Author: The Black Swan

Compiled by: TechFlow

We had some “false” hope last week and felt like we were out of the woods, but this week we felt lost again.

Today, we’ll take a look at some stablecoins you can hold that generate yield in different ways.

While you wait for better opportunities, it might be a good idea to hold on to some stablecoins. Here are five stablecoins that are currently offering the best yields (which is great in a boring “bull market”).

introduction

Many people are disappointed in the current market. Some choose to leave, while others continue to maintain a pessimistic view and discuss topics such as politics. Your social media is filled with discussions that have nothing to do with cryptocurrencies.

At this time, cryptocurrency enthusiasts will rest and relax by looking for the best protocols, especially to provide their assets liquidity (LP) to stablecoins to take advantage of these funds when the market turns bullish. Here are five leading stablecoins and how to maximize their returns:

USDe

USDe is one of the fastest growing synthetic stablecoins, with a market cap of over $3.5 billion in just 8 months, thanks to its airdrop opportunities and unique benefits for USDe holders. This is despite a 14% drop in supply since June, which can be attributed to pessimistic market sentiment:

USDe adoption is rising rapidly. Some highlights include: USDe is now natively deployed on Solana and Scroll, and has partnered with multiple parties such as Securitize (a Blackrock-backed RWA project). So despite the price drop, adoption continues to grow.

If you want to maximize your gains on holding USDe, here are some of the best farms I’ve found:

Bybit recently integrated USDe. Each user can earn up to 20% annual percentage rate (APR) on each USDe held every day, and use USDe as collateral when trading derivatives, with no buy and sell fees for USDe/USDT and USDe/USDC spot trading. You can view yesterday's APR on Bybit's savings page.

Infinex (founded by Synthetix founder Kain, with an investment of over $25 million) offers up to 20x USDe rewards every day. If you convert USDC to USDe in the app, you can get an additional 20x reward, as well as a 200x bonus.

Depositing USDe through Kinto (the most secure L2 with $5 million raised) will earn you 20x rewards and a 5% Kinto mining reward boost with no deposit fees. If you deposit the staking version of USDe (sUSDe), you will earn 17% APY, a 5% Kinto mining reward boost, and 5x rewards from Ethena.

PendleIntern provides a great discussion explaining how to earn up to 55% annual returns by purchasing PT-sUSDE, detailing the sources of returns and the associated risks.

By depositing USDe with Gearbox , you can earn up to 180x rewards, while the staking version (sUSDe) offers up to 45x rewards.

You can buy and sell the USDe/FRAX trading pair on Morphoblue (raised over $69 million), which has partnered with Contango (raised $4 million from investors including Coinbase Ventures) to offer 20x rewards on each USDe held (up to 15x leverage), while farming two token-free protocols at the same time.

Depositing USDe on Origami can earn you up to 155x rewards and 10x Origami points, while getting up to 7x leverage on both USDe and the staking version (sUSDe).

Users who stake at least 25 USDe in their Binance Web3 wallet will receive an equal share of the $12,000 daily reward pool, while enjoying a 50% boost in their rewards, in addition to a 4% USDe staking rewards(subject to change). The promotion ends on August 29.

USD0 (Usual Money)

USD0 is a decentralized real-world asset (RWA) stablecoin that redistributes value and power back to the ecosystem, which makes it different from other stablecoins such as USDC and USDT, which do not gain any value accumulation when held. Currently, USD0's development lags behind Blast L2's stablecoin USDB.

There is currently a campaign where users can earn “Pills” every day for a share of 7.5% of the $Usual supply. The TGE is expected to take place in Q4. Here are some of the best farms to help you maximize your Pill earnings:

1/ Deposit funds in Origami to get 15 times the Pills bonus and 10 times the Origami points. With the lending liquidity provided by Morpho, this combination is like a three-in-one Lego toy.

2/ PendleIntern’s analysis shows that by depositing funds on Pendle, you can earn up to 38.3% on your investment.

3/ By exchanging USDT for USD0 or staking USD0-USDT LP on PancakeSwap , you can collect transaction fees while farming Pills.

USDz

USDz is a U.S. dollar backed by tokenized real-world assets (RWAs), allowing users to diversify their portfolios from cryptocurrency price fluctuations to capture yield from the $7 trillion private credit market, which is said to be undergoing a version update.

Season 1 will focus on holding USDz or providing liquidity to earn points redeemable for tokens, which is expected to be launched in Q4.

