What is PayFi: a future financial system with blockchain as the core technology

PayFi, as the name suggests, is a concept that combines "Payment" and "Finance" functions. Broadly speaking, it refers to payment infrastructure and financial services based on blockchain technology .

PayFi is considered a bridge between traditional finance (Web 2) and decentralized finance (DeFi), combining the advantages of both to provide more flexible, efficient and secure financial solutions for institutions, businesses and consumers.

Crypto Payment in the Past VS PayFi in 2024

As far as the history of blockchain development is concerned, payment is not a very novel track. Bitcoin was initially used as a peer-to-peer payment tool, but in the past PayFi usually focused on solving the shortcomings of traditional finance until RWA’s recent The concept emerged, making PayFi's application scope not only limited to payment, but also including the storage, management and investment of digital assets.

PayFi not only combines the RWA application to allow users to make their cash flow more flexible or get more feedback after daily consumption, but also adds AI functions such as automatically finding the lowest-cost payment path, and even adding financing and lending services, gradually forming a complete financial ecosystem.

To put it simply, blockchain payment in the past was Crypto Payment, and today's PayFi is a combination of Payment+RWA+AI.

Lily Liu, chairman of the Solana Foundation, called out the word PayFi at this year’s ABS Asia Blockchain Summit and believed that PayFi may be one of the most important narratives of this round: “PayFi is the creation of a new financial market around the time value of money. . On-chain finance can realize new financial models and product experiences that are impossible to achieve in traditional finance.”

Crypto Payment in the past: decentralized payment, cross-border transfer, automated finance

Of course, the reason why PayFi has made technological and conceptual breakthroughs in recent years is largely due to the foundation laid by its predecessors. Before entering PayFi, let us first understand the "traditional Crypto Payment" application:

Decentralized payment system

Traditional cross-border payments usually involve multiple intermediaries, such as banks and payment processors, making the entire process time-consuming and costly. PayFi uses blockchain technology to establish a payment system that does not rely on intermediaries, eliminating the traditional payment process. delays, settlement times and high fees.

The RippleNet network developed by Ripple has now become a key player in the global cross-border payment field. In addition to being a partner of AWS, RippleNet has more than 100 financial institutions around the world using RippleNet's xCurrent, xRapid, Xvia and other services to process timely payments. , reduce liquidity costs and integrate global remittances, using blockchain technology to provide faster transaction speeds and lower costs while ensuring transaction transparency and security.

Cross-border payments and remittances

Traditional cross-border payments or remittances usually take several days to complete, and the handling fees are expensive because they go through different national exchanges, banks and third-party institutions. PayFi allows cross-border payments and remittances to be completed in minutes, and Costs are significantly reduced .

BitPay in the United States is a blockchain-based payment processing platform that can provide one-stop consumer payment, wallet storage and exchange between different currencies. BitPay allows merchants to accept cryptocurrencies such as Bitcoin as payment units, and at the same time The option to instantly exchange received cryptocurrencies for fiat currency eliminates the risk that the average consumer or merchant may perceive from cryptocurrency price fluctuations.

In addition to payment, PayFi applications can also provide more flexible payment options for the booming e-commerce platform and support seamless transactions for global users. Platforms such as Shopify have begun exploring the integration of blockchain technology into their payment systems to reduce transaction costs and increase payment speeds.

Smart contracts and automated finance

PayFi uses smart contracts to automatically execute payment agreements and financial contracts, reducing manual intervention. It can not only operate 24/7 to improve efficiency, but also reduce risks caused by human negligence.

Well-known DeFi platforms such as Uniswap and Aave are typical representatives of related applications. The platforms allow users to conduct transactions and loans without trusting third parties, and automatically perform these financial operations through smart contracts, improving the efficiency and effectiveness of financial services. transparency.

PayFi Today: Instant Offset Settlement, Trade & Business Finance, and Other Applications

(Taken from Huma Network)

According to research by PayFi Network Huma Network, financing mechanisms have dominated the global payment industry in the past few decades. Financing mechanisms break various transaction time constraints by providing instant funds.

For example, credit cards allow consumers to make purchases before repaying in the future, driving merchant payments of US$16 trillion per year; trade finance ensures that companies can successfully complete transactions before goods are delivered or paid, creating B2B payments of US$10 trillion per year; cross-border The pre-raised funds in cross-border payments ensure the timeliness of remittances and global settlements, creating an annual cross-border payment of US$4 trillion, allowing units that rely on remittances to obtain funds on time. These mechanisms effectively promote the expansion and application of the payment system through time adjustment.

Therefore, the emerging PayFi can be said to be an industry that uses the time difference in currency values to obtain financial liquidity and profits.

Instant Settlement

Instant offset settlement means that in financial transactions, settlement is completed immediately once the transaction is confirmed, without having to wait for several days like traditional finance. In the traditional financial system, transaction settlement usually involves multiple intermediaries and requires waiting for a certain settlement cycle, which may lead to delayed transfer of funds, thereby increasing risks and costs. Traditional payment giants spend nearly 100 billion US dollars each year to maintain the operation of payment networks, and blockchain technology can eliminate these problems through decentralization and automation to achieve instant and automatic settlement.

