Blockchain data analysis agency Glassnode pointed out in a chain weekly report released on Tuesday (27) that while Bitcoin (BTC) on-chain activities and the perpetual futures market are in balance, investors’ speculative interest is weakening.

The report highlights a decrease in profit and loss realization activity in the market, with perpetual contract funding rates returning to neutral levels, indicating a significant reduction in speculative interest among market participants, regardless of investment vehicle or cryptocurrency. Additionally, perpetual contract liquidations have decreased significantly compared to the excitement surrounding the all-time highs in March, further supporting the view of reduced speculative interest and indicating that the market is more inclined to focus on spot trading.

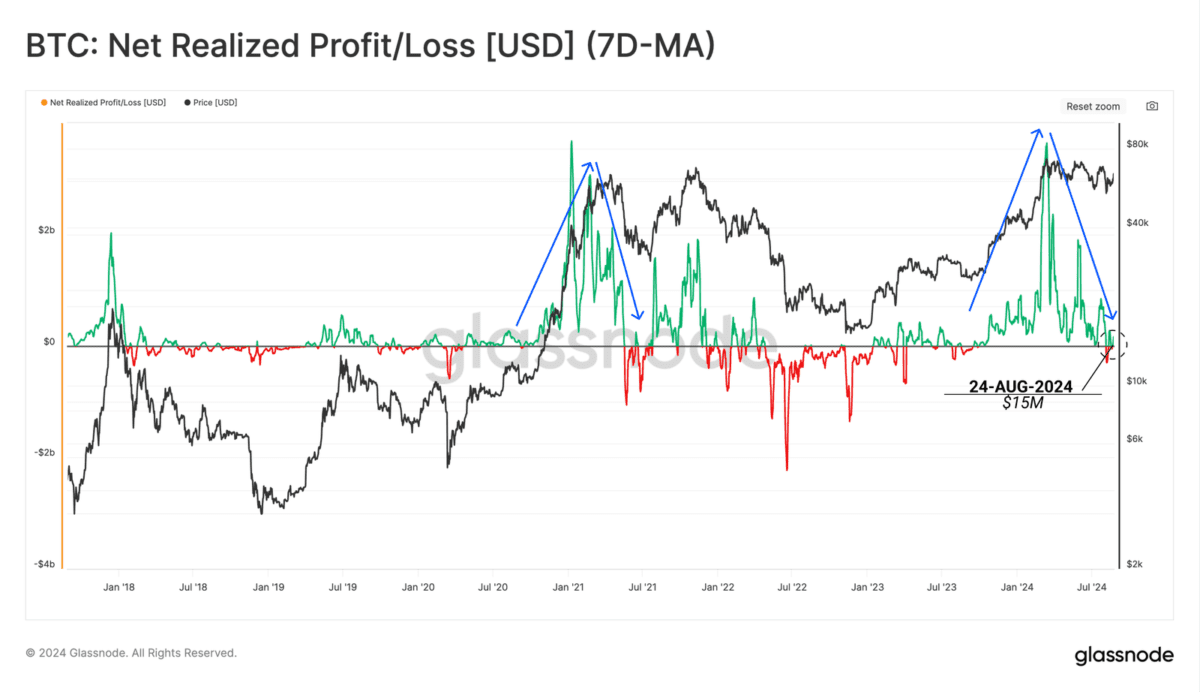

Glassnode also noted that net capital inflows into Bitcoin have slowed in recent months, showing a balance between investors taking profits and realizing losses. The report shows that daily net realized gains and losses currently exceed $15 million, significantly lower than the $3.6 billion in daily inflows when the market hit a record high of $73,000 in March. Glassnode notes that the indicator typically returns to neutral levels as markets approach inflection points, which could be the continuation of a market trend or turn into a macro-scale bear trend.

