Source: Crypto Market Watch

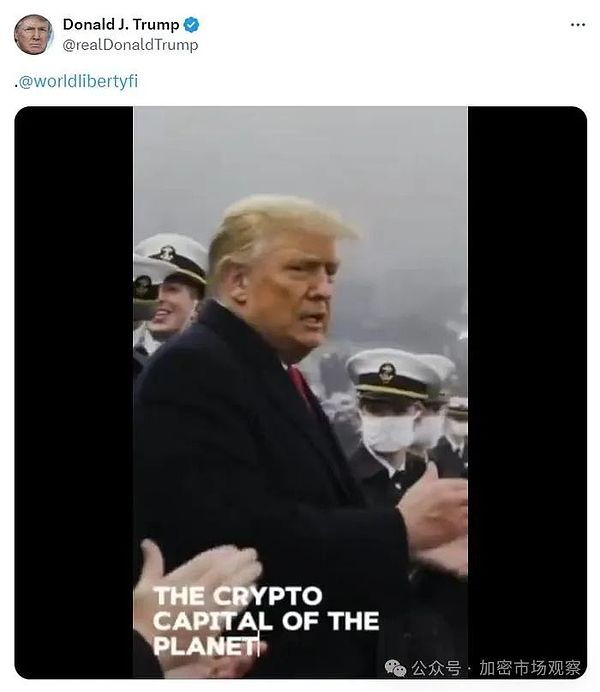

Trump announced yesterday that if elected, he would build the United States into the world's crypto capital.

In fact, a few years ago, China was the capital of encryption.

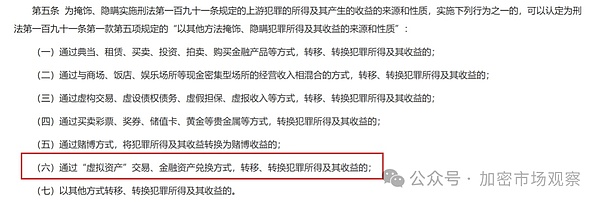

However, under the successive policy hammers, only Hong Kong is still fighting to take back this "crypto capital". For example, the Supreme People's Court and the Supreme People's Procuratorate recently clearly listed "virtual asset" transactions as one of the methods of money laundering, which made many people nervous.

But don’t worry, everyone. Other ways of money laundering that are listed together with virtual asset transactions include investment, leasing and other traditional economic activities. As long as the source of your funds is not criminal proceeds, you will not be affected. Therefore, the market conditions of the crypto market are almost unchanged.

Taking advantage of this topic, let’s review in depth the Chinese government’s policies on encryption.

01 In 2009, there were experts in the system

As early as 2009, Zhou Xiaochuan, then governor of the central bank, published an article entitled "Thoughts on Reforming the International Monetary System"

The article focuses on supranational currency, which is to "create an international reserve currency that is decoupled from sovereign states and can maintain long-term currency stability."

At this time, Bitcoin had only been on the market for one year.

02 2013, Free Participation

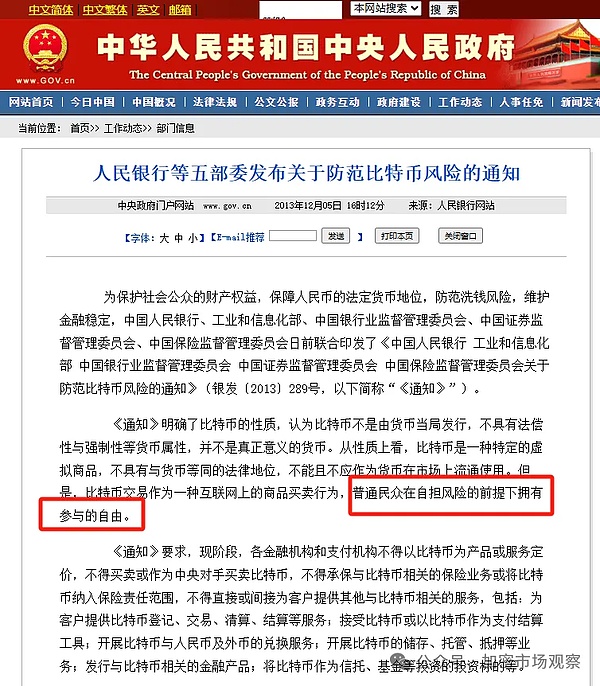

Therefore, China has actually paid attention to Bitcoin very early. As early as 2013, when Bitcoin was less than $1,000, a notice was issued to warn everyone about the risks of Bitcoin.

