The yen interest rate hike triggered a V-shaped reversal after the market plummeted. The fundamental data is positive, but the market will continue to face volatility risks in the short term.

Crypto Market Summary

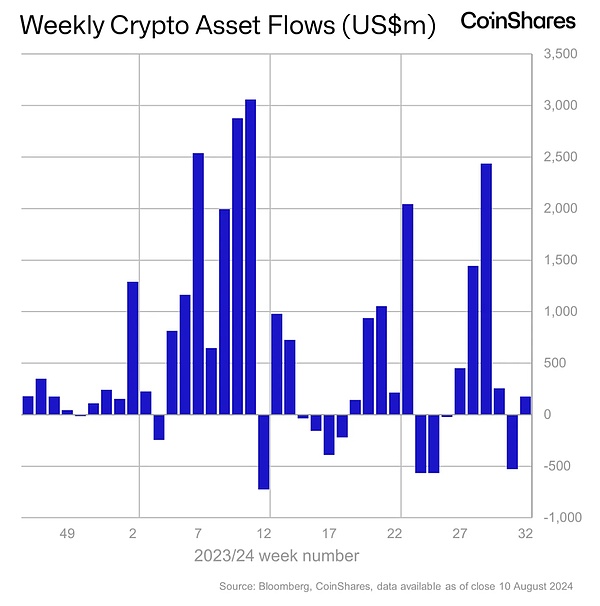

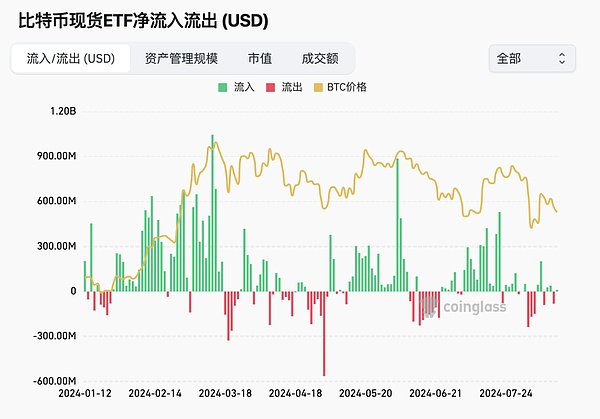

1. From August 1 to August 16, two weeks ago, the BTC market plummeted by 14.43% after the surge in late July, with the largest drop reaching 24.5% (August 5). The main reason was that the U.S. stock market was in a correction at a high level and technology stocks were under pressure, and the Japanese yen suddenly raised interest rates, causing capital panic. In the following week, the market gradually dispelled the panic, and both the U.S. stock market and crypto ushered in a V-shaped reversal. The V-shaped reversal is very rare, proving that the long-term supply of chips quickly hit the market to grab chips, which is very bullish for the capital market. It can also be seen from the U.S. stock market that a large amount of funds have poured in.

2. The world's first Solana spot ETF was approved by the Brazilian Securities and Exchange Commission (CVM) on August 7 and is currently awaiting approval from the Brazilian Stock Exchange B3. The fund will be launched in Brazil soon after approval. Given the growing market demand, the US Solana spot ETF product may also be launched soon.

3. On August 2, the U.S. Bureau of Labor Statistics released data showing that the U.S. non-farm payrolls data for July cooled across the board, with only 114,000 new non-farm payrolls, significantly lower than the market expectation of 175,000; the unemployment rate rose to 4.3%, triggering the critical value of Sam's Law. Affected by this, the optimism triggered by the Federal Reserve's interest rate cut took a sharp turn for the worse, and the "recession trade" replaced the "interest rate cut trade" as the main narrative in the market.

4. In terms of regulation, Republican Trump summarized his speech at the Bitcoin Conference, including Bitcoin in the national reserve and predicting that its market value will exceed that of gold. He promised that after being elected, he would force the SEC chairman to step down and retain the government's Bitcoin as a strategic reserve. Democratic Harris is also trying to win over the crypto community.

1. Market Overview

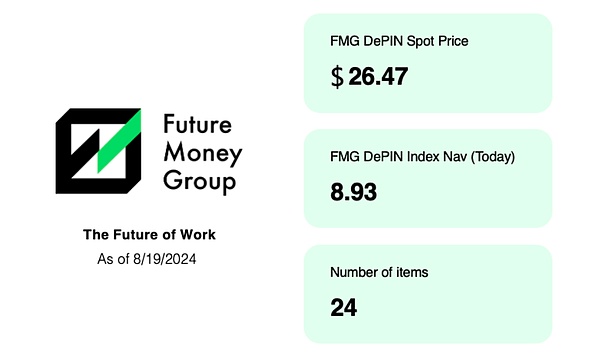

1.1 FutureMoney Group DePIN Index

The FutureMoney Group DePIN Index is a high-quality DePIN portfolio token index constructed by FutureMoney, which selects the 24 most representative DePIN projects. The initial value of the index is 10, with January 5, 2024 as the base period. As of August 19, the net value of the index was 8.93, down 22% from the last report. Among them, hnt is the most resistant to decline in this market, and Rndr continues to be observed.

1.2 Crypto Market Data

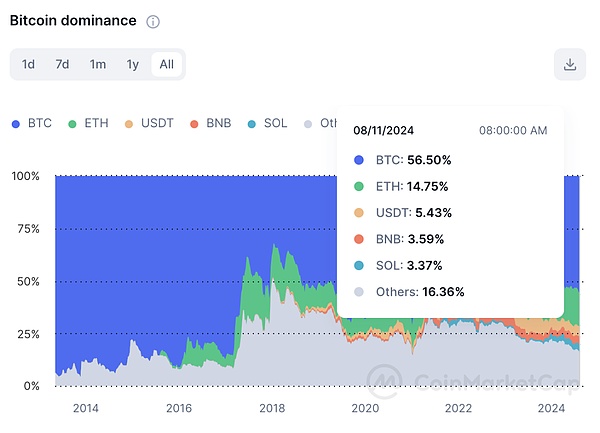

From August 1 to August 18, the market capitalization of stablecoins increased by $1.41 billion, an increase of 0.95%. Bitcoin's share of the total crypto market capitalization remained flat at 53.19%.

