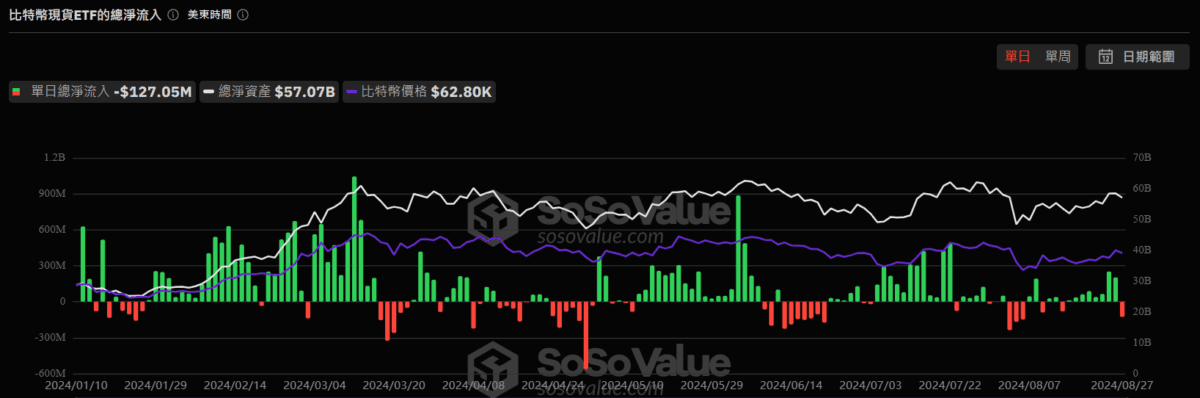

According to statistics from SoSo Value, the total net outflow of U.S. Bitcoin spot exchange-traded funds (ETF) yesterday (27th) was approximately US$127 million, returning to net outflow status after eight consecutive trading days of inflows.

Yesterday's fund outflows from Bitcoin spot ETFs were mainly led by the ARKB fund jointly issued by Ark Investment (Ark) and 21Shares, with a net outflow of nearly US$102 million. This was followed by Grayscale’s GBTC and Bitwise’s BITB, with net outflows of US$18.32 million and US$6.76 million respectively.

No Bitcoin spot ETF showed net inflows yesterday, and the other nine funds, including BlackRock's IBIT, all had zero net fund flows.

At the same time, the Ethereum spot ETF recorded its ninth consecutive day of net outflows yesterday, totaling $3.45 million. However, only Grayscale’s ETHE fund showed a net outflow, amounting to US$9.18 million, while Fidelity’s FETH and Bitwise’s ETHW recorded net inflows of US$3.88 million and US$1.86 million respectively. The other six Ethereum funds ETFs all have zero net fund flows.