What is Astria – a decentralized sorting layer

"The Sequencing Layer"

Astria defines itself on its official website as follows: sorting layer . Want to know what sorting is? Why sort? Let’s first briefly review the basic operations of blockchain:

Blockchain operates in blocks, and nodes are responsible for executing work. When people initiate transactions on the chain, these transactions are first sent to the transaction pool, and the nodes select the transactions they want to process from the pool (usually gas The higher the fee, the easier it is to be selected), and then the node will sort these transactions. The sorting method may be according to the timestamp, or according to the most beneficial way for them, and then select the person responsible for creating it according to the consensus mechanism of the chain. The person who created the new block will package these transactions into the new block in this order. After the block is uploaded to the chain and confirmed by settlement, it will be finalized and become an unalterable transaction record.

The so-called sorting refers to the process of arranging the order of transactions that were originally out of order in the pool, and subsequent new blocks will package these transactions in the order.

Next question: Does transaction ordering matter? What value does this create?

MEV (Miner extractable value) miner extractable value

As mentioned in the previous paragraph, nodes perform work on the blockchain. Nodes are also called miners. They are the people who actually process all transactions, verification and records on the blockchain.

MEV: Between sending a transaction and being packaged into a block and uploaded to the chain, the profit that miners can make by adjusting the order of transactions or adding transactions between transactions becomes an on-chain transaction that you may not notice. travel expenses

The most direct way is to cut the queue in the middle, commonly known as sandwich attack:

If you want to know more about sandwich attacks, you can read this article:

Warning: Your trade may be under attack | Talking about sandwich attacks | Are you being front-runnered?

In addition, there are practices such as arbitrage and liquidation. Having the power to sort transactions can lead to a lot of profits. Users may not know it, but they are actually eating a lot of tofu secretly.

The figure below shows the atomic arbitrage scale of major public chains estimated by on-chain data tools. If sandwich attacks are included, the MEV scale can reach hundreds of millions of dollars a day and tens of billions or even hundreds of billions of dollars a year.

Source: L1 & L2 MEV

Mastering the power of transaction sorting means mastering MEV. Not only that, it is also related to the decentralization and censorship resistance in the core spirit of the blockchain.

Briefly describe the modular blockchain architecture

(Basic layered diagram of modular blockchain)

Modular blockchain is an existence relative to a single blockchain. A design in which one chain handles all functions is called a single blockchain. The advantage is simplicity, but the disadvantage is lack of flexibility and performance limitations.

Modularization improves performance through a hierarchical division of labor structure, the most common of which is Ethereum and layer 2. The execution is moved to layer 2, and then multiple transactions are packaged and summarized in a rollup manner to Ethereum for verification and settlement. Ethereum plays the role of the settlement layer.

Because Ethereum is responsible for verification and settlement, layer 2 enjoys the same security and decentralization as Ethereum in terms of finality, but there is a big difference before settlement.

Layer 2 does not necessarily need to run decentralized nodes. Most nodes may be actually controlled by the official, and transaction ordering is also centralized. All MEV is earned by the official, and because of centralization, transactions can be reviewed, and it can continue to reject certain transactions. Transactions initiated by users are always not included in new blocks, which violates the decentralization and censorship-resistant spirit of the blockchain.

This part is slightly complicated and requires a basic understanding of modular blockchain, layer 2, and rollup. Reference reading:

What is Modular Blockchain? Does Ethereum count? Why is it worth paying attention to?

What exactly is Layer 2? Taking stock of Layer 2 solutions

Astria, as a decentralized sorting layer, is between the execution layer and the consensus layer in the modular blockchain structure. It sorts the transactions received by the execution layer and sends them to the consensus layer to package new blocks; it operates in a decentralized manner. , does not prioritize the best interests of miners, but sorts transactions through open principles. Under decentralized operation, transactions cannot be censored, and it still retains anti-censorship characteristics.

At this point, we have understood the importance and value of the decentralized sorter, and then we will take a closer look at the Astria project.

