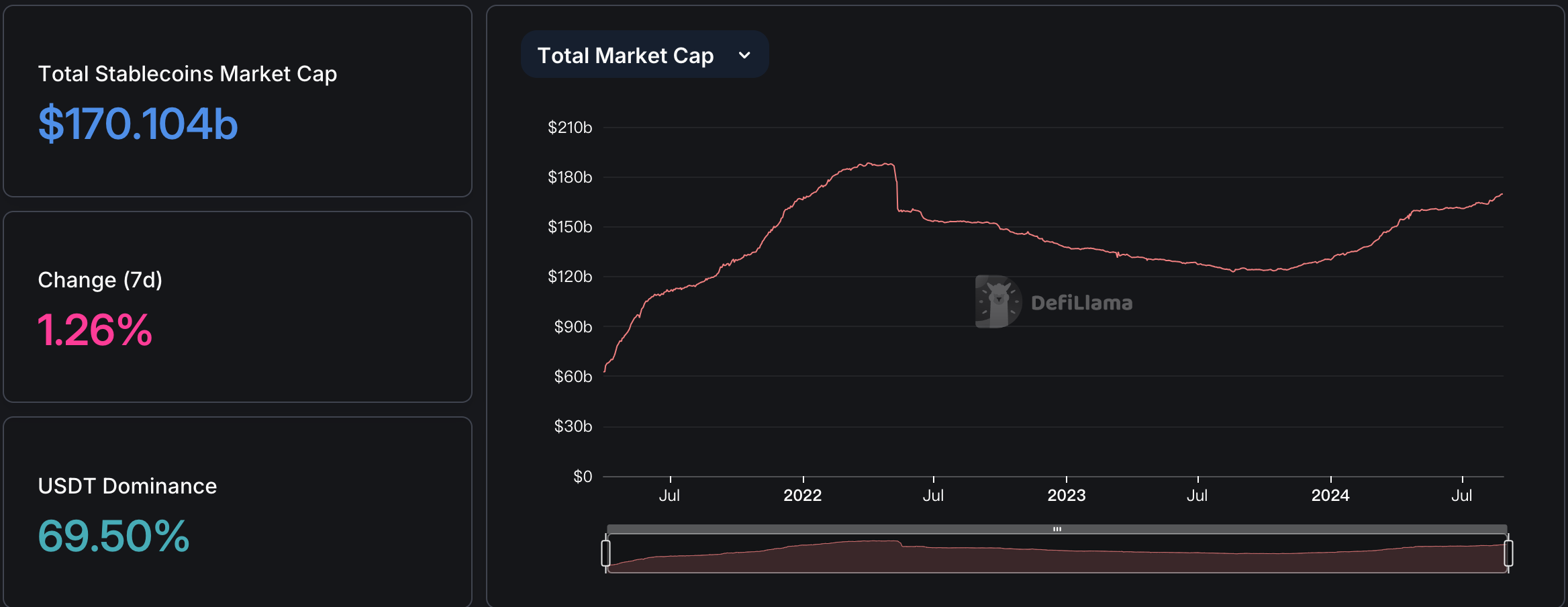

DeFiLlama data shows that the market value of the global stablecoin market has reached US$170 billion, of which USDT and USDC occupy the major shares. The stablecoin PYUSD issued by PayPal and Paxos has grown rapidly due to the advancement of the Solana ecosystem, and now its market value has exceeded the US$1 billion mark. .

Table of Contents

ToggleStablecoin market value exceeds US$170 billion

Data pointed out that the market value of stablecoins excluding algorithmic stablecoins has exceeded US$170 billion, surpassing the historical high in early 2022.

Among them, Tether's USDT has a market value of US$118.2 billion, retaining nearly 70% of the market share; while Circle's USDC has a market value of US$34.1 billion, 20% of the market share; others including DAI and USDE have a market value of US$5.2 billion and US$2.9 billion respectively. .

Obviously, the increase in widespread demand has further promoted the surge and expansion of the market value of stablecoins, and new external funds continue to flow into the crypto market.

( Tether enters the United Arab Emirates and will issue stablecoins linked to AED )

Previously, Ki Young Ju, CEO of CryptoQuant, an analytical institution, also said that the liquidity and momentum of stablecoins will be one of the factors in assessing the quality of the market. Perhaps readers can also look forward to the development of the market outlook.

