Written by: 0xkyle, Jimmy Zheng, Alex

Compiled by: Vernacular Blockchain

1. Introduction

Founded in 2014 by Danish entrepreneur Rune Christensen and officially launched on the Ethereum network in 2017, Maker is a credit protocol with a decentralized stablecoin, DAI. This simple concept has grown into the world's largest decentralized stablecoin in 10 years of development. With a total locked value (TVL) of more than $10 billion, Maker is currently one of the giants in Ethereum DeFi.

We believe that Maker, as a foundational asset, will usher in a huge boost from the increasingly institutionalized digital world. The core idea is simple: with the launch of Bitcoin and Ethereum ETFs, and the tokenization of real-world assets, Maker is at the intersection of institutional adoption and DeFi.

However, as a protocol, Maker is notoriously complex, and most research has focused on high-level overviews. At Artemis, we believe the world is moving in an increasingly fundamentals-driven direction, so the goal of this paper is to build a first-principle thesis to truly understand the mechanics of Maker and then go further to build a case for it.

* Note: Throughout this article, Maker will refer to the general protocol, while MakerDAO will refer to the decentralized autonomous organization (DAO) that manages the Maker Protocol.

2. Analysis of Maker

1) History of Maker

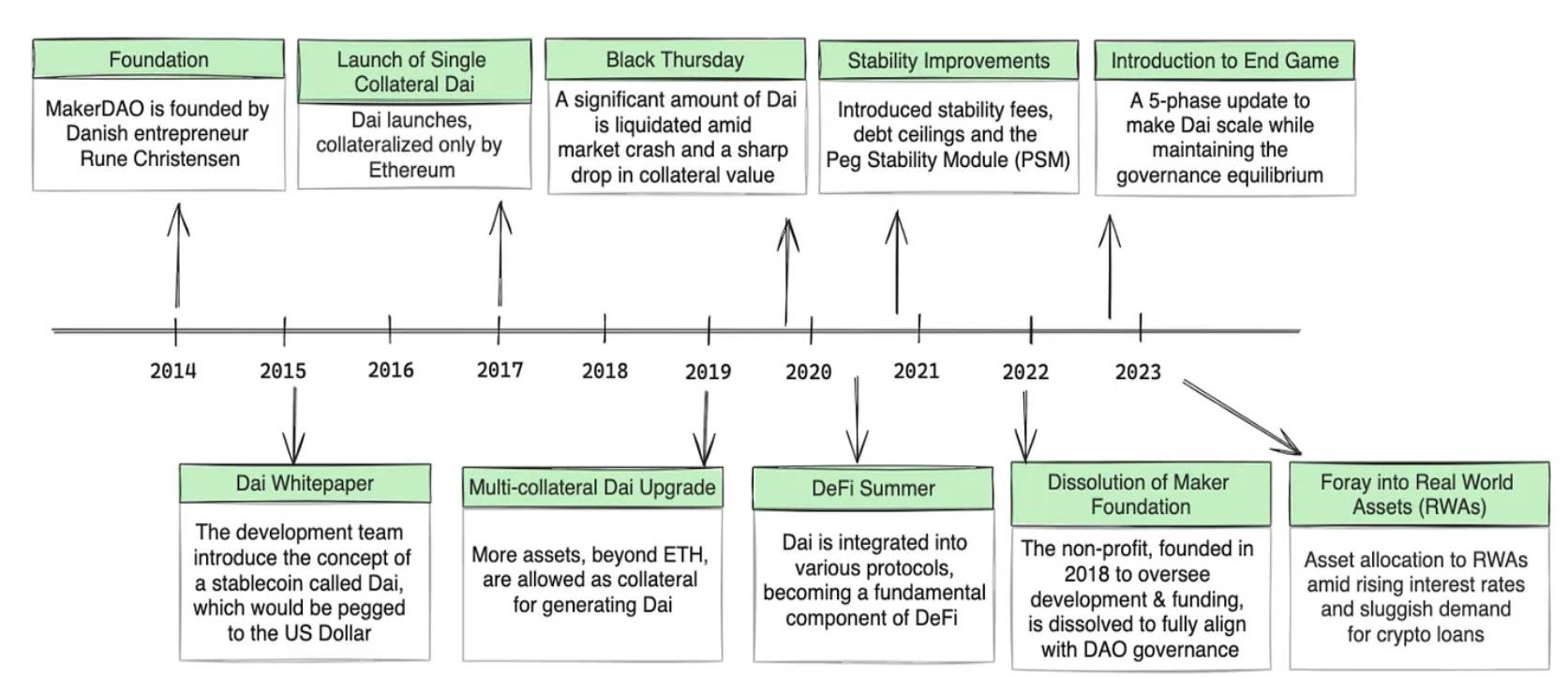

Before we get started, it’s worth taking a deeper look at the background of Maker. MakerDAO was founded in 2014 and is the brainchild of Rune Christensen, who dreamed of a world with a more transparent and accessible financial system. After losing his funds to Mt. Gox, he set out to develop a more stable alternative to the volatile cryptocurrencies and founded Maker.

In 2017, DAI was officially launched: a decentralized stablecoin pegged to the US dollar and governed by the DAO. In its first year, DAI managed to maintain its peg despite Ethereum’s price falling by more than 80%. Over the next seven years, Maker continued to demonstrate resilience to market-wide crashes, like Black Thursday in 2020, when the entire cryptocurrency market lost a third of its value.

Christensen’s leadership is the undeniable reason for Maker’s antifragility: his ability to navigate challenges and steer the protocol is critical to its success. Even today, he continues to contribute to the strategic direction of MakerDAO and proposes Maker’s endgame proposal. He remains a firm believer in the decentralized future, saying that he “looks forward to the day when he is no longer needed.”

History of Maker - Source: Steakhouse Finance

2) A detailed introduction to how Maker works

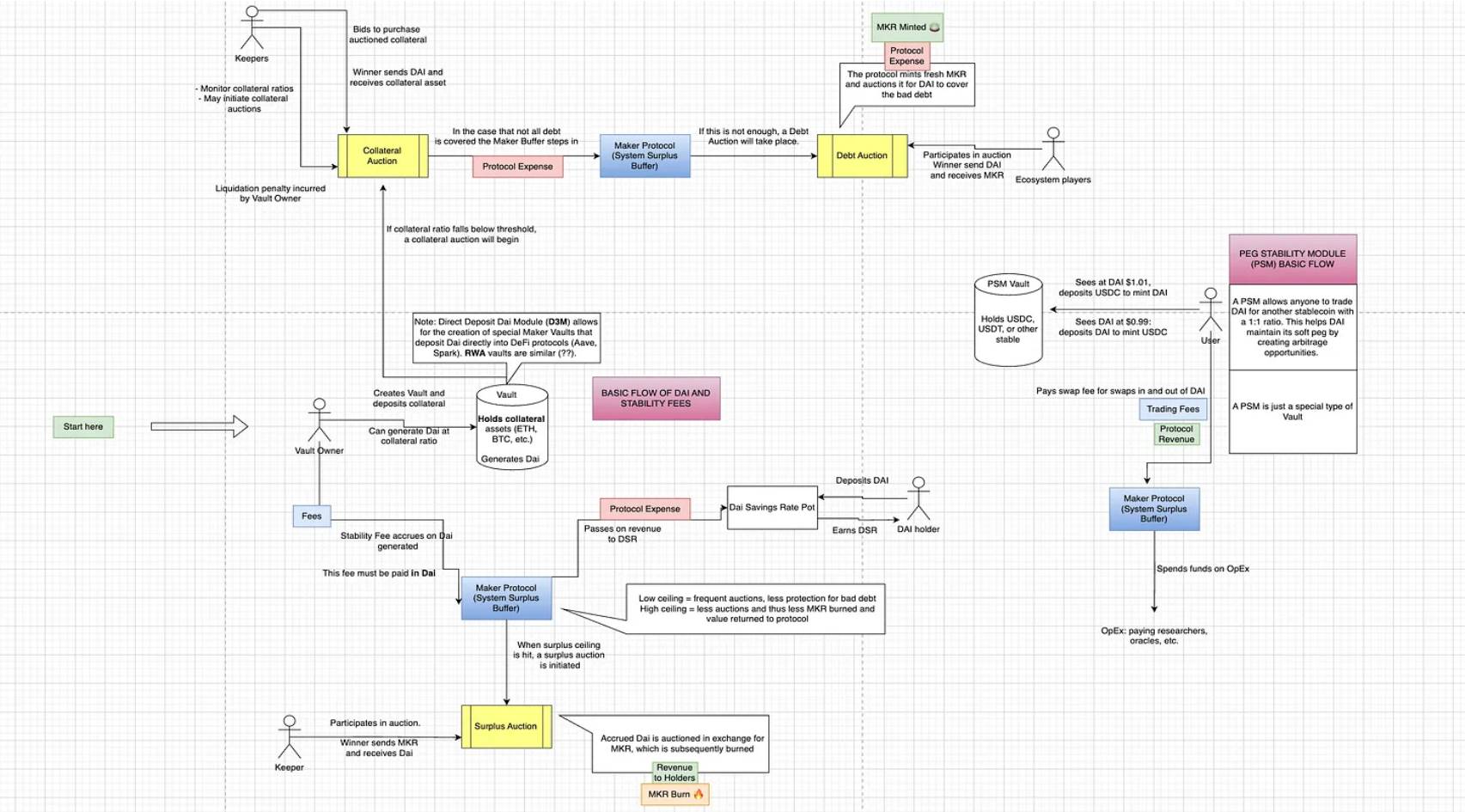

Schematic diagram showing how Maker works

Looking at Maker’s history, it’s clear that it has gone through many changes over the past decade: from accepting more assets as collateral to introducing stabilization mechanisms; each upgrade has brought more complexity. What started out as a simple lending protocol has evolved into something much more complex - but at Artemis, we believe in building knowledge from first principles; so we’ll dive into how it works.

