Ethereum founder Vitalik Buterin criticized the sustainability and value of DeFi, sparking widespread controversy in the community over his attitude toward DeFi.

Original text: Does Ethereum's Founder Even Like DeFi? Vitalik Buterin Clears the Air (Decrypt)

Compiled by: Vernacular Blockchain

Cover: Photo by Pawel Czerwinski on Unsplash

For years, Ethereum has been subject to waves of skepticism about whether its flagship use case, decentralized finance (DeFi), has real value. Suddenly, one of the main drivers of these criticisms is the network’s founder, Vitalik Buterin.

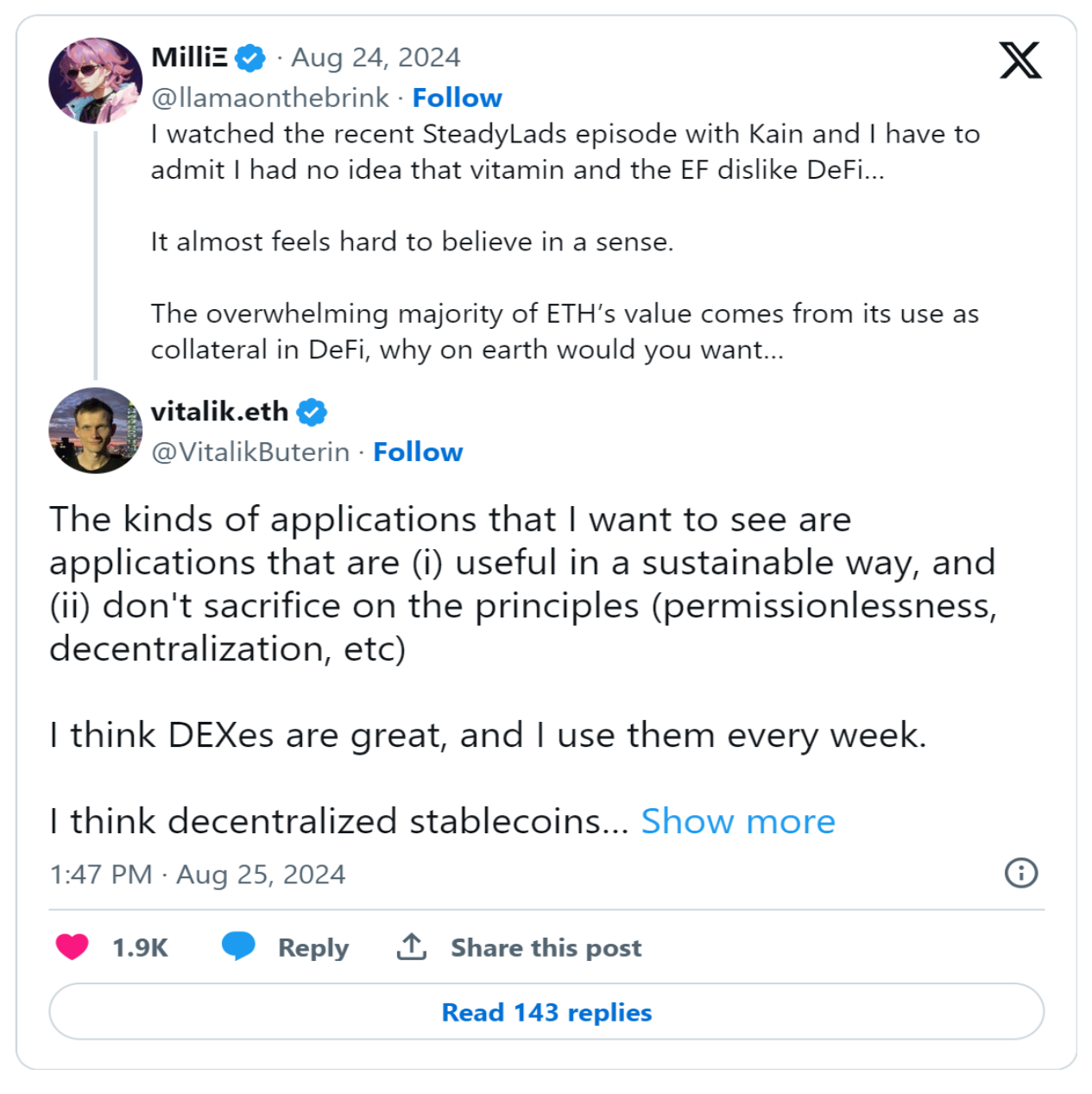

Discussing his thoughts on DeFi on Sunday, Vitalik wrote on Twitter: The applications I want to see are those that are (i) useful in a sustainable way, and (ii) do not sacrifice principles (permissionlessness, decentralization, etc.).

He praised decentralized exchanges, stablecoins, and Polymarket as examples, but criticized the unsustainable products that emerged from the “2021 liquidity mining frenzy.”

Vitalik’s latest comments come in response to growing frustration within the Ethereum community that he, as the most influential voice in the ecosystem, is only “barely tolerating” DeFi while trying to advocate for other niche use cases that have yet to find the same product-market fit.

“One of the biggest mistakes he made in the last five years was underestimating the importance of DeFi,” Synthetix founder Kain Warwick said on a podcast Friday, accusing Buterin of “moralizing” other industry leaders and telling them to “stop doing DeFi.”

“He’s been trying to make something that’s not DeFi real,” Warwick continued. “The reality is, the market is right — you’re wrong.”

After the show aired, many were disappointed to learn that Vitalik did not welcome or encourage DeFi on Ethereum, except for the exceptions he mentioned. On the other hand, some staunch Bitcoin supporters were unexpectedly delighted by Vitalik’s remarks, as they unexpectedly found common ground with him in opposing DeFi yield schemes.

As Vitalik later clarified, his criticism even extended to DeFi protocols that provided yield to token holders through borrowers and transaction fees , rather than through token inflation or “Ponzi economics.”

“This feels like a self-eating snake: the value of crypto tokens is that you can use them to earn a yield, and those yields are paid by … people trading crypto tokens,” he wrote.

Even overcollateralized lending markets that use ETH as collateral — like Aave — are limited in Vitalik’s view because the value and existence of these markets ultimately rely on downstream outcomes in the ETH market.

“I’d love to see a story where the source of the benefit is rooted in something external,” he said. “I’ve heard of some possible candidates ... I’d love to hear more of those ideas.”

Disclaimer: As a blockchain information platform, the articles published on this site only represent the personal opinions of the author and guests, and have nothing to do with the position of Web3Caff. The information in the article is for reference only and does not constitute any investment advice or offer. Please comply with the relevant laws and regulations of your country or region.

Welcome to join the Web3Caff official community : X (Twitter) account | WeChat reader group | WeChat public account | Telegram subscription group | Telegram exchange group