However, the tone of the 2013 notice was relatively neutral. It did not recognize the currency status of Bitcoin, but positioned Bitcoin as a "commodity on the Internet" and did not prevent ordinary people from participating freely.

In fact, our government’s top officials have long noticed the impact of Bitcoin on the financial system.

In 2016, Zhou Xiaochuan said in an exclusive interview with a reporter from Caixin.com that "Bitcoin is a digital currency that does not require a central bank." This shows that our government elites were indeed powerful at that time!

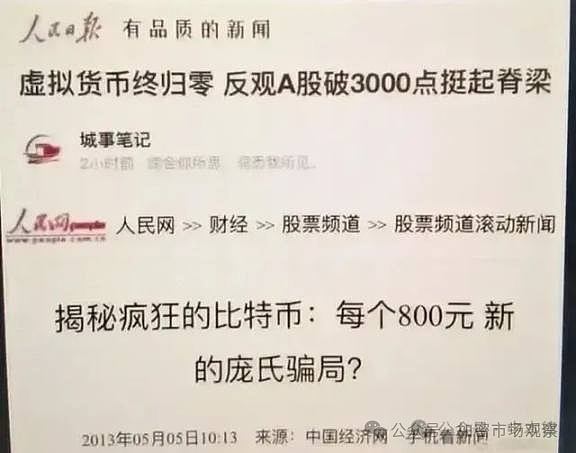

The attack on Bitcoin at that time was mainly verbal, and left two classic headlines:

Virtual currency eventually returned to zero, while the A-share market stood up and broke through 3,000 points.

Unveiling the crazy Bitcoin: 800 yuan per coin, a new Ponzi scheme?

Now every time the A-share market falls below 3,000 points, friends in the crypto circle will post this picture to lash out

And if someone really bought 800 yuan of Bitcoin, not only would he have made 500 times the profit by now, but he would also be an OG big shot in the crypto circle, the kind that even the most famous people would want to lead their horses and whip him.

03 2017, heavy punch

After Ethereum supported one-click coin issuance in 2017, a large number of people of all kinds poured into the crypto industry, and the country finally couldn’t help but start to take action:

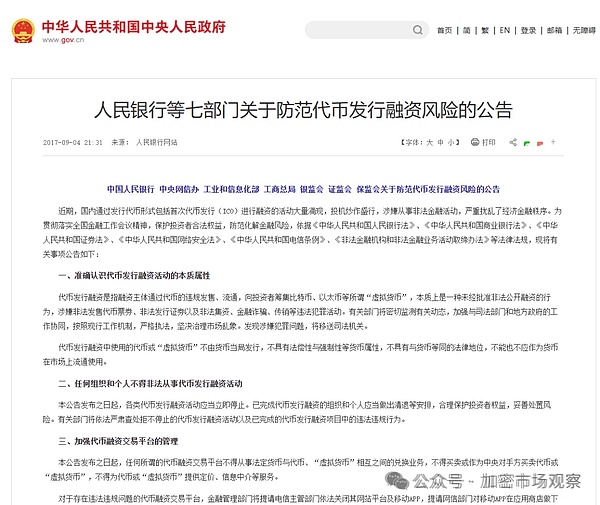

On September 4, 2017, the People's Bank of China and seven other ministries jointly issued the "Announcement on Preventing the Risks of Token Issuance and Financing", requiring a ban on virtual currency transactions.

This was the 94 incident that caused a lot of controversy at the time.

Before this notice was officially issued, executives of the three major exchanges at the time, BitChina, OKCoin, and Huobi, were said to have all been placed under border control.

Of course, there are some big guys who are more informed and have fled abroad:

These big guys who ran away are all living relatively well overseas. Xue Manzi went to Japan and bought a street, named "Manzi Alley", which has eleven old townhouses. Recently, it seems that he has run out of money and returned to Hong Kong to cause trouble.

Bao Erye Guo Hongcai purchased a hundred-acre estate in Silicon Valley, USA, and named it "Leek Estate".

CZ is now the top player in the industry, and his Binance is now firmly in the top spot among exchanges.

Justin Sun has also been very successful. He acquired Huobi, and his Tron chain is also a mainstream and active public chain.

This is the last group photo of Bao Erye, Xue Manzi and CZ in mainland China.

From then on, Chinese encryption practitioners went overseas one after another, and they had to go far.

For example, the PlusToken project team only went as far as Sihanoukville, Cambodia, where they were arrested by police across the border and 190,000 bitcoins were seized, which is worth more than 100 billion yuan today!

