The last time such a plunge occurred was the last time.

The crypto market has not yet recovered from the crash on August 5, and today it is experiencing violent fluctuations again.

At 5am this morning, Bitcoin suddenly plummeted from $60,000 to $58,000, while Ethereum fell even more severely, from $2,600 to $2,400. In the past three trading days alone, Bitcoin has fallen by 7,000 points, while Ethereum has fallen by more than 400 points. The violent market turmoil once again confirmed the high volatility of cryptocurrencies. : At any time, a comfortable investment environment may be destroyed by a sudden storm. In the face of such market shocks, it is crucial to stay calm and vigilant.

At this moment, the famous investor Buffett’s famous words still apply:

“Buy when the market is volatile and blood is flowing, even if that blood is your own.

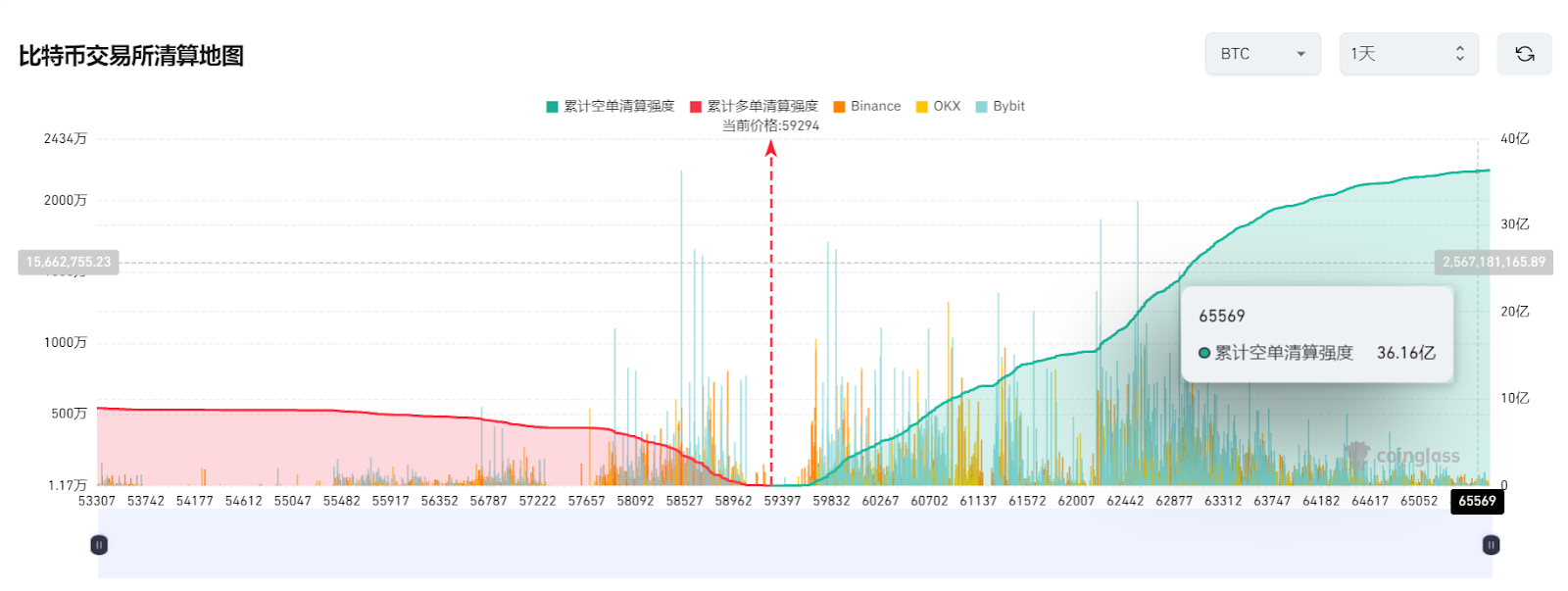

According to Coinglass data, in the past 24 hours, more than 88,000 people had their positions liquidated, with a total liquidation amount of up to $322 million. Among them, the liquidation amount of long orders was $285 million, the liquidation amount of short orders was $36 million, the liquidation amount of Bitcoin was $23.65 million, the liquidation amount of Ethereum was $48.85 million, and the liquidation amount of Dogecoin was $5.89 million. The largest liquidation occurred in Binance's ETHBTC trading pair, with an amount of up to $12.6725 million.