Astria profile

Project name | Astria |

Token name | No coins have been issued yet |

The ecological track we are on | #modularblockchain #decentralizedsorter #rollup |

team member | Josh Bowen |Co-Founder & CEO Jordan Oroshiba |Co-Founder & CTO Christian Arita | COO Ryan Whitehead | CMO There is a more complete team list on the official website , with a total of 18 members listed. |

Financing history | 2023/April: US$5.5 million - led by Maven11, with participation from 1kx, Delphi Digital, Lemniscap, Robot Ventures, Figment Capital, Breed VC, etc. 2024/July: US$12.5 million - led by Placeholder and DBA, with participation from Maven11, 1kx, Bankless Ventures, Figment Capital, Hasu, Will Price, Jason Yanowitz, DCbuilder, etc. |

Official link | Official website https://www.astria.org/ Official Twitter https://x.com/AstriaOrg |

Astria project introduction

"Astria is building a decentralized sequencing layer that can be shared amongst multiple rollups." - Astria builds a decentralized sequencing layer that can be shared amongst multiple rollups.

Astria is a middleware blockchain that operates between blockchains and chains. It is hidden in the behind-the-scenes mechanism and is not accessible to ordinary users.

Rollup is a technology that packages and summarizes transactions. The execution layer packages multiple transactions into one, condenses and simplifies the transaction information, and submits it to the settlement layer for verification of settlement. This process is called rollup and is currently common in various layer 2s. The decentralized sorting layer established by Astria operates between the execution layer and the consensus layer and can be integrated into various rollups. This allows other rollups to not need to build their own decentralized sorters and can directly use Astria as a solution.