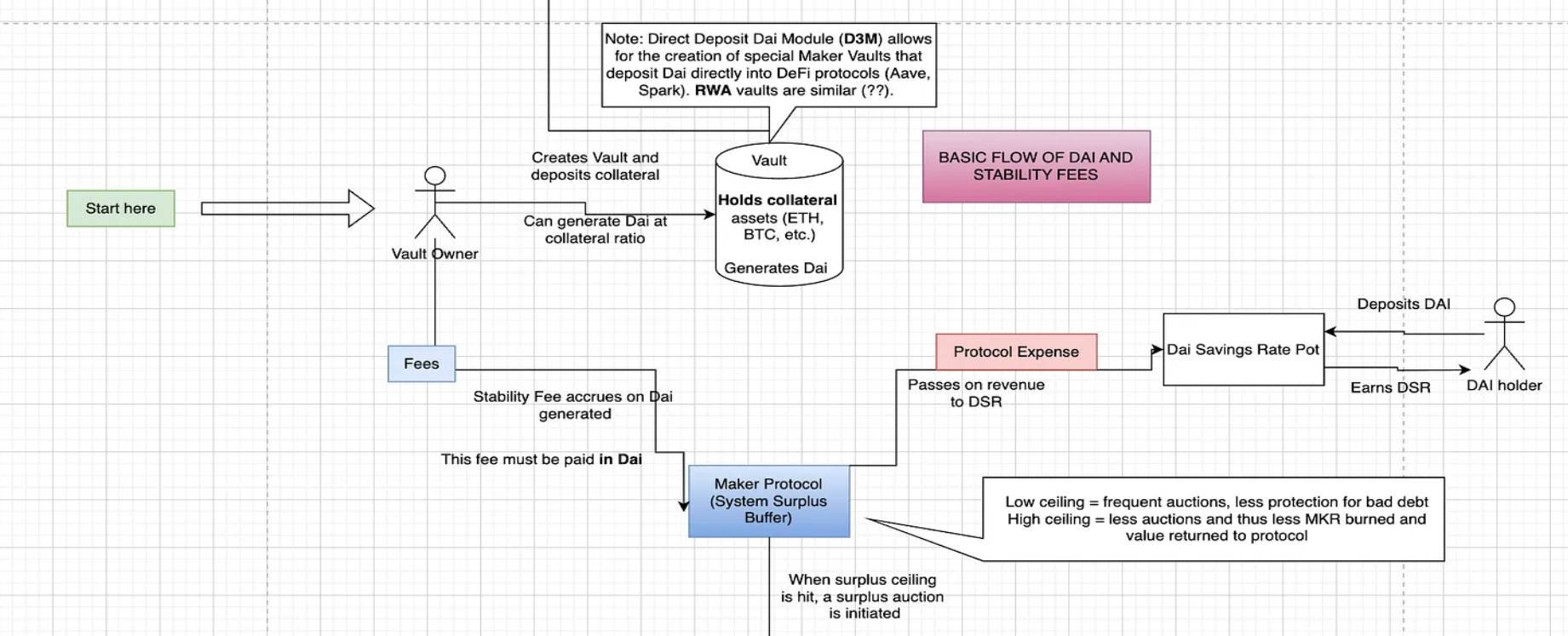

a). Debt borrowing and repayment

Debt borrowing and repayment

Let’s start with an overview. Bitcoin is at $60,000 and Billy has 1 Bitcoin. He needs liquidity but doesn’t want to sell his Bitcoin in a bull market. He goes to Maker to ask for a loan: by pledging his Bitcoin, he can borrow money against his Bitcoin.

Some time has passed and Billy wants to repay his loan. He has to pay back the debt he borrowed + the stability fees (interest) accumulated on his loan (in DAI). Some of this interest goes into Maker’s system residual buffer, while the rest goes to Dai Savings Rate holders — people who deposited DAI with Maker.

However, the buffer has a cap - sometimes, money that should have gone into the surplus doesn't because of the cap - in which case a surplus auction is initiated where DAI is "sold" to get Maker and then destroyed.

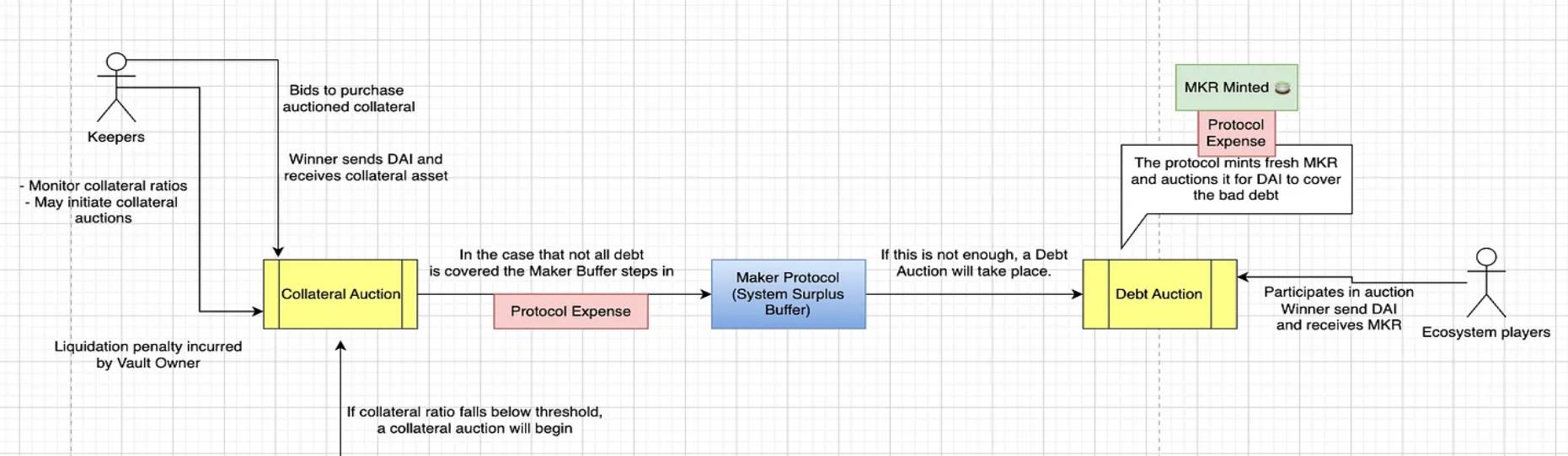

b). Liquidation Auction

Liquidation Auction Operation Guide

However - what if Billy can't repay his debt? Let's say Billy takes out a $30,000 loan with a Loan-To-Value (LTV) ratio of 0.5 when the Bitcoin price is $60,000. The next day, Bitcoin drops to $40,000 and his LTV ratio spikes to 0.75 - let's say that's the maximum LTV ratio allowed before he's liquidated. Billy still has to pay interest on the loan, as well as liquidation penalties if any.

In a liquidation scenario, the debtor must not only repay the debt, but also pay interest on the debt and liquidation penalties. An overview is as follows:

Maker owns 1 Bitcoin (worth $40,000)

Billy owes $30,000 (debt)

Billy owes $3,000 (stabilization fee)

Billy owes $2,000 (liquidation costs)

Therefore, the protocol has several ways of handling it:

Collateral auction. The protocol first sells the collateral (in this case 1 Bitcoin) to anyone willing to buy it at a slight discount. Best case scenario, someone buys Bitcoin for $35,000 for a slight arbitrage - that money goes directly to fill the hole.

If the collateral auction does not raise enough funds, Maker will use the remaining buffer in its system.

If the buffer is insufficient, the last resort - a debt auction - is initiated, where Maker mints new MKR and auctions it off to obtain DAI to cover bad debts.

It is worth noting that debt auctions are only actually activated when there is a deficit in the system, that is, when the total value of the collateral backing DAI loans falls below the required level, resulting in under-burdened debt. This means that debt auctions only occur in extreme cases, and therefore have only occurred once - during the 2020 new crown black swan event that caused a market-wide crash.

