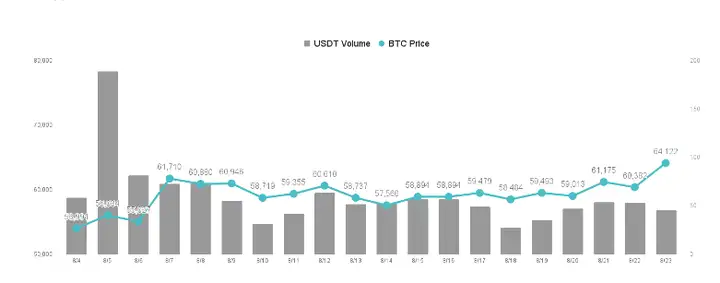

Bitcoin achieved a weekly increase of 8% this week, with its price gradually rising from US$59,000 to US$64,000. Ethereum also slowly recovered, but its weekly increase was only 5% due to the outflow of ETF funds. Currently, the performance of Ethereum spot ETF is worse than that of Bitcoin ETF. On the contrary, Bitcoin ETF funds had a more significant inflow last week.

Although the spot price of Bitcoin has not risen significantly, institutional investors are actually slowly accumulating chips, presenting a scenario where retail investors are selling and institutional investors are buying in large quantities. Institutional investors are adopting Bitcoin through ETFs faster than any other ETF in history.

More information Tuanzi Finance

Judging from the numbers, the Bitcoin spot ETF has accumulated a net inflow of US$17.5 billion since January this year, compared to the Nasdaq index ETF QQQ which only attracted US$5 billion in its first year.

Among the 25 largest hedge funds in the United States, 15 hold Bitcoin ETF positions, and no fund has sold Bitcoin ETFs in the second quarter of this year. Most are still accumulating chips. These do not include companies such as MicroStrategy that continue to buy Bitcoin. Judging from the current situation, institutional investors are still slowly buying Bitcoin, and there has been no significant selling behavior. Instead, most of them are typical long-term holders.

However, in the short term, the price of Bitcoin is expected to fluctuate more. The main reason is that cryptocurrencies are now deeply linked to the US election, which is expected to greatly increase the difficulty of transactions in the short term. Next, let’s talk about our views on the trend of cryptocurrencies in the fourth quarter, which is expected to be a volatile bullish trend.

As the election approaches, trading becomes more difficult

As the U.S. presidential election heats up, the cryptocurrency market has also begun to be led by changes in the election situation. Especially after Trump began to intervene in cryptocurrency and launched the "Made in the USA" Bitcoin policy, investors began to link Bitcoin to Trump concept stocks. Subsequently, as long as the Democratic Party's Kamala Harris leads in the polls, the price of Bitcoin will decline. Although this phenomenon started a long time ago, the fact that Bitcoin did not rebound as strongly as the U.S. stock market in the past few days was largely due to the fact that Trump was overtaken by the Democrats in the polls.

The cryptocurrency community has even begun to trade based on changes in the election situation. The connection between the two can be said to be getting deeper and deeper, which has also caused the difficulty of cryptocurrency trading to rise sharply. If you still remember that during Trump's presidency, he governed the country through Twitter and continued to influence the stock market. Because the stock market went up and down according to the remarks of Trump's investment consultants, it indirectly led to the collapse of many hedge funds after suffering heavy losses in those years. Now the cryptocurrency market is linked to politics, which will also lead to an increase in trading difficulty.

In this regard, I believe that low-leverage contracts should be maintained until the end of the election, or only spot transactions should be made, because the short-term small fluctuations in cryptocurrencies are expected to be more drastic, and will rise and fall with changes in the election situation. It is almost impossible to predict the trend under false information and different interpretations. The only way to avoid being affected by media information is to aim at the medium- and long-term trends. Before the end of the election, it is expected that the difficulty of trading in the cryptocurrency market will be very high.

Looking ahead, the United States will officially enter a rate cut cycle in September, and there will be more favorable policies released in the subsequent US election. The medium- and long-term trend of the cryptocurrency market is actually highly likely to be bullish, but this bull market will be stumbling. Last week, the Fed also hinted at a rate cut at the global central bank annual meeting. At present, a one-basis rate cut in September is a certainty. Investors are curious about how fast the rate will be cut in the future. The U.S. Treasury yields have already responded to this direction. Taking the 10-year U.S. Treasury yield as an example, it has dropped from 4.2% a few months ago to 3.8%, reflecting a rate cut of about 2 basis points.

Assuming that Bitcoin experiences a significant decline in the short term, it will be a safer entry time for long-term investors.