"The time has come to lower the target interest rate and now is the time to adjust policy."

On August 23rd, local time, Federal Reserve Chairman Powell attended the Jackson Hole conference and released a clear signal of interest rate cuts in his speech. After the 2008 financial crisis, the Jackson Hole conference often became a forward-looking guide for various monetary policies. This speech was seen as a signal that a rate cut cycle is about to begin, adding fuel to the already highly anticipated September interest rate meeting.

At the end of August, how will the Fed's interest rate cut be implemented? This article will briefly analyze the issue of the Fed's interest rate cut.

01Why have expectations for interest rate cuts been strengthened?

In order to confirm the correctness of past decisions, Powell focused on the reasons for changes in U.S. inflation in this speech. According to Powell's conclusion, the Fed's continued suppression of aggregate demand and the resilience of the U.S. economy after the U.S. emerged from the epidemic have jointly contributed to the conclusion that inflation has fallen. Overall, Powell believes that his anti-inflation policy since 2020 has achieved relatively satisfactory results.

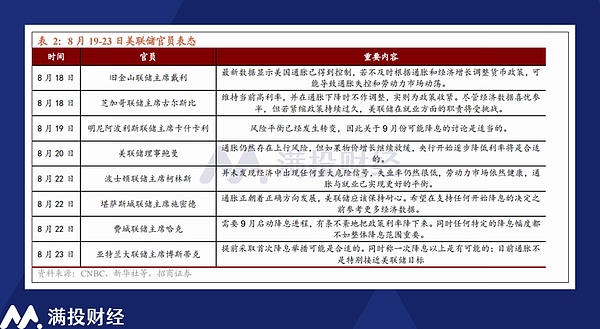

Judging from Powell's speech on August 23, the priority of US employment data is the main reason for the start of the interest rate cut process. Powell made it clear at the meeting that "further cooling of the labor market is neither sought nor welcomed" , which seems to be intended to put employment goals before inflation targets. In the past two years of interest rate stagnation, the market generally believed that the decline in inflation targets was tied to the rise in unemployment. Now Powell's statement has changed from the past "inflation-only theory".

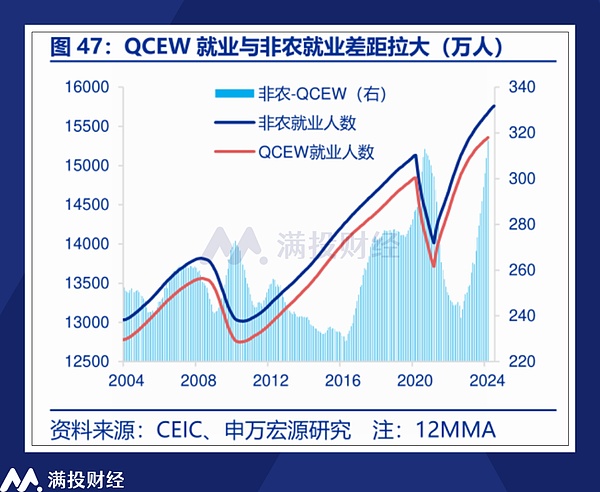

The main reason may be the employment and wage census data (QCEW) for the first quarter of 2024 released by the U.S. Bureau of Labor Statistics. According to the data from the Department of Labor, the total number of non-agricultural employment in the first quarter of 2024 in the United States is 157.21 million, which is 818,000 jobs short of the total number of non-agricultural employment announced in March 2024. Based on this, the non-agricultural data has also significantly revised down the employment data of the past labor market.

It is reported that the data of the U.S. Department of Labor is based on the employment positions with unemployment insurance in U.S. companies, and does not count self-employed people. The non-farm data is collected through various methods such as telephone, fax, and electronic data, and the rigor is much lower than that of the U.S. Department of Labor. Therefore, the non-farm data is often revised based on QCEW. Judging from the revised data, there are many falsely high employment data in the past .

Of course, this does not mean that the non-farm data is completely distorted. Because the non-farm statistics include a lot of illegal immigrants and self-employed people, these people have certain deficiencies in social security, so they are not included in the data of the U.S. Department of Labor. But overall, the data released by QCEW is obviously not as strong as the previous non-farm employment data.

As for specific data, we need to wait for the full report of QCEW in 2025 to compare the deviation of non-agricultural data from the perspective of the whole year. But for the Federal Reserve, perhaps the current employment data has already raised the suspicion of "missing the time to cut interest rates", and its priority needs to be raised to avoid causing risks in another direction.

02How will the interest rate cut path work?

Although Powell was quite hawkish in terms of the timing of the rate cut, he was actually quite mysterious about how to implement the rate cut. In his speech, Powell only mentioned that " the timing and pace of rate cuts will depend on subsequent data, changes in the outlook and the balance of risks." Powell did not discuss the specific scale of the rate cut, the target point and the path, nor did he deliberately refute the expectation of a single large rate cut (50BP).

