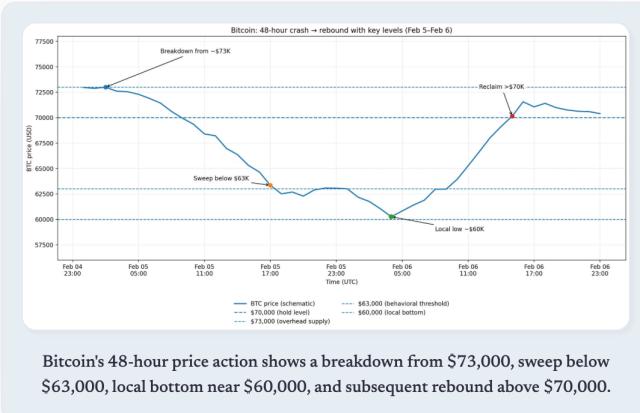

Bitcoin briefly exceeded US$65,000 at 7:00 a.m. yesterday (26th), and then selling pressure emerged and continued to fluctuate downward. Zuogao fell below US$63,000 to trade at US$62,873, down 2.18% in the past 24 hours.

If this wave of correction fails to stand above $63,000, judging from the intensive transaction area in the past month, Bitcoin's next support will be around $61,000, which happens to be the starting point of the rapid rise last weekend.

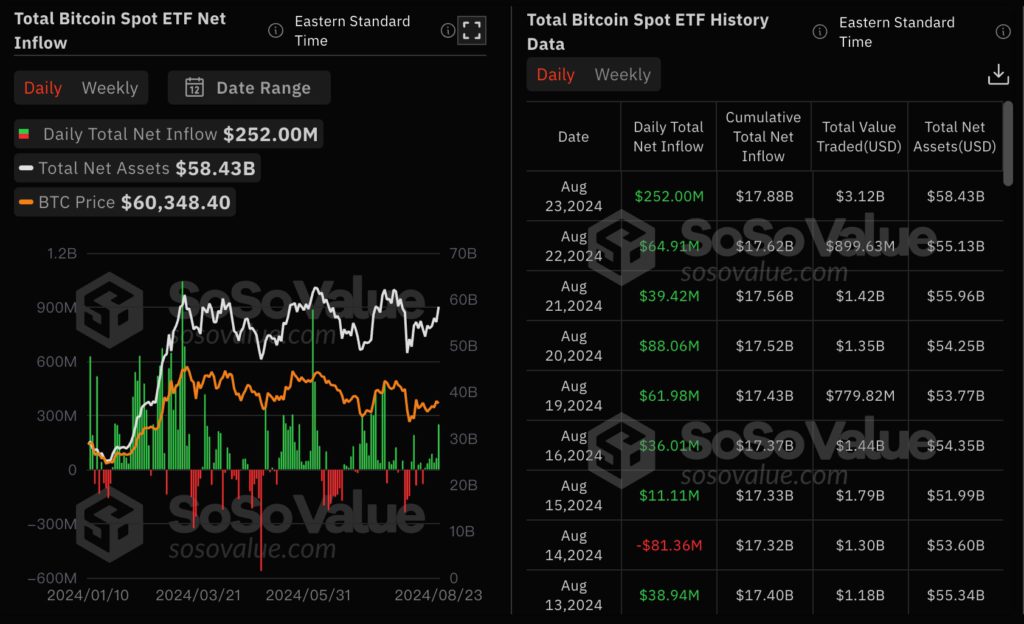

Bitcoin Spot ETF Fund Flow

At present, the capital flows of the 12 U.S. Bitcoin spot ETFs yesterday have not been fully released, but from the data in recent days, we can see an obvious return of funds. On the 23rd, the net inflow of US$252 million set a new high in more than a month.

Ethereum loses $2,700

The trend of Ethereum is similar to that of Bitcoin. It also showed a downward trend yesterday. At the time of writing, it fell below US$2,700 and is now trading at US$2,685, down 2.33% in the past 24 hours.

The entire network liquidated $114 million in the past 24 hours

Amid the volatility of Bitcoin, Coinglass data shows that in the past 24 hours, the entire cryptocurrency network liquidated more than US$114 million (longs accounted for US$96 million), and nearly 60,000 people were liquidated.

However, overall it seems that it has not yet reached the stop-loss point for a large number of investors, and subsequent fluctuations may be amplified, so investors are advised to be cautious.

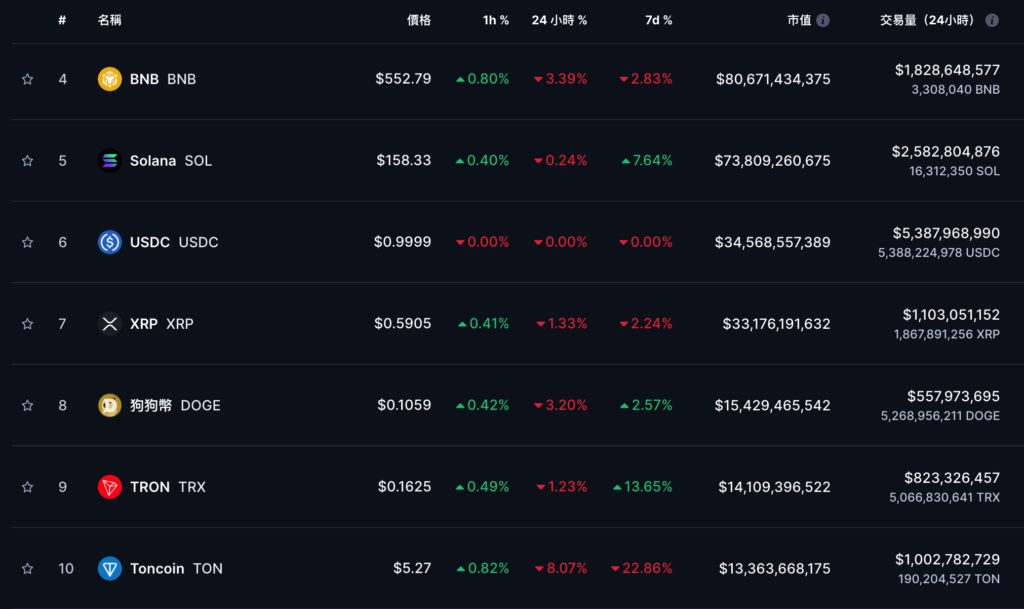

Top 10 tokens generally fell

CoinMarkeCap data shows that the other top ten tokens have also fallen in the past 24 hours: the largest decline was TON, which fell 8.07% in the past 24 hours, BNB and DOGE also fell by 3.39% and 3.2% respectively.