Why crypto shaming?

Do you feel shy about your involvement in the crypto/blockchain industry?

Recently, the term "crypto shame" has appeared frequently in the industry. Some people feel "ashamed" that blockchain has not brought real value to society, while others are too embarrassed to speak out because of the sluggish market. It is worth noting that this sentiment exists not only among ordinary investors, but also among Ethereum core developers who have been deeply involved in the industry for many years.

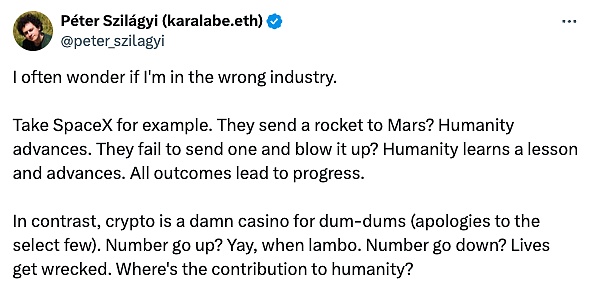

On August 5, 2024, the day of the market crash, Péter Szilágyi, a member of the Ethereum Foundation and head of Geth development, posted a tweet. He compared the crypto asset industry to SpaceX, pointing out that SpaceX is constantly advancing human progress through research on rocket launches, while the crypto asset industry is more like a casino for gamblers and does not create real social value.

You may argue that from Bitcoin, which was born in the 2008 financial crisis, to the stable coins, DeFi, DEX, wallet applications, etc. that have emerged in the following decade, aren’t they all the results of these years? Peter agrees that stable coins have indeed played a role, but he also believes that:

BTC’s initial attempt to become a safe-haven asset was a failure, with wild price swings making it difficult to achieve its original goal.

Decentralized exchanges facilitate speculation more than substantive value creation.

Although tools such as Dune and Messari can be used to analyze the market, they essentially still serve a "casino"-like market.

Although high TPS has been achieved technically, the current application scenarios are almost limited to supporting the issuance of a large number of Meme Coins rather than creating truly valuable services or products.

Indeed, technology itself is not the goal, but developing technology to bring substantial improvements to the lives of the public. At present, regardless of whether life has been improved, in fact, if you want to ensure your life, it seems safer to keep silent about the industry you are engaged in and the crypto assets you hold.

A month ago, a 29-year-old BTC holder was kidnapped by four men in the Ukrainian capital of Kiev and was killed after BTC worth about $207,000 was stolen. At the recent EthCC conference held in Brussels, Belgium, several participants were also robbed.

Casa co-founder Jameson Lopp pointed out in his article A bitcoiner's guide to organized crime that there are organized criminal gangs in the United States that target BTC holders and steal victims' BTC.

Many cases of encryption practitioners being robbed have been reported in the news, so in order to protect their own safety, many people choose to hide their identities from the outside world.

The instability and volatility of the crypto asset market is also a reason why some crypto practitioners find it difficult to talk about it. The price crash has damaged the confidence of investors and holders, and has also affected the public's view of the entire crypto asset industry.

Is encryption really "shameful"?

First of all, we need to recognize the current problem of the crypto industry: lack of practical applications. Except for BTC and a few ecosystems, most projects still lack substantial application scenarios. All technological development seems to only facilitate speculation.

Indeed, the main purpose of speculators is to make money, and they don't care about the specific investment targets. However, from the perspective of the market, speculators have added liquidity to many sub-markets, objectively filling the liquidity gap. Value investors and speculators each have their own significance. To use a metaphor that may not be appropriate, if the water is too clear, there will be no fish. If there were no speculators, the activity of the market might be greatly reduced.

Therefore, understanding the importance of speculators to the market helps us look at various phenomena in the industry more rationally. In addition, from the perspective of personal safety, hiding the identity of crypto practitioners is understandable; but if it is due to a lack of sense of value or market volatility, it may be unnecessary. Encryption has practical significance at present and will continue to expand in the future.

The relevance of encryption today

Take BTC as an example. It is the first successful decentralized digital asset experiment. It does not require a central bank or other authoritative institutions to maintain its operation. This feature means that BTC can circulate freely around the world without the intermediary role of traditional financial institutions. Although it is extremely volatile, for some investors, it is a long-term means of storing value, similar to the role of gold, which can to some extent resist the risk of depreciation of legal currency due to inflation.

