Will the BTC price decline end before September? Five things to watch for Bitcoin this week

Bitcoin faces a critical candle close this week as BTC price rebounds and sellers attempt to reverse the early August crash.

As August came to an end, Bitcoin experienced a recovery, with the BTC price target heading towards $65,000.

The largest cryptocurrency has shown impressive strength over the past week, and traders are hoping the good times will continue.

Aside from a quiet weekend, Bitcoin has consolidated its gains and is now up an impressive 40% from this month’s low of $45,500.

Therefore, the upcoming monthly candle close is expected to provide an interesting trading environment as the market looks forward to a breakout from the nearly half-year long consolidation phase.

Can Bitcoin Finally Challenge All-Time Highs Again?

So far this month, BTC/USD is almost back to where it started, but there is still a lot of volatility waiting to happen.

A flurry of macroeconomic data releases this weekend will provide fresh tests for an increasingly cautious community of short-term Bitcoin holders.

Meanwhile, fundamentals look good, with mining difficulty expected to increase modestly in the coming days.

Market sentiment returned to neutral territory, with regular cryptocurrency investors quickly shaking off their fears.

Cointelegraph takes a closer look at the current state of Bitcoin during this crucial week, as the cryptocurrency faced calls to enter a new bear market just two weeks ago.

Bitcoin’s monthly close draws attention

Bitcoin is rebounding strongly after a dismal start to August, but traders’ attention is now focused on the monthly close.

BTC/USD 1-hour chart. Source: TradingView

Such events are themselves triggers for volatility, and despite a 40% gain from this month’s lows, BTC price action still faces numerous challenges.

“Bitcoin struggled back to where it was in August, almost flat,” Daan Crypto Trades, a popular trader on X, summarized, attaching data from monitoring resource CoinGlass.

BTC/USD monthly return rate (screenshot). Source: CoinGlass

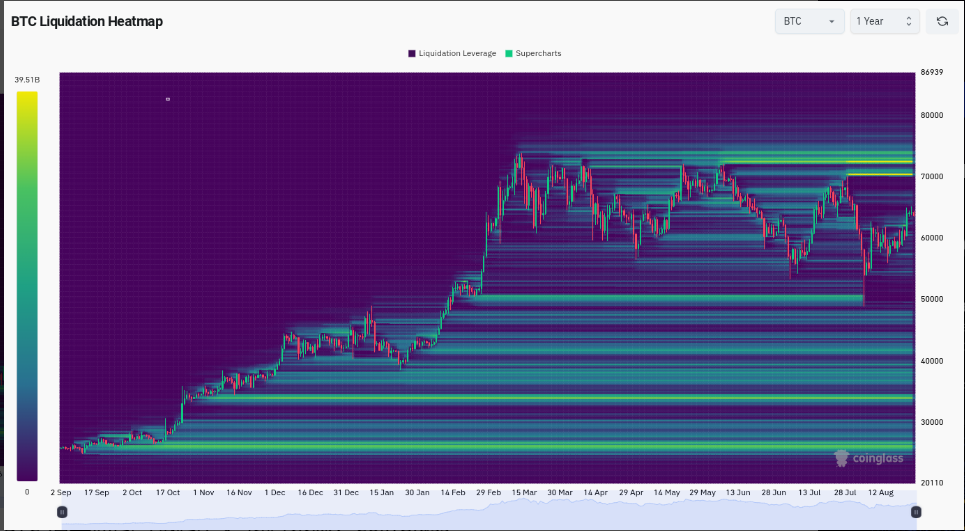

Nonetheless, order book liquidity insights show that there is still strong resistance above, with a wall of sell orders separating the spot BTC price from its all-time high.

BTC liquidation heat map (screenshot) Source: CoinGlass

“Now let’s see if there’s enough momentum to really push prices higher,” continued Daan Crypto Trades.

In another post, he acknowledged that the BTC price has been in an unprecedentedly long period of consolidation since its all-time high in mid-March.

“Bitcoin near 6 month ‘consolidation’ at last cycle high,” he told followers.

“This is the longest time it has taken to break the previous all-time high. At the same time, this is the fastest time that the price has made a new all-time high in a cycle (before the halving). It all balances out.”

