Author: OurNetwork

Compiled by: TechFlow

Layer 2s

Arbitrum | Base | Blast | Starknet

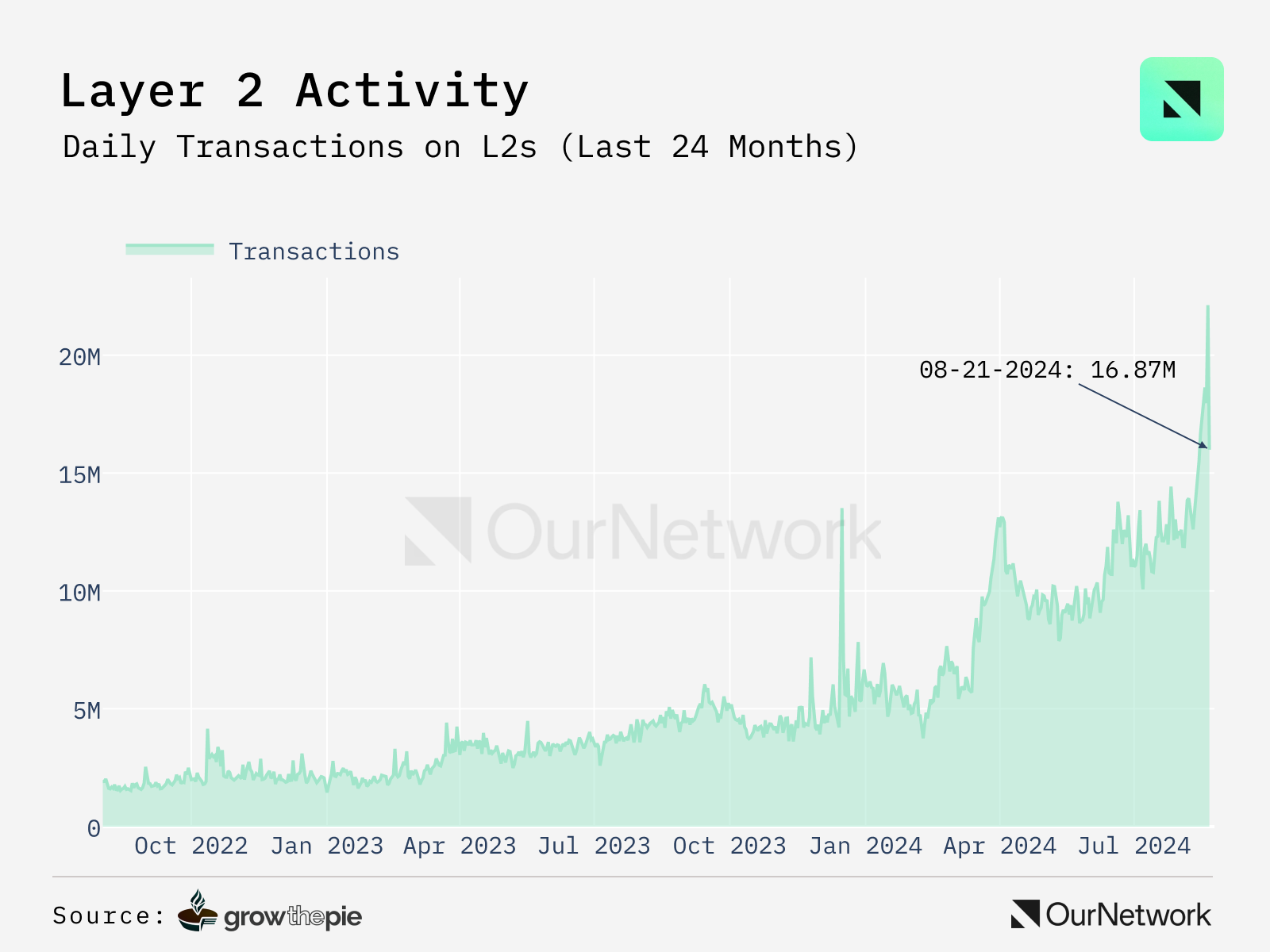

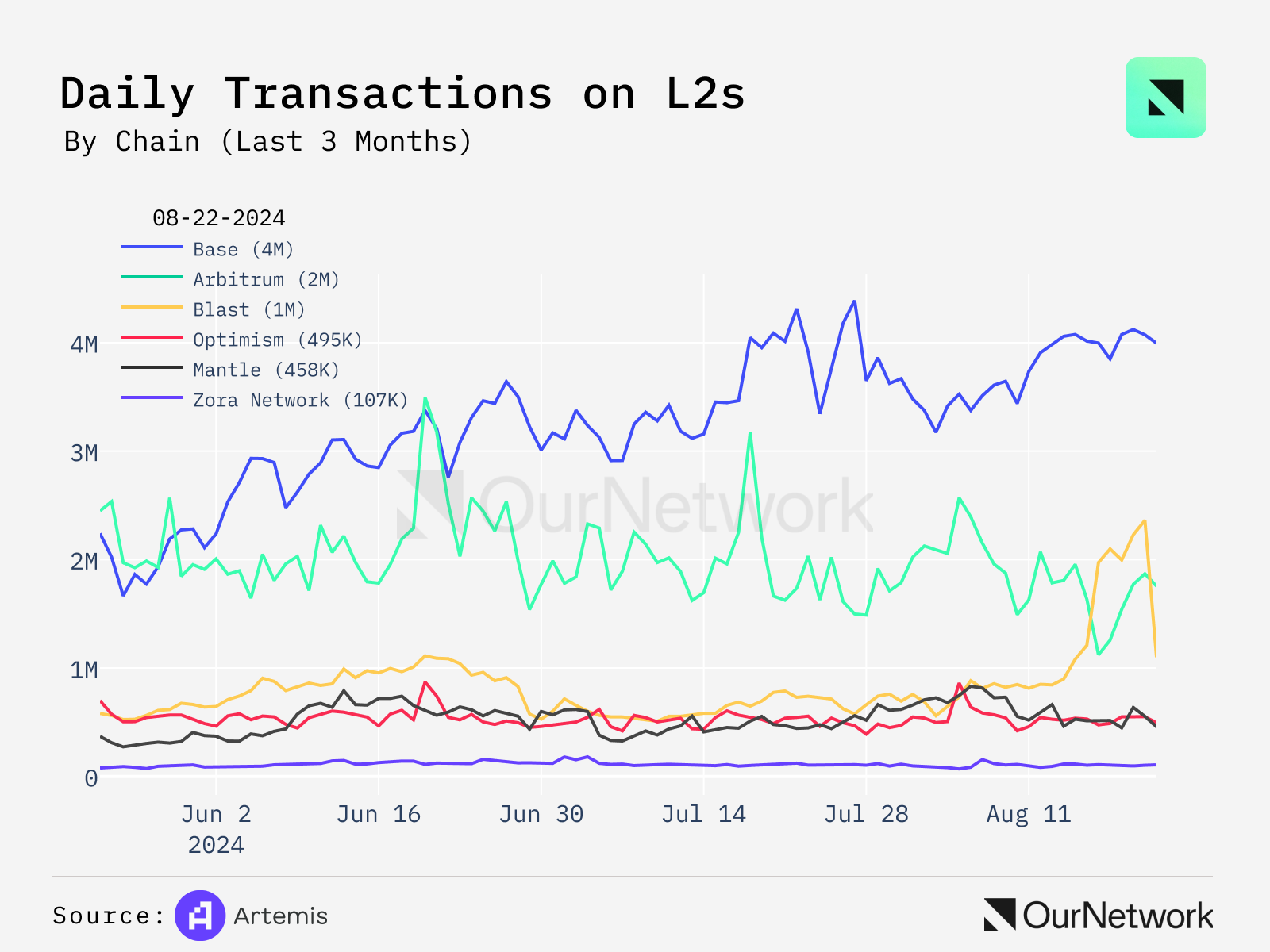

Layer 2 transaction volume increased by more than 350% year-on-year, with daily transaction volume of approximately 16.87 million

growthepie provides featured analysis on Layer 2. Since its inception, Layer 2 has shown impressive growth – with daily transaction volume reaching an all-time high of approximately 16.87 million in August.