c). DAI anchor maintenance

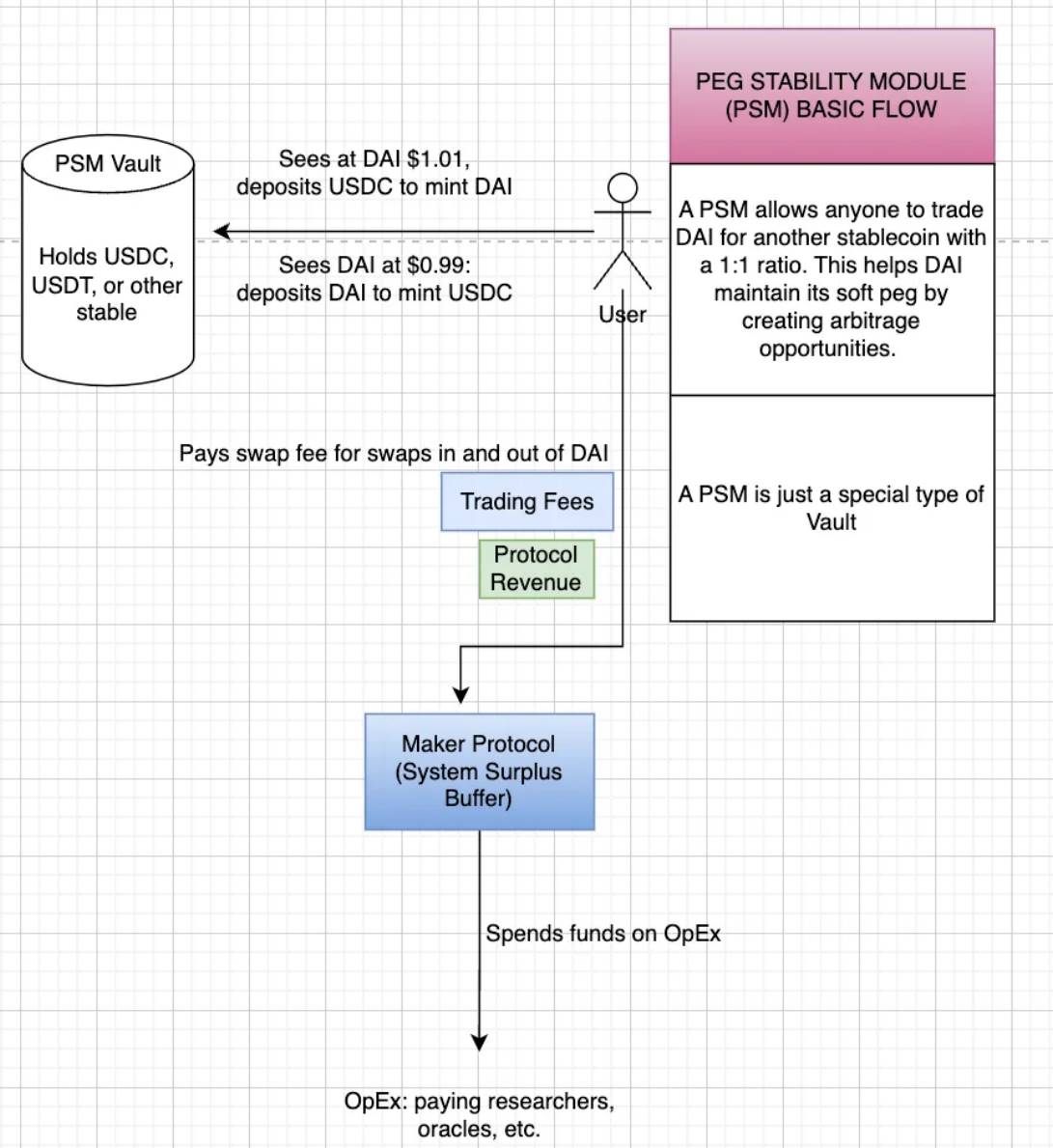

PSM (Peg Stabilization Module) Vault Operation Guide

Now suppose Billy is not interested in collateralized debt, but wants to do arbitrage - since DAI is a decentralized stablecoin, he wants to make a profit every time the peg is unpegged. How does Maker incentivize this behavior?

We now have the Pegged Stability Module (PSM) - a special vault that allows anyone to swap DAI for another stablecoin at a 1:1 ratio.

If the price of DAI is $1.01, you can deposit 1 USDC to mint 1 DAI, making a profit of $0.01.

If the price of DAI is $0.99, you can deposit DAI to mint 1 USDC and also make a profit of $0.01.

Thus, PSM allows arbitrageurs to maintain the price of DAI - which does not incur any swap fees.

d). How ordinary users can use Maker

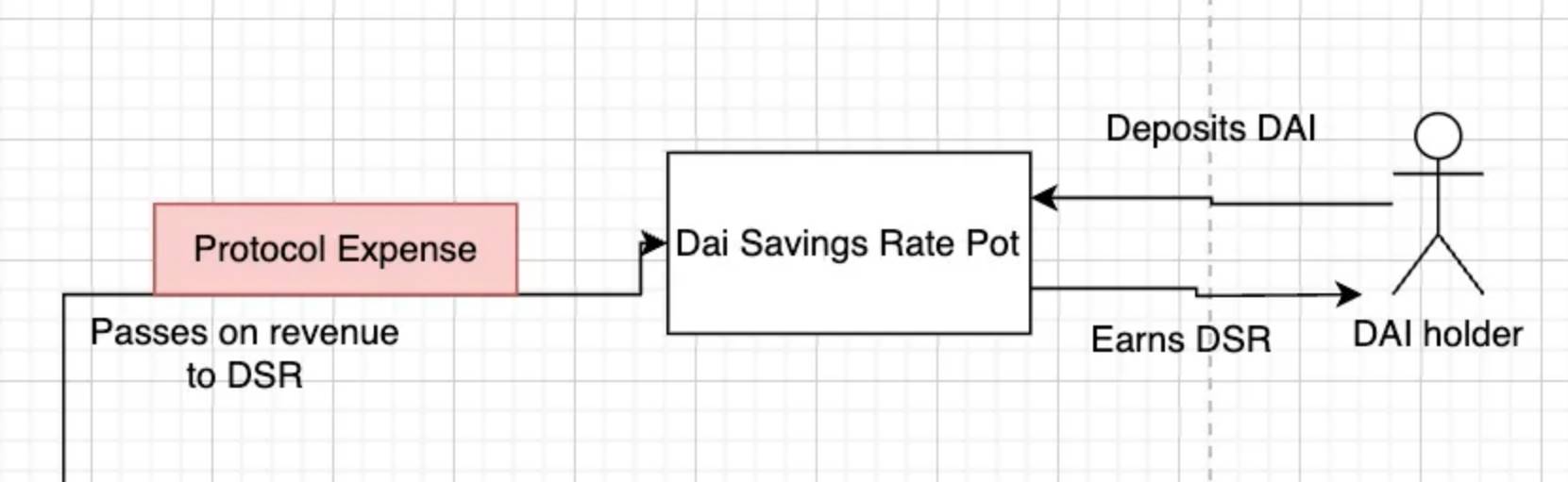

In the last case, Billy doesn’t want the complexity, he just wants to collect some yield. Through the Dai Savings Rate (DSR) pool, Billy can deposit DAI and earn a competitive DAI interest rate. This yield comes from multiple sources, the main one being the stability fees paid by borrowers on their collateral.

Here’s a how-to guide on how Maker works. Now that we have a better understanding of the essentials of how it works, we can dive into the intricacies.

3) Maker’s Mechanism

a. Collateral deposit

Maker allows you to take out collateralized loans in two main ways:

Spark: Maker’s website will redirect Billy to Spark.fi, which is a child DAO of Maker. The difference between Spark and MakerDAO vaults is that Spark can provide loans for a wider range of assets, while MakerDAO’s vaults are independent, and each vault offers different liquidation ratios and debt ceilings.

sDAI: Spark also launched sDAI, a version of DAI that comes with a yield and implements advanced risk management features such as efficiency mode and isolation mode.

D3M: Spark connects to Maker through D3M - a direct liquidity line. It enables interaction between the Maker ecosystem and third-party lending protocols.

MakerDAO Vaults - accessible through Summer.fi, allow users to deposit collateral assets to mint new DAI. As such, MakerDAO Vaults are more personalized in nature - for the same asset, there will be different vaults depending on the amount you want to borrow.

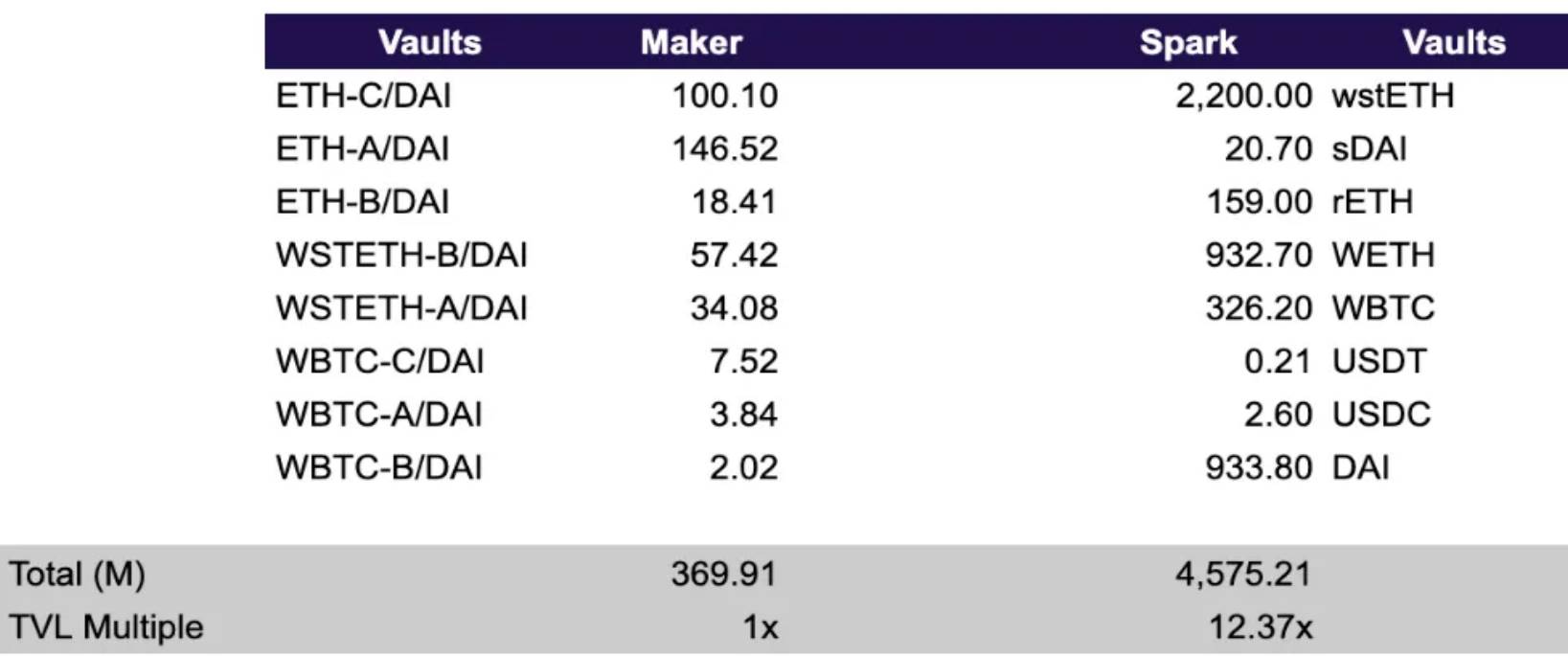

TVL comparison between vaults - Source: Artemis

You can see that the TVL in Maker’s vault is much lower than Spark’s. For Maker’s vaults, the differences between A/B/C are in their stability fees, liquidation ratios, and debt ceilings. A big reason for this TVL difference could be that Maker is not working hard to promote these vaults - as mentioned earlier, Maker’s vault is hosted on Summer.fi, while Maker’s main webpage leads you directly to Spark.