BTC/USD 2-week chart Source: Daan Crypto Trades

BTC/USD 2-week chart Source: Daan Crypto Trades

Another trader, Crypto Tony, also called for solid support to sustain further recovery moves.

Source: Crypto Tony

Data from Cointelegraph Markets Pro and TradingView shows that BTC/USD is trading around $63,700 at the time of writing, with prices remaining flat over the weekend.

PCE week is here, countdown to Fed rate cut

As markets become more confident about financial policy easing, one of the highlights of this week's macroeconomic data is the Federal Reserve's "preferred" inflation indicator.

July data on the Personal Consumption Expenditures (PCE) index will be released on August 30, exactly one day after the release of the US second quarter GDP data.

The two figures will follow a key earnings report from NVidia, which this year has become a barometer of the health of the tech industry.

As such, trading resource The Kobeissi Letter told X's followers to "get ready for a wild week".

“Nvidia earnings and PCE inflation data released in the same week provide good conditions for trading,” it wrote.

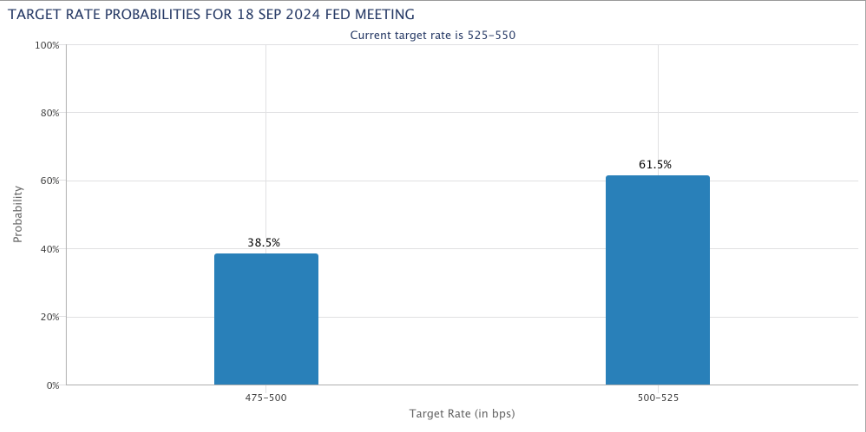

Fed target rate probability Source: CME Group

When the PCE was released, the market had 100% expected a rate cut in mid-September, and more and more people believed that the rate cut would exceed the lowest 0.25%.

The latest data from CME Group’s FedWatch tool put the probability of a 25 basis point and 50 basis point rate cut at 61.5% and 38.5%, respectively.

“September rate cut is confirmed but there is no indication of how big it will be, so the August jobs report will be critical,” trading firm QCP Capital wrote in an update to its Telegram channel subscribers over the weekend.

"A 25 basis point rate cut would likely be market positive, while a 50 basis point cut would likely signal a sharp move by the Fed to prevent the economy from falling into recession."

Mining difficulty is expected to resume its upward trend

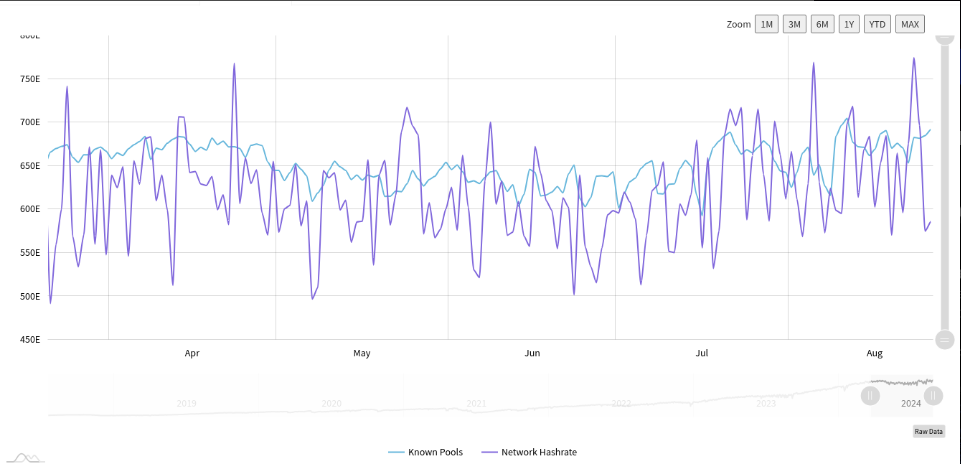

After being tested over the past month, the fundamentals of the Bitcoin network are showing signs of a turnaround.

