In a podcast, Kain, the founder of Synthetix and Infinex, mentioned that Vitalik Buterin or the Ethereum Foundation had a negative view on DeFi (decentralized finance). This triggered a strong reaction from the community, which led to various discussions about DeFi. These discussions clearly show Vitalik's views on DeFi and provide multiple topics and insights related to DeFi, so it is necessary to take a closer look at them.

1. Background — Vitalik’s “DeFi Only” Limitations

1.1 The intersection of DeFi and decentralized technology will become very important

Vitalik responded to a question on August 25 about why he or the Ethereum Foundation does not seem to encourage DeFi. He said that the applications he wants to see are those that are useful in a sustainable way and do not sacrifice principles such as permissionlessness and decentralization. He attaches great importance to decentralized exchanges (DEX), decentralized stablecoins such as RAI, and Polymarket, but he "does not respect unsustainable protocols that attract users only through temporary factors." For example, he mentioned that the "liquidity mining" craze in 2021 did not arouse his interest because it mainly came from temporary token issuance. He emphasized that it is very important to understand the source of DeFi's interest income, who is on the other side of the transaction, and who is paying the interest income.

Furthermore, he added that finance alone is not enough, and it is important to find the intersection of DeFi and technology. With the rapid development of technology today, many risks of centralization (centralization of credit scores, social media, artificial intelligence, brain-computer interfaces, etc.) are emerging, and decentralized finance plays an important role in solving these problems. For example, decentralized financial infrastructure is necessary because a VPN is not anonymous if its payment method does not ensure privacy. Similarly, decentralized social applications like Farcaster use decentralized financial elements as a sustainable monetization strategy rather than traditional advertising revenue models. Overall, he believes that the intersection of DeFi and decentralized technology is very important.

1.2 The DeFi market depends on the existence of the ETH market

In the following discussion, a debate was held around the structural limitations of DeFi. In response to Vitalik's point, it was pointed out that "DeFi" does not only mean the "Ponzi economy" in 2021, but also includes lending protocols like Aave, CDPs (collateralized debt positions) like RAI, synthetic assets, etc. The interest income of these protocols comes from borrowers and transaction fees, making it a sustainable model and therefore a positive use case for DeFi.

In response, Vitalik expressed concerns that interest income only comes from borrowers and transaction fees. He pointed out that the value of DeFi tokens comes from being able to earn interest income, but this structure is limited because the interest income is paid by those who trade these tokens. For example, the person who gets 8% annual interest is paid 8% annual interest by the person who is long ETH with 2x leverage. The problem with this phenomenon is that it means that the existence of the DeFi market is still dependent on the Ethereum market, suggesting that DeFi is fundamentally limited and cannot be a factor in driving cryptocurrency expansion to 10-100x adoption.

To summarize Vitalik’s views on DeFi from these different discussions:

- Sustainable DeFi protocols that do more than just temporarily attract users, like the liquidity mining craze, clearly make sense.

- However, DeFi alone is not structurally sufficient to act as a catalyst to scale cryptocurrencies 10-100x. DeFi plays an important role as one of the components to achieve decentralized technology, and importantly brings value (interest) from the outside, without relying on the Ethereum economy.

2. Summary - The significance of liquidity mining and DeFi

We can supplement Vitalik’s views from multiple perspectives, ranging from small topics such as interest income sources and sustainable DeFi protocols to big topics such as the significance of DeFi’s existence and its structural limitations.

2.1 Misunderstandings about Liquidity Mining

As Vitalik mentioned, the key to judging the sustainability of a DeFi protocol is to examine the source of interest income it guarantees. Especially in the 2021 "liquidity mining" craze, the interest income provided by DeFi protocols to users is paid in governance tokens that have no independent value accumulation mechanism. As a result, these governance tokens cannot maintain a stable price, resulting in reduced liquidity mining incentives and unsustainable operations. In fact, most DeFi protocols failed to prove their subsequent product-market fit (PMF) after the end of liquidity mining activities, lost user retention, and eventually disappeared from the market.

