Looking back at the development in the past year, leveraging Solana is undoubtedly a key turning point in the expansion of the PYUSD market, and real money subsidies and the expansion of application scenarios are making it more competitive.

Author: Nancy, PANews

Cover: Base

Backed by payment giant PayPal, the US dollar stablecoin PYUSD has grown into the sixth largest stablecoin after a strong start last year. Looking back on the development in the past year, leveraging Solana is undoubtedly a key turning point in the expansion of the PYUSD market, and the real money subsidies and the expansion of application scenarios are making it more competitive.

It has become the sixth largest stablecoin, and its market value and trading volume have surged after expanding to Solana

PYUSD has shown a high expansion rate this year. According to DeFiLlama data, as of August 20, the total market value of the stablecoin market reached 167.99 billion US dollars. Among them, PYUSD's circulation volume at the beginning of the year was 230 million US dollars, accounting for less than 0.2% of the overall market. Now it has a market value of nearly 870 million US dollars and has a market share of 0.5%, ranking sixth, surpassing a number of stablecoins such as USDD, TUSD and FRAX.

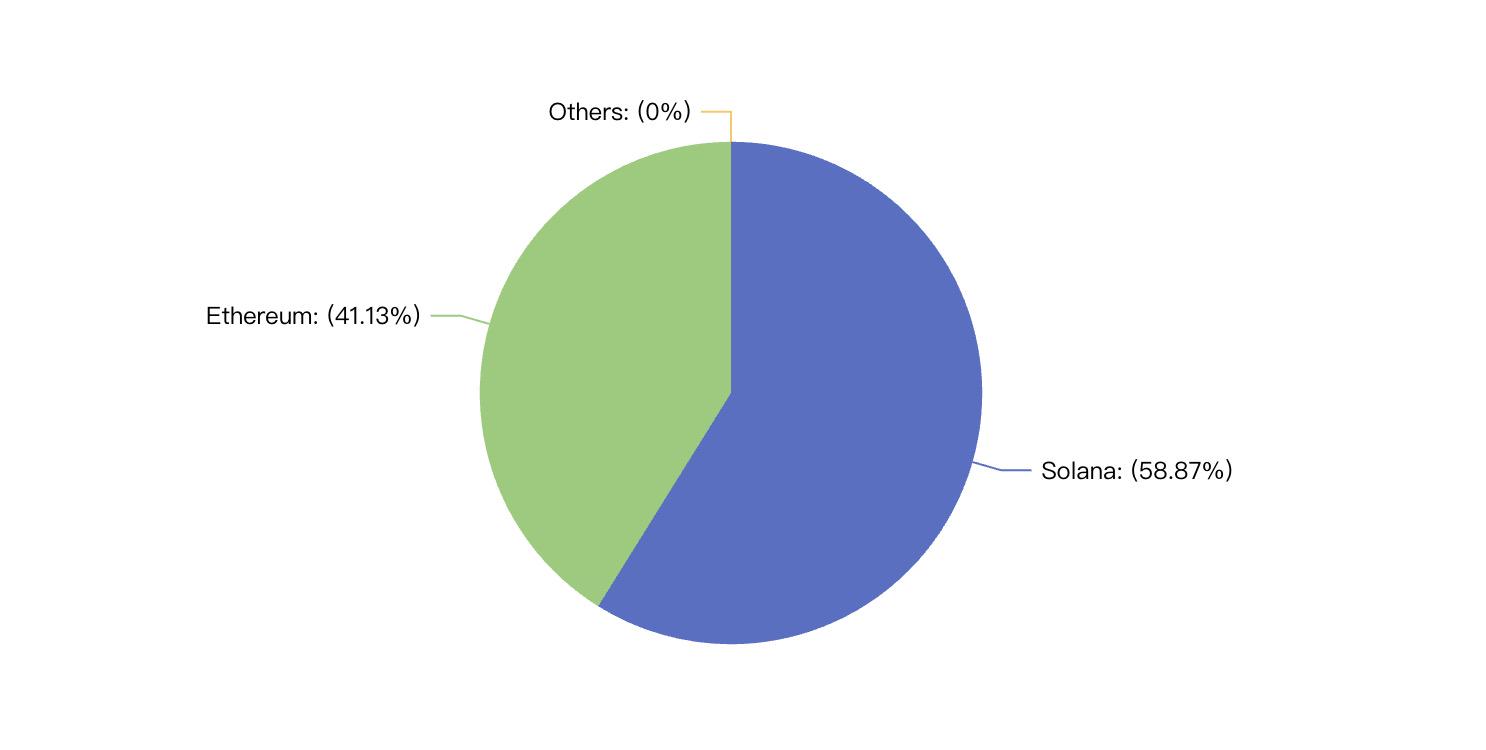

Unlike stablecoins such as USDT, USDC, and Dai, which are issued on dozens of blockchains, PYUSD is now only issued on Solana and Ethereum. According to DeFiLlama data, as of August 21, the circulation of PYUSD on Solana was 510 million, accounting for nearly 58.9%, and on Ethereum it was 350 million, accounting for 41.1%.

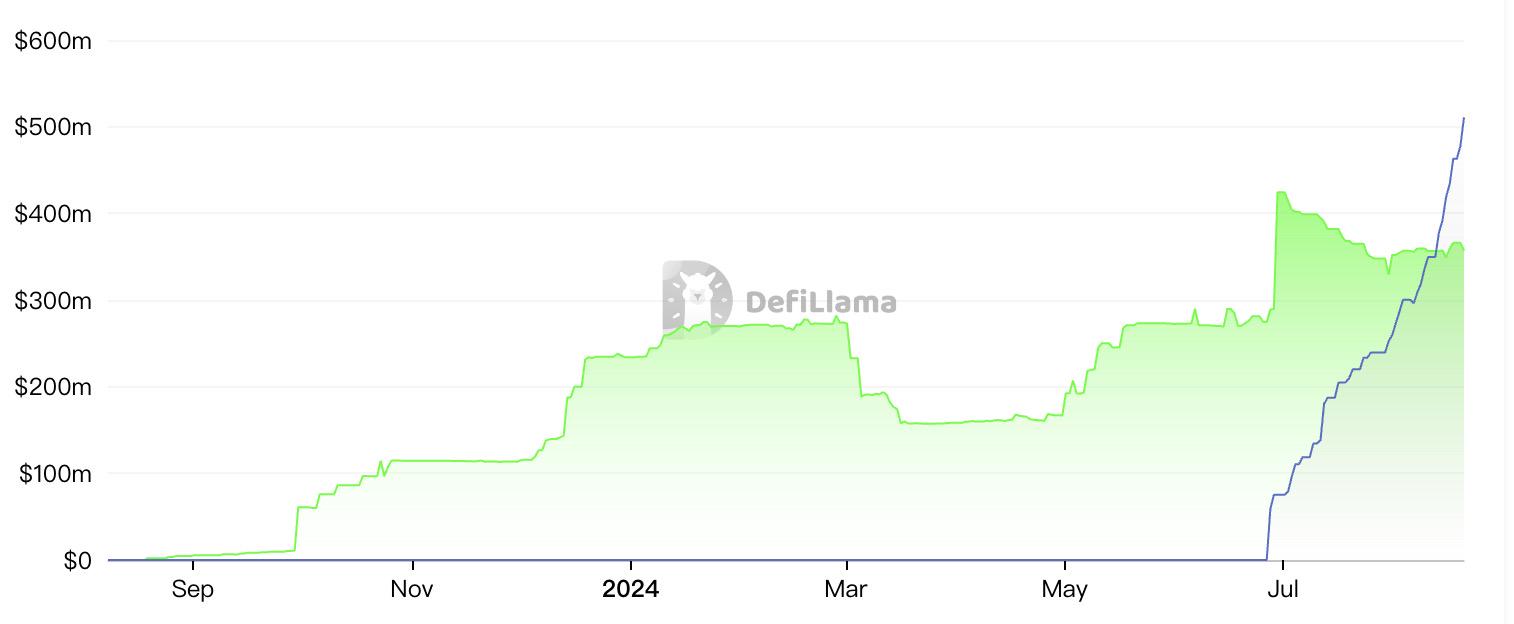

Although the market share of PYUSD in these two blockchains is not much different, Solana's expansion was achieved at the end of May this year. PYUSD was originally planned to be first issued on Solana in 2022 in cooperation with FTX, and a relevant cooperation agreement was signed, but due to the collapse of FTX, it was finally issued on Ethereum.