PYUSD market value exceeds US$1 billion

At the same time, PYUSD, jointlylaunched by payment provider PayPal and stablecoin issuer Paxos, and backed by 1:1 US dollar reserves, has become one of the most significantly growing stablecoin projects.

As of today, PYUSD's issuance has exceeded US$1 billion, becoming the sixth largest stablecoin in the global market, and its market value has more than tripled in one month.

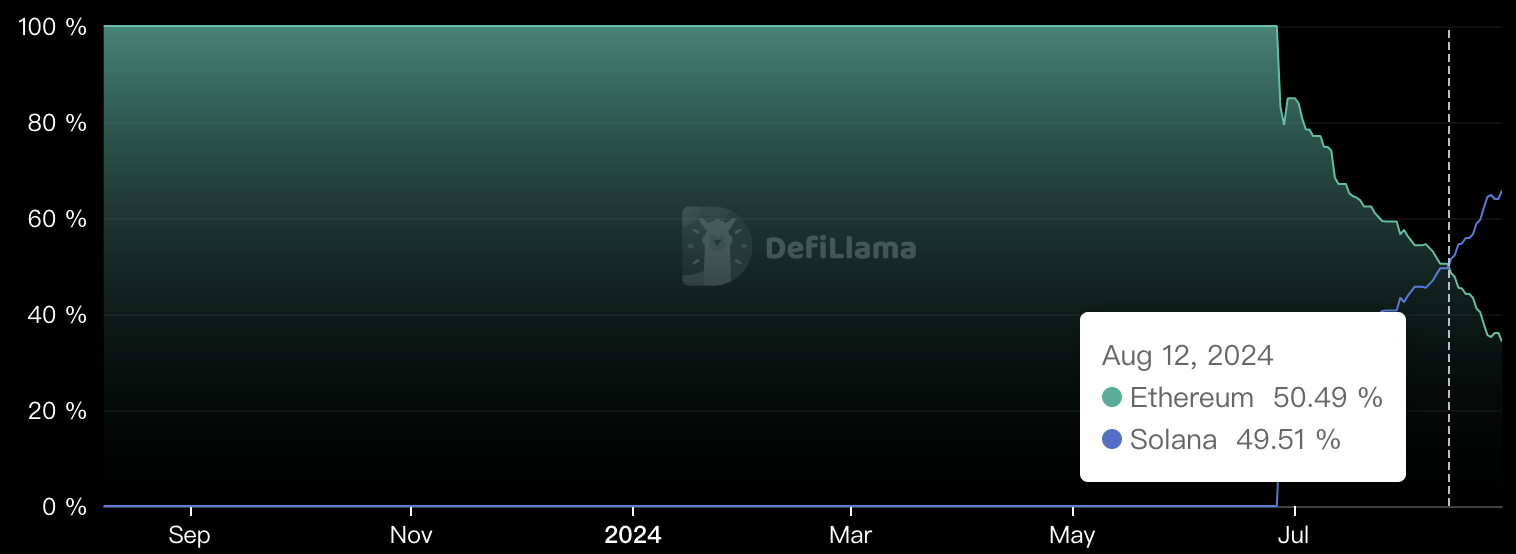

Solana leads PYUSD

This outstanding report card of PYUSD is obviously produced by Solana. Since the stablecoin was launched on the network in June, the issuance of PYUSD on Solana has surpassed Ethereum two months later, and the current ratio has reached 2 :1.

Tom Wan, business development assistant at digital asset investment company 21.co, attributed the key to PYUSD’s success to its integration with the DeFi ecosystem and its fairly generous incentives:

Incentives have played a huge role in PYUSD’s recent growth.

It is reported that PayPal provides hundreds of thousands of dollars worth of PYUSD rewards to Kamino and DEX Drift, the lending protocols on Solana, every week. Users who inject PYUSD into the two protocols will enjoy an annualized rate of return of 13% to 16%, or even far higher. 3.5% higher than the PYUSD of Aave, the lending and borrowing protocol on Ethereum.

Actively expand PYUSD adoption

At the same time, PayPal has also oriented its stablecoin development strategy to expand the accessibility of PYUSD , including collaborating with crypto custodian Anchorage Digital to launch a reward program, and collaborating with MoonPay to simplify the currency purchase process.

( Can stablecoins earn interest? PayPal and Anchorage launch PYUSD reward program )

However, even so, the market value of PYUSD is still far behind USDT and USDC, whose market values are as high as US$118 billion and US$35 billion respectively.