Despite reports of squeezed profitability, the mining sector is on its way higher, according to the latest estimates from monitoring resources BTC.com and MiningPoolStats.

Mining difficulty dropped by 4.2% in the last automatic adjustment and is expected to resume growth of 2.8% this week.

This would bring the metric close to new all-time highs, offsetting the impact of BTC's price drop below $50,000 in early August.

Overview of Bitcoin network fundamentals (screenshot) Source: BTC.com

Meanwhile, raw hashrate data shows that the processing power allocated to mining is still rising steadily, hitting a new all-time high of 774 EH/s on August 23, with known mining pools contributing 682 EH/s.

Bitcoin hashrate raw data (screenshot). Source: MiningPoolStats

Previously, Cointelegraph reported that while miner selling has decreased in recent weeks, their overall impact on BTC price action has been overshadowed by the power of institutional investment.

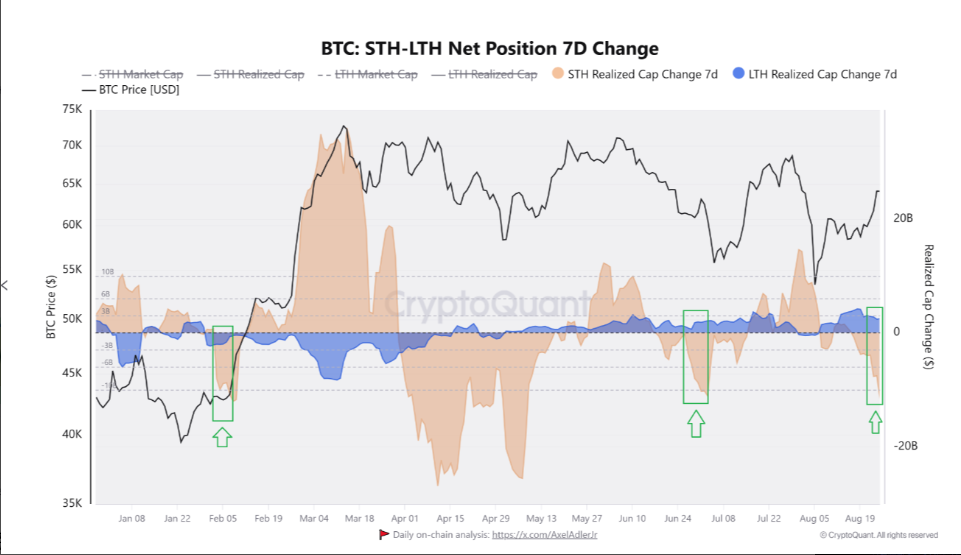

Short-term BTC holders sell $10 billion in one week

Bitcoin’s short-term holders (STHs) have distributed a large amount of Bitcoin to the market over the past week as the price recovered.

According to data from on-chain analysis platform CryptoQuant, as of August 25, the STH group's week-on-week net position change decreased by more than $10 billion.

“This suggests increased selling of STH,” Amr Taha, a contributor to the platform, wrote in a Quicktake blog post, citing a chart from analyst Axel Adler Jr.

Bitcoin STH net position change (screenshot) Source: CryptoQuant

STH entities refer to people who hold a certain amount of BTC for no more than 155 days and belong to the more speculative part of Bitcoin investors.

The recent BTC price volatility has hit this group hard, with massive loss-making selling occurring as BTC/USD fell to a six-month low.

Now, STH’s comprehensive cost base comes into focus, which could act as a potential support line once a new price decline begins.

According to data uploaded to X by investment firm MS2 Capital, STH's current consolidated cost base is $63,600.

Among speculators, those who held for less than a month had a lower cost basis, between $60,000 and $62,000.