Prior to this, it took about ten months for PYUSD on Ethereum to reach a scale of less than $300 million, but after being deployed on Solana, the market value surged by 217.9% in less than three months. And judging from the growth in supply, the adoption rate of PYUSD on the Solana network is climbing at a relatively fast pace. On-chain data shows that in the past 30 days, the supply of PYUSD on Solana has increased by 131.8% to 510 million, while Ethereum has fallen by 2.4% to 350 million in the same period, indicating that the adoption rate of PYUSD on the Solana network is growing at a relatively fast pace.

PYUSD also occupies an important share in the Solana stablecoin market. According to DeFiLlama data, as of August 21, the scale of stablecoins on Solana reached 3.81 billion US dollars, and PYUSD ranked third among 26 stablecoin projects. But in the past month, the market value of PYUSD has increased by 132%, exceeding the first-ranked USDC (14.03%) and the second-ranked USDT (down 2.64%).

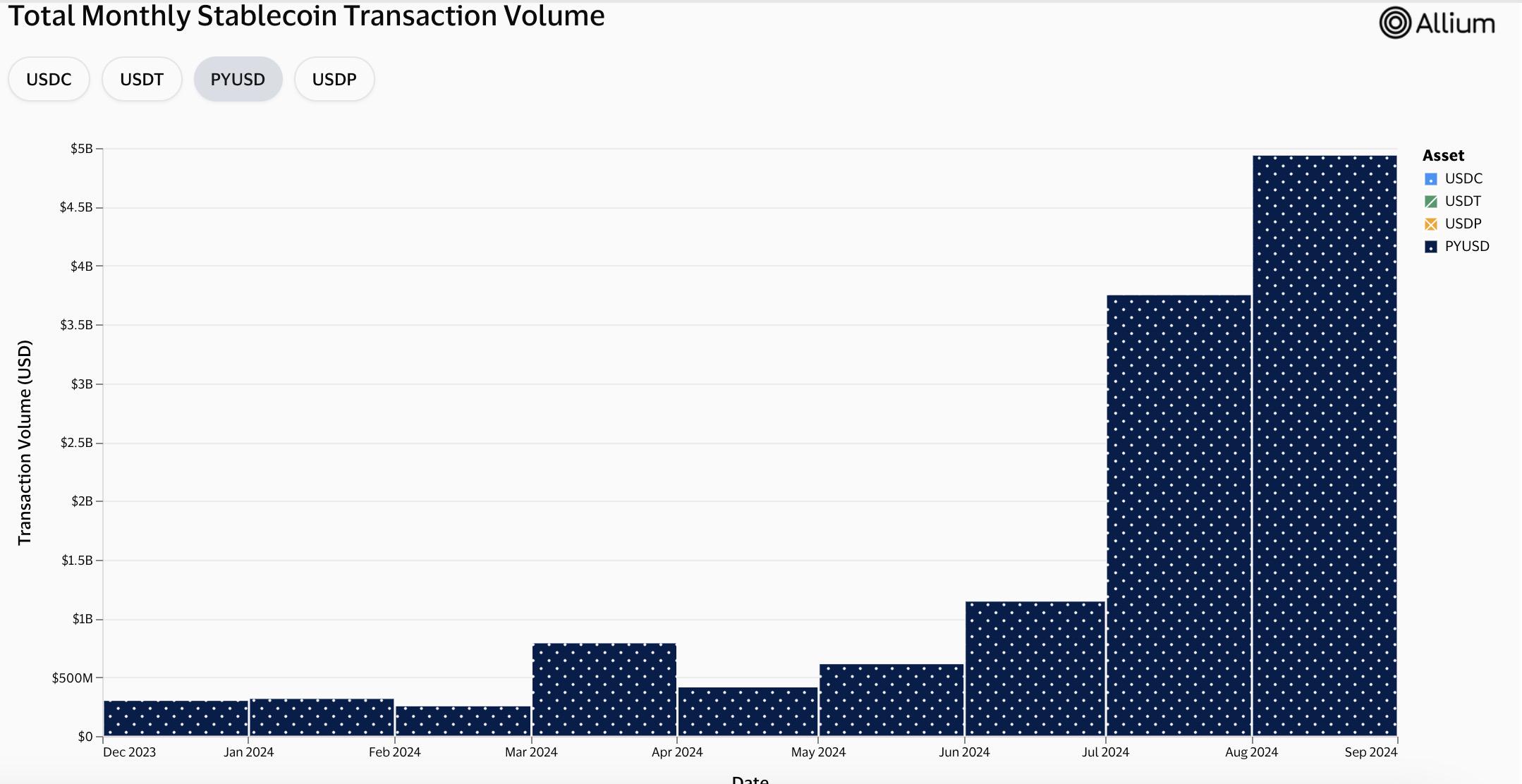

As the market value grew, PYUSD's trading volume also increased significantly. Data from blockchain data provider Allium Labs showed that PYUSD's trading volume in August was $4.94 billion, more than 15.4 times the $320 million at the beginning of the year. Especially since its expansion to Solana, PYUSD has achieved a trading volume of more than $9.84 billion in the past three months, which is 3.6 times the total of previous transactions ($2.69 billion).

High APY income expands usage, and multiple measures increase popularity

The rapid expansion of the PYUSD market size is inseparable from the generous subsidies from cooperation with major DeF protocols on Solana and the popularization of payment scenarios.

In recent times, PYUSD has cooperated with many protocols such as Jupiter, ORCA, Wormhole, Drift Protocol, Kamino Finance and Marginfi. For example, when Jupiter launched PYUSD, the stablecoin can also be used in all payment integrations on the platform, including platforms such as Sphere Labs and Helio Pay; Kamino introduced PYUSD and officially launched a deposit incentive activity, and increased PYUSD weekly incentives by 64% to 192,000.

At the same time, PYUSD on these DeFi protocols also provides high returns to encourage users to use it. For example, there are 350 million PYUSD on Kamino with an APY return of 17.64%, Marginfi can provide PYUSD with an APY return of 18.58%, and the APY of PYUSD on Drift Protocol is 17.49-18.28%.