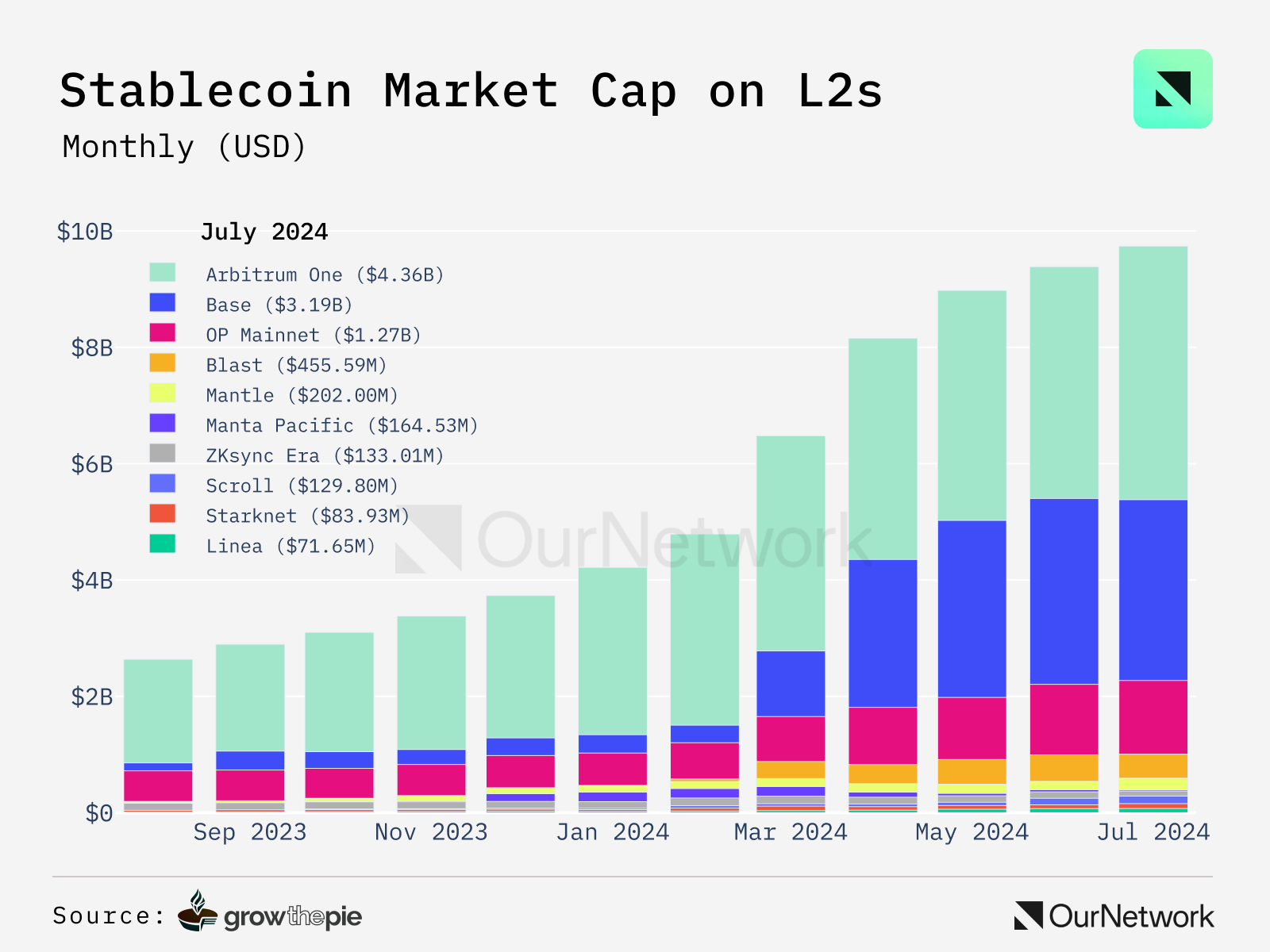

Layer 2 stablecoin market cap is also rising — now approaching $10 billion. For reference, this equates to ~12.5% of stablecoins on Ethereum or ~5.7% of the entire stablecoin market. Over 75% of L2 stablecoins are on Arbitrum One or Base — with Arbitrum One accounting for the largest share at ~45% of all L2s.

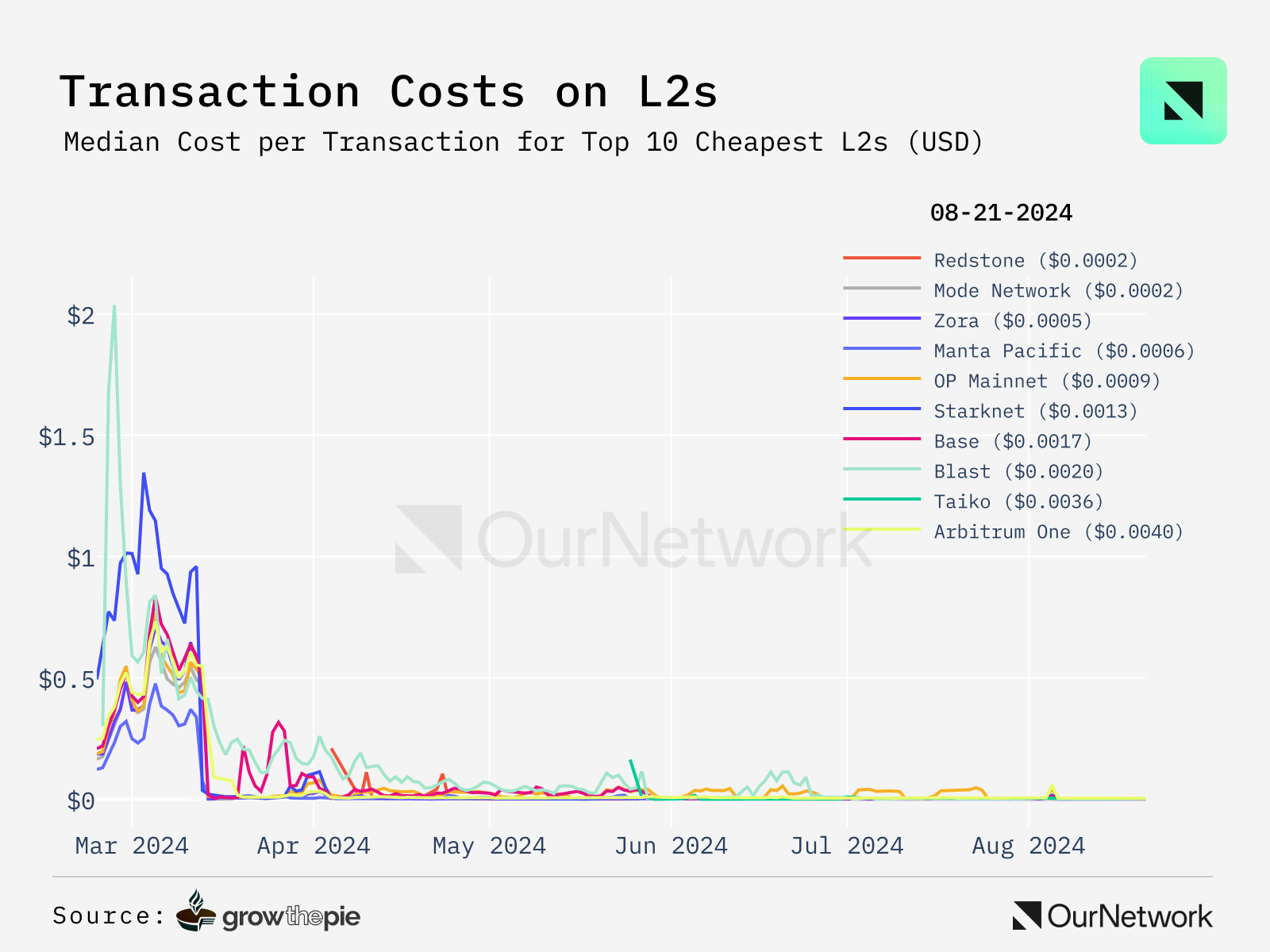

Transaction costs for most L2s have now dropped below a cent - of the 16 chains tracked by growthepie, all but 2 have a median transaction cost below 1 cent. These costs can fluctuate. Over the past 30 days, the highest median daily transaction cost on Polygon zkEVM has been $0.124.