We can't help but sigh that in just a few days, Bitcoin has experienced "ice and fire".

Prior to this, Bitcoin had rebounded sharply from the bottom of $49,000 to $65,000 after 20 trading days. Bitcoin rebounded from the bottom of $49,000 to $65,000. After Federal Reserve Chairman Powell hinted at a rate cut at the Jackson Hole annual meeting last Friday, the market was likely to set a new high.

However, today's extreme market volatility once again makes people sigh that the manipulation power of dog dealers is extraordinary.

Current Alternative data shows that today's cryptocurrency panic and greed index has dropped to 30, from 48 yesterday, and market sentiment has once again turned to panic.

Apart from the old-fashioned supply issues (worrying that the US government might sell seized tokens), there is no noteworthy negative news. So why did Bitcoin fall from its highs, and what happened in the market? The author analyzes several possible reasons:

1. The Ethereum Foundation sold coins and other actions

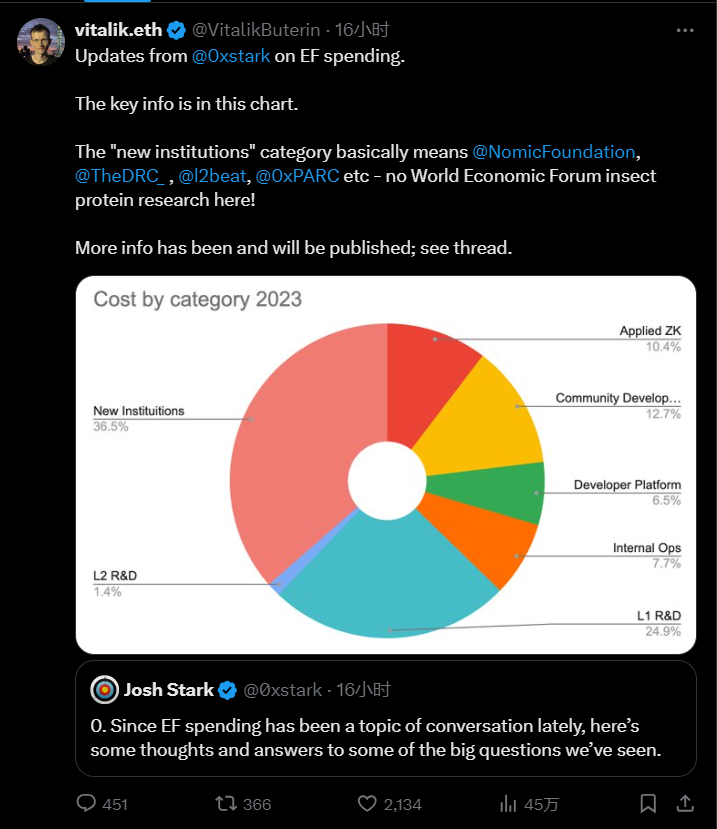

On August 24, the Ethereum Foundation deposited 35,000 ETH (about $94.07 million) into Kraken. The last similar operation was on May 6 last year, when the 15,000 ETH (about $30.1 million) transferred in caused ETH to fall by 13% in the following six days. On August 27, Ethereum co-founder Vitalik Buterin revealed information about salaries and foundation expenses on social media.

This series of actions has attracted widespread attention in the crypto community, and many people believe that the Ethereum Foundation is now becoming a heavy burden on ETH. This organization with a strong ideological color has become a negative asset to Ethereum and its ecosystem. Web3 venture capitalist LordWilliamUK bluntly pointed out the six major drawbacks of the foundation, including its "congressionalism" phenomenon that has led to the hunting of various funds and interests, the vast majority of members only conducting research on paper but indifferent to innovative projects, the opacity of the annual expenditure of US$100 million, excessive focus on "orthodoxy" and neglect of practical applications, failure to effectively serve high-quality potential projects, and slow iteration.

As the world's second largest non-profit organization for Ethereum by market value, the Ethereum Foundation is now facing various controversies, especially the frequent large-scale sales of ETH, which has caused widespread concern in the cryptocurrency community. This is also the main reason for the sharp drop in the ETH/BTC index and the subsequent decline of many Altcoin.