b. Maker Auction

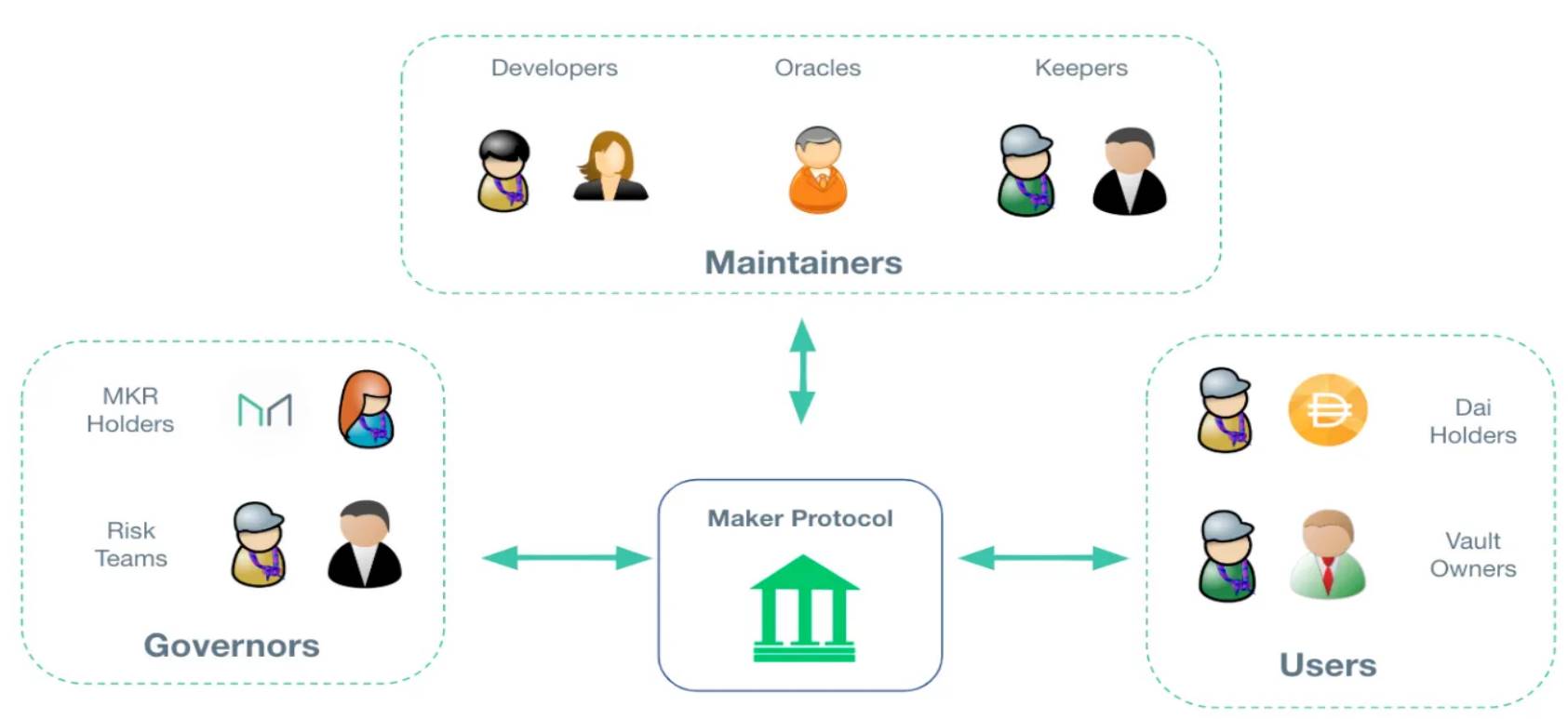

Maker has three main auctions: the Remaining Auction, the Collateral Auction, and the Debt Auction. Market participants who participate in these auctions are called “Keepers”, and each auction has a different purpose, which will be explained in detail below:

Surplus Auction

When everything is working fine, a stability fee is generated through the interest paid by borrowers. This interest is in the form of $DAI and is used to pay for the Maker Protocol's system surplus buffer. The system surplus buffer is a buffer used to pay for Maker operating expenses, such as oracles, researchers, etc. This system buffer can be adjusted through MakerDAO's governance, and in a 2021 proposal, it was increased from $30 million to $60 million.

Therefore, the system prioritizes using revenue to fill the buffer, but once the buffer reaches its cap, the remaining DAI will be auctioned to external participants in exchange for MKR. In this auction, bidders bid for a higher amount of MKR. Once the auction ends, the auctioned DAI will be sent to the winning bidder, and the system will destroy the MKR provided by the winning bidder.

Therefore, this system is called a residual auction.

Collateral Auction

Collateral auctions are the first line of defense for liquidation. They are used as a means to recover debt in liquidated vaults. For each type of collateral, there are different specific risk parameters, but the general mechanics are as follows:

When a vault is liquidated, a collateral auction is triggered. Any user can liquidate an unsecured vault by sending a "bite" transaction identifying the vault. This will initiate a collateral auction.

If the amount of collateral in the bitten vault is less than the batch size of the auction, then a single auction will be held for all the collateral in that vault.

If the amount of collateral in the bitten vault is greater than the batch size of the auction, then an auction will be initiated with a batch size of the full collateral, and the vault can be bitten again to initiate another auction until all the collateral in the vault has been bid in the collateral auction.

An important aspect of collateral auctions is that the auction expiration and bid expiration parameters depend on the specific type of collateral, with more liquid collateral types having shorter expiration times and vice versa.

At the end of the collateral auction, the winning bidder purchases the collateral in the liquidated vault with Dai. The Dai received is used to repay the outstanding debt in the liquidated vault.

Debt Auction

Finally, the Debt Auction will only be triggered if the system has Dai debt that exceeds the specified debt ceiling and there is not enough funds in the remaining buffer to make up for it.

Debt auctions are used to fund the system with a fixed amount of Dai by auctioning off MKR. This is a reverse auction where keeper’s bid is how much MKR they are willing to accept in exchange for a fixed amount of Dai.

As this is so rare, it has only happened once in MakerDAO history: during the Covid crisis in 2020. There, 40 separate batches worth 50,000 DAI each were released, with bidders committing to buy a gradually decreasing amount of MKR in exchange for their bid of 50,000 DAI.

Once the auction is over, the Dai paid by bidders in exchange for newly minted MKR will reduce the original debt balance in the system, while the circulating supply of Maker will increase.

c. Stabilizing nail module

Next, we have the Stability Peg Module (PSM). This is a key mechanism in the MakerDAO system that is designed to help maintain DAI’s peg to the USD. Due to its decentralized nature, DAI must have some safeguards in place to maintain its peg, and the PSM has some mechanisms that allow this to happen:

Direct 1:1 Swaps: The Stable Peg module allows users to swap fiat-backed stablecoins (e.g. USDC, USDP) for Dai at a 1:1 ratio, paying only a small fee in the process of swapping, and vice versa. This is essentially designed to create arbitrage opportunities for Dai to maintain its peg, subject to any fees set by the protocol.

If demand for Dai drives the price > $1, arbitrageurs can deposit 1 USDC into PSM to mint 1 Dai and sell the Dai.

Conversely, if Dai < $1, arbitrageurs would buy Dai on the open market, deposit it in PSM and receive 1 USDC for their profit. This would burn Dai (reducing supply) and push it towards $1.

Collateral backing: Users can choose to deposit USDC into PSM instead of exchanging - in return they will receive an equal amount of DAI, making the DAI backed 1:1 by the deposited USDC.

In addition, Maker has two additional features that, while not core to maintaining the DAI peg, are still features that help maintain the DAI price:

MakerDAO can adjust the stability fee through governance voting to maintain DAI’s peg.

If DAI > $1, increasing the stability fee makes borrowing collateral in the vault more expensive, which disincentivizes DAI creation and reduces supply.

If DAI < $1, lowering the stability fee will stimulate demand for DAI by reducing creation costs, increasing supply and pushing the price of DAI towards $1.

The Dai Savings Rate is essentially the interest rate that Dai users can earn by locking up their Dai. While it ostensibly provides an incentive to hold DAI, it also helps maintain Dai’s peg to the dollar, as MKR token holders can adjust the DSR to help steer Dai in the direction of the peg (but in the opposite direction of the stability fee).

The main sources of DSR income include stability fees, protocol revenue, protocol surplus, and general market dynamics. The DSR interest rate is set by MakerDAO governance as a tool to balance the supply and demand of DAI. The DSR may be raised when there is an increase in demand for DAI, which requires more funds to be allocated to support the higher interest rate. The DSR is not funded by external sources or traditional investment funds. As of July 2024, the DSR is 8% annualized.

d.DAI Savings Rate (DSR)

As mentioned above, the Dai Savings Rate (DSR) is a special module that Dai holders can deposit to earn yield on their Dai. Dai holders can lock and unlock Dai into the DSR contract at any time. Once locked into the DSR contract, Dai will continue to increase according to a global system variable called DSR.

Essentially, DSR depositors receive a portion of the revenue generated by Maker. DSR revenue comes from profits generated by MakerDAO, including stability fees paid by borrowers, liquidation fees, and other protocol revenues such as earnings on T-bills in the Maker vault.

Currently, there is over $2 billion in DAI in the DSR, and it earns an annual interest rate of 7%.

e.MKRToken

Finally, Maker is governed by its Token MKR. Holders of MKR can vote on key parameters of the system. MakerDAO's governance is community-driven, and decisions are made by MKR token holders through a scientific governance system. This includes executive voting and governance voting, allowing MKR holders to manage the protocol and ensure the stability, transparency, and efficiency of DAI.

