds and BTC prices over the entire analysis period of June 1 to August 15, 2024. One reason these relationships are weaker than expected could be due to the many crosscurrents that affect prices, such as the direction of U.S. monetary policy, concerns about an impending supply glut, and other factors we have previously highlighted," said David Lawant, head of research at FalconX, in an email to CoinDesk.

A number of headwinds, including a reported massive sell-off in the German state of Saxony and concerns about a large supply from creditors of defunct exchange Mt. Gox, have limited BTC’s upside since June, masking the shifting odds for the Republicans. Still, with Harris now focusing on crypto, the upcoming election could become a major driver of BTC’s price. “Of course, a lot can change before November 5th. It will be interesting to see whether market data reveals election news as a key driver, or even the dominant force, of price action as we get closer to Election Day,” Lawant noted.