2. Binance internal transfers and Palestinian fund freeze

Yesterday, the market data showed a significant shift, with a surge in the turnover of chips around $64,000, and nearly 45,000 BTC changing hands at $63,000. A total of 134,131 BTC flowed out of this range. The author compared the transfer data of the exchange and the stock of the US government and Mentougou, and found no obvious changes. However, the transfer data within the exchange revealed that 130,000 BTC flowed within Binance, which was obviously caused by wallet sorting, not selling, otherwise the market panic would be more intense and the situation would be more serious.

Ray Youssef, co-founder of crypto platform Paxful and CEO of Noones P2P platform, posted on X platform on August 26 that Binance froze the funds of Palestinians at the request of the Israel Defense Forces (IDF). This move affects all Palestinians and may foreshadow similar situations in Lebanon, Syria and other countries. This series of events may trigger panic among traders and affect the market.

3. Bitcoin and Ethereum spot ETF outflows

Yesterday, the U.S. spot Bitcoin ETF had a net outflow of $127.05 million, ending the net inflow for the past eight consecutive trading days. BlackRock and Fidelity Funds, which have always been generous, stopped buying. The Ethereum spot ETF had a total net outflow of $3.4452 million yesterday, continuing the net outflow for 9 consecutive days.

As of press time, the total net asset value of the Ethereum spot ETF is $7.183 billion, and the ETF net asset ratio (market value as a percentage of the total market value of Ethereum) has reached 2.31%. The total cumulative net outflow has reached $481 million.

Cryptocurrency markets have been lackluster since the launch of the Ethereum (ETH) spot exchange-traded fund (ETF) in the U.S. on July 23. While other risk assets have also shown weakness during this period, cryptocurrencies have remained subdued since the rebound in non-farm payrolls (NFP) after volatility adjustments. Unless the market provides more transparency on the prospects of a “soft landing vs. hard landing” for the U.S. economy, ETF flows are likely to remain disappointing.