Transaction level analysis: By using the tag page of growthepie, we can see that the contract address with the most transactions in the past 7 days is marked as WETH9 and is located on Taiko Layer 2. The transaction volume of this address exceeds 6.5 million, accounting for more than half of all transactions of Taiko in the past 7 days. It is very likely that this contract is used by airdrop farmers.

1. Arbitrum

Sbhn_NP & Sam Friedman | Website | Dashboard

Arbitrum is continuously expanding its liquidity layer, with L2 total locked value (TVL) currently accounting for approximately 41% on Arbitrum One, and approximately 51% of the total ETH bridged across chains on the platform.

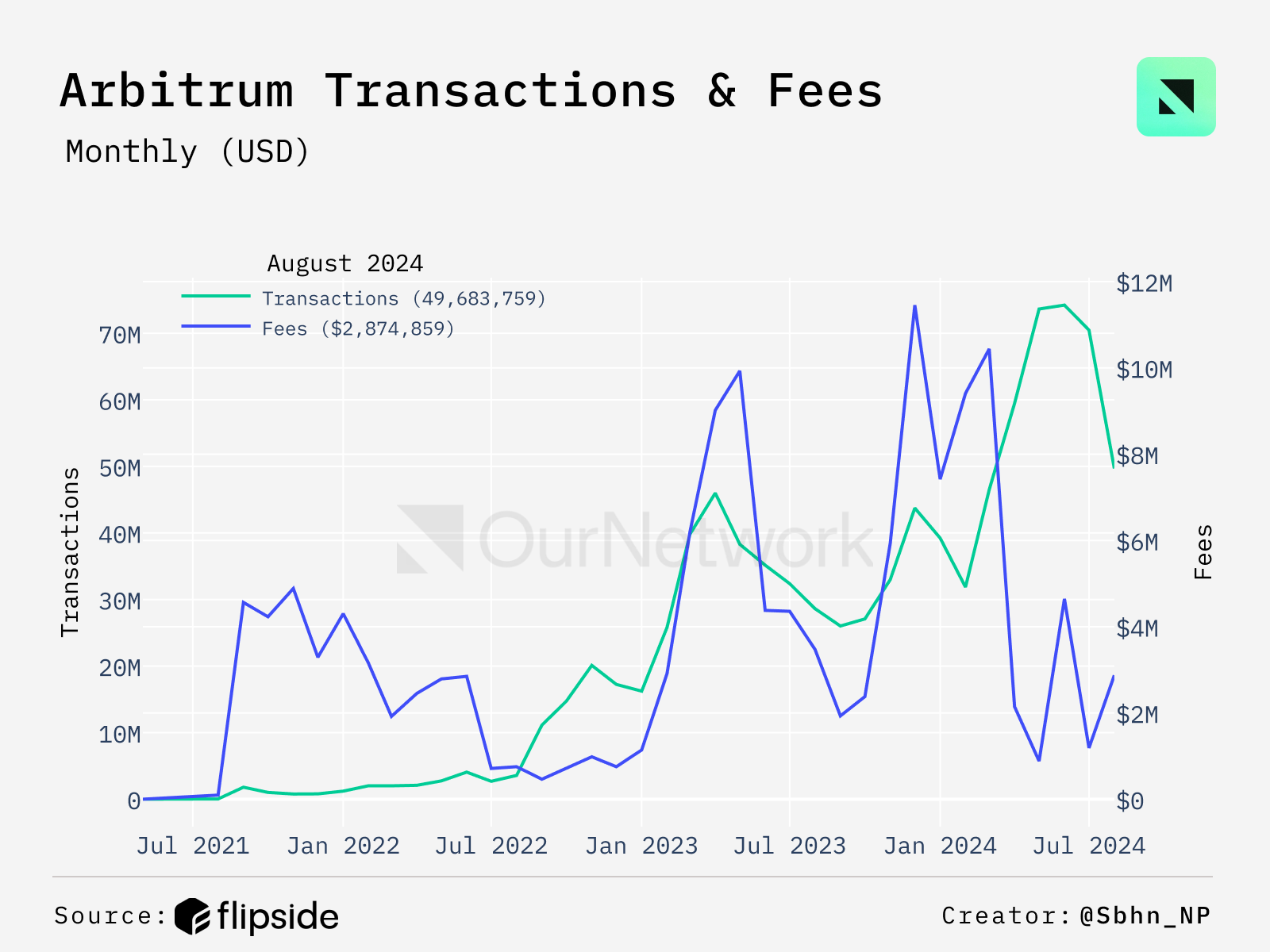

Recent data shows that transaction volume has nearly doubled in the past few months (including May, June, and July), while transaction fees paid by users have dropped significantly. Arbitrum has successfully reduced transaction fees in recent months, with fees falling by more than 80% since the first quarter of 2024.