By leveraging all the mechanisms we described above, Maker provides a secure, decentralized, and stable financial system that allows users to generate and use DAI without relying on traditional financial intermediaries. This approach embodies the core principles of cryptographic thinking, providing a decentralized alternative to the traditional financial system and enabling permissionless access to a variety of financial services.

f. Maker’s income sources

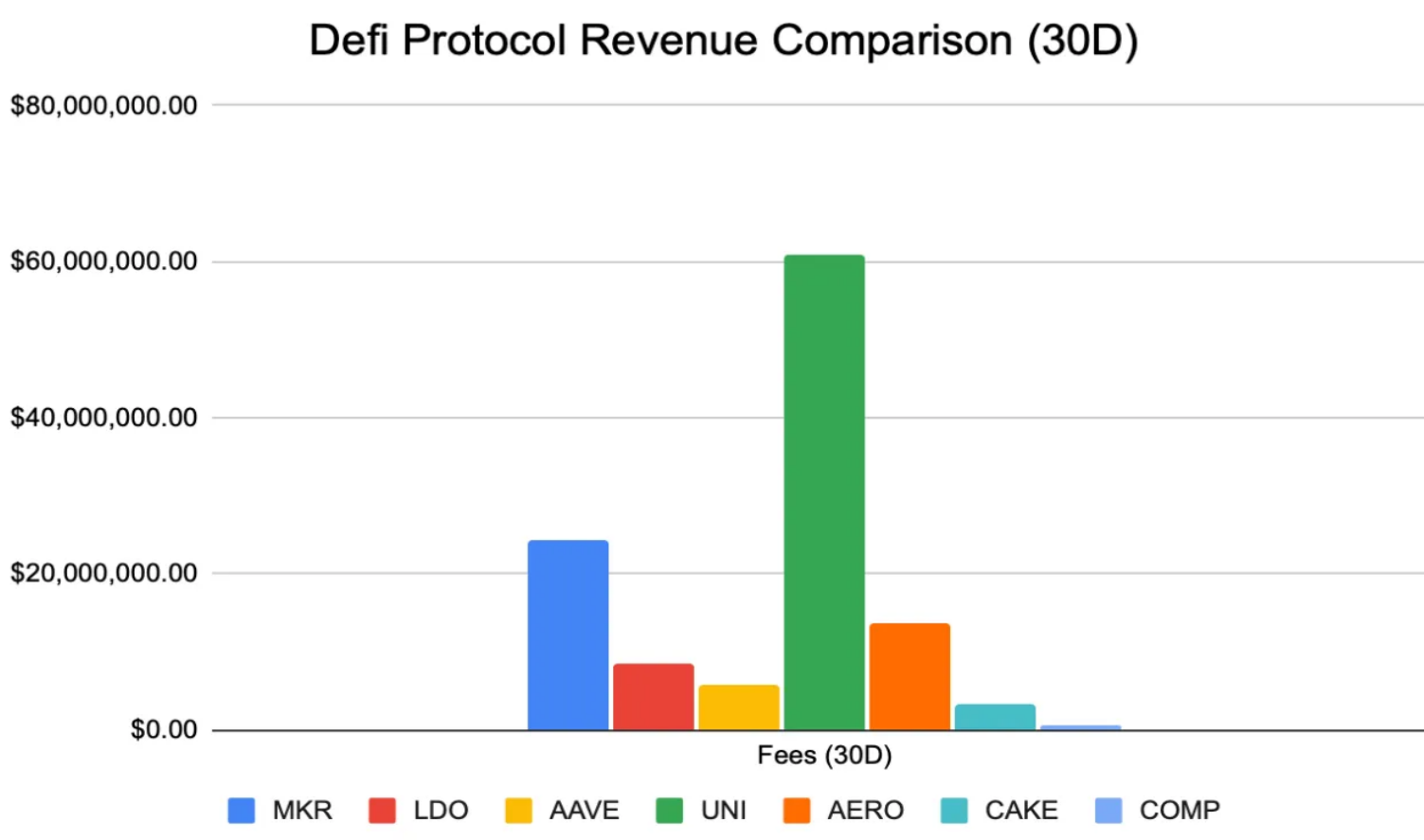

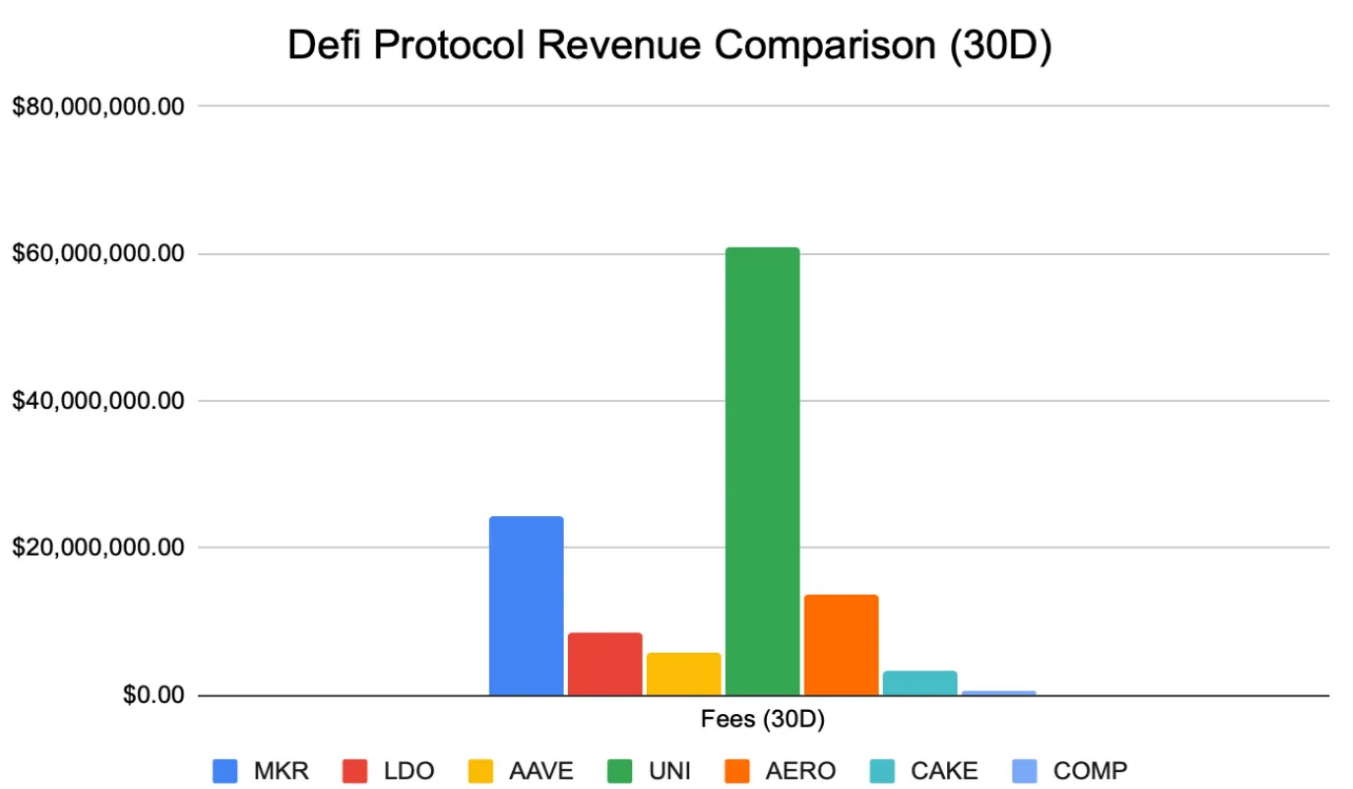

Now that we have covered the various mechanics of Maker, we can move on to exploring how they primarily make money. Of all the DeFi protocols, Maker generates the most revenue per year. In the chart below, we will compare the revenues of DeFi protocols to get a more detailed understanding of the day-to-day performance of the protocols.

It’s worth noting that for Uniswap, the numbers provided are the fees they earn — since the revenue generated goes to liquidity providers, they don’t actually earn any revenue. But for comparison purposes, we use fees as a proxy for revenue.

Source: Artemis

Among all DeFi protocols, Maker has the best FDMC/fee ratio trading at a multiple of 9.48x. Among other money markets such as Aave and Compound, Maker leads by a considerable margin and has the highest fee income among all DeFi protocols except DEX.