However, this does not mean that all DeFi protocols that have conducted liquidity mining are unsustainable. On the contrary, those DeFi protocols that rely entirely on liquidity mining have been eliminated by the market due to their failure to develop good enough products to achieve sustainable growth. In other words, liquidity mining is not essentially part of a sustainable model, but a "temporary" activity to successfully guide liquidity and users. Therefore, I think the evaluation of liquidity mining needs to be more multi-dimensional.

Source: Gauntlet - Flywheel effect of Liquidity Mining

Looking back at the past liquidity mining craze, the lending service Compound took the lead in launching liquidity mining activities in June 2020. Since then, money market protocols such as Aave and DEXs such as Uniswap have not only provided rewards to liquidity providers from loan interest and transaction fees, but also distributed native tokens or tokens obtained through other channels (Uniswap distributed its share of liquidity mining). The U.S. stock market Arbitrum provided airdrops to liquidity providers after its launch) as additional incentives to stabilize users and liquidity.

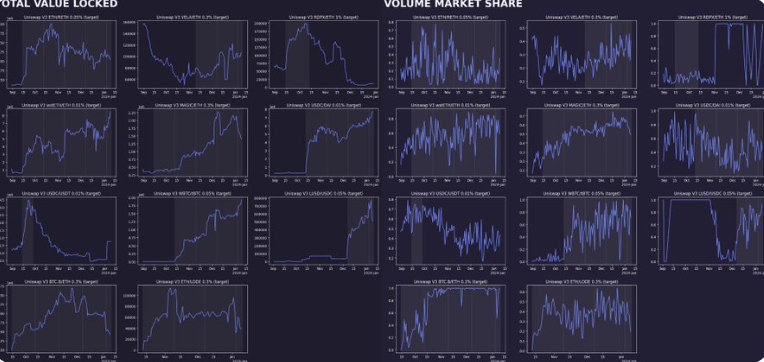

Source: Gauntlet - TVL(left) and Volume market share(right) for Incentivized pools of Uniswap

In fact, liquidity mining has shown high effectiveness in steadily securing liquidity and users when launching initial DeFi protocols or expanding business areas to new chains. Therefore, liquidity mining has become an effective bootstrapping strategy by providing additional incentives such as opening temporary mining pools. In addition, another reason why liquidity mining needs to be evaluated in many aspects is that compared with "Pointnomics" or the token distribution method led by high FDV VCs that occurs opaquely off-chain, liquidity mining is a relatively transparent way to distribute governance rights and effectively align the incentives of users who contribute to the liquidity of the protocol with the incentives of the protocol. To summarize, it is true that oversupplied DeFi protocols without technical or product advantages can only attract temporary user interest through liquidity mining. However, various DeFi protocols such as Compound, Aave, Uniswap and SushiSwap have maintained stable activity in a sustainable model, solving the incentive problem of liquidity providers through interest or transaction fees provided by borrowers as a bootstrapping strategy to solve the cold start problem. So, while Vitalik’s take on the 2021 liquidity mining craze has some merit, there is room for misunderstanding when judging the sustainability of liquidity mining and DeFi protocols, which is why I am sharing my thoughts on the matter.

2.2 DeFi is sufficient in itself, but can still be expanded

Before discussing Vitalik’s view that DeFi can only exist as a subsidiary structure of the Ethereum market, it is necessary to clarify his controversial point of view.

First, he likened the structure of generating and receiving DeFi interest to the image of a "snake swallowing its tail." While this can be seen as a concern about the stability of the source of interest generated from lending, the flow of funds from borrowers to lenders to provide interest is not significantly different from the mechanism of the banking system. Therefore, he did not express concerns about the interest payment ability or financial soundness of money market protocols such as Aave and Spark. In addition, judging by the fact that he mentioned that Polymarket, which relies on oracles, is a positive use case and acknowledged the practicality of USDC, he did not have a negative view of DeFi because he is a "pure" DeFi advocate.