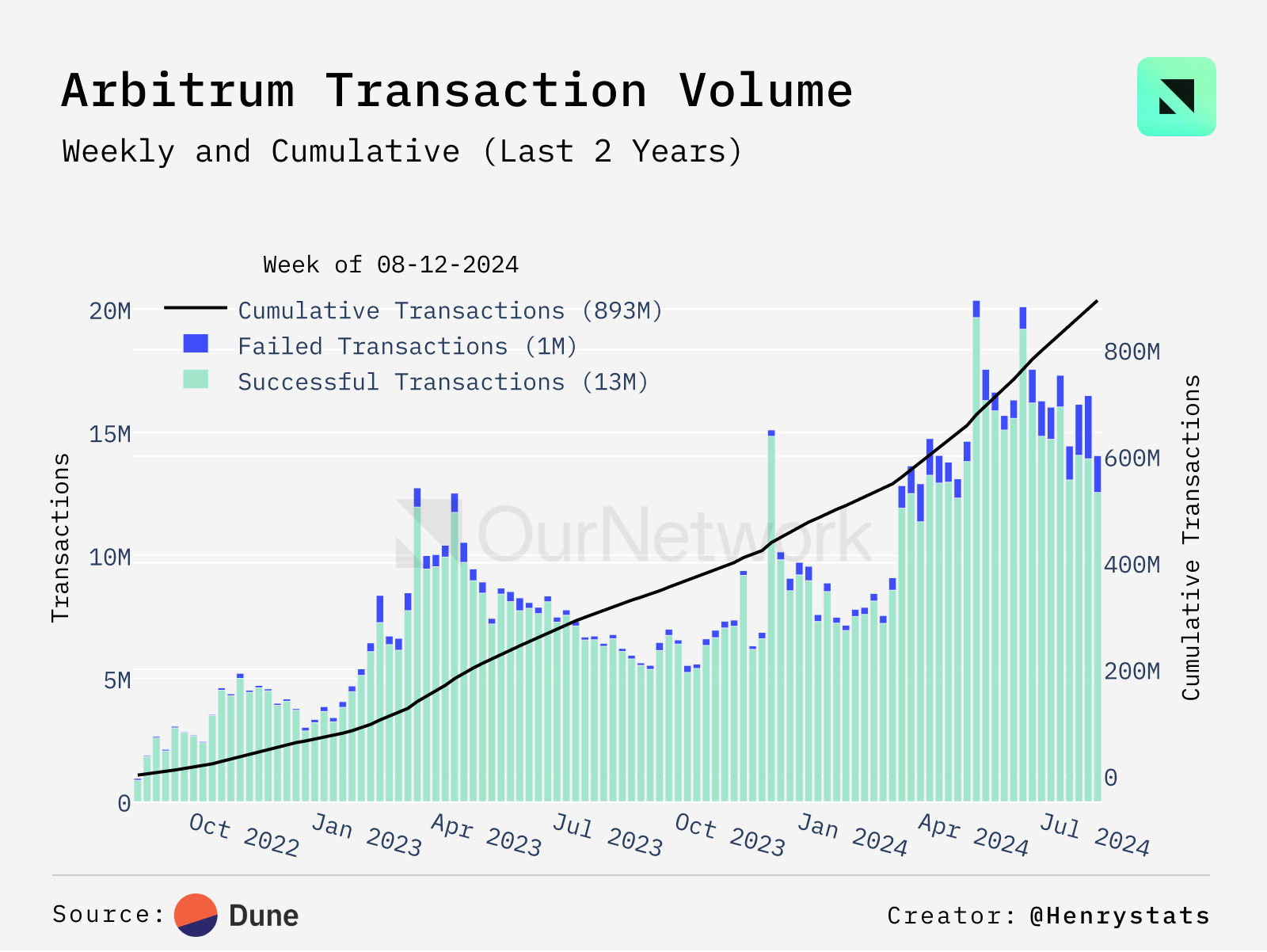

Arbitrum’s popularity seems to have risen since Q1 2024. Trading volumes have surged, with May and June being the most active months. Additionally, they have recorded more failed trades than before, which is understandable given the increase in trading volumes.

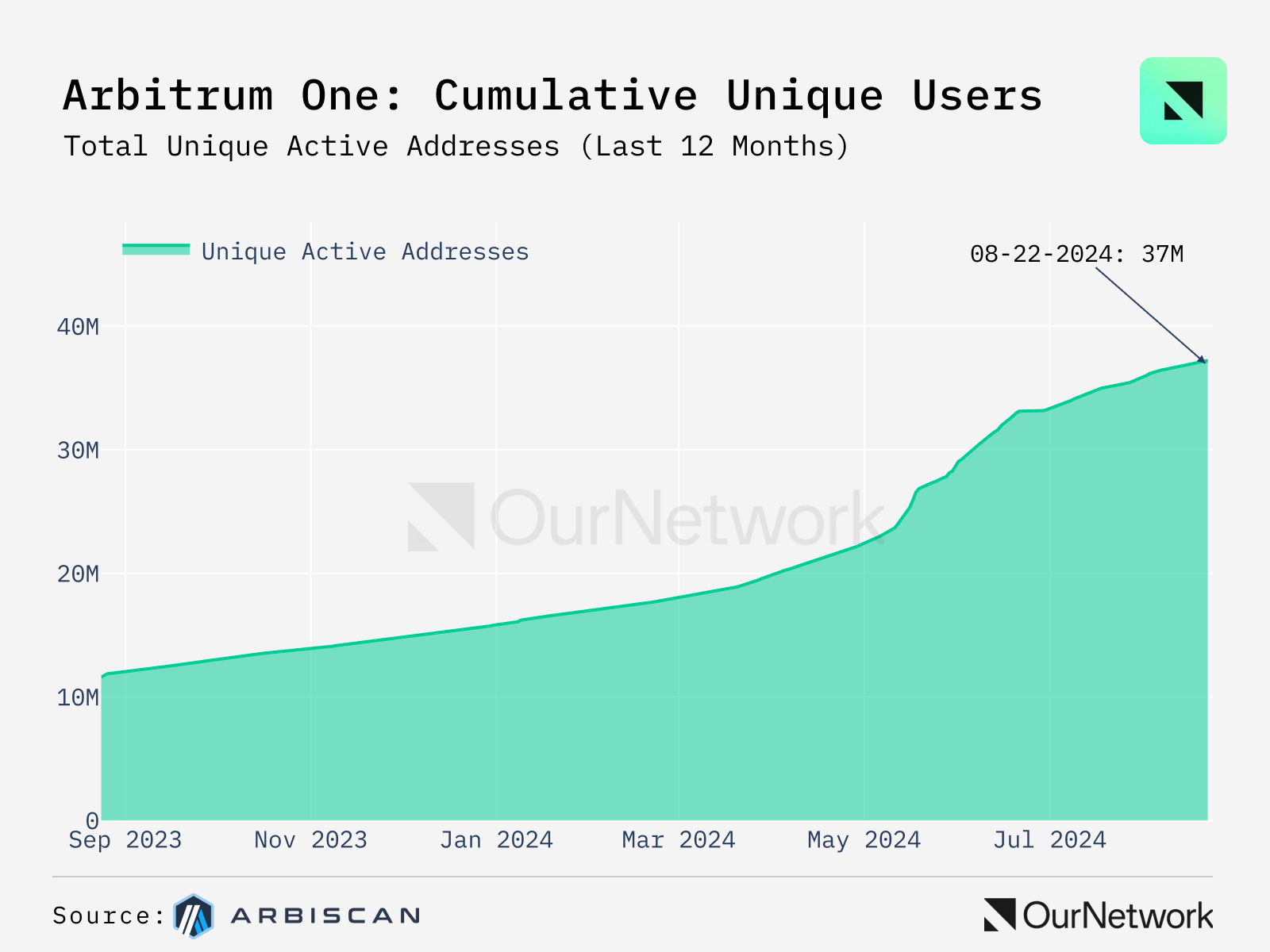

This chart shows the total number of addresses on the Arbitrum One blockchain and the growth of daily active addresses over the past year. The highest number of new addresses was recorded on May 18, 2024, with 637,812 new addresses.