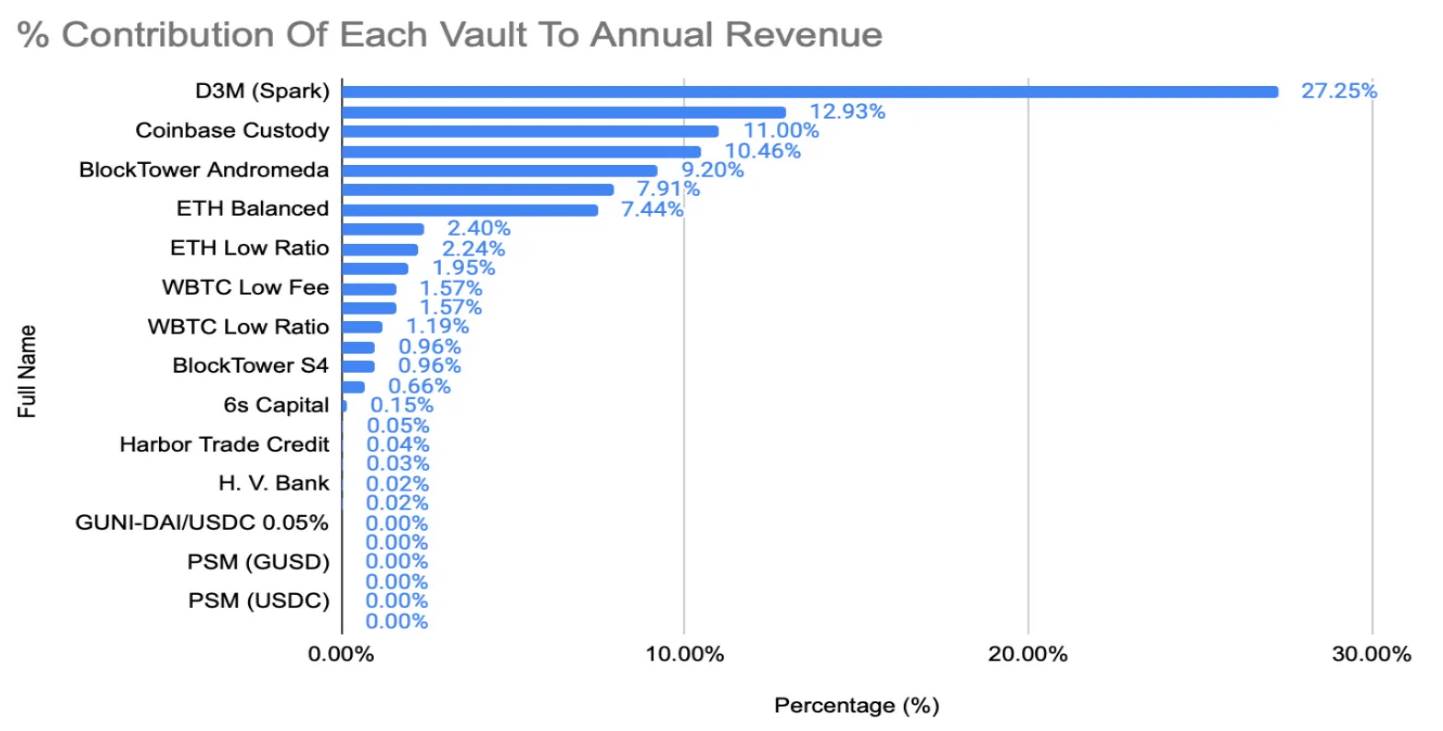

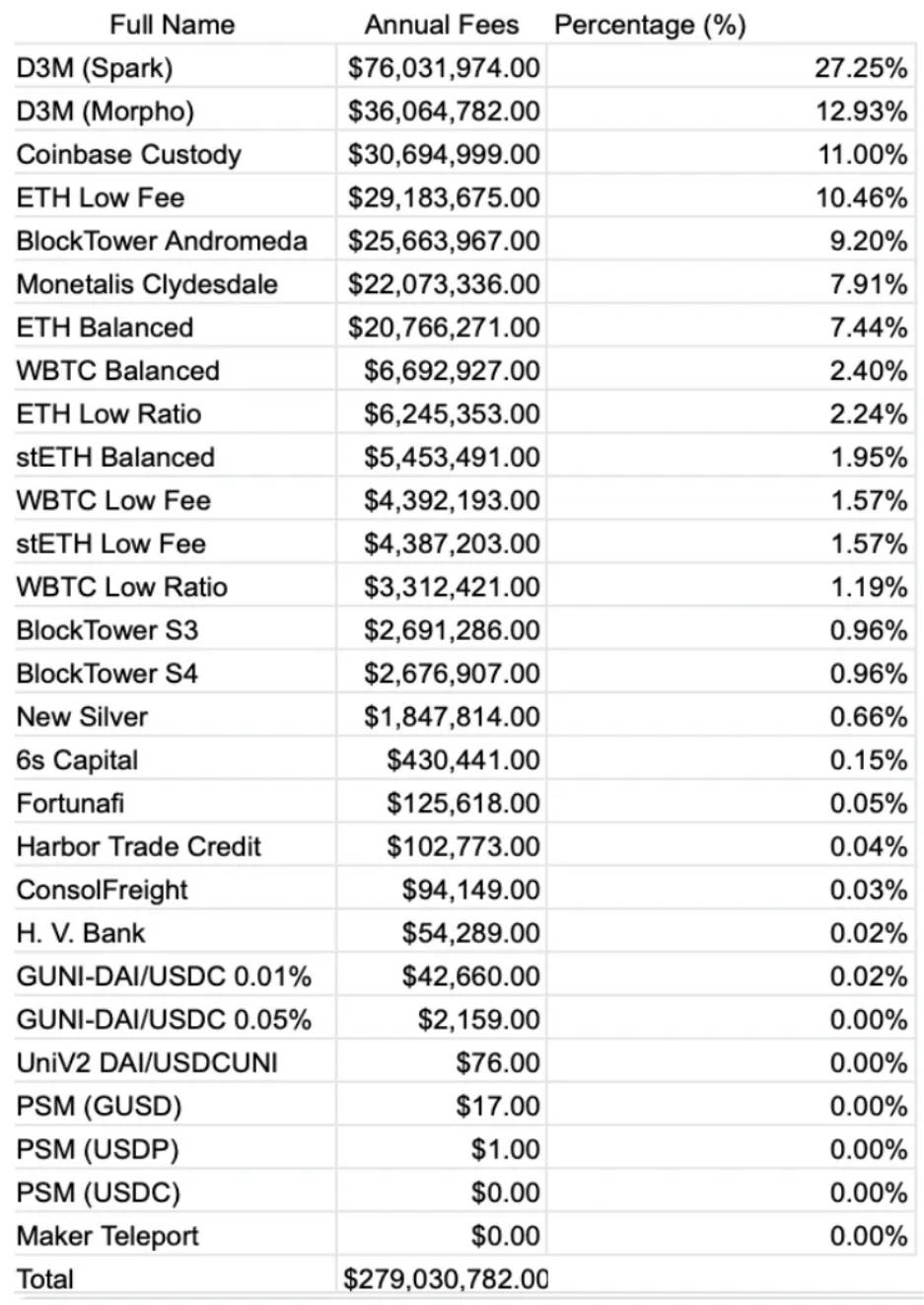

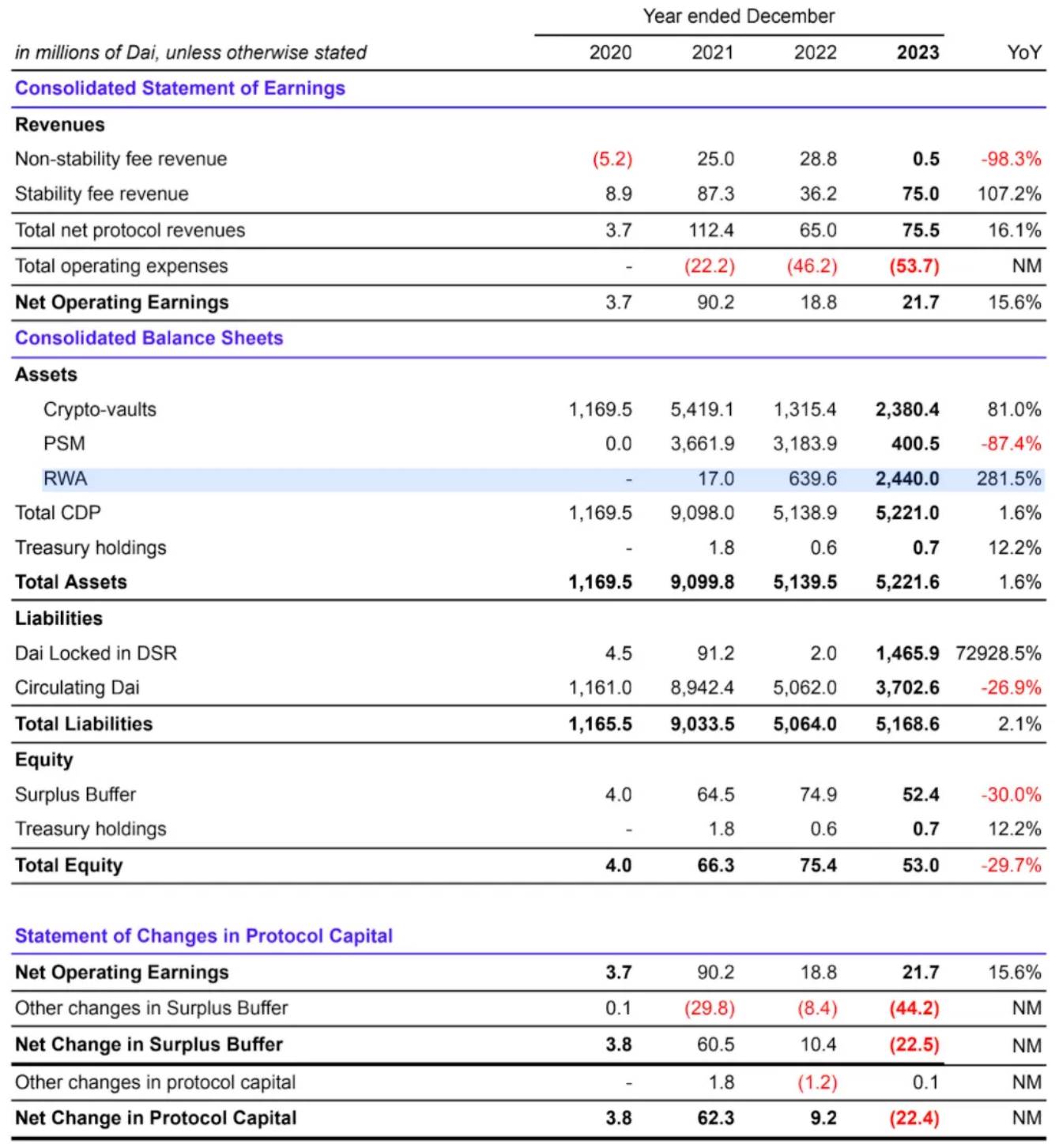

When looking at its financials, Maker is clearly one of the best performing De-Fi protocols with an eye-popping $274 million in revenue per year. So where does Maker’s revenue come from?

3. Maker’s income sources

1) Maker has three different sources of income

Interest rate payments, also known as stability fees: This is Maker’s main source of revenue. Users pay these fees when they borrow DAI against collateral. For example, the D3M (Spark) vault generates over $84 million in revenue per year.

