Since the current round of Bitcoin halving, mining companies have been under increasing revenue pressure. Not only have small mining companies been shut down, but even large mining companies have also received a large amount of capital transfusions. Data shows that after the halving, listed mining companies have raised a total of US$2.2 billion to cope with cash flow tightening.

In addition to increasing stock market issuance, these leading mining companies also use equity financing, convertible notes and loans to alleviate debt problems caused by tight liquidity.

However, financing can only solve the problem temporarily. Listed mining companies still need to find new economic growth paths, including increasing mining machines to improve computing power, acquiring and merging to expand mining sites, and turning to the AI field. It is worth noting that some mining companies have begun to choose to invest in Bitcoin, such as Marathon Digital, which recently purchased more than 4,000 BTC. This shows that investing in BTC has become one of the business options for large mining companies, trying to follow in the footsteps of MicroStrategy.

Listed mining companies that have raised funds continuously

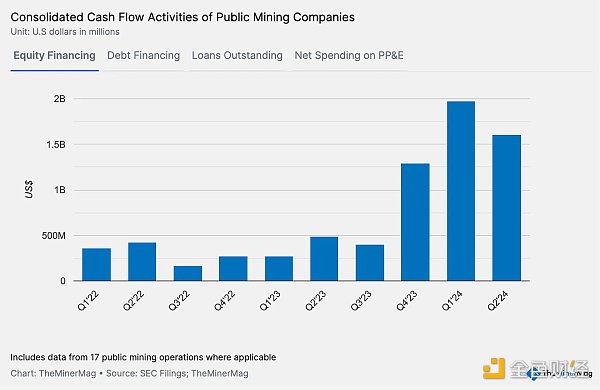

On August 1, Galaxy released its 2024 Bitcoin Mining Mid-Year Report, which showed that listed mining companies raised $1.8 billion in Q1, setting a record for the highest quarterly financing amount in the past three years. Of the $1.8 billion raised, 75% came from the top three miners by market value: Marathon, CleanSpark, and Riot.

In addition, since the beginning of the year, there have been a large number of mergers and acquisitions between Bitcoin mining companies, with a total transaction value of more than US$460 million. The transaction types are divided into site sales, reverse mergers and company acquisitions.

According to TheMinerMag data, 9 of the 13 mining companies listed in the United States in Q2 2024 - Bitdeer, Bitfarms, Cipher, CleanSpark, Core, HIVE, Marathon, Riot and Terawulf - raised a total of $1.25 billion through various stock issuance plans. In addition, Iris Energy raised $458 million in the second quarter, bringing the total funds raised by miners to more than $1.7 billion.

And an additional $530 million has been raised so far in the third quarter, bringing the total amount raised to more than $2.2 billion.

As can be seen from the above figure, mining companies raised more than US$1.5 billion in Q1 and Q2 of 2024. Although the second quarter data was slightly lower than the first quarter, it is worth noting that convertible notes and asset-backed loans have increased since the second quarter.

The amount of financing raised by listed mining companies has increased significantly this year, which largely reflects the urgent need for cash flow of these companies. Especially with the arrival of the Bitcoin halving cycle, mining revenue has been greatly reduced, and the living environment of mining companies has become increasingly harsh. Such negative news has also frequently appeared in reports.

In August this year, Bitcoin mining company Core Scientific announced its financial results for the second quarter of fiscal year 2024, with a net loss of US$804.9 million, compared with a net loss of US$9.3 million in the same period of 2023.

Cipher Mining's Q2 financial report showed a net loss of $15 million in the quarter, slightly higher than the net loss of $13.2 million in the same period last year. Just last month, the company had plans to sell after receiving acquisition intentions.

Even the leading mining company Marathon's second-quarter revenue was lower than expected, at $145.1 million, while its second-quarter adjusted EBITDA turned from $35.8 million in the previous year to a loss of $85.1 million.

In July, the CEO of Swan, a California-based Bitcoin-specific investment platform, announced that the company was withdrawing its mining operations, downsizing, and canceling its IPO plans. Swan's managed mining division was established in July 2023 and was originally planned to be listed at the end of this year.

Revenue reduction, expansion of new paths

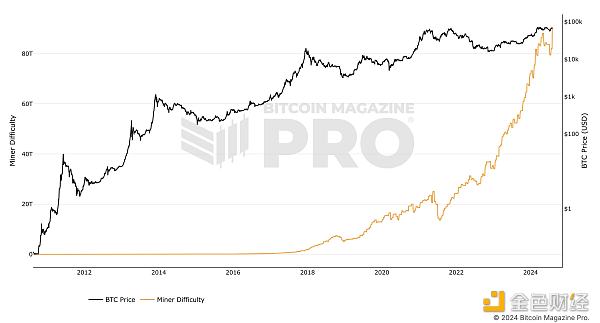

The biggest reason for the reduction in revenue of listed mining companies is the halving of Bitcoin, which is needless to say. There are other factors behind the mining companies' willingness to issue additional shares to raise funds, such as the difficulty of mining reaching a record high and the increase in electricity costs.