Observing the trend changes in Coinglass contract holdings, the bearish sentiment has eased.

In July, the total open interest of Bitcoin contracts increased to $36.9 billion, and continued to fall to $26.6 billion from August 1 to August 6, and then rebounded to $29.5 billion (August 16). The total open interest of Ethereum contracts fell from $14.4 billion on August 1 to a low of $9.734 billion (August 8), and then rebounded to $10.6 billion. The recent price drop caused by the market's expectations of a recession may be seen by institutions as a buying opportunity.

1.3 CPI/initial jobless claims/retail data and market reactions to market judgment

Within two days, there are three favorable macro data:

Macro:

The macro data this time is very good. The three data CPI/unemployment benefits/retail data should all be positive feedback to the market. In fact, the US stock market is also reflecting this sentiment, and the head concentration is still obvious. In addition, a very noteworthy phenomenon has appeared in the US stock market. The Russell has risen by 2.45%. Small-cap stocks are also starting. Small-cap stocks and junk stocks need to be vigilant about the risks of US stocks within one month after the surge. Looking back at crypto, BTC and ETH led the decline. Analysts predict that it is likely that funds have gone to the US stock market. Embracing higher certainty, the crypto market is likely to fluctuate sideways in the short term, and it is not ruled out that individual sectors will begin to exert their strength.

Encryption:

The positive data this time, the decline of crypto has a guiding effect on the market. Analysts believe that it is not conducive to the short-term trend of crypto, and they are still firmly bullish in the long term. This short-term shock market is a good opportunity to observe and increase positions. However, it is still unclear how much downward space there is. If BTC falls below 54,000, it will be a normal callback. If it falls below 51,000, it may be necessary to operate cautiously, and pay attention to ensuring that it is not washed down and does not explode.

Sectors worth planning:

In these 12 hours, we found that sectors with real yield are more resistant to declines. In addition, some coins that are rising have also appeared. This is the first time that a large-scale real yield sector has been resistant to declines, mainly DeFi, such as Aave/CRV/DYDX/UNI, which have all fallen less than BTC. This phenomenon has been studied before and represents a logical shift in the market. This 12 hours is likely to be a turning point.

2. Crypto Market Hotspots and Narratives

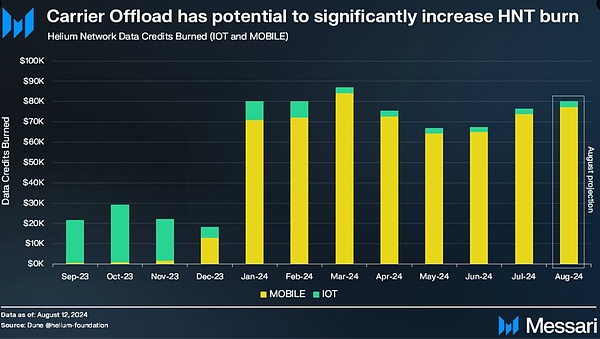

2.1 Helium Launches Carrier Offload Program

This is one of the most exciting developments in Helium.

The two largest telecom operators in the United States are using Helium, and the synergy between the two parties is very obvious:

1. Operators save costs and provide better coverage.

2. Traffic on the Helium Network increases, which results in more rewards for hotspot providers and more HNT being destroyed.

Meanwhile, Helium is expanding its subnetworks with an IoT subnetwork and an upcoming energy subnetwork.

2.2 DOGS releases token economics, with a total supply of 550 billion

TON Ecosystem Meme Project DOGS Releases Token Economics, Total Supply of Community Token $DOGS is 550 billion. 81.5% of them are allocated to community users, 73% will be awarded to Telegram OG users, and the rest will be used to reward traders, sticker creators and future community members. In addition, 10% is allocated to the team and future development, most of which will be gradually released within 12 months. 8.5% is used for CEX and DEX liquidity and related listing activities.

As a community token derived from VK and Telegram, DOGS will launch the function of on-chain minting and tradable emoticon stickers in the future to further expand its application scenarios.

From the most active applications, we can see that the main trend is to shift to the real income track, mainly public chain platforms Ethereum and Solana. The games in the Ton ecosystem have low barriers and community participation as their breakthroughs.

III. Regulatory Environment

This year, against the backdrop of the US election, with the unexpected approval of the Ethereum spot ETF as a turning point, cryptocurrency regulatory policies have frequently been favorable, and this year's crypto market may move beyond the election trend.

On August 16, according to The Block, Nasdaq withdrew two applications for listing and trading Bitcoin spot and Ethereum spot ETF options. The New York Stock Exchange also withdrew the listing and trading applications of Bitwise and Grayscale Bitcoin spot ETF options on the same day. Bloomberg analyst James Seyffart expects Nasdaq and the New York Stock Exchange to resubmit applications for listing Bitcoin spot ETF options in the next few days or weeks.

Meanwhile, as Russia continues its turn toward crypto assets, ministers in Moscow and the country’s central bank are discussing plans to create a “Russian crypto exchage.” Russian Finance Minister Anton Siluanov noted that existing Russian cryptocurrency exchanges still operate in a regulatory “gray area,” but that Russia’s recent legislative efforts in cryptocurrency regulation are “significant progress.”