The Liink platform developed by JP Morgan has become an important tool for accelerating cross-border payments and instant offset settlement among global financial institutions. The Liink platform is part of the Onyx department of JPMorgan Chase's blockchain department. It has been adopted by more than 400 financial institutions. It uses blockchain technology to achieve faster fund transfers, reduce settlement time and costs, and enable transactions to be completed in seconds. Completed within minutes, greatly improving the efficiency of cross-border payments and reducing the risk of counterparty exchange rate fluctuations.

Trade and Business Finance

Trade finance refers to the provision of financial support to match transactions between import and export companies in international trade. However, traditional trade finance processes often rely on paper documents and multi-party verification, making the transaction process very slow and prone to operational risks that increase costs. The processing of traditional instruments such as Letter of Credit (LC) requires the participation of multiple intermediaries, which prolongs the time for transaction completion and increases the uncertainty of capital flows. It is inefficient and inefficient in the modern globalized economy. The cost is high.

The Contour platform is a trade finance solution based on blockchain technology. It focuses on digitally processing trade finance tools such as letters of credit to accelerate the speed and transparency of global trade. It is now widely welcomed by many large banks and enterprises around the world. By digitizing the letter of credit and storing it on the blockchain, all parties to the transaction can view and verify the document in real time. Once the transaction conditions are met, the Contour platform can automatically complete payment and instant offset settlement through smart contracts, greatly shortening the trade financing cycle, reducing operational risks and significantly reducing transaction costs.

Other emerging applications - What is Buy Now, Pay Never?

In addition to the above-mentioned applications, PayFi can also exert potential in all financial-related aspects, such as the Buy Now, Pay Never retail transaction mentioned by Lily Liu, chairman of the Solana Foundation, which is different from the traditional BNPL (Buy Now Pay Later) that only deferred payment. time, BNPN allows consumers to directly use the interest from the lending platform to pay for consumption without using additional principal. Or Polytrade Finance, the on-chain invoice financing tokenization platform we introduced previously, helps companies obtain accounts receivable in advance.

The companies you are familiar with have already stepped in: the layout of Web 2 giants in PayFi

With the popularization of blockchain technology in the past few years, many large Web 2 companies have already actively deployed to maintain their competitive advantage in the fiercely competitive market by improving the efficiency and security of financial services. Specific information can be found through our past Review the articles one by one.

PayPal, as one of the world's top online payment platforms, entered the cryptocurrency market as early as 2020, allowing users to buy, hold and sell cryptocurrency, supporting cryptocurrency payments and launching its own stable currency PYUSD. As soon as PYUSD went online Since then, we have cooperated with Kamino, and now lending PYUSD on Kamino still has an APR of 12.46%, and it currently ranks as the sixth largest stablecoin. Establish substantial progress on the road to combining traditional payment services with blockchain technology.

▌Recommended reading: PayPal Stable Coin PYUSD: Best Uses, Purchase Channels and Security Concerns Analysis

In addition, Visa and Mastercard, the world's two largest payment processing companies, are not lagging behind. Visa has launched a credit card that supports cryptocurrency payments and has cooperated with a number of blockchain companies to develop blockchain-based payment solutions. Mastercard also launched its own blockchain payment platform and announced support for cryptocurrency transactions, further advancing the development of the PayFi field.

▌Recommended reading:Why did Visa exclusively name Solana? From the perspective of global payment status and Sol chain technology

▌Recommended reading: Paymaster’s gas fee-free era is coming? Visa lets you never have to buy ETH again in your life! ?

Although Amazon has not officially entered the field of cryptocurrency payments, Amazon's investment in blockchain technology has already seen initial results. Amazon Web Services (AWS) has launched a variety of blockchain solutions over the past few years, and there are rumors that Amazon is working on its own cryptocurrency payment system.

The trend of these companies deploying PayFi not only demonstrates the leadership of the company in technological innovation, but also indicates the importance that major global financial institutions attach to the PayFi track. PayFi will reshape the future payment and financial transaction ecology to some extent. became a consensus.

