- Author: Lao Bai

With the launch of Babylon and the opening of Lorenzo staking, let’s talk about the recent development of the BTC ecosystem.

Since Ordi made the BTC ecosystem popular, in fact, BTC has quickly compressed and gone through the same route as ETH - first on-chain assets (ERC20) - then expansion plans (Rollup) - and then Staking/Restaking. But because there is no steadfast needle like ETH Foundation and Buterin to determine the direction, BTC is basically a situation where hundreds (luan) flowers (qi) come together (ba) bloom (zao).

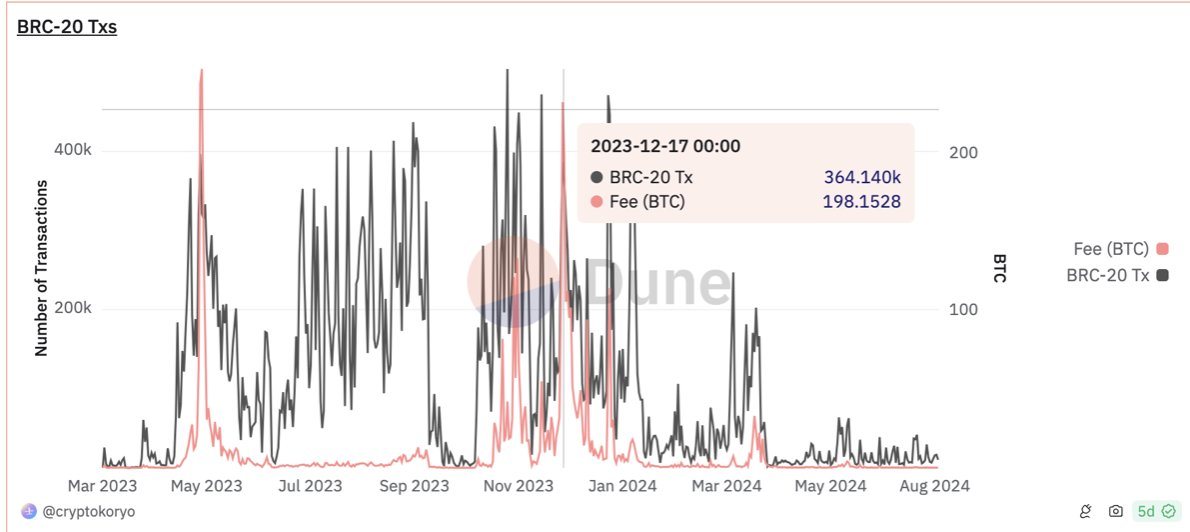

On the asset side, Ordinal became popular first, and then various XX20s such as Brc20, Arc20, Src20, Orc20, etc., poured out like crazy. Many people were happy last year and felt that the BTC security model was expected to be solved (it will take another 20 or 30 years to experience this) The block reward after halving four or five times can be so small that it can be ignored. There must be enough TX on the chain to pay the miners the handling fee). At the end of last year, when Inscription went crazy with new products, the handling fee was indeed more than the block reward. You can see from this picture that the maximum handling fee is 300 BTC per day.

Let’s look at August…the daily BTC fee income was only 0.0%. In April and May, Rune became popular for a short time, and then died out.

After ETH's ICO in 2017, the expansion plan represented by Merlin was followed. First, we took ETH's EVM ready-made technology stack + a multi-signature side chain to run (speaking of Polygon - it was also called Matic at the time, and it did the same thing).