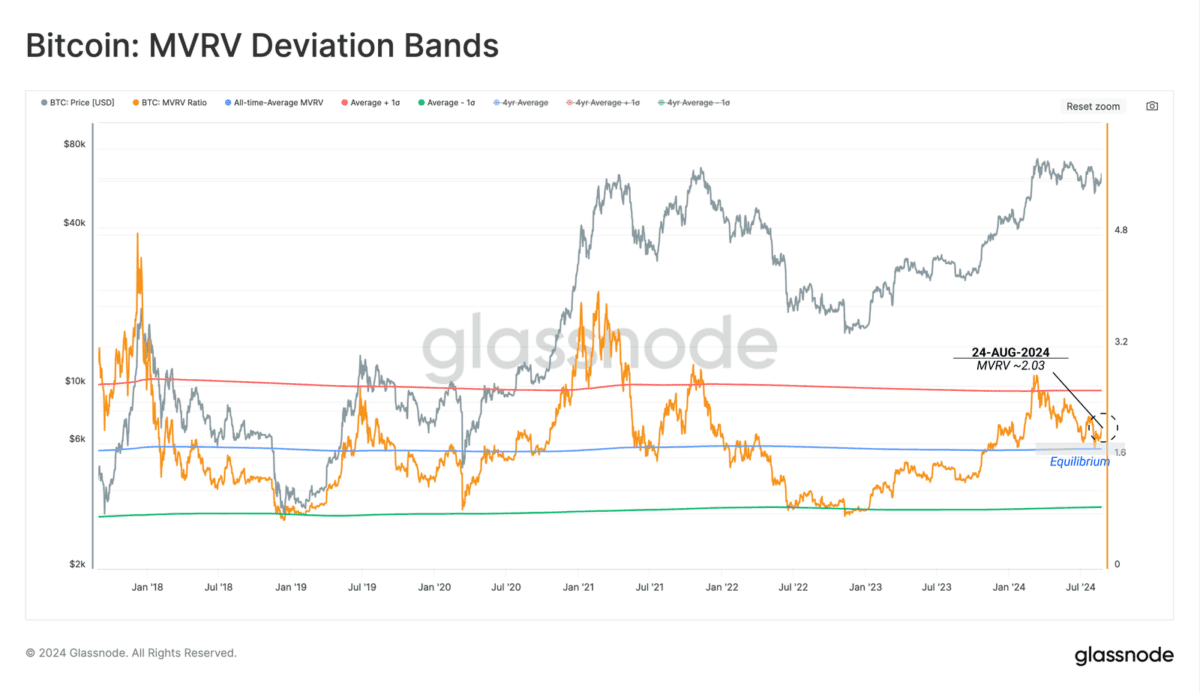

Additionally, the market-to-realized value ratio (MVRV), which measures investors' average unrealized profits, tested its historical average of 1.72 over the past two weeks, a level that historically marks the turning point between macro bull and bear trends.

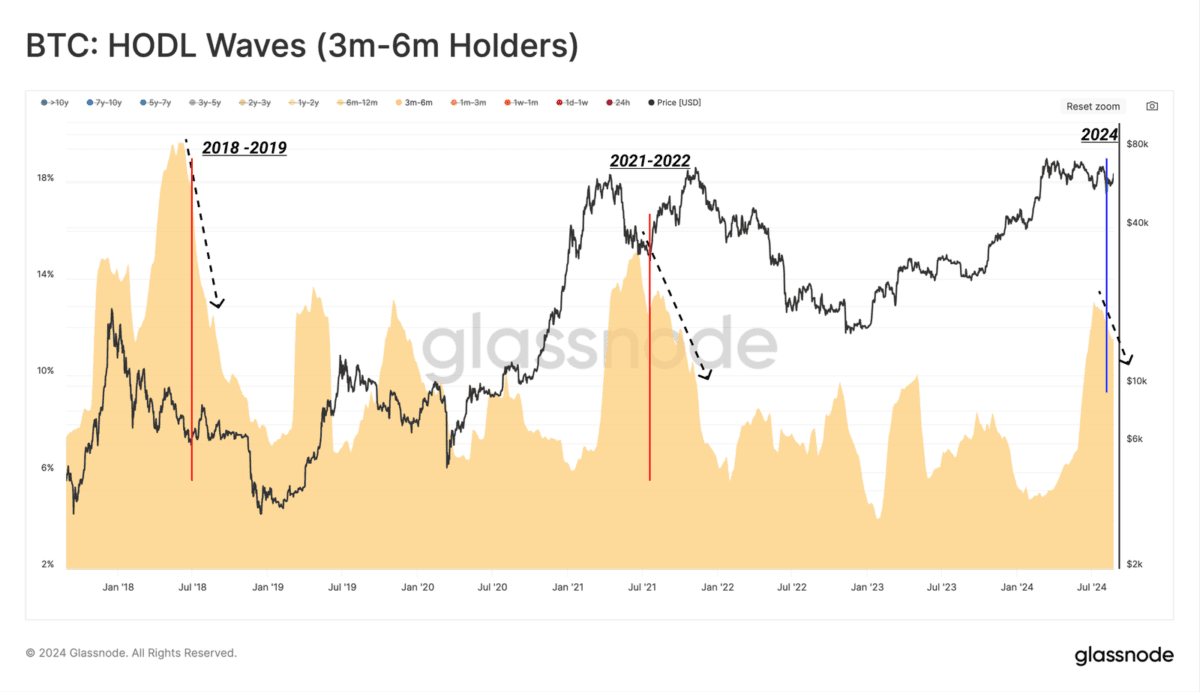

Notably, some of the new investors became long-term investors after the price reached new highs, and the sideways moves in recent months have tested their confidence. [Note: Glassnode considers addresses that hold Bitcoin for more than 155 days as long-term holders (HODLER)]

“Historically, supply in the 3- to 6-month age band tends to peak shortly after major market highs are established, often during the subsequent rollback process. Some of these new investors will Those who decided to HODL during the shock eventually became long-term investors, while many others chose to exit their positions and realize losses. "Currently, 3- to 6-month-old coins account for 12.5% of the circulating supply," Glassnode's report reads. Above, the structure is similar to the sell-off in mid-2021, but also to the peak of the 2018 bear market.”

Glassnode concluded that a large number of coins are now showing neutral funding rates, indicating that speculative interest across the crypto market has reset and that recent price movements may be driven by the spot market. The market has been running in a structurally orderly downward trend for more than 5 months. Based on historical experience, Glassnode believes that this calm and stable market structure usually does not last long and often indicates that market volatility may follow. intensified.

Source: CryptoSlate , Glassnode