Author: Marcel Pechman, CoinTelegraph; Translated by: Deng Tong, Jinse Finance

ETH has gained 7.5% since dropping to $2,396 on August 27, but a 22% drop over the past 30 days suggests investors are still uneasy about their positions. While Ethereum’s network activity is increasing, the price of Ethereum has yet to show signs of recovering the $3,800 levels seen in early June.

Ethereum ETF spot demand is weak, partially explaining ETH weakness

This is all the more concerning given that Altcoin market capitalization has dropped 13% over the past 30 days, meaning Ethereum is underperforming its peers. This trend is partly attributed to overly high expectations for the launch of a spot exchange-traded fund (ETF) in the U.S. on July 24. However, there is more to the story, as Ethereum was most recently trading at $3,200 on April 24.

Ethereum bulls are pinning their hopes on the recent drop in average Ethereum transaction fees, which fell below $1 for the first time in four years. Coupled with the successful reliance on Layer 2 solutions for projects that require higher throughput, Ethereum’s dominance in decentralized applications (DApps) remains unchallenged.

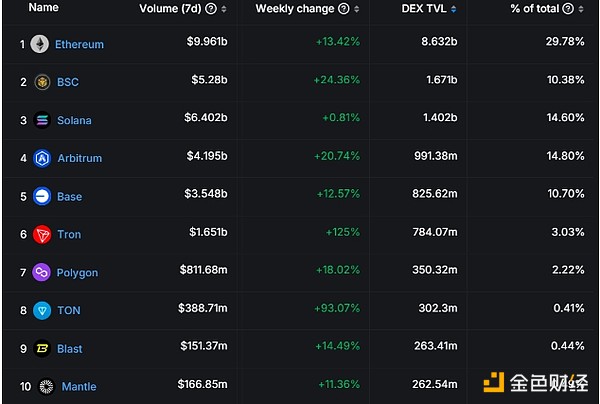

Decentralized exchange 7-day trading volume, USD. Source: DefiLlama

Ethereum bears argue that competing chains offer lower fees on the base layer, providing a simpler user experience for newcomers. In fact, most users are not concerned about higher centralization on Tron or BNB Chain or the excessive cost of running a Solana validator. The success of Ethereum’s own layer 2 solution, Base, shows that users value direct access to Coinbase more than self-sovereignty.

Ethereum network TVL and transaction volume continue to rise

Regardless of whether Ether’s price is benefiting from its Layer 2 ecosystem, the total locked value (TVL) on the Ethereum network has been rising. According to DefiLlama, total deposits in Ethereum DApps increased to 18.9 million ETH, up 4% from two weeks ago. In contrast, Tron’s TVL fell 10% in TRX terms over the same period, while deposits on Avalanche fell 4%.

Symbiotic, a recently launched staking project on the Ethereum network, has shown the most significant TVL growth over the past two weeks, up 83% to 640,310 ETH. Similarly, total deposits on Ether.fi’s liquid staking protocol grew by 15%. However, claiming that Ethereum’s network activity has grown simply by analyzing its TVL is misleading, as most DApps do not require a large deposit base.

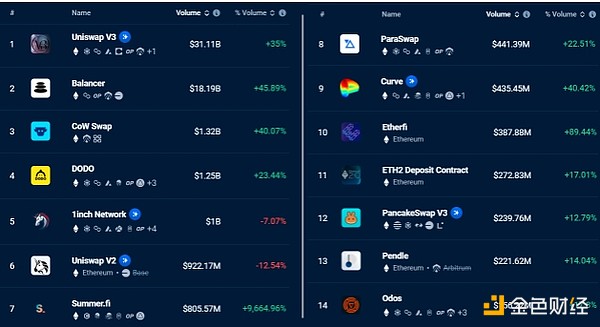

In terms of network activity, Ethereum’s DApp volume grew 36% between July 22 and July 29, driven primarily by decentralized exchange Uniswap, which saw a 35% increase in volume to $30.8 billion, and automated market maker Balancer, which saw a 46% increase in volume to $18.1 billion, according to DappRadar. In contrast, DApp volume on the Solana network stagnated at around $6.3 billion per week.

Top Ethereum DApps by 7-day transaction volume, USD. Source: DappRadar

Active addresses and transactions declined

However, not all aspects of Ethereum network activity have been positive since August 22. For example, the number of active addresses interacting with DApps has remained the same, while the total number of transactions has dropped by 8%. In contrast, BNB Chain has seen a 7% increase in active addresses, while Solana has seen a 10% increase in users over the same period.

Ethereum’s performance has also been dragged down by weak inflows into spot Ethereum ETF funds, which have seen net outflows of $107 million over the past two weeks, according to data from Farside Investors. The data highlights a lack of interest from institutional investors despite strong momentum in similar Bitcoin spot ETF tools, which have seen net inflows of $523 million over the same period.

Ultimately, there are no clear signs of excitement within the Ethereum network to justify a significant increase in the price of Ethereum. Critics may argue that Ethereum's average transaction fee falling below $1 is not enough, especially considering that competitors such as BNB Chain and Solana offer much lower costs. Finally, the data shows that Ethereum's price has no direct correlation with on-chain activity.