Author: Kevin Kelly, CoinDesk; Translated by: Tao Zhu, Jinse Finance

The consensus in the past was that rising BTC prices would lead to a trickle-down wealth effect in ETH, and eventually spread to the long tail of “Altcoin” — a cute term often used to describe all other crypto assets outside of the two “mainstreams.” We saw this dynamic in the last cycle. When BTC and ETH went up, everything else went up, too.

Currently, the disconnect between major currencies and the rest of the market (especially BTC) is greater than ever. Despite a gain of around 130% over the past 12 months, we have yet to see the “full rally” that many were expecting.

We’ve seen a handful of outperforming tokens — Solana, AI, memecoins — but the majority of the crypto market has lagged far behind.

Dispersion has been the focus of this cycle, and this is likely to continue.

For context, during the 2017 cycle, the total cryptocurrency market cap grew from about $40 billion to nearly $740 billion (about 18 times). The market cap of “Altcoin” grew from essentially zero to over $400 billion — 90% of that growth occurred in the second half of 2017.

During the 2020-2021 cycle, the total market grew from a base of approximately $280 billion to nearly $2.8 trillion (approximately 10 times), while the market capitalization of "Altcoin" soared from approximately $70 billion to $1 trillion (approximately 15 times).

But during this cycle, the entire cryptocurrency market has only grown 2x — and the market cap of “Altcoin” has grown even less. Even when the market peaks in March 2024, the total Altcoin market cap will still be about $200 billion below the previous high in November 2021.

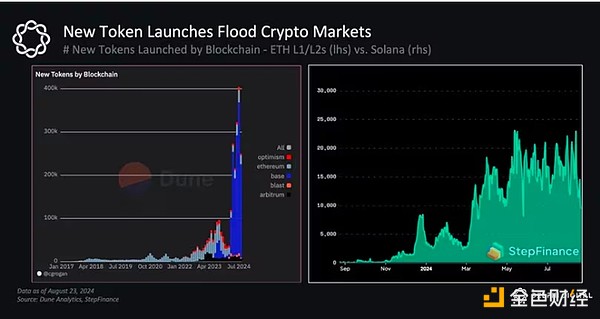

All markets are simply a function of supply and demand. The cryptocurrency market has grown tremendously over the past few years, but the total supply of new tokens has also grown with it, and the cryptocurrency market is currently suffering from a severe supply imbalance.

Today, the supply of new tokens is growing at the fastest rate the market has ever seen. The rise of DIY token issuance platforms such as pump.fun has sparked a surge in new token issuance, most of which are memecoins.

At the same time, with the advent of the venture capital wave a few years ago, the number of token unlocks from large protocols and dApps began to flood the market. Private investment comes with the expectation of returns, and in cryptocurrencies, exit liquidity usually comes in the form of selling tokens.

At the same time, we saw a 50% year-over-year increase in the number of tokens with a market cap of $1 billion. More tokens have higher valuations, which means more capital is needed to support their prices.

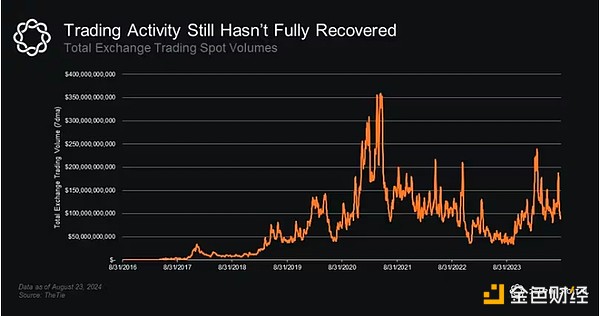

But so far, demand has not kept pace. For example, trading volumes on major exchanges have yet to return to the highs of the previous cycle.

Another major difference compared to the previous cycle is the lackluster growth in crypto credit and lending, which fueled the buying frenzy we’ve seen in 2021. The crypto lending market peaked in 2021-2022 on the back of low interest rates and rising risk appetite. For context, Genesis’ loan book peaked in Q1 2022 at around $15 billion, up 62% year-over-year (total loan originations peaked at $50 billion in the previous quarter).

However, the collapse of many major institutional lenders (e.g., BlockFi, Celsius, Voyager, Genesis) has hampered the speculative demand driven by these lenders. While we have begun to see signs of recovery, with new entrants such as Coinbase’s institutional funding business, the space remains tepid compared to a few years ago. Additionally, today’s high interest rate environment also reduces the incentive to move funds into volatile markets, especially when the alternative is to earn a 5% return on cash or stablecoin holdings.

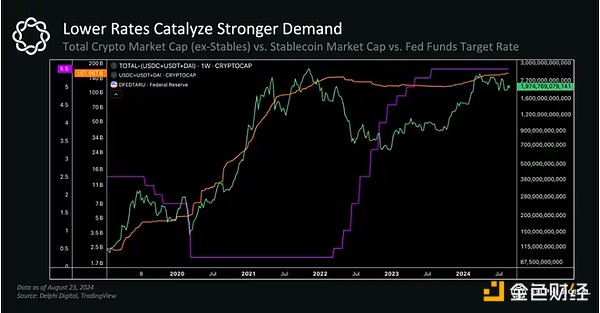

As the almighty Fed begins cutting rates — which the market is unanimously expecting — we expect risk sentiment and credit conditions to improve as the risk-reward for moving capital on-chain becomes more favorable. Lower rates could also reignite growth in the total stablecoin market cap, a good indicator of rising demand as on-chain activity picks up.

This could spark much-needed demand in the cryptocurrency market right now. But whether it will be the spark for the “resurrection” that many are hoping for remains to be seen.