Real World Assets (RWA): This has become the main source of revenue for Maker. Maker has public credit vaults like Monetalis Clydesdale, a vault worth 1.11 billion DAI secured by US Treasury bonds.

Nearly 80% of Maker’s fee revenue has come from real-world assets in the past year as of 2023. This has generated $13.5 million in revenue for the protocol’s treasury over the past 12 months.

Operationally, users do not deposit RWA directly into Maker. Instead, storage rooms like Monetalis Clydescale (as discussed in MIP65) obtain USDC through the Peg-Stability Module and invest it in liquid bonds.

Liquidation Fees: Their third and final source of revenue comes from liquidation fees, which are collected when collateral is liquidated due to insufficient collateral. However, due to the rarity of such events, the revenue from liquidations is not that much. It has decreased from 28.8 million DAI in 2022 to only 4 million DAI in 2023.

Source: MakerBurn

2) Maker and RWA

Now, let’s talk about why Maker is on everyone’s lips in Q3 2024. The most notable thing about Maker is not their numbers, but rather stems from a pivotal moment in Maker’s history, in 2022, they decided to strategically expand into real-world assets.

This move marks a major shift in the DeFi space, as it is the first time that a DeFi protocol has integrated real-world financial products on a large scale. Maker has done so through various initiatives such as:

Deploy $500M USDC into short-term bonds, ETFs, and Treasuries (Monetalis Clydesdale, Blocktower Andromeda)

A 100 million DAI vault was launched to serve Huntingdon Valley Bank, a 151-year-old Pennsylvania financial institution.

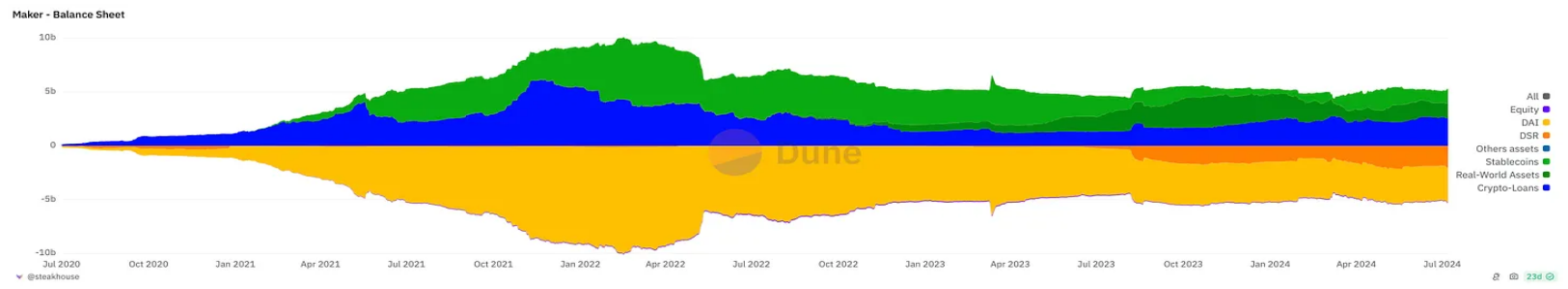

Source: Steakhouse Dune Dashboard

Today, real-world assets currently make up approximately 25% of Maker’s balance sheet and DAI backing. Maker’s successful integration of real-world assets not only drives overall fees, but also enables Maker to tap into more stable and diversified revenue streams - which is critical in maintaining Maker’s moat and solidifying its position as the leading DeFi protocol amid tough market conditions.

This is an underrated point that must be made, crypto markets are known to be very cyclical and reflective, both up and down. As the market matures, investors seek safer investments - Maker's foray into real world assets creates a more stable and consistent source of income, rather than the recurring fluctuations that follow market conditions.

Maker is now a testament to the potential of DeFi to merge and enhance traditional finance, setting a new standard for innovation and real-world applications in the space. It represents an important step in building a bridge between decentralized finance and traditional financial products, positioning Maker at the forefront of DeFi innovation and meeting the trend of institutional demand for digital assets.

4. Reasons to be optimistic about Maker

1) RWA boom in 2024

Now that we’ve discussed how Maker is moving to RWAs, we can make the case for why RWAs are important. 2024 is the year that the cryptoasset market matures; with the launch of the Bitcoin ETF, we saw over $14 billion in net inflows into Bitcoin. This surge in institutional participation is not limited to Bitcoin ETFs, with major banks and financial institutions increasingly accepting crypto assets:

Standard Chartered and Nomura Securities used their in-house technology to build digital asset custody solutions through Zodia Custody and Laser Digital, respectively.

Citibank, JPMorgan Chase and Bank of New York Mellon have partnered with crypto companies such as Metaco, NYDIG and Fireblocks to provide cryptocurrency custody services.

Visa and Mastercard have expanded their crypto card programs, partnering with major trading platforms to offer cryptocurrency-related cards to retail and institutional clients.

It’s clear that the biggest institutional players believe in digital assets, but not just Bitcoin. Major asset managers have talked about tokenization for a long time, and the world’s largest asset manager BlackRock is currently experimenting with tokenization:

BlackRock USD Institutional Digital Liquidity Fund: Launched in March 2024, the fund is represented by the blockchain-based BUIDLToken on the Ethereum network. The fund is fully backed by cash, U.S. Treasuries and repurchase agreements, and pays returns to token holders every day through the blockchain network.

$100 Trillion Tokenization Vision: BlackRock is carrying out digital transformation in the financial sector, aiming to tokenize various assets such as bonds, stocks, real estate and cultural assets.

This of course sparked a race among the largest financial institutions to tokenize all assets:

JPMorgan Chase: Launched programmable payment capabilities through its blockchain platform Onyx, enabling institutional clients to benefit from real-time, programmable financial functions.

HSBC: Launched a blockchain-based platform called Digital Vault for custody clients to instantly access their private assets (debt, equity and real estate).

Goldman Sachs has invested in and supports the USDC stablecoin issued by Circle, which allows large-scale global fund transfers without volatility risk, and is exploring the tokenization of physical assets as a new financial instrument.

It is clear that the next decade will be dominated by institutional adoption and integration of cryptocurrencies, positioning Maker at a critical moment in this evolving space. Maker has established a strong presence in RWA tokenization, DeFi, and is also geared towards institutions. In fact, just a few days ago, Maker announced that it would launch an open competition on Thursday to invest $1 billion in tokenized US Treasury issuance: top issuers such as BlackRock, Securitize, Ondo Finance, and Superstate plan to apply.

At the end of 2023, real-world assets accounted for 46% of the total assets on Maker’s balance sheet. Source: Steakhouse Finance

We believe that the proportion of real-world assets in Maker's balance sheet will continue to grow. Therefore, Maker is strategically positioned as one of the largest DeFi protocols with one of the broadest integrations with real-world assets to date. This, coupled with the potential for an Ethereum ETF to launch in Q3/Q4 2024, provides even greater tailwinds for Maker's long-term bullish case. As Ethereum continues to become the backbone of DeFi, Maker's prominent position in this ecosystem further solidifies its role in facilitating institutional adoption.

2) Maker’s stability and resilience

As major financial institutions increasingly embrace cryptocurrency and blockchain technology, they are also looking to "established" brands in the space. In an industry dominated by hacks and pump and dump operations, time-tested protocols like Maker have greater legitimacy and heritage in leading the coming wave of institutional interest.

Beyond that, Maker has demonstrated the ability to handle large-scale financial operations and has shown remarkable stability and resilience during market downturns - they have shown the ability to adapt to changing market conditions: mitigating risks in decentralized stablecoins through diversified collateral pools, building adaptive mechanisms like the Peg Stability Module, and flexible governance mechanisms that allow for dynamic adjustments when needed.

This antifragility gave Maker the necessary legitimacy, and now, with institutional-grade infrastructure and risk management protocols, it makes Maker the most dominant platform for institutional participation.

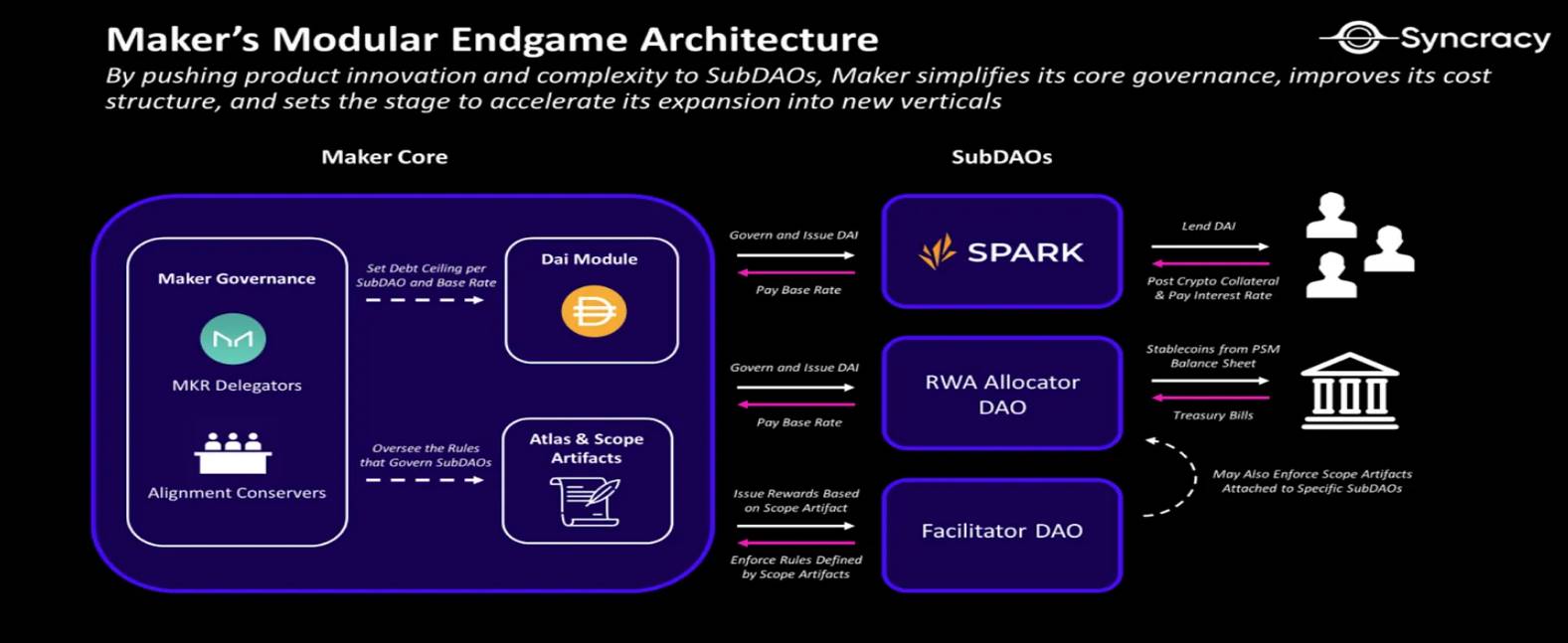

3) Ultimate goal

Maker is positioned as one of the leading decentralized banks, poised to become one of the largest financial institutions in the world. Maker’s case has been proven due to DAI being the most widely used decentralized stablecoin, being able to provide cheaper credit than competing structures, and its strategic position as a leader in the space.