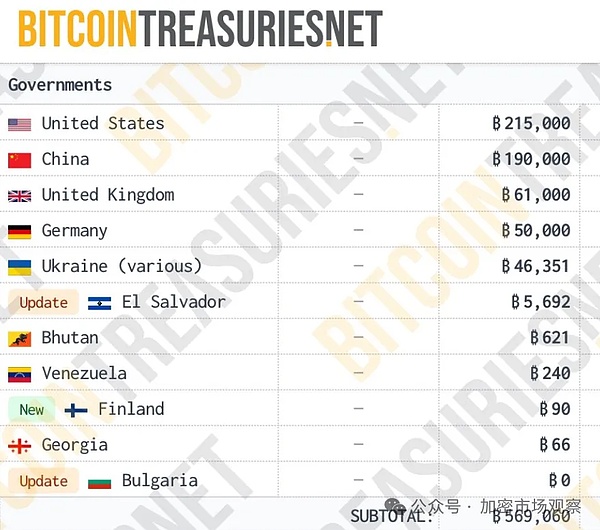

These bitcoins also become the source of the 190,000 bitcoins held by the Chinese government.

But you can guess, does the Chinese government still have these 190,000 bitcoins?

04 2021, the darkest hour

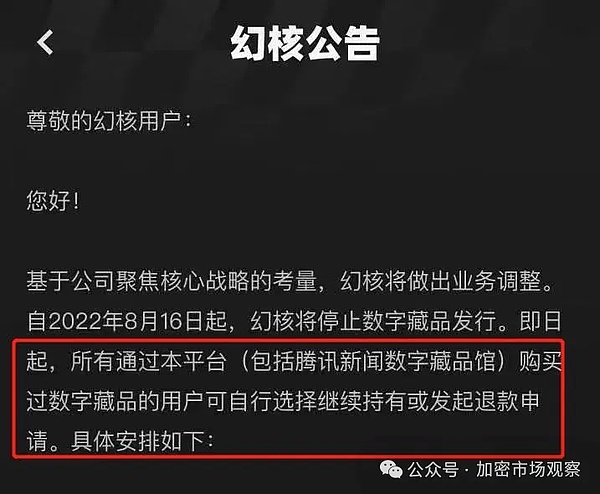

A few years later, perhaps the Chinese government felt that its efforts to crack down on exchanges and fiat currency projects were far from enough. In September 2021, the mainland began to clean up all businesses providing cryptocurrency-related services. At this time, many major Internet companies such as Tencent and Alibaba also began to clear out their encryption projects.

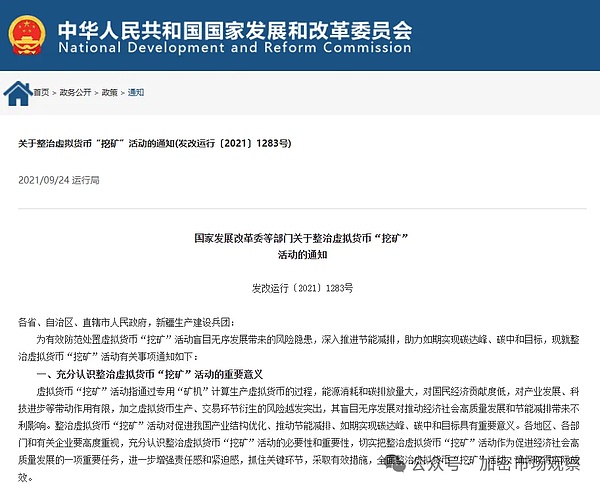

At the same time, it has begun to crack down on Bitcoin mining, and stipulated that virtual currency-related business activities are illegal financial activities, and related civil legal acts of ordinary people holding virtual currency are invalid.

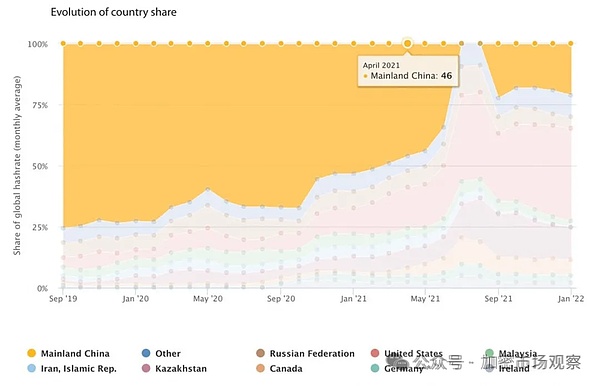

This crackdown caused a large number of miners to go overseas, and the Bitcoin mining computing power in mainland China was even "cleared to zero" at one point.

The reason is "energy conservation and emission reduction"

At this point, Bitcoin