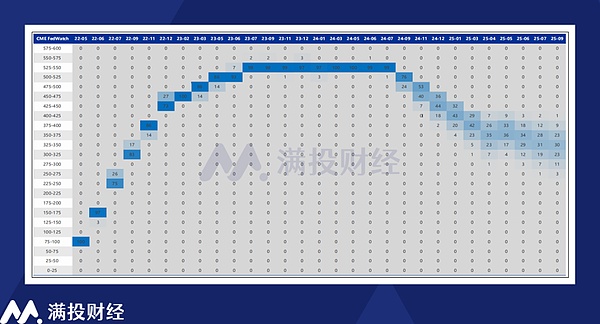

Overall, Powell's attitude towards the pace of rate cuts is rather ambiguous, and the market has also made corresponding adjustments. After Powell's speech, the market's expected probability of a 50bp rate cut in September increased slightly, while the probability of a 25bp rate cut fell slightly. According to CMEFedWatch data forecasts, the current market pricing is 76% for a 25bp rate cut in September, 24% for a 50bp rate cut, and 53% and 44% for a 25bp and 50bp rate cut in November and December, respectively. In other words, the most likely path is a 100bp rate cut this year and a 200bp rate cut in the next year.

However, it should be pointed out that in this speech, Powell did not mention the so-called "inflation target", but only said that the monetary policy review process will start every five years later. This is the indicator that Powell has valued most in the past few years. To this day, the US inflation expectations have not reached the 2% target , and judging from the speeches of past Fed officials, the current inflation value should actually fail to meet the Fed's expectations for rate cuts.

However, things are different now. With global easing and countries having started a cycle of interest rate cuts, the Fed may have reached a point where it "has to cut interest rates". Therefore, in subsequent interest rate policies, inflation may not be given the same priority as in the past. However, precisely because the inflation target has not yet been achieved, past policy inertia may affect the Fed's subsequent decisions. In terms of the pace of interest rate cuts, I tend to believe that the Fed's interest rate cuts are discontinuous and "stop-and-go".

According to Powell's current remarks, economic data, especially employment performance, will be the key to determining the pace of interest rate cuts. The upcoming August non-farm data may become a key factor that significantly affects the decision to cut interest rates in September. If the employment data is higher than expected, the path of interest rate cuts this year may also be lower than 100BP, fluctuating between 75BP and 50BP.

The interest rate cut in September is a foregone conclusion. However, if the US inflation data rebounds significantly during September and October, and the labor market tightens further in a tight state, the Fed's determination to cut interest rates may not be able to support it to maintain its rate cut process. The current interest rate cut trading atmosphere in the market may also be affected. If the employment data further weakens, the probability of multiple or single large interest rate cuts this year will increase.

03It ’s a commonplace, what is the impact of interest rate cuts on assets?

Judging from the current economic environment of the United States, its economic resilience is still there and the environment is still far from a deep recession. The main purpose of the decision to cut interest rates is to prevent further deterioration of employment data. Therefore, this interest rate cut can be regarded as a so-called "preventive interest rate cut". Referring to the Fed's interest rate cut history since 1984, such interest rate cuts are often not too radical in pace, and the initial progress is controllable, but the overall interest rate cut may be deeper depending on changes in the economic environment.

In the short term, preventive interest rate cuts often have a positive effect on assets such as US stocks, US bonds, and gold. The liquidity released by interest rate cuts will stimulate the allocation scale of such assets to varying degrees. However, as mentioned in previous articles, interest rate cuts often have advance reactions. Judging from the trends of US stocks and gold since July, this "preemptive run" is quite obvious. Therefore , in the month of interest rate cuts, it is necessary to pay attention to certain callback risks .

However, as far as the trend of gold is concerned, its price obviously has more supporting factors. In my previous judgment, gold may fluctuate at a high level below 2,500 points this year. But the actual gold price broke the $2,500 mark a few days ago, and once rose to $2,531. Between July and August, the situation in the Middle East and the conflict between Ukraine and Russia have deteriorated to varying degrees. I believe this is the main reason for the upward trend in gold prices. As for the stimulus of interest rate cuts on gold prices, I still believe that it has been reflected in the market, and the expectation of gold price increase after the interest rate cut is still not too high.

From a long-term perspective, equity assets and gold can often obtain relatively good positive returns and average returns in the liquidity easing brought about by interest rate cuts. However, commodity prices and crude oil prices, which are closely tied to the real economy, often face pressure during the interest rate cut cycle. At the same time, interest rate cuts in the US market often lead to active global liquidity, and emerging markets in Asia may benefit from this.

However, the start of the US dollar rate cut cycle does not mean that the liquidity of the domestic market will be quickly corrected and improved. Especially in the context of the tense competition between China and the United States and the asynchronous economic cycles, it should be considered that liquidity from the Americas will be blocked due to other factors. To evaluate the direction of Chinese assets, we must ultimately focus on the improvement of China's own fundamentals.