However, perhaps the biggest catalyst has yet to be explained - Maker's ongoing "endgame" release will transform it into a more scalable, modular protocol ecosystem, potentially making it one of the most important stories of the upcoming cryptocurrency cycle. This upgrade is huge and is divided into four main phases:

Phase 1: Launch Season - New Tokens and Infrastructure

New Tokens: Introducing “NewStable” and “NewGovToken” (placeholder names) as optional upgrades for DAI and MKR.

Lockstake Engine (LSE): A new feature that allows NewGovToken and MKR holders to earn returns on locked tokens.

NewBridge: A low-cost bridge connecting Maker ecosystem tokens from Ethereum to major Layer 2 networks.

Token economics update: Modifications to the MKR destruction mechanism and a new token distribution method.

Phase 2: New Horizons - Expanding the Maker Ecosystem

Launch new child DAOs: Create self-sustainable, specialized DAOs within the Maker ecosystem, starting with SparkDAO.

Phase 3: Launching a dedicated Layer 1 blockchain to host core token economics and governance mechanisms

Phase 4: Core governance aspects of the Maker and Sub-DAO ecosystems will become final and immutable

Through this plan, Maker aims to scale DAI from its current $4.5 billion market cap to “$100 billion or more.” For the most part, we will not be focusing on many of these initiatives because we believe the main initiative that will drive growth is the addition of child DAOs.

4) SubDAO

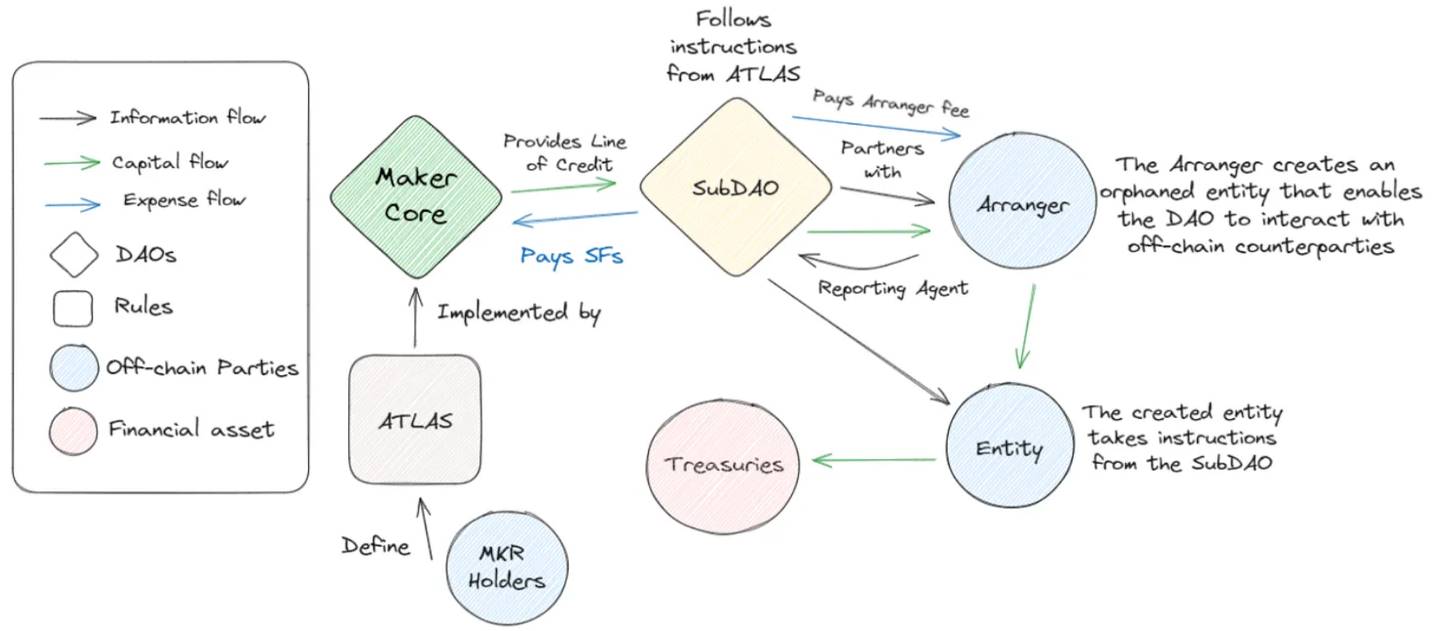

The Ultimate Plan represents a complete reorganization of the Maker ecosystem, transforming it into a set of interconnected modular protocols. At its core, this vision introduces SubDAOs. As their name implies, they are projects that operate outside of the Maker cost structure and are ultimately governed by MakerDAO.

This new architectural approach is designed to simplify MakerDAO’s operations and enhance its scalability. SubDAOs will be able to quickly develop and launch new products in parallel, while Maker Core can focus on becoming an efficient Dai minting engine.

Expected results of this reorganization include:

Accelerate ecosystem growth;

Enhanced process automation;

Greater decentralization;

Significant reduction in operating expenses.

Source: Syncracy Research

SubDAOs each have their own unique governance tokens, governance processes, and staff. There are three types of SubDAOs:

FacilitatorDAOs

They are administrative in nature and are used to organize the internal mechanisms of MakerDAO, AllocatorDAOs, and MiniDAOs. FacilitatorDAOs help manage the governance process and enforce decisions and rules.

AllocatorDAOs

AllocatorDAOs has three main functions:

Generate Dai from Maker and allocate it to profitable opportunities within the DeFi ecosystem

Providing an entry point to the Maker ecosystem

Incubating MiniDAOs

MiniDAOs are experimental SubDAOs without any specific mission other than to drive growth of the Maker Protocol. They are incubated by AllocatorDAOs to further decentralize, promote, or solidify a specific idea or product. In essence, they act as experimental spinoffs with potentially shorter lifespans.

SubDAOs are therefore revolutionary for MakerDAO and the broader decentralized finance (DeFi) ecosystem as they represent a paradigm shift in how large-scale decentralized protocols evolve, innovate, and manage risk.

For example, the following diagram is a simplified illustration of how MakerDAO will work after the ultimate goal:

Source: Steakhouse Finance

By introducing a multi-level governance structure, SubDAOs enable MakerDAO to rapidly experiment and grow in specialized areas while maintaining core stability.

This approach addresses several key challenges facing mature DeFi protocols, including governance fatigue, stagnant innovation, and concentrated risk. SubDAOs allow for decentralized decision-making, empowering small, focused groups to drive innovation in specific areas without jeopardizing the entire ecosystem.

This structure not only improves the protocol's ability to adapt to changing market conditions, but also creates new opportunities for community engagement and value creation. In addition, the SubDAO model extends MakerDAO's influence beyond the traditional boundaries of DeFi, potentially catalyzing real-world economic impact through local initiatives and targeted capital allocation. Currently, in addition to existing SubDAOs like Spark (Maker's first SubDAO), there are plans to launch a new bridge for transferring DAI between Ethereum Layer 2 networks; while they are not making revolutionary moves (the main product is a lending engine), they prove the effectiveness of SubDAOs. Spark will also have the ability to invest capital in real assets, once again demonstrating how SubDAOs provide incredible flexibility to otherwise monolithic protocols.

By providing a more flexible and scalable governance framework, SubDAOs pave the way for MakerDAO to evolve from a single-purpose stablecoin issuer to a diverse, self-sustaining ecosystem of interconnected financial services and products. This revolutionary approach could set a new standard for how decentralized organizations manage growth, innovation, and risk in the evolving blockchain financial sector.

5. Summary and thoughts

Maker is at the forefront of bringing cryptocurrency to the traditional world, and it’s exciting to see this effort push its potential to scale to a larger scale. With the launch of Endgame, it sets an example for the entire cryptocurrency space, and other DAOs are expected to follow suit, as DAOs often suffer from bureaucratic paralysis when votes are divided.

In addition, Maker is at the perfect intersection of RWA and Ethereum DeFi. With the help of Ethereum ETF, Maker is likely to lead the wave of Defi 1.0 asset recovery. Names such as Aave and Uniswap remind people that some "old" protocols have proven to be resilient under pressure after multiple cycles, while others have even achieved product-market fit and established sustainable revenue models.

Maker’s success will largely depend on its ability to deliver Endgame while carefully navigating the growing political uncertainty surrounding crypto assets. However, with growing institutional interest in crypto assets and the launch of Bitcoin (and potentially Ethereum) ETFs this year, Maker’s future looks brighter than ever.

Maker’s Endgame plan represents a bold and ambitious vision for the future of the protocol. As the world moves towards a cryptocurrency-centric future, Maker stands at the forefront of the industry and is expected to help bridge the gap between decentralized assets and the centralized world.