2.Base

El Barto | Website | Dashboard

Base has more than 4 million transactions per day

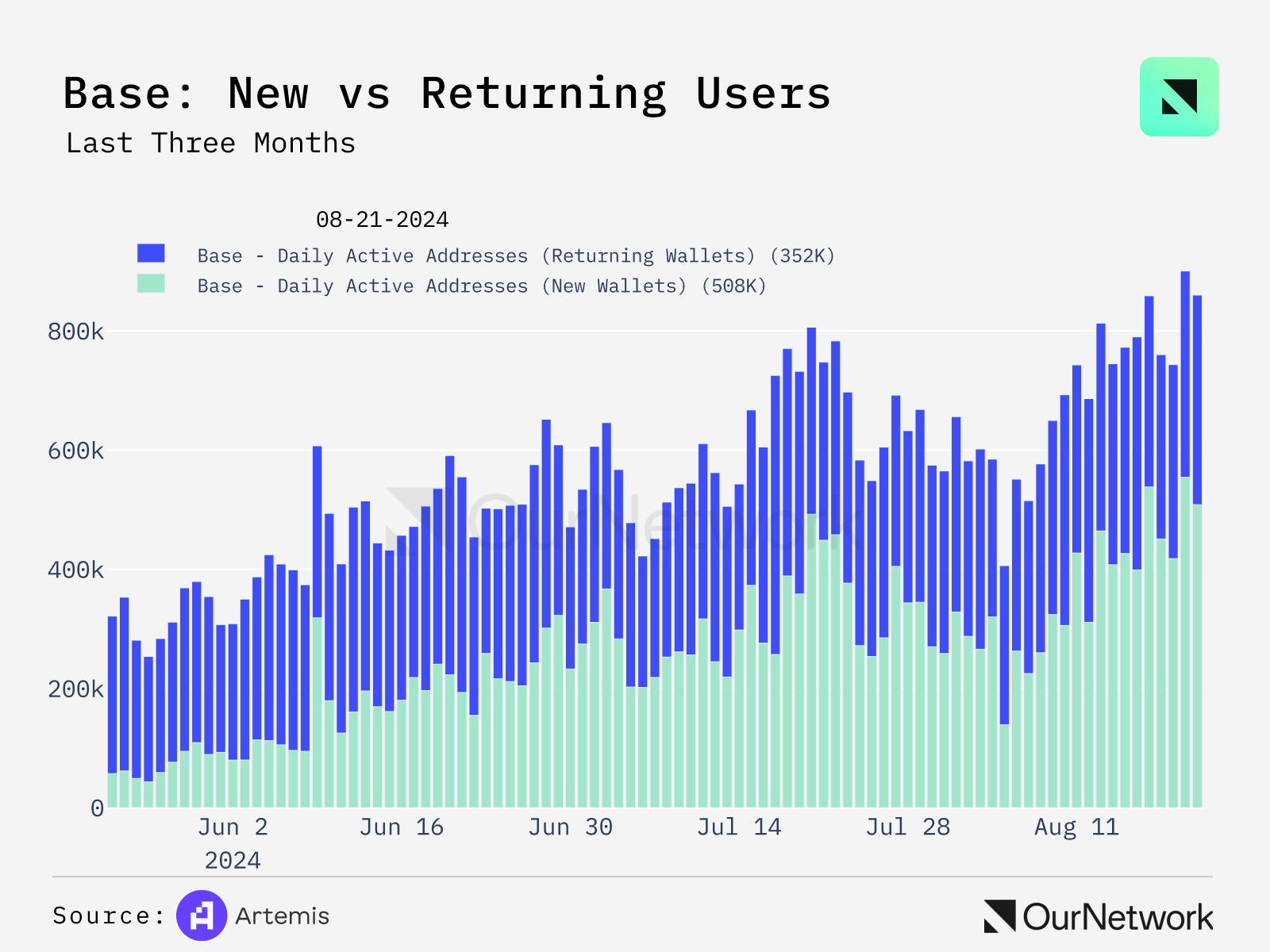

Coinbase describes Base as "a secure, low-cost, developer-friendly second-layer Ethereum solution designed to bring the next billion users to the blockchain." Since the beginning of the year, Base has shown strong growth in multiple indicators, including daily active addresses, decentralized exchange (DEX) trading volume, and number of transactions. In the past week, Base's daily transaction volume reached 4 million, ranking first among all optimistic rollups projects.

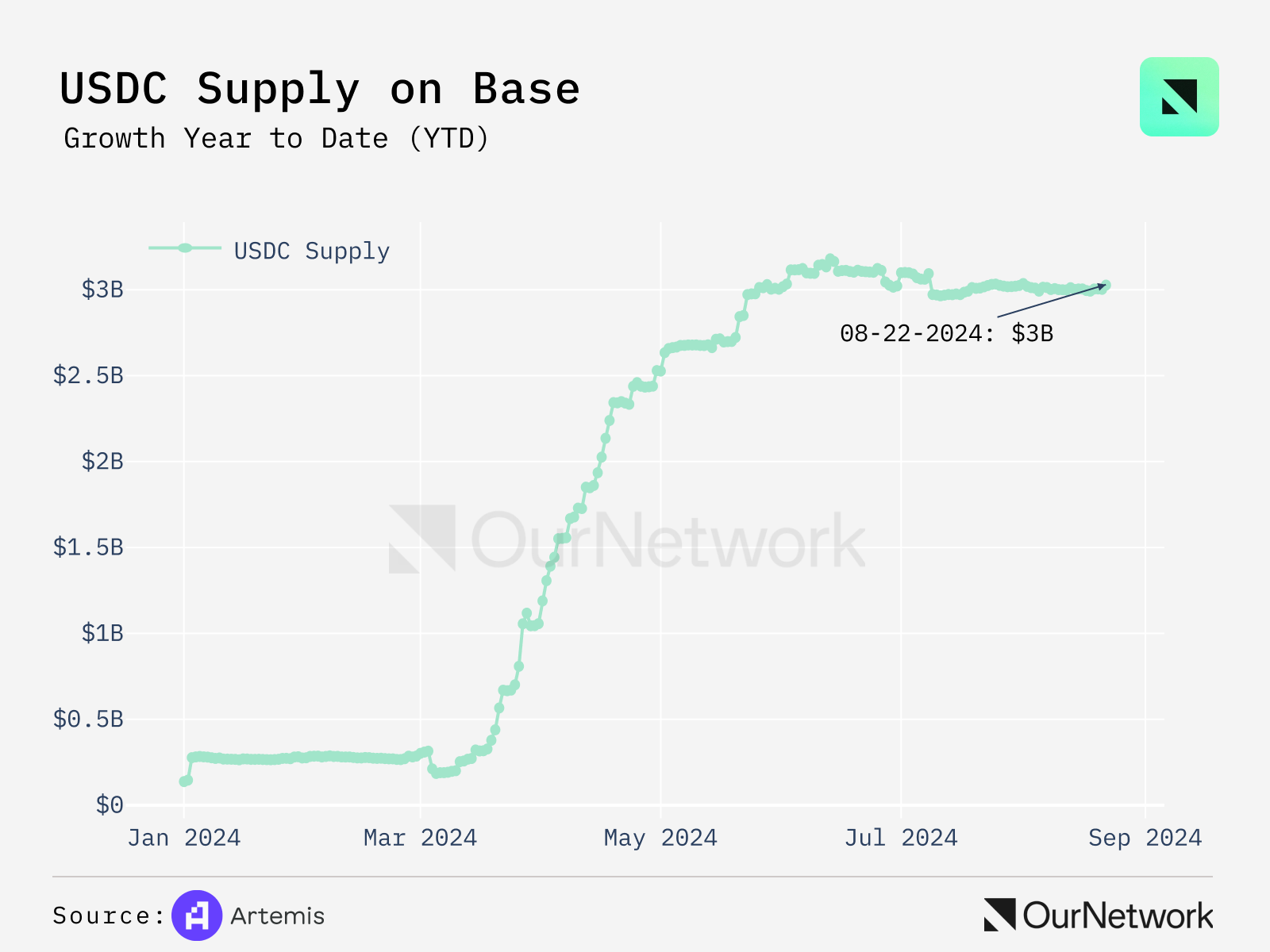

Due to the low fees of optimistic rollups, Base is well suited for stablecoin payments. Since the beginning of the year, the circulating supply of USDC on Base has grown rapidly and is currently around $3 billion.

Recently, Base has seen a large number of new wallets added, mainly thanks to Uniswap and the game Blocklords that utilizes account abstraction technology. As the Base ecosystem continues to expand, there is little reason for the trend of users continuing to join to slow down.

