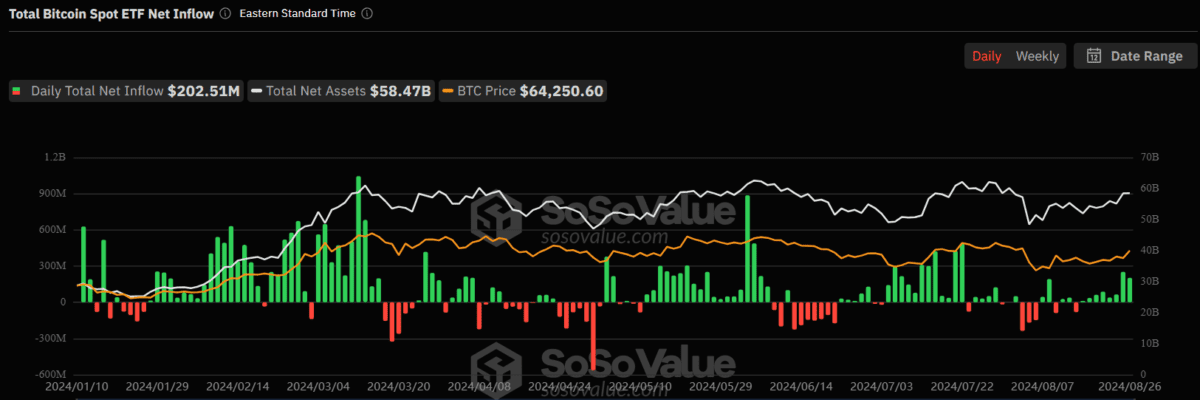

According to statistics from SoSo Value, the total net inflow of U.S. Bitcoin spot exchange-traded funds (ETF) yesterday (26th) was approximately US$202 million, which has been a net inflow for 8 consecutive days. In the past eight trading days, 12 Bitcoin spot ETFs have attracted a total of US$756 million in funds.

The Bitcoin spot ETF with the largest net inflow yesterday was IBIT issued by BlackRock, with an amount of approximately US$224 million. This was the largest single-day inflow since July 22. The net inflows of the other two funds were smaller. EZBC WisdomTree's BTCW issued by Franklin Templeton recorded net inflows of US$5.52 million and US$5.06 million respectively.

The other six Bitcoin spot ETFs, including Grayscale's GBTC, had zero net fund flows on the day, and three of them showed net fund outflows. The total single-day turnover of these funds fell from US$3.12 billion last Friday to US$1.2 billion yesterday, returning to typical levels.

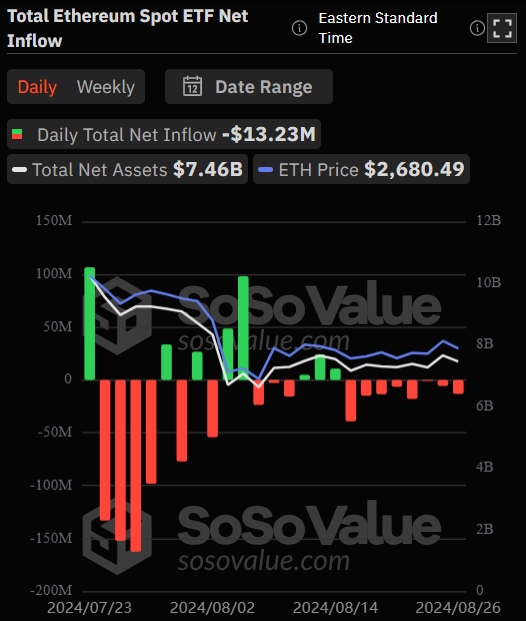

At the same time, the U.S. Ethereum spot ETF showed the opposite capital flow situation, recording net fund outflows for the eighth consecutive trading day. These nine Ethereum ETFs recorded a net outflow of US$13.23 million on Monday, of which ETHE issued by Grayscale had a net outflow of US$9.52 million.