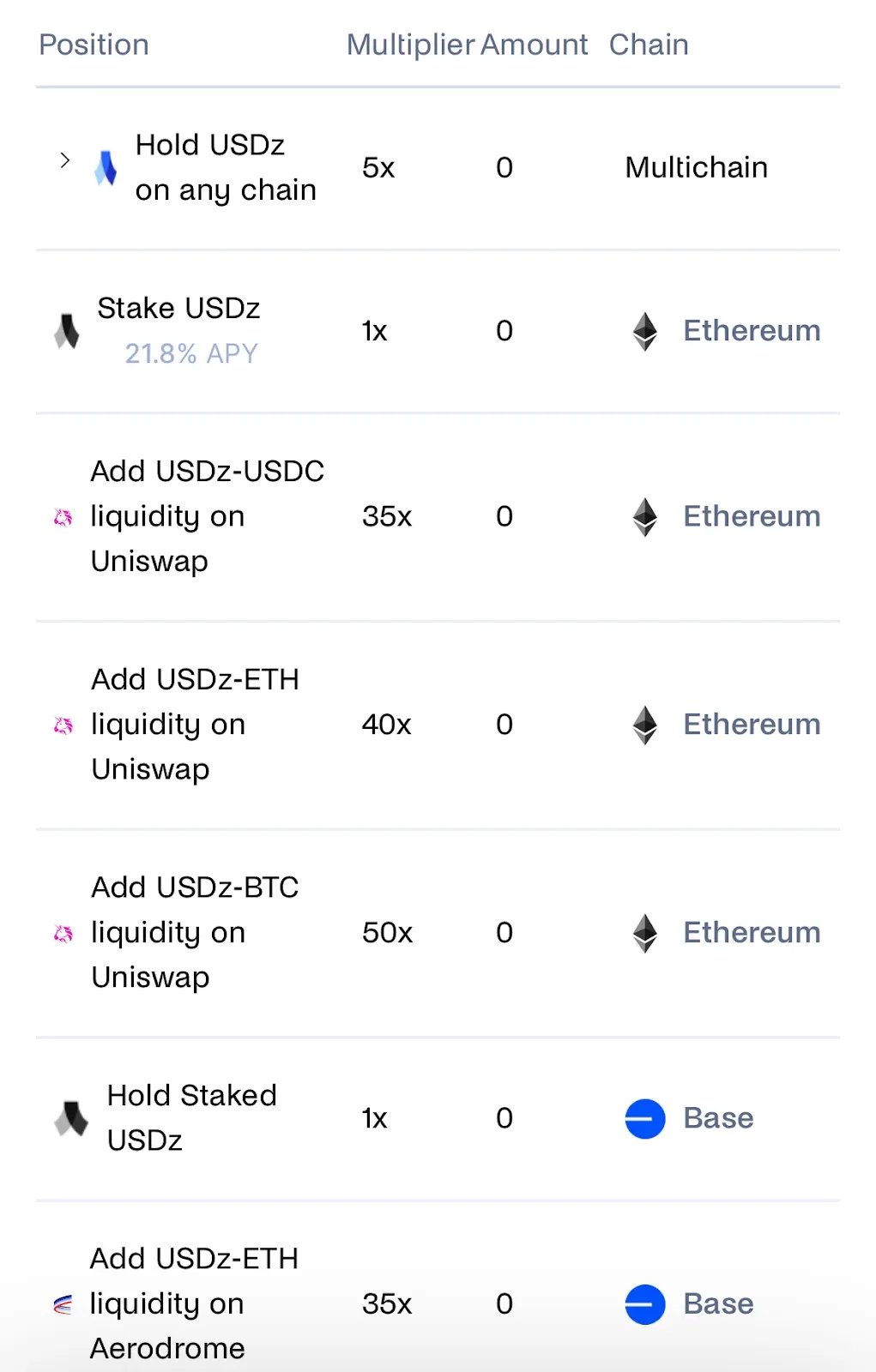

The multipliers that provide liquidity to certain pools vary.

At the time of writing, the best pool with the highest multiplier is providing liquidity to the USDz-BTC pool (ETH) on Uniswap. If you want to save on fees, you can choose to get a 35x boost by depositing funds on Hyperlock (Blast) or farm on USDz-ETH Aerodrome LP (Base) to get the same boost while interacting with both L2s in the future.

Deusd

Deusd (Decentralized Dollar) is a fully collateralized synthetic dollar powered by the Elixir network. It is minted through stETH and sDAI, and the deposited collateral is used to short ETH, resulting in a delta-neutral position. It is similar to USDe, but on the Elixir network. There is a 10-week campaign underway to kickstart Deusd's liquidity, and users can receive corresponding rewards based on their contributions.

Here are the best farms to increase your rewards balance:

1/ Stake your Deusd/FRAX LP tokens to get up to 5x reward boost.

2/ Add liquidity to the sdeUSD/deUSDon Balancer to get a 5x reward boost.