3. Blast

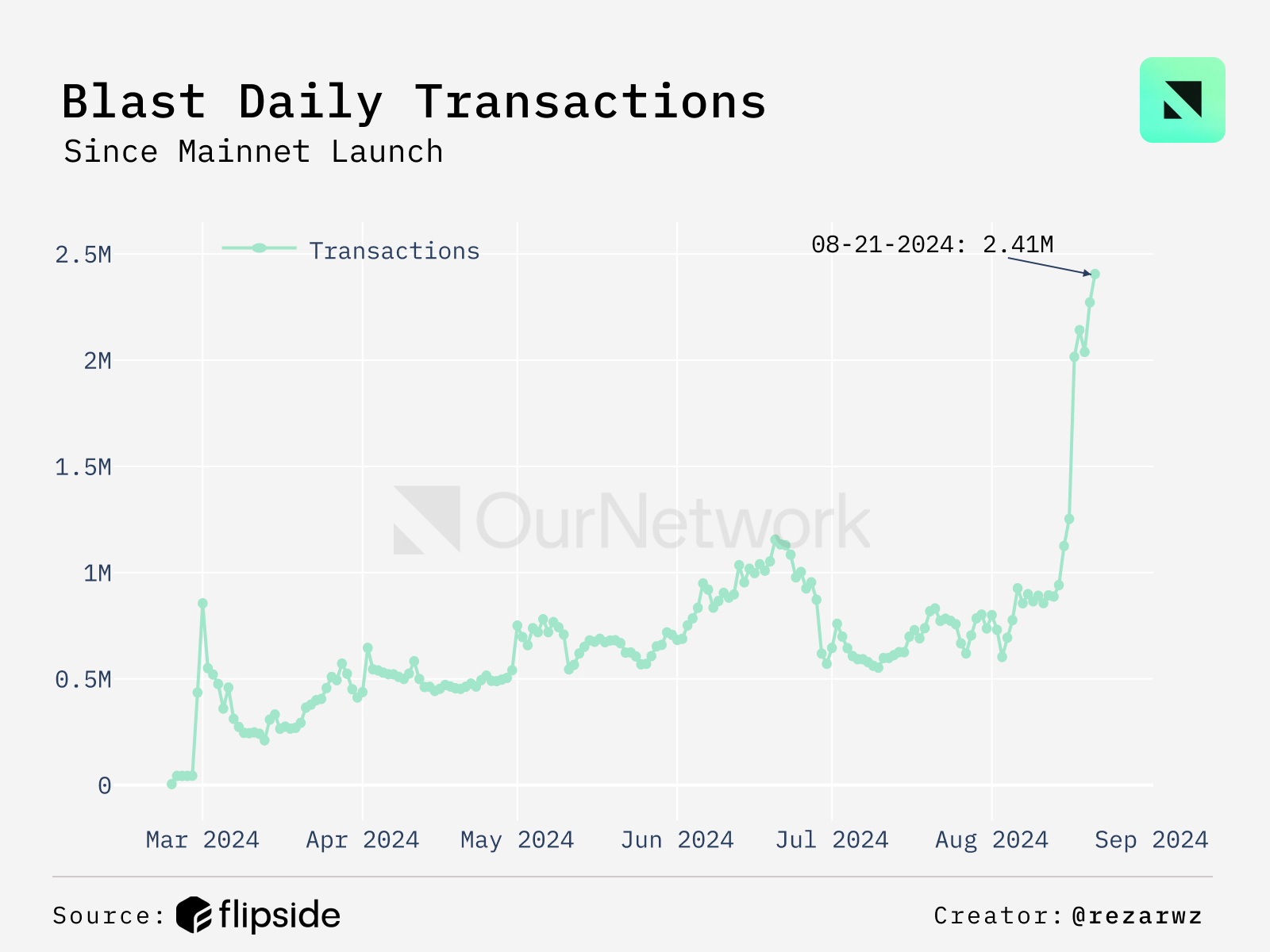

Blast surpasses 120 million transactions, 1.5 million wallets, and $10 million in revenue

Blast is the only Ethereum Layer 2 solution (L2) that provides native yields for ETH (4%) and stablecoins (6%). In less than six months since its launch and less than two months after its first airdrop, Blast has seen 121.5 million transactions on its network, averaging 20 million transactions per month. Daily transaction volume has risen significantly over the past seven days, reaching an all-time high of 2.72 million transactions per day. Daily transaction volume over the past two weeks has also exceeded the average level before the Token Generation Event (TGE).

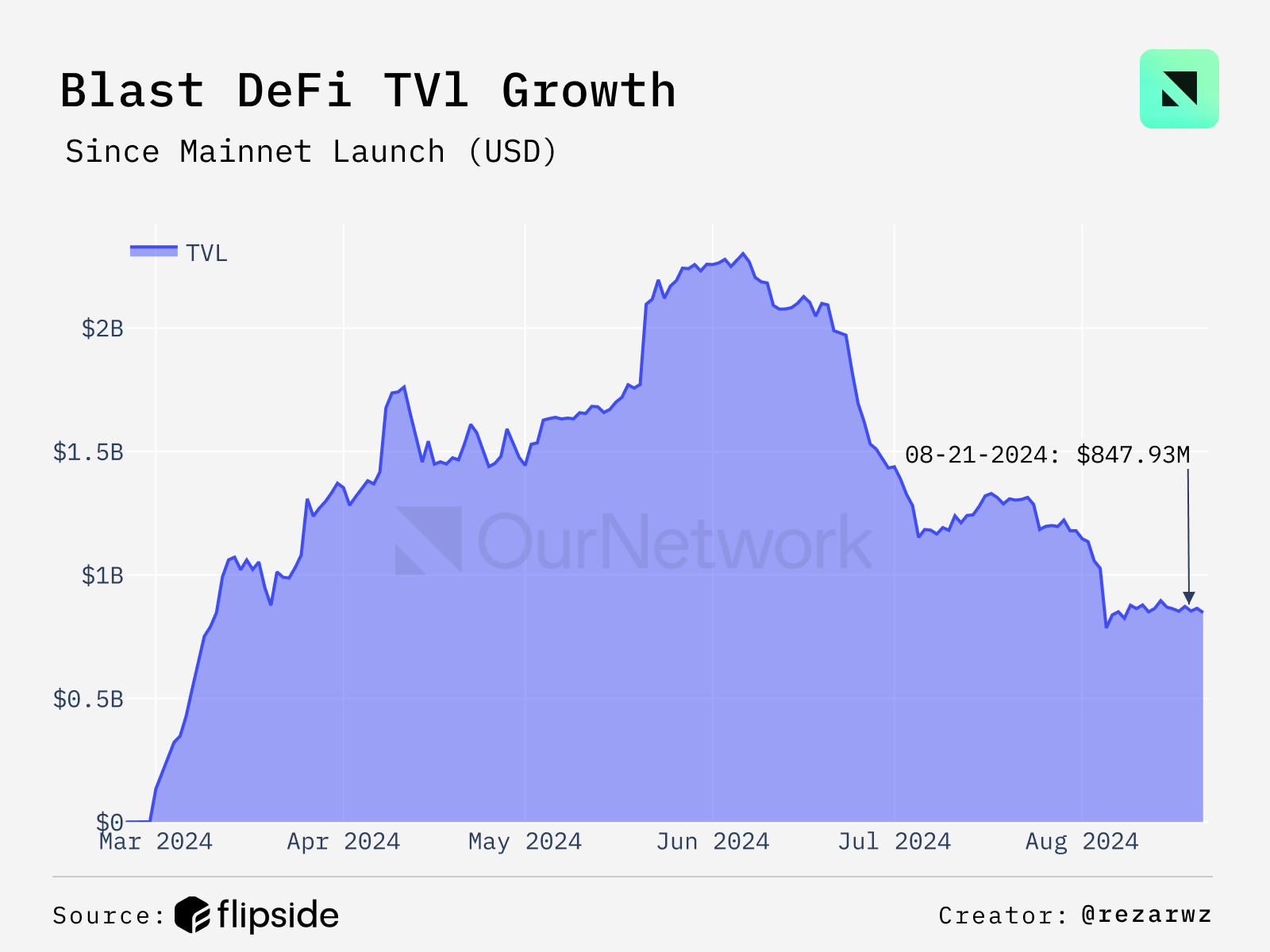

Blast is known for its decentralized finance (DeFi) ecosystem, reaching $1 billion in total locked value (TVL) within 10 days of its launch, peaking at $2.3 billion. However, after the TGE, its TVL dropped rapidly and is currently 60% lower than its all-time high at $857 million. More than 80% of the TVL comes from the Blast native platform, led by Thruster, Juice Finance, and Particle Trade.