BTC/USD 1-day chart. Source: MS2 Capital

Cryptocurrency rebounds strongly from brink of 'extreme fear'

Perhaps unsurprisingly, last week’s recovery in BTC prices immediately impacted sentiment across the cryptocurrency market.

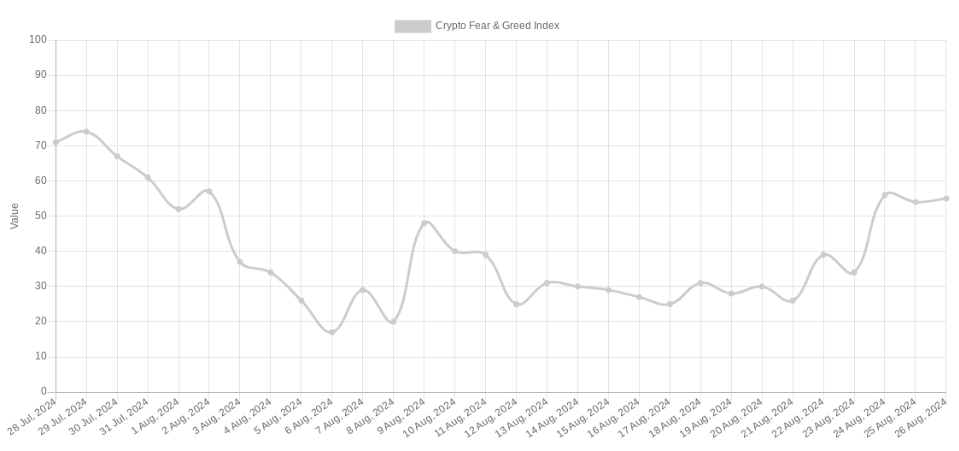

This is reflected in the Crypto Fear & Greed Index, which has risen in a matter of days from 26/100 on August 21 to 55/100 at the time of writing.

This shift in sentiment suggests that the mentality of ordinary cryptocurrency investors has shifted from the brink of "extreme fear" to "greed."

Crypto Fear and Greed Index (screenshot). Source: Alternative.me

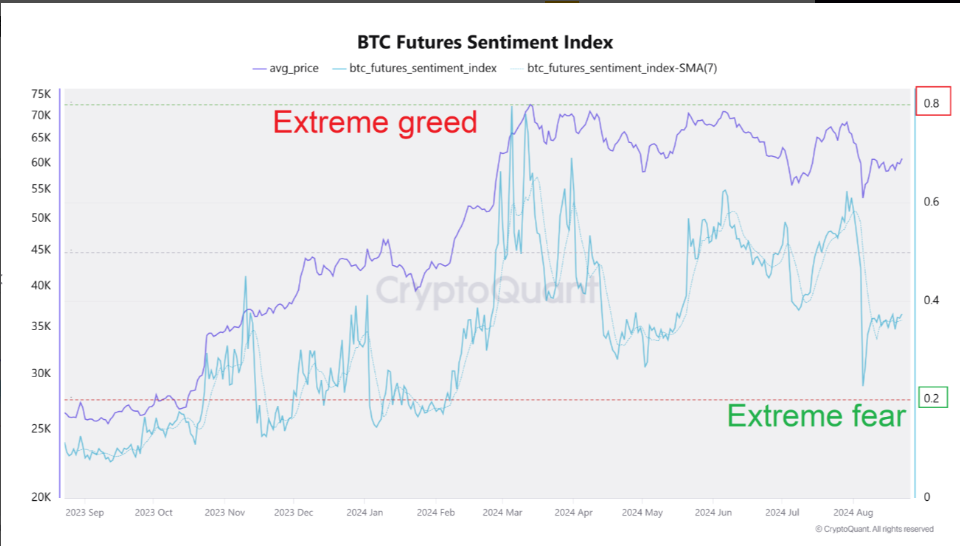

The recovery is also reflected in CryptoQuant’s indicator specifically for bitcoin futures market sentiment, which narrowly missed falling into “extreme fear” territory in August.

BTC Futures Sentiment Index (screenshot) Source: CryptoQuant