Author: Aaron Wood, CoinTelegraph; Translated by: Wuzhu, Jinse Finance

The cryptocurrency industry is very, very weird.

What would you expect from an industry founded by cypherpunks and embraced in its early days by privacy and cryptography idealists, software geeks, anarcho-capitalists, and disillusioned Ron Paul voters?

As cryptocurrencies evolved, in the age of Initial Coin Offerings (ICOs), it became increasingly easy to create new cryptocurrencies, and no idea was stupid or unexpected. And this was before memecoins could be created with the click of a button, resulting in the creation of millions of coins that weren’t even an idea.

While it’s impossible to come up with an exhaustive list of all the weird crypto projects out there, here are some of the most popular ones:

1. Dentacoin

The Dentacoin Foundation was founded in 2017, and its eponymous cryptocurrency aims to simplify the modern dental industry. According to the Dutch project’s white paper, the Ethereum-based Dentacoin (DCN) token is supposed to be a “utility token for rewards, payments, and exchange within and outside the dental industry.” For practitioners, the token is a means of payment for materials, equipment, and other services, while patients can earn it by taking oral health surveys, providing practitioner reviews, and tracking and maintaining oral health practices.

The ultimate goal is to speed up medical payments, which typically takes a lot of time and involves a lot of red tape.

Like many tokens with niche use cases, the DCN price spiked upon launch and then flatlined. As of August 24, the project had a market cap of just $235,000, failing to live up to its grand ambitions of disrupting the dental industry with blockchain.

2. Lovecraftians use cryptocurrency to worship Cthulhu

Cthulhu is a monster from the horror stories of HP Lovecraft, an evil and terrible "old god" whose power is beyond human comprehension. The purpose of the Cthulhu (FHTAGN) token seems equally puzzling. The token first appeared on online forums in 2013 and seemed to have no other purpose than to provide some activity and messaging for hardcore cryptocurrency and Lovecraft fans.

Cthulhu emerges from the sea. Source: Andree Wallin

Cthulhu emerges from the sea. Source: Andree Wallin

Forum users viewed FHTAGN (the code itself being a word in the unpronounceable horrible language of the ancient gods) as part of the Cthulhu religion and mythology, where the tokens were “sacrifices,” holders were “cultists,” and the tokens were mined through “sacrifices.”

Cthulhu has no measurable market cap, with each token valued at $0.000032, according to the few sites that track it.

Other Cthulhu-related tokens have also emerged. The Cute Cthulu (CTHULU) token is a Solana-based project that aims to raise awareness and support related work for marine life and ecology.

In June, the project donated $2,000 to The Ocean Cleanup.

"In his home at R'lyeh, dead Cthulhu waits to dream."

3.SpankChain, just search it on Google...

If cryptocurrency is the native currency of the internet, it was only a matter of time before it intersected with porn and adult entertainment. SpankChain was founded during the ICO boom and received fairly positive press coverage. It aims to provide a platform for adult performers to have more control and agency over how they are paid for their work. The currency is used for payments on Spank.live. Performer Allie Awesome told Cointelegraph Magazine in 2020 that she made a small fortune through the site’s CryptoTitties app. “I love that I get to keep 100% of my payments with CryptoTitties, as opposed to losing 20% or more with a fiat payment processor,” she said, adding that “it’s been really hard to get non-crypto people to use it.” Despite promotion by famous porn performers and millions of dollars in investment, the project hit some snags in March 2023 and has been largely stagnant since then. SpankChain had to shut down its payment processor, SpankPay, after it lost service provider Wyre and failed to find a new one. However, according to the SpankPay X page, the project will be back soon and is already allowing users to register usernames.

4. Trump Tokens Didn’t Win Outright

Although not always a fan of cryptocurrencies, former US President and 2024 presidential candidate Donald Trump has been present in the space in one way or another for some time. To date, there are several cryptocurrencies explicitly dedicated to Trump and allegedly supporting his return to the White House. The first, initially launched under the name Trump Coin but later renamed FreedomCoin (FREE), was launched in 2016, eight years before he publicly supported the cryptocurrency industry.

The most “successful” of these — the Solana-based TrumpCoin (DJT) — has a market cap of $1.43 million. The project has no official ties to the Trump campaign, and infamous “pharma bro” Martin Shkreli has hinted at helping create the token. Research firm Arkham Intelligence even offered a $150,000 bounty to anyone who could definitively prove who started the project. Rapid price action and speculation about the coin suggests it’s likely just a memecoin that taps into the hype surrounding Trump and the US election. None of the various Trump coins are officially associated with Trump’s campaign or organization. However, his presidential campaign does accept cryptocurrency donations. Make crypto weird again.