For countries with severe inflation of their own fiat currencies, BTC has become an alternative. For example, El Salvador officially announced BTC as one of the country's legal currencies on June 9, 2021 to deal with the problem of depreciation of its own currency. At the same time, BTC helps to improve financial inclusion. For those who cannot access traditional banking services, BTC provides a new way of payment and savings.

In addition, BTC introduced blockchain technology, the application of which goes far beyond crypto assets themselves, including supply chain management, identity authentication and many other fields.

Stable Coins are also widely used in cross-border payments due to their stable value. For example, Xoom, an international remittance service under PayPal, allows users to use Stable Coins for transfers without paying any fees. This further reduces the cost of international remittances and improves efficiency.

The social value of the future of encryption

Peter’s analogy between crypto assets and SpaceX may not be appropriate. Rockets have a clear purpose - to send objects into space, while the development of crypto assets and blockchain technology, like Internet technology, is not limited to a specific purpose, but has the vitality of self-iteration and keeping pace with the times.

Compared to rockets, 5G may be a more appropriate analogy. In the just-concluded Paris Olympics, 5G technology was widely used in the live broadcast and data transmission of the event. For example, the Olympic broadcast service agency OBS used 5G cameras and ultra-high-definition image technology in the broadcast, providing a higher-quality viewing experience for global audiences. Ten years ago, in an era when 2G and 3G were enough, who could have imagined what application scenarios 5G would have? But today, taking China as an example, 5G applications have covered 70% of the national economy, and there are more than 94,000 5G commercial projects.

Therefore, technologies that seem to have unclear application scenarios in the early stages may gradually show their great social value as technology advances. The core feature of blockchain technology is that the information on the chain cannot be tampered with, which increases the transparency and traceability of data. Applying it to the charity field can increase the trust of donors, and in the food supply chain, blockchain can be used to track the source and history of food, so that food safety can be better guaranteed. At the same time, its encryption technology can be used for identity authentication to ensure that only authorized users can access specific resources, while enhancing data security and reducing the risk of identity theft and data leakage, etc.

Although it seems that crypto assets and blockchain developers have invested manpower and material resources in infrastructure construction and TPS improvement, which are mainly used in Meme Coins and speculative scenarios, the key to the future lies in how to apply these technologies to more practical scenarios. As shown in the development history of 5G technology, with the maturity of technology and the continuous expansion of application scenarios, crypto assets and blockchain technology will gradually prove their value.

Government regulation of the crypto industry

Bitcoin was born in the financial crisis of 2008. Out of disappointment with the traditional monetary system, Satoshi Nakamoto created Bitcoin without a central issuing agency and wrote in the Genesis Block:

The Times 03/Jan/2009 Chancellor on brink of second bailout for banks

The sentence translated into Chinese means: January 3, 2009, The Times: The Chancellor is on the brink of a second bailout for the banks.

The emergence of crypto assets was initially a challenge to traditional finance and governments, but today, governments around the world have begun to gradually establish relevant laws for the crypto industry, which to a certain extent reflects their recognition of the industry.

In 2023, the European Parliament passed the Crypto-Asset Market Regulation Act (MiCA). This bill is an important development for the crypto-asset industry as it provides a comprehensive regulatory framework for crypto-assets throughout Europe, including but not limited to the issuance, trading and custody services of crypto-assets.

This year, the United States has successively approved spot ETFs for Bitcoin and Ethereum, marking the entry of crypto assets into the mainstream market. At the same time, the United States is brewing a new proposal to establish a BTC tax-free digital economic zone (DEZ) to promote the use and development of BTC by providing a tax-free trading environment.

In August 2024, Russian President Vladimir Putin signed a law legalizing crypto mining. At a previous meeting on economic issues, the Russian government also emphasized the importance of crypto assets as a promising economic sector and planned to quickly establish a legal framework and regulatory system.

These countries and regions have adopted more standardized regulatory measures on crypto assets, from establishing a comprehensive regulatory framework to promoting the development of specific crypto assets. This reflects the government's positive expectations for the future development of the industry and also provides an answer to the issue of "crypto shame" from the government's perspective.

at last

We do not think crypto is shameful, and those who work in and participate in this industry should keep their original intentions in mind and move forward.

We also do not think that Arthur Hayes' statement that "crypto asset holders should proudly display their wealth" is an unconditional initiative. At least make sure you are in a safe environment first.

We believe that encryption is necessary, especially after recognizing the source of vitality of the encryption industry.

What we need most right now is patience.