What to look for when researching PayFi: from infrastructure to end-consumer applications

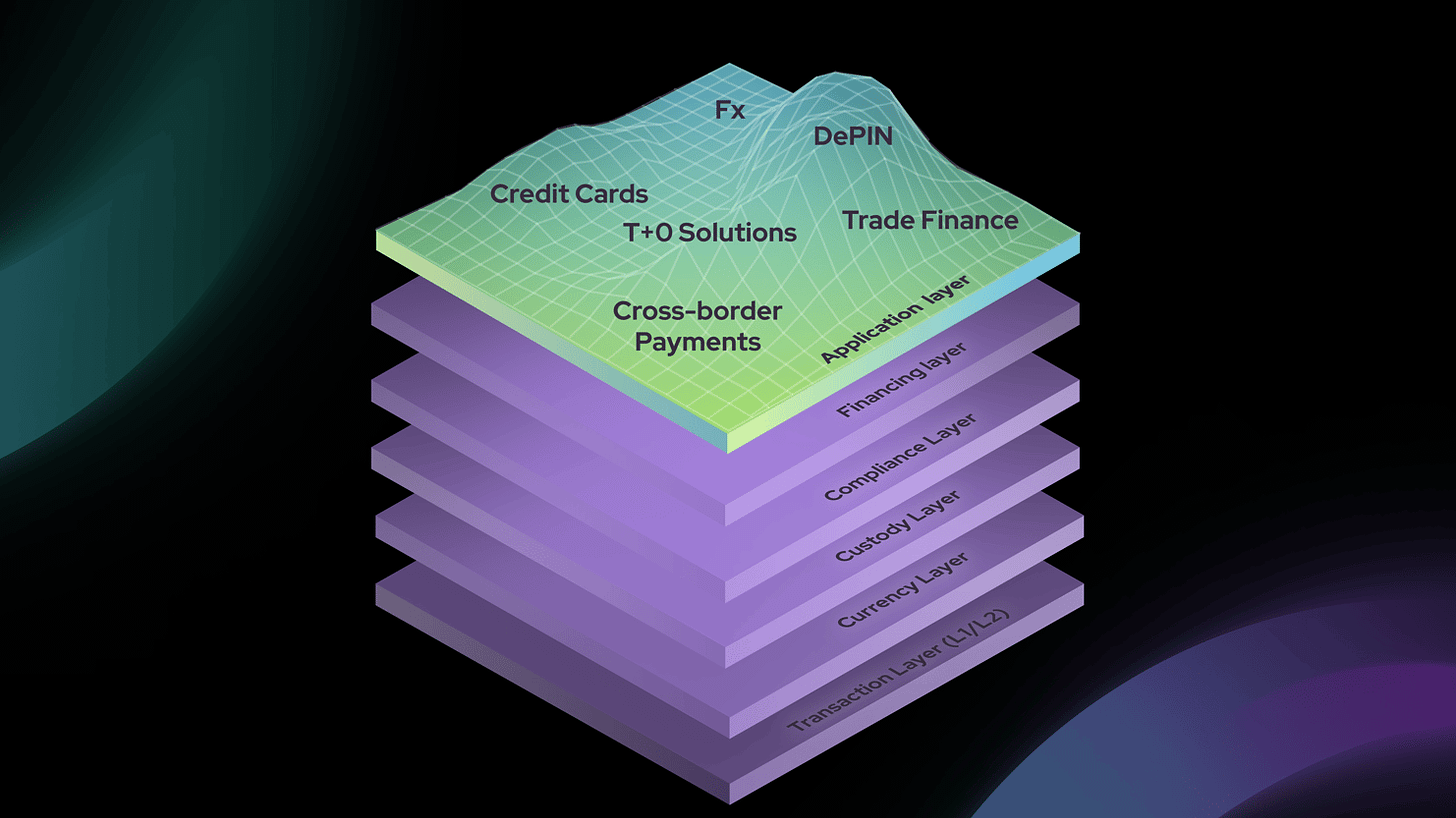

Regarding how to study the emerging field of PayFi, Huma Network provides a good research framework. From the infrastructure to the end application, it is divided into: transaction layer, currency layer, custody layer, financing layer, and compliance layer.

Transaction layer : focuses on providing high throughput and low-cost payment processing capabilities. Simply put, it means whether the blockchain itself has enough resources to meet the performance requirements of financial payment settlement.

Projects to follow: Solana, Stellar, Scroll

Currency layer: that is, stable, trustworthy and liquid trading units, that is, regulatory-compliant and widely used stablecoins that can provide flexible solutions for payments and savings.

Items to follow: PYUSD, USDM

Custody layer: The financial service needs of institutions are quite complex and rigorous, so asset management and customized account control that can be controlled by multiple parties are very important, including various third-party custody services and abstract account wallet services.

Projects you can focus on: Plimico, Safe, Gelato

Financing layer : Financing protocols and the key to risk management infrastructure, such as oracles, on-chain DID, credit assessment, verification and underwriting related tools.

Projects to follow: Huma, Polyflow, Credora, Pyth, Chainlink

Compliance layer : In recent years, international anti-money laundering supervision has become increasingly tight. Therefore, the most critical thing when using cryptocurrency for actual payment is whether compliance can be achieved. Facilities that can assist and ensure compliance are crucial.

Projects to follow: Plume, Poltmesh

Application layer: terminal applications directly facing users, including storage, consumption, payment, and lending, developing the possibility of PayFi in all aspects of finance.

Projects that can be focused on: Arf, Vishwa, Payman, Reap, Zeebu, Raincard