Author: 0xNought Source: @0xNought

Today I talked with a friend about how blockchain is entering a new phase after Bitcoin in 2009 and Ethereum in 2014. Peer-to-peer electronic cash and smart contract platforms have become popular, so what’s next? No matter what it is, its original driving force is still “DAO”. Let’s talk about it in detail.

1. Exploration and development of DAO

The core of blockchain is the decentralized autonomous organization (DAO). Bitcoin is a DAO jointly promoted by miners, core developers, and Bitcoin holders, and has gradually developed to today. Inspired by Vitalik Buterin and others, Ethereum started this 10-year exploration journey by building a DApp platform with "DAO" as the core.

However, in the current atmosphere of PvP and small circles, the entire industry seems to be moving away from the original intention of DAO. This situation also happened between 2018 and 2020, when many mainstream forces were exploring "coinless blockchains", forming a trend similar to halalism, and other projects were similar to casinos. In the end, the positive externalities generated by DeFi platforms (such as server support brought by decentralized exchanges and lending), as well as the distribution of tokens controlled by protocols, brought DeFi Summer. This phenomenon entered the public eye through new proof-of-work methods such as "liquidity mining" and "IDO", and gradually spread to the traditional financial world.

DeFi protocol DAO has conducted a lot of experiments in the past. Whether it is SushiSwap, Curve, or YFI, DAO has become an optional option for organizations. Under new market conditions, we need to explore new ways of "proof of work" and "financing".

2. New “Proof of Work” Method

From the perspective of "proof of work", whether it is PoS or "liquidity mining", these methods are capital-intensive, and community members from disadvantaged groups do not have an advantage. However, community members have relative advantages in attention and social connections.

In a world where capital is over-concentrated, attention and social connections are relatively decentralized as factors of production. In a permissionless and trustless system, anyone can contribute openly and get rewards, take risks, co-create value, and share the results. In the process of changing production relations, DAO should play a greater role in these areas rather than capital-intensive industries. It is destined to be a small and micro organization for the community economy. These organizations are based on protocol control and token distribution, presenting the form of "automation at the center and humans at the edge". Social DAO is naturally suitable for gathering like-minded people in open communities to form open organizations.

3. New financing methods

The adoption of DAO-type organizations gives us another option besides "foundations" and small-circle startups. From a financing perspective, it cannot continue to adopt the "IDO" and "ICO" methods, which are not suitable for social DAOs.

After having initial liquidity, social DAOs can rely on the "tips" of community members to obtain financial support. This "tip" does not come from direct investment by members, but is obtained indirectly through staking rewards and other means. Specifically, the stakers stake PoS tokens on the PoS chain through social DAOs, and obtain DAO tokens by block, while the DAO receives staking rewards. We call it the Initial Staking Offering (ISO), which adheres to the original intention of "DAICO" proposed by Vitalik in 2018, while protecting supporters and moderately supporting the development of DAOs.

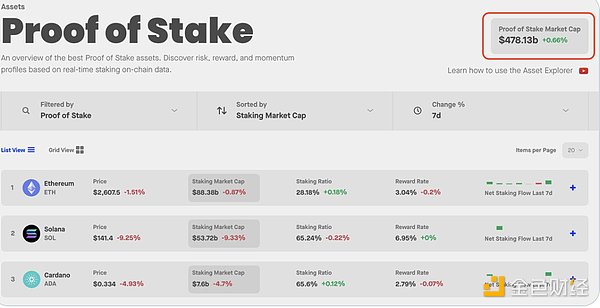

With the development of the PoS mechanism, the staking economy market has reached 150 billion US dollars. Based on a 5% staking income per year, the annual income can reach 7.5 billion US dollars. If 1%-10% of it forms a "DAO incubation fund", its scale can reach 75 million to 750 million US dollars.

Assuming that each social DAO requires $100,000 in funding per year, this amount of funding is sufficient to support the development of 750 to 7,500 social DAOs.