3/ Stake deUSD-USDC or deUSD-USDT on Ethereum to earn $CAKE and up to 134% annual yield (note that the annual yield will decrease as liquidity increases).

4/ By depositing funds with Abracadabra, you can get a bonus boost of up to 29.5x, depending on your leverage.

USDM

USDM is the first prudently regulated, yield-generating stablecoin. Its underlying assets are U.S. Treasuries, which also provide yield. Currently, USDM is the 30th largest stablecoin, surpassing other stablecoins such as EURC issued by Circle.

Ways to maximize returns when holding USDM are:

1/ Long and short wUSDM/USDT trading on Dolomite through Contango can earn 5% annual yield (APR) and additional Arb rewards, while interacting with two token-free protocols to obtain future airdrops.

2/ The wUSDM pool on Morpho Blue currently earns a 5% annual yield (APR) plus additional Morpho rewards while leaving your on-chain record on Base (three-in-one?).

Dyad

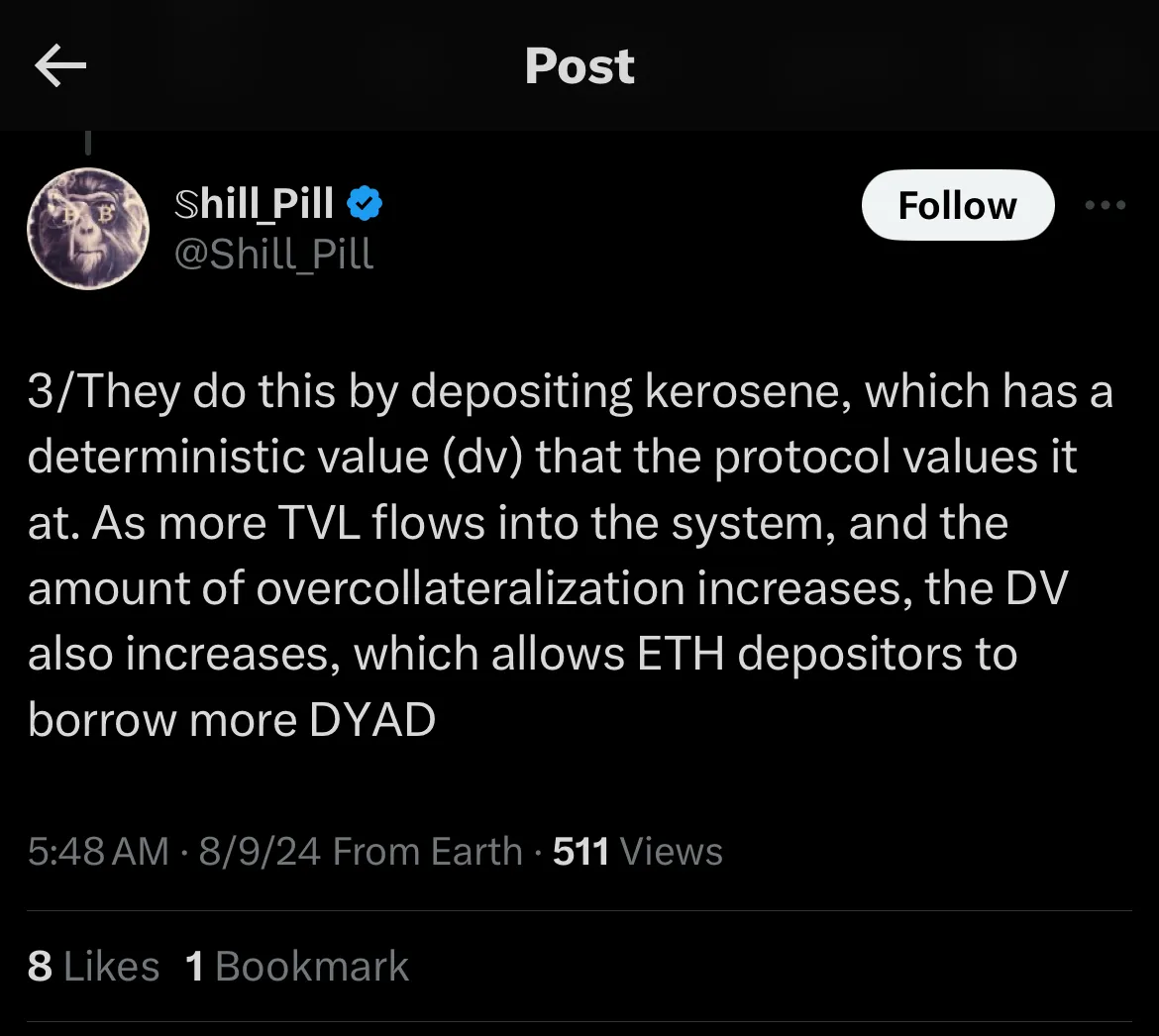

Dyad aims to surpass existing stablecoins in capital efficiency through a unique model. Dyad's advantage lies in the three assets it deploys: $DYAD (stablecoin), Note (DYAD NFT, dNFT), and $KEROSENE (tokenized excess collateral). Note (dNFT) is like a ticket to the Dyad ecosystem, tracking the user's activities within the ecosystem through metadata called XP. The more XP your Notes accumulate, the more you earn. $KEROSENE can be obtained by providing liquidity in certain pools that are exclusive to Note NFT holders. Kerosene's functionality is not limited to generating returns.