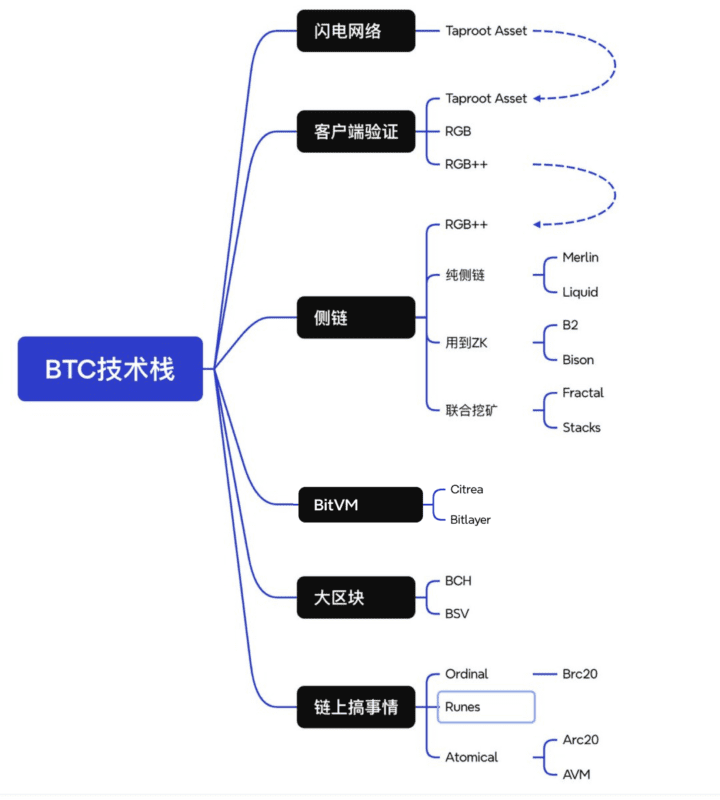

Then, the expansion plan, compared to the official rollup on ETH, there is much more on BTC. I simply drew a diagram, which is basically like this (including on-chain assets is considered a technical branch).

At present, Taproot Asset can only do transfers. The most BTC Native ones (that is to say, based on UTXO characteristics) are definitely RGB (can the mainnet no longer be delayed in September?), RGB++ & UTXO Stack, and Unisat Fractal (very popular recently).

There is actually another route missing from the picture, which is the contract virtual machine extension of the 1.5 layer type. The representative is undoubtedly Arch Network. The OP_NET we talked about recently also counts, but Arch uses ZKVM and OP_NET uses WASM.

The technology stack of the expansion plan is too complex, more messy than the assets, so it’s hard to say who will come out in the end. I can only say that each has its own advantages and disadvantages, and leave it to time and the market. This is a pessimistic argument in this direction, and perhaps it is not impossible to prove all of it in the end. After all, BTC’s current main narrative of “electronic gold” does not actually require expansion. More expansion is to serve “on-chain assets” , if the route of on-chain assets does not take off, expansion will naturally lose its meaning.

Finally, let’s talk about the third stage (Staking/Restaking)

This route is actually more solid than the previous two routes, because it does not conflict with the electronic gold narrative at all, and is even a perfect complement – releasing the liquidity of gold and turning gold into an interest-earning asset!

The most important project at this stage is undoubtedly Babylon, because BTC does not have a natural POS yield like ETH. Under the premise of the existence of Lido, EigenLayer's Restaking narrative is more like a Booster, or the icing on the cake, for ETH itself. Babylon is a timely help for BTC. By restaking BTC through Trustless method and generating Yield, BTC is no longer an interest-free asset "gold".

The other two worth mentioning on this route are Solv and DLC.Link. The former gives BTC interest + SolvBTC liquidity in the form of Cefi+Defi (one of the Babylon entrances), and the latter is currently trusted by WBTC. In a crisis environment, use DLC technology to mint dlcBTC, and use "Trustless Bridge" BTC to participate in the Defi ecosystem on various chains such as ETH and Solana. It is easy to understand and can be simply regarded as a decentralized and secure version of WBTC.

Closer to home, back to Babylon and Lorenzo. Babylon undoubtedly targets the ecological niche of EigenLayer, so there will naturally be asset entrances, that is, the ecological niche of LST/LRT is also extremely important. EigenLayer has Etherfi, Renzo, Puffer, etc., and Babylon has There are also Solv, Lombard, and Lorenzo competing for entrance.

The differentiation of each company is greater than that of Eigen's leading LRT projects. For example, Solv, in addition to Babylon, also has profits on Cefi, and there are also BTC/ETH-related projects on Defi, such as Ethena, Merlin, Arb, etc. Benefits from cooperation with the second floor, etc.

Lombard has advantages in capital and circle resources. At the same time, the LBTC it issues is also the most secure, using CubeSigner (a professional non-custodial key management platform) + Consortium (an industry leader node) Alliance chain node network) is the most balanced solution I have seen so far in terms of security and flexibility.

Lorenzo directly integrates Pendle's principal and interest separation function. The liquidity pledge token stBTC for the principal part of BTC (the same for each pledge project), and the liquidity pledge token YAT for the interest part (different for each pledge project). Lorenzo is also the only LST project on the market that provides users with a dual incentive system of YAT and points. The current total limit is 250 BTC (in order to ensure user income), and there is still a capacity of dozens of BTC, which is expected to be full soon, first come first served. have to

Finally, compared to the two directions of asset issuance and expansion on the BTC chain, BTC’s interest generation/liquidity release is a more visible and tangible direction. From Binance’s perspective on this direction, especially the asset entrance The layout is also evident. Among the projects mentioned above, Binance has invested in Renzo, Puffer, Babylon, Solv and Lorenzo. So you know, old man, you have to pay close attention to this track!