The core of the message seems to be to emphasize the importance of DeFi as a financial infrastructure that supports decentralized technologies or applications, as DeFi is limited to the intrinsic demand and supply interactions within the Ethereum economy. In addition, this can also reasonably be seen as opening up possibilities for broader cryptocurrency adoption, not just limited to the current Ethereum network usage that is biased towards DeFi.

From this perspective, we can agree with his point of view that the usability of Ethereum, or even the usability of blockchain, should not be limited to DeFi. DeFi itself provides important value because it can greatly reduce the high entry barriers of traditional financial infrastructure. In addition, DeFi allows the construction of "Lego Finance" through interoperability between different types of DeFi protocols, from money markets and decentralized exchanges to derivatives such as synthetic assets and yield markets, demonstrating its unique value that cannot be found in traditional financial infrastructure, proving the irreplaceable significance of DeFi's existence.

However, it is worth remembering that even in traditional markets, “finance” was originally a field where only a small number of professionals were able to participate and interact economically. Therefore, it is difficult to see DeFi as a catalyst when we look forward to blockchain adoption by more users. This is also one of the reasons why consumer-facing applications like Polymarket or Farcaster have received more attention recently compared to DeFi, and why it is not meaningless to point out that DeFi’s existence inevitably has a structure attached to the Ethereum economy.

2.3 Conclusion: Thought-provoking Challenges for Ethereum and DeFi

As we all know, opinions on Vitalik are divided. At the extreme, these evaluations can be divided into two views: one highly values him as the founder of the "neutral" Ethereum network and an advocate of privacy and decentralized technologies, and the other considers him an idealist who deliberately ignores market logic and the actual needs of the community. Similarly, his latest statement on DeFi discussed today has also sparked different opinions within the community.

As a Layer 1 blockchain grows, it’s common to see the CEO or founder actively communicating with the community, mentioning applications in the ecosystem, and highlighting updates. This is common in most Layer 1 projects such as Solana, Monad, Sui, and Injective. In this context, when the founder appears to express negative opinions about DeFi, which accounts for one-third of Ethereum’s annual network fees, it may cause concern in the community. Especially with the fragmentation of the ecosystem due to the L2-centric roadmap and the reduction of ETH deflation, people are already concerned about Ethereum’s position. In this context, Vitalik may underestimate the importance of DeFi applications that drive the ecosystem.

However, it seems that he is not just expressing a negative view on DeFi, but is proposing a direction about the role of DeFi in the expansion of the blockchain network and its ideal development path. Although not everyone needs to agree with this message, it can be said that this discussion at least throws out a constructive topic with a consistent direction for the crypto market, which is of certain significance.

3. Other people’s opinions

3.1 Opinions from Jay, one of the “Four Pillars”

Vitalik pointed out that to date, many DeFi experiments have focused on on-chain assets, resulting in the proliferation of worthless assets and often evolving into zero-sum games. At the same time, he emphasized the importance of off-chain and on-chain integration and the importance of finding intersections with real-world technologies.

I believe this announcement ties in closely with an important turning point for broader blockchain adoption. For example, enabling financial activity on the blockchain through infrastructure optimized for the introduction and interaction of specific assets (such as Plume Network’s RWAFi or Story Protocol’s IPFi) is closely aligned with the essence of blockchain - facilitating trusted interactions with a variety of real-world assets.

However, at the same time, I hope that this view will not lead to the misjudgment that all Web3 native experiments are meaningless. Especially in the field of DeFi, these experiments serve as important "empirical case studies" to explore the multiple possibilities of programmable assets. The rise and fall of numerous DeFi projects with different strategies provide valuable lessons on how to implement creative incentive mechanisms for specific goals, whether the results are positive or negative. In short, while it is essential to find these intersections, we should not be limited to them. In other words, we should focus on verifying external validity through ongoing Web3 native experiments to find more effective intersections, rather than focusing solely on the intersections themselves.