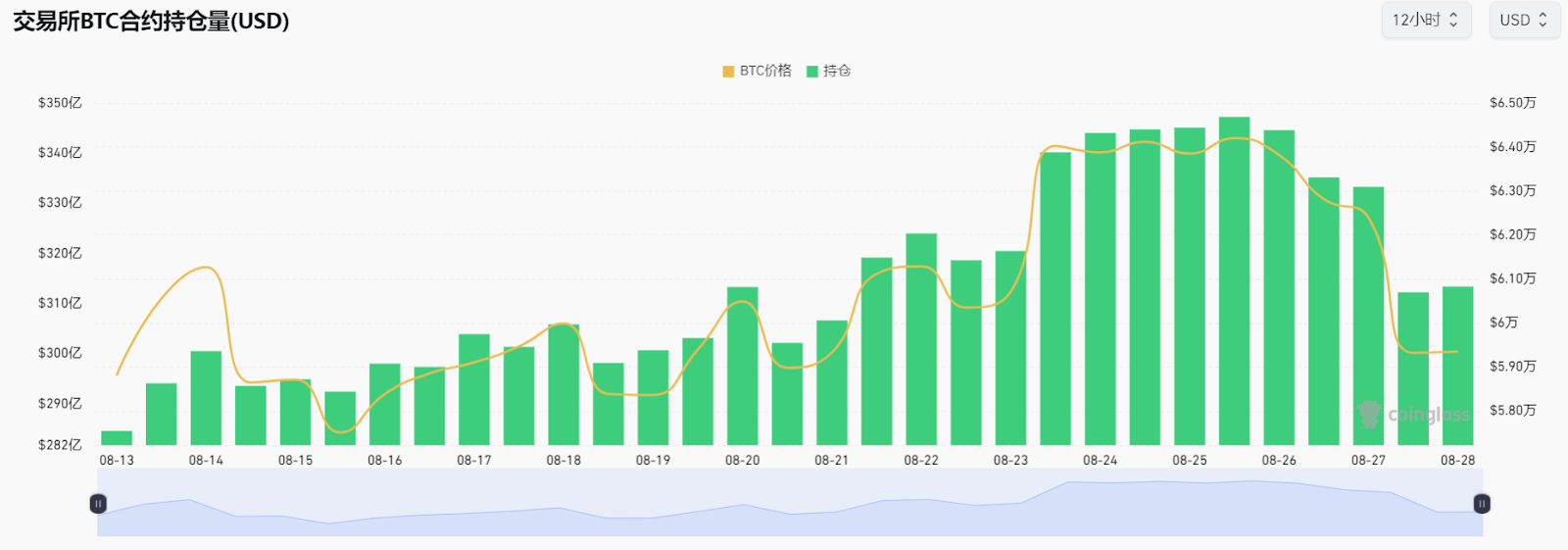

4. Liquidation of long leverage and the impact of macro data

According to Coinglass data, in the past two days, the total open interest of futures contracts on the entire network has withdrawn a total of US$3.4 billion, and there are still US$31.3 billion in open interest. In the past week, long liquidity has been almost completely cleared, and now there are only newly opened long positions around US$58,000 in the market. From a liquidity perspective, despite the upcoming interest rate cut by the Federal Reserve, the rise in Bitcoin prices may be due to Nvidia's stronger-than-expected earnings, which has stimulated the liquidation of shorts by "smart money." However, the strong performance of technology stocks is not necessarily good for Bitcoin, and some analysts worry that the opposite effect may occur.

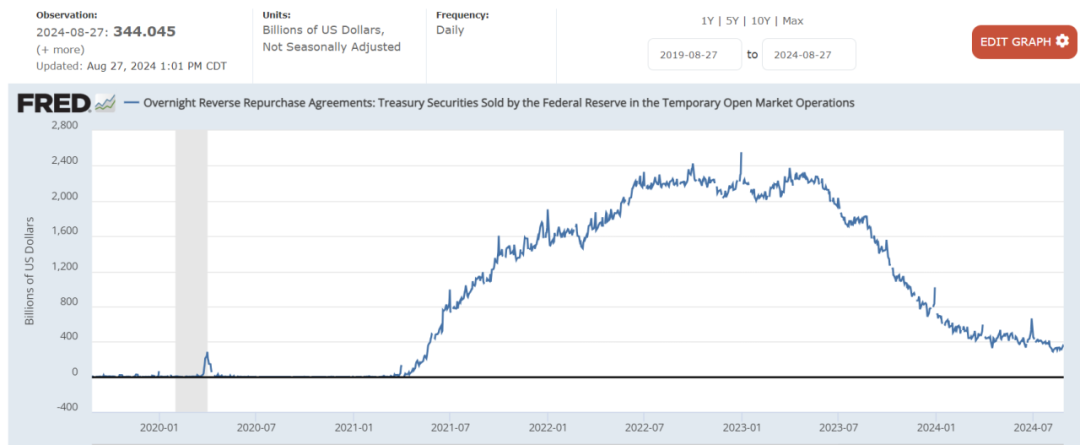

In addition, near the end of the month, some changes have occurred in the money market. The scale of overnight reverse repurchase has continued to increase. The data was once below $300 billion on August 6, and recently returned to the range of $340 billion to $350 billion, which means that liquidity has contracted in stages. On the other hand, SOFR, an indicator that measures the cost of borrowing cash overnight with U.S. Treasury bonds as collateral, has also rebounded significantly. These macro factors may limit the sharp breakthrough of asset prices.

When you see wild price swings, the dense accumulation of liquidity on the liquidation map shows that these high-multiple contracts will be liquidated soon. Extreme price behavior in the market is often purposeful, and when liquidation liquidity is large and densely distributed on both the long and short sides, only a small amount of spot can quickly drive drastic price changes.

Finally, Mars Finance reminds everyone that in such a volatile market, it is particularly important to remain cautious and be sure to protect your funds. Frequent liquidation incidents often stem from the leverage effect in cryptocurrency trading. Although leverage can magnify returns, it also magnifies risks. When the account balance falls below the maintenance margin bottom line, the trading platform will automatically close the position and force the sale of assets at market prices to avoid greater losses, which often brings huge financial shocks to investors.

Therefore, ordinary investors should use leverage with caution and take a long-term view. Compared with short-term sharp fluctuations, long-term holding and focusing on projects with strong fundamentals usually bring more stable returns.