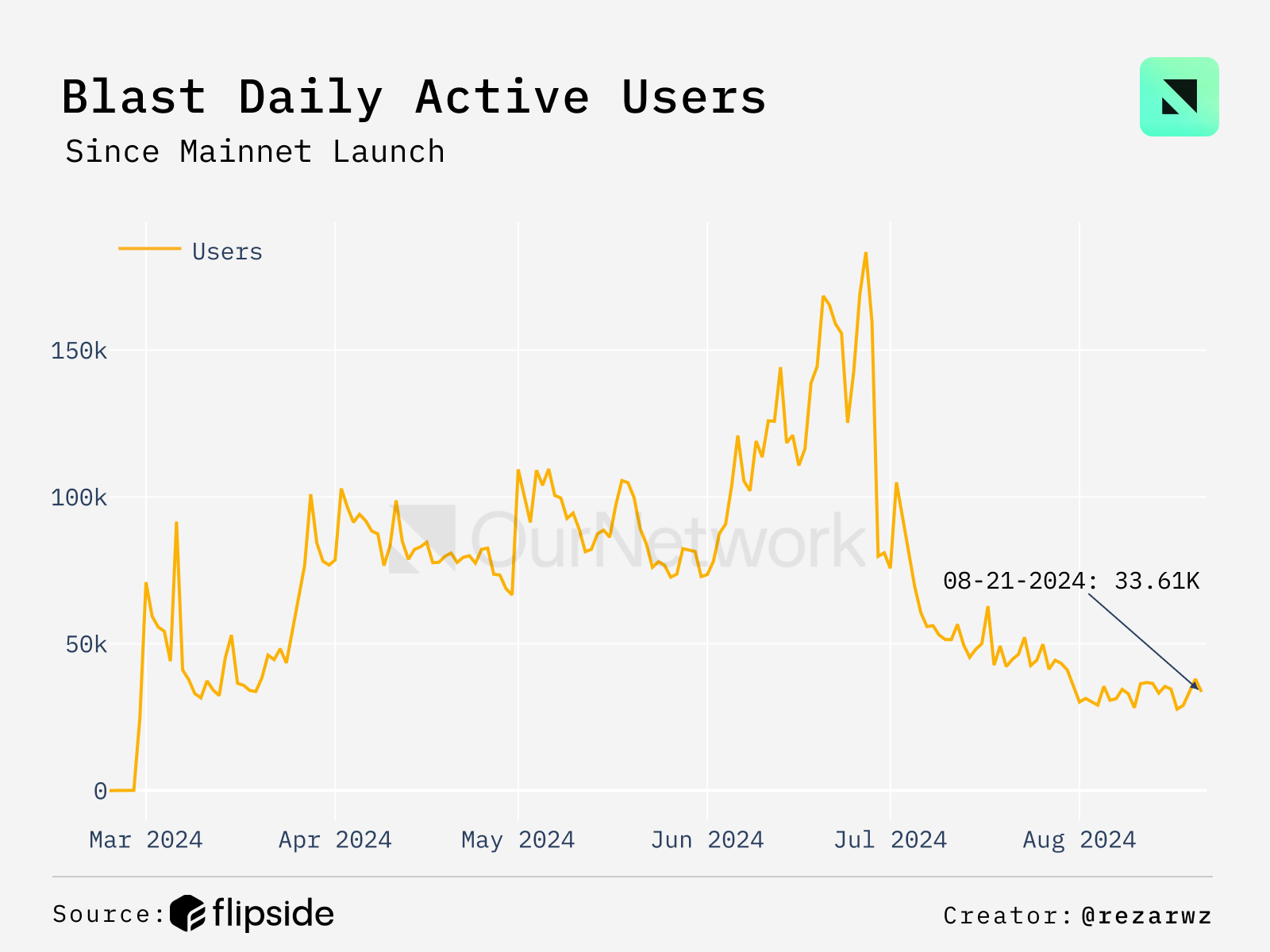

After the TGE, Blast’s daily active users dropped significantly, from an average of 81,000 before the TGE to 51,000 after the TGE, a decrease of more than 35%. The number of new users also dropped significantly, especially in the past month, with an average of only 3,000 new users after the TGE, a 70% decrease from the 30,000 before the TGE.

Transaction-level Alpha: Blast collected $18 million in gas fees from users, generating about $10 million in revenue using blobs and subsequent changes. While other L2 platforms keep the revenue from gas fees for themselves, Blast programmatically returns net gas revenue to decentralized applications (Dapps). Most of the revenue is distributed to Dapps, and developers have collected 775 ETH so far. For example, Juice Finance collected 200 ETH (including 60 ETH in this transaction ), while SynFutures collected 166 ETH (48 ETH in this transaction ).

4. Starknet

Ali Taslimi | Website | Dashboard

Starknet has more than 4 million users, with an average of 7,500 daily active users

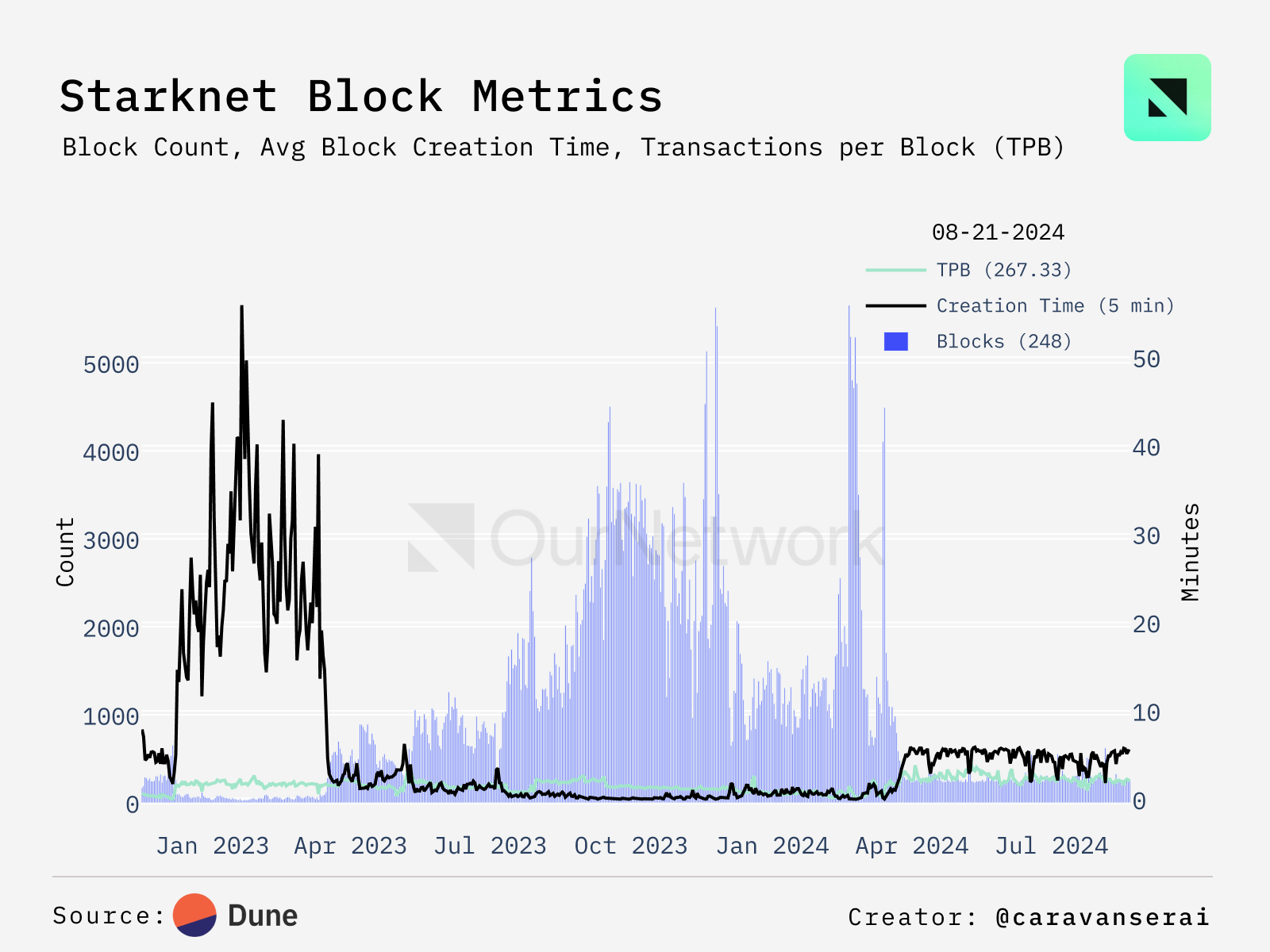

Starknet is a permissionless, zero-knowledge rollups layer 2 solution designed to enable large-scale computation for Ethereum while leveraging Ethereum's composability and security. On average, about 300 blocks are created per day, with a creation time of 4 to 6 minutes. With the Starknet v0.13.2 upgrade approaching, the network will add parallel execution capabilities, enabling transactions to be processed simultaneously. This will increase transactions per second (TPS) and reduce block creation time.