5. Cannabis Coin

At the height of the ICO boom, the cannabis industry was no stranger to the ubiquity of custom token projects. Initially, cannabis tokens did solve a problem for the US cannabis industry. Federal-level prohibition on cannabis meant that any bank with federal deposit insurance (pretty much any bank you wanted to do business with) would not provide services to cannabis growers, distributors, or dispensaries. Cryptocurrencies would provide a secure way for all of these parties to transact without having to use a bank or carry large amounts of cash around. PotCoin (POT), HempCoin (THC), and Cannabis Coin (CANN) all emerged as tokens to cure the industry’s ills. PotCoin even sponsored US basketball star Dennis Rodman, who wore a PotCoin shirt during his infamous trip to Singapore to meet with Trump and Kim Jong-un, which caused the price to surge.

Yet, as some observers have pointed out, even these cannabis coins have failed to offer significant advantages over more established currencies like Bitcoin. They all now have negligible market capitalizations and virtually no on-chain activity. That’s really depressing.

6. At least they’re honest: Useless Ethereum tokens

The Useless Ethereum Token (UET) is, as the name implies, useless. UET was originally created as a joke. The project's website says it has no intended use and is not designed to accumulate value. As the anonymous creator, UET's CEO, told the New York Observer, "I realized that people don't really care about the product. They care about spending a little money, looking at the charts, and then taking a little money out. So why not do an ICO with no product, do it completely transparently, just to see what happens?" The project raised $300,000 in the ICO, according to industry media reports. It's unclear what the CEO did with the money, and the tokens are not listed anywhere. Really useless.

7. Garlicoin values community and...Garlic

Garlicoin was originally created as a joke, but still has an active community. The token was created in early 2018 as another ICO wave with a garlic and garlic bread theme. On the project’s website, anthropomorphic garlic heads and garlic bread slices suggest that the network has fast and cheap transactions and is resistant to specialized mining equipment such as application-specific integrated circuits.

Garlicoin Garlic. Source: Garlicoin

The community remains strong and highly committed to the project’s garlic-centric identity. In the project’s Discord, one member wished garlic (GRLC) holders “Garlic mornings! Garlic afternoons! Garlic evenings!” Another user suggested a way to get more GRLC holders: “Ideas: 1. Invite ‘friends.’ 2. Everyone brings their favorite version/variety of garlic bread. 3. Everyone gets to enjoy garlic bread. Very good. 4. Give everyone who shows up a paper wallet with some GarlicCoins.” GRLC prices have been largely flat, but in 2021, the token has risen along with the rest of the market.

8. A small step forward for cryptocurrency, Mooncoin

Created in 2013, Mooncoin (MOON) embodies the crypto community’s belief that their chosen coin will “go to the moon.” It is also popular among astronomy enthusiasts and has a maximum token supply of 384 million, which corresponds to the 384,000 km distance between the Earth and the Moon. Space-themed marketing and its astronomical references have made the token an odd favorite among holders. The platform never conducted a pre-mine or ICO and was designed to offer cheap transactions. According to Coinfi, the project has a market cap of over $6 million and a 24-hour trading volume of just $141. Failed launch?

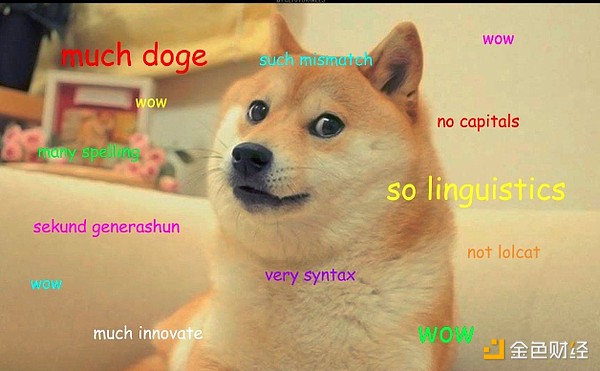

9. The original memecoin, Dogecoin

Dogecoin was created in 2013 by software engineers Billy Markus and Jackson Palmer.

An example of the original Doge meme format. Very outdated. Very 2013. Source: All Things Linguistics

What started out as a critique of the highly speculative nature of cryptocurrencies has now become the very thing its creators wanted to criticize.

As of August 20, it has a market value of more than $15 billion and a large number of fans, including eccentric tech billionaire Elon Musk.

Dogecoin inspired another dog-related currency, SHIBA, which was founded in 2020. The pseudonym "Ryoshi" created the coin as a tribute to DOGE, and the idea of a memecoin took off.

Since then, thousands of strangely named, highly speculative memecoins have emerged.

Thank you, Dogecoin. Stay weird, crypto.