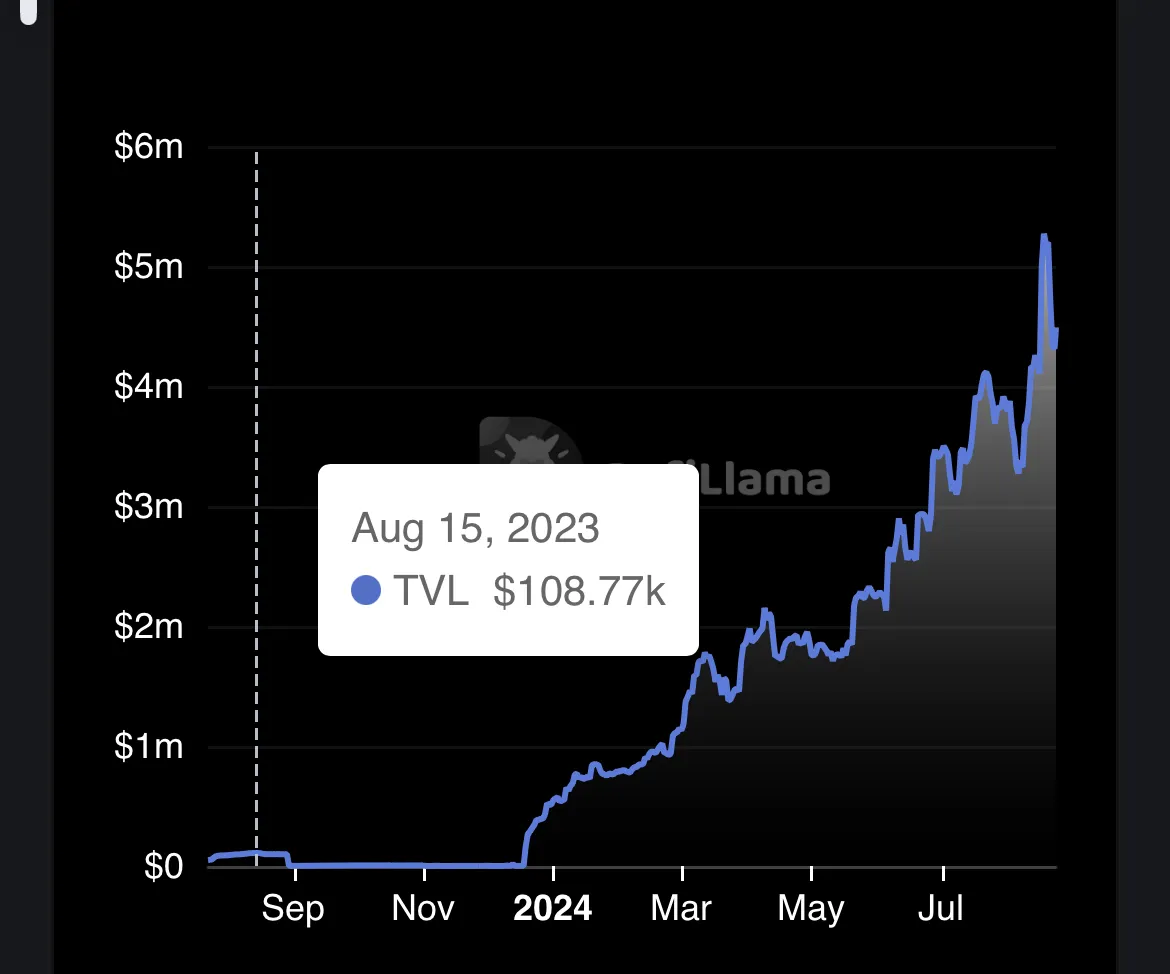

All of this works together to make Dyad the most capital efficient stablecoin. Since its launch, Dyad has achieved significant growth and the TVL (total value locked) has been rising.

Currently, you can earn over 80% annualized yield (APR) by providing liquidity for the USDC-DYAD trading pair . Supported collateral includes $wstETH, $tBTC, and $sUSDe.

See below:

Okay. That's all for today.