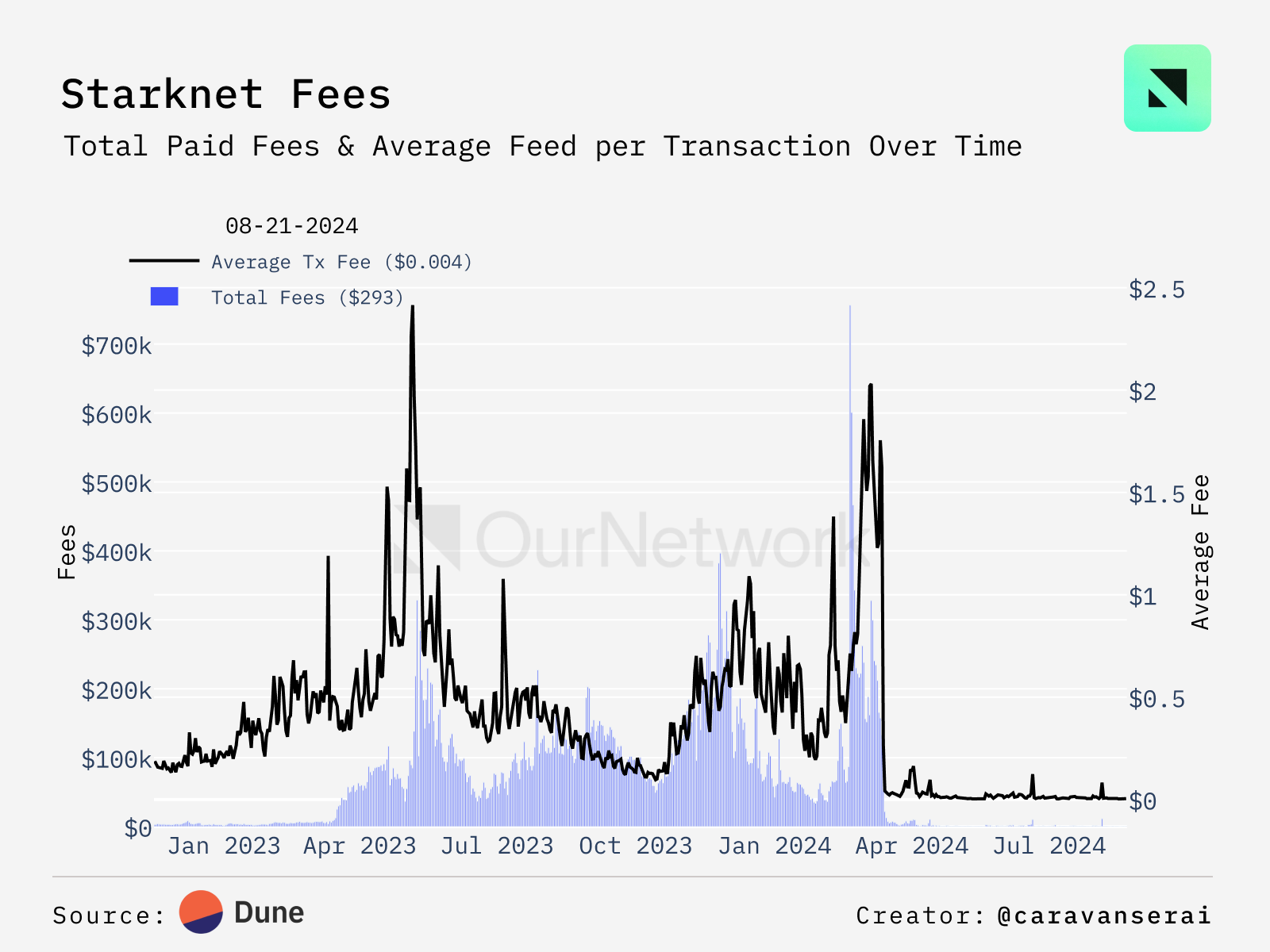

Dune Analytics - @caravanserai

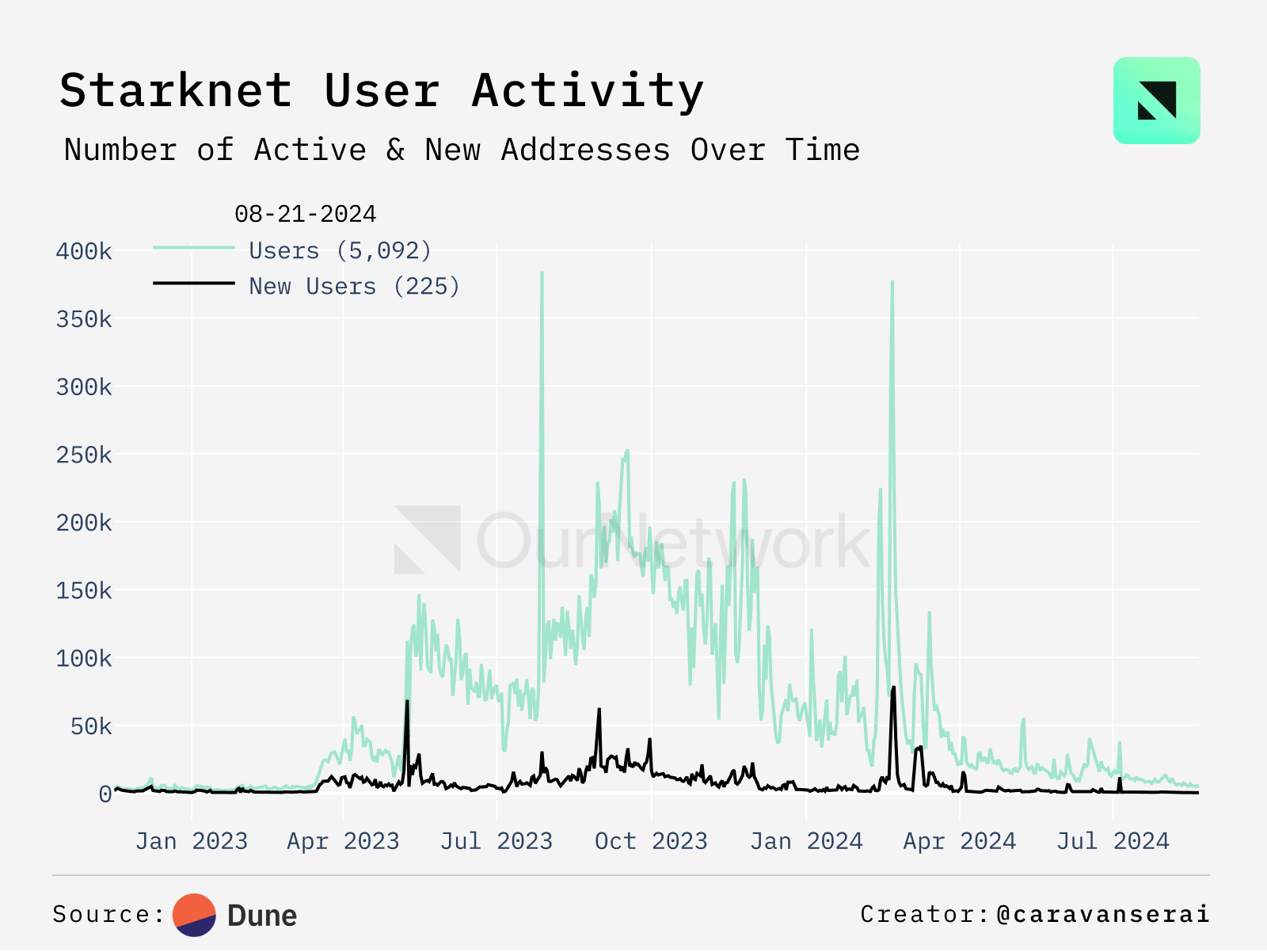

Starknet's mainnet was launched on November 16, 2021, and the STRK token was released a year later. Due to the airdrop qualification, activity increased significantly, but after the release of STRK in February 2024, the number of active and new users declined, with an average of less than 1,000 new users per day and less than 10,000 active users.

Dune Analytics - @caravanserai

With the launch of Ethereum’s Dencun update on March 13, which introduced blob transactions, transaction fees on major L2s (including Starknet) have dropped significantly. Since then, all transactions on Starknet use blobs, with average fees dropping to less than a cent.