According to Bitcoin Magazine's statistics, the difficulty of Bitcoin mining has reached a record high. As of the time of writing, the difficulty of Bitcoin mining is 86.87 T, and the average computing power of the entire network in the past seven days is 633.73 EH/s. Correspondingly, the income of Bitcoin miners has also hit a new low for the year as the difficulty of mining has reached its peak, with only 2.54 million US dollars on August 11.

In this regard, JPMorgan analysts also pointed out that Bitcoin mining profitability fell to an all-time low in August.

On the other hand, the electricity costs of mining companies are also increasing. The halving of Bitcoin and the increase in mining difficulty have forced mining companies to improve the performance of mining machines, expand the number of mining machines, and expand the scope of mining sites to maintain income, which will inevitably lead to an increase in electricity consumption.

Due to the shortage of electricity resources and environmental factors, government departments are also trying to raise electricity prices to put pressure on mining companies. For example, recently, senior executives of the International Monetary Fund proposed to increase the electricity price of cryptocurrency mining by 85%, and the Paraguayan National Electricity Administration increased the electricity fee of cryptocurrency mining operators by 14%.

The sharp decline in revenue and the pressure on operating costs have also forced mining companies to constantly try new business development paths, such as the efforts of the above-mentioned mining companies to increase production. Recent cases include BitDeer's plan to issue US$150 million convertible bonds for data center expansion and Cleanspark's acquisition of 26,000 Bitmain immersion mining machines for US$167.7 million.

In addition, mergers and acquisitions are also happening among mining companies, such as Riot Platforms' acquisition of Block Mining for $92.5 million, CoreWeave's intention to acquire Core Scientific, and Bitfarms' negotiation to acquire Stronghold Digital Mining for approximately $164 million.

In addition to improving the level of mining business, mining companies are also trying to turn to the field of AI. Examples of this include Core Scientific signing a long-term contract with CoreWeave, Hut8 announcing the start of AI business commercialization, and BitDeer planning to acquire ASIC chip design company Desiweminer in an all-stock transaction worth $140 million.

The transformation of AI layout has been effective for mining companies, and their stock prices have rebounded to varying degrees. However, in the long run, it still needs to be tested by the market. Obviously, the above paths require a lot of capital for mining companies to achieve, which can well explain why mining companies continue to raise a lot of funds.

What is different from the past is that some mining companies have begun to use the funds they have raised to invest in Bitcoin.

On August 12, Marathon Digital Holdings announced plans to privately issue $250 million in convertible senior notes, and the company intends to use the net proceeds from the sale of the notes to purchase additional bitcoins. Immediately afterwards, the market reported that it had purchased 4,144 bitcoins in two days.

Earlier in July, Marathon Digital increased its holdings by 2,282 BTC, and it did not sell any Bitcoin in June.

Marathon Digital's choice to buy a large amount of Bitcoin is closely related to its performance. Its revenue in the second quarter was lower than expected. And it has made many efforts this year, such as Marathon Digital's acquisition of Applied Digital's Bitcoin mining data center for $87.3 million, cooperating with NiceHash to launch customized firmware for Bitcoin ASIC miners optimized for the NiceHash mining platform, and launching mining products MARAFW firmware and MARA UCB 2100 control board, but all of the above measures have driven the company's stock price to rise.

Another mining company, CleanSpark, mined 494 BTC in July, but only sold 2.54, bringing its reserves to 7,082 BTC.

The CryptoQuant research report also pointed out that the Bitcoin hash indicator also indicates that the period of miners' selling has ended.

The above phenomenon shows that listed mining companies raise funds by issuing convertible bonds and stocks to expand market share and increase hash rate, but in the final analysis, they still need to find ways to maximize their profits. Retaining and investing in Bitcoin is becoming a business choice for mining companies.

Conclusion

The reduction in income has forced mining companies to seek diversified sources of income to maintain competitiveness, and conventional methods include improving existing business capabilities and levels, acquiring companies, adjusting industry directions, etc. However, Marathon Digital made a bold choice different from other mining companies, namely, purchasing Bitcoin on a large scale.

In fact, MicroStrategy's successful model is right in front of us. The profits brought by mining companies' increased investment in Bitcoin may not be lower than other businesses, and continuing to sell Bitcoin obviously cannot help mining companies get rid of their current predicament.