The generally high yield of PYUSD is also believed to be related to PayFi, which is highly promoted by the Solana Foundation. Payment and stablecoins are revealed to be the key focus of Solana in the future. In sharp contrast, for example, the APY of PYUSD on Ethereum Aave is only 3.55%.

Not only that, compared to Ethereum, PayPal also introduced some new features to provide a better user experience when deploying PYUSD on Solana, including "confidential transfers" to provide consumers with confidentiality of transaction amounts while meeting regulatory requirements, transfer hooks that allow developers to call custom programs when transferring tokens for individuals and merchants when using PYUSD, and notes fields that allow users to record transaction information when paying. In order to further promote innovation and the adoption of PYUSD on Solana, PYUSD recently announced a global hackathon for its stablecoin PYUSD, with a total prize of 40,000 PYUSD.

In addition to expanding application scenarios, PYUSD has also expanded its popularity by reducing transaction fees, supporting cross-border transactions, and attracting developers to join. For example, the Web3 payment infrastructure Transak launched a fiat-to-cryptocurrency channel for PayPal USD to popularize digital asset payments; the Bitcoin Pizza Festival temporarily waived the transaction fees for exchanging BTC, ETH and other tokens with PYUSD; PayPal's cross-border remittance service Xoom provided PYUSD users with free remittance services to expand its international remittance market share.

In general, after laying the foundation with the help of Ethereum, which has a large user base and extremely high market consensus, PYUSD has made considerable progress by leveraging Solana's popularity and attractive profit opportunities, and has gained a certain degree of market recognition, but it still has a long way to go to gain greater voice in the stablecoin market.

Disclaimer: As a blockchain information platform, the articles published on this site only represent the personal opinions of the author and guests, and have nothing to do with the position of Web3Caff. The information in the article is for reference only and does not constitute any investment advice or offer. Please comply with the relevant laws and regulations of your country or region.

Welcome to join the Web3Caff official community : X (Twitter) account | WeChat reader group | WeChat public account | Telegram subscription group | Telegram exchange group