Technical architecture

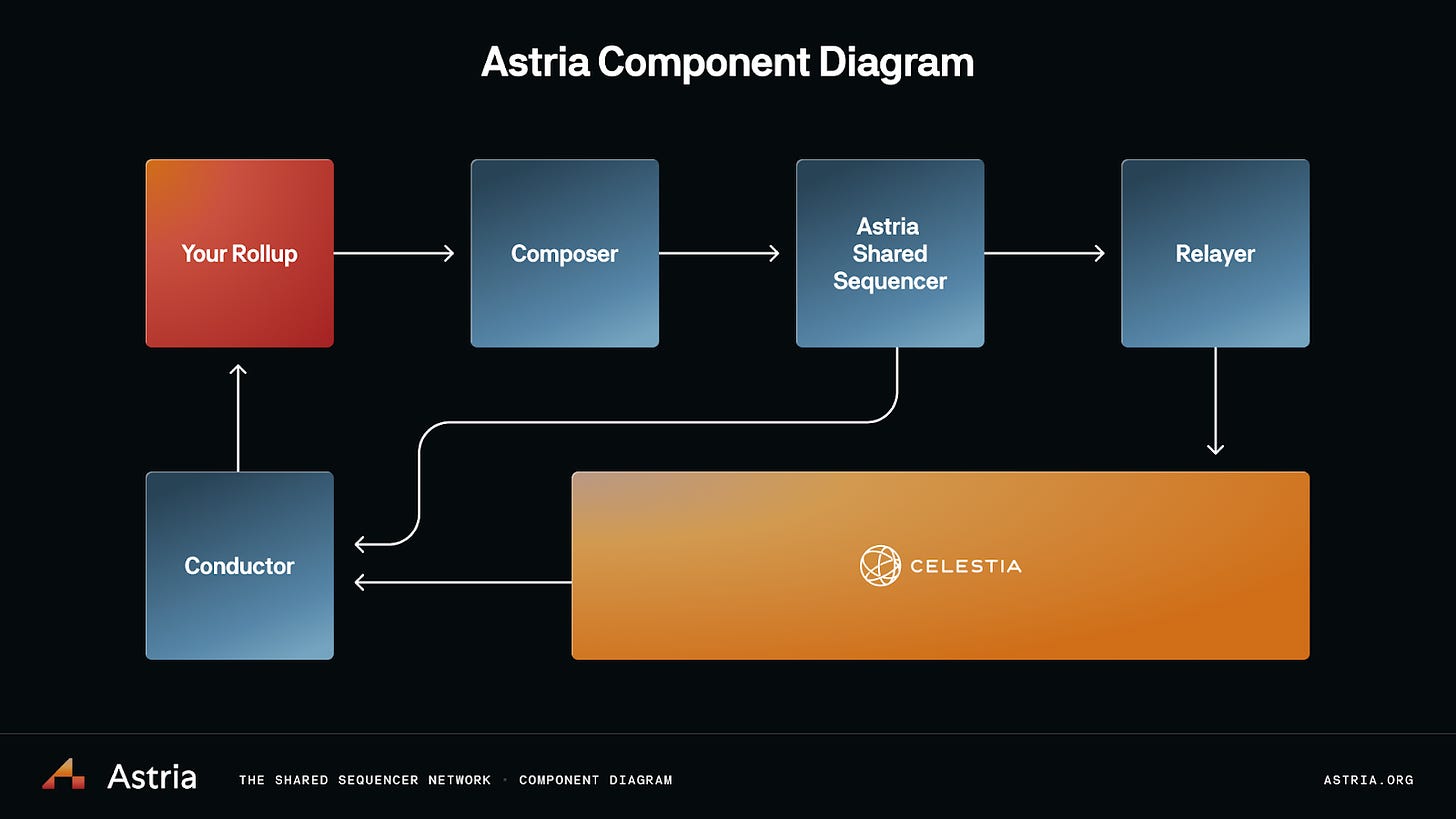

Let’s briefly understand the operation of Astria. After layer 2 receives the transaction, it is handed over to Astria for sorting. After arranging, layer 2 executes in this order, packages blocks, and rolls up to the main chain. Part of the handling fees of these transactions is allocated to Astria as compensation. .

Astria's operating process, excluding rollup itself, has five components:

Composer

Receive transactions from rollup, perform preliminary batch processing and optimization, and then send them to the sorter.Astria Sequencing layer

This is a network composed of decentralized nodes, using the CometBFT consensus mechanism, and its main task is to sort transactions.Relayer

Responsible for the transmission between chains, here it is to assist in transmitting relevant data to the data availability layer. The data availability (DA) project Astria cooperates with is Celestia.DA layer- Celestia

Distribute, verify and store data.Conductor

Do the final check at this stage, which can provide quick certainty (not final certainty yet), and then send the data to rollup to generate blocks and generate summary submissions. The final certainty will be after the main chain verifies the settlement.

Reference: https://docs.astria.org/overview/introduction

Astria EVM

An EVM rollup chain launched by Astria uses Astria's decentralized sorting layer and Celestia as the data availability layer. It can be understood as a layer 2 chain, and its main purpose is to make the Celestia ecosystem more active.

Reference: https://www.astria.org/blog/introducing-the-astria-evm

Astria Stack

A toolkit used to develop rollups, using Astria sorting layer and Celestia data availability layer. The first supported virtual machine is EVM. Developers can use this toolkit to create their own rollups.

Forma is the first rollup built using Astria Stack and was launched in May this year.

Reference: https://www.astria.org/blog/how-forma-uses-the-astria-stack

Ambush Astria Potential Airdrop - Using Forma Chain to Mint NFTs

Although the currency issuance plan has not yet been announced, the high amount of financing means that the primary market is actively participating. For ordinary people, the most direct way to participate in the primary market, besides ICO or IEO, is airdrops. But of course airdrops are potential opportunities, not yet For airdrop activities that have been publicly released, it is recommended to participate in an appropriate amount.

Why do veteran players in the crypto like to ambush potential airdrop opportunities?

Confirmed airdrop > clear rules, low risk > many participants > the pie will be small after distribution

Potential airdrops > Not necessarily, rules are unclear, risks are high > Participants are sparse > If there are airdrops, you can get a bigger share of the pie

However, due to the higher risk, be sure to participate at an affordable cost

The previous paragraph mentioned that Forma, built using Astria, is a project for on-chain creation. The most direct association of on-chain creation is NFT. There are some mint NFT activities on the website. The cost of mint is not high. You can consider participating in a moderate amount and doing some interaction. , betting on potential airdrop opportunities in the future.

Action: Minting NFT (the first wave has been minted at the moment of writing, you can follow Forma and wait for the next wave to open)

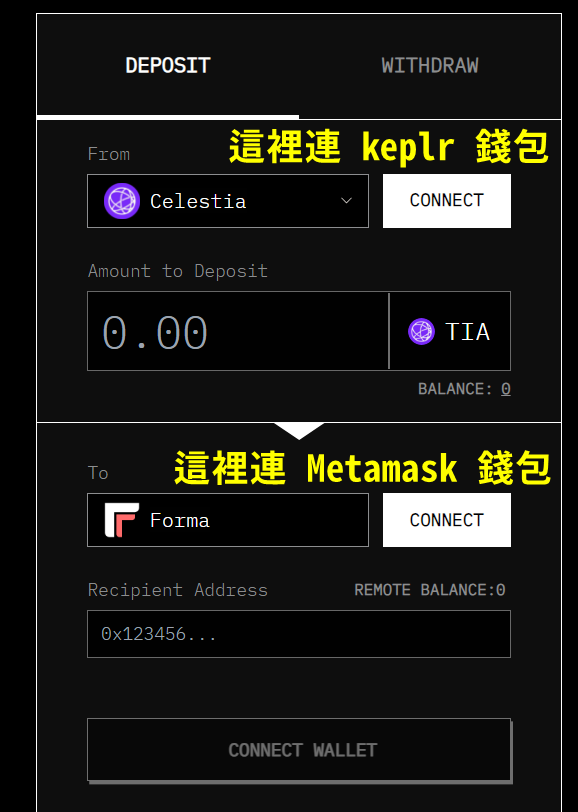

Prerequisite: Need to prepare $TIA The currency is on the Forma chain and can be transferred from Celestia

▌First get $TIA coins:

You can buy it from Binance Exchange and withdraw it to the Celestia chain. The Celestia chain uses the Cosmos wallet, and you can use the Keplr wallet.

Cosmos wallet tutorials and recommendations | Keplr wallet creation, transfer, and staking tutorials

From Celestia chain $TIA to Forma chain, use the official cross-chain bridge

▌Then go to the casting page:

As of this writing, casting has ended, and the next wave has yet to be announced. The previous casting prices were mostly between 0 - 3 $TIA, ranging from free to more than ten U. Plus the gas fee is the casting cost, which is not high.

The next wave of castings has yet to be announced. You can add the website to your favorites to check regularly, or follow Forma’s official Twitter to follow the latest news.

Summary- Blockchain technology is becoming more and more complex, and I hope the operation will become simpler and simpler.

As the blockchain develops in the direction of modularization, it becomes more and more complex in terms of technology and the richness of project themes. This should be considered a good thing, indicating that the blockchain is moving towards being able to bear increasingly large-scale and The direction of diversified application development has given rise to many new opportunities. For example, the data availability layer is a new track. Re-staking and AVS are also new tracks for shared security developed under a modular structure. There are also modules, for example. New applications such as co-processors in the blockchain.

A brief look at the potential of modular blockchain projects Celestia | Polygon Avail | Danksharding

What is the popular narrative "restaking" in vernacular? What is the derived AVS?

DePin + AI + co-processor, can Phala Network break out of the siege?

As the technology becomes more and more complex, the user interface should become simpler and simpler. For example, the Astria - decentralized sorting layer introduced in this article is theoretically invisible behind the mechanism, and users should not be able to feel it at all. Technology and structure should be hidden, and users only need to face simple and easy-to-understand interfaces. This part corresponds to the chain abstraction track, which is also a booming field:

What is "chain abstraction" in vernacular? Technical principles|Project introduction

However, when it comes to cryptocurrency investment, you will indeed face increasingly complex technologies and projects, and more and more information to digest, so it is important to do more homework and establish your own correct and credible information sources. You can pay more attention to this part. Coin Research:

▌Research and discuss with the Biyan community. Welcome to join the daily Biyan Chinese exchange group !

▌Subscribe to the daily Coin Research e-newsletter (1-2 articles per week to quickly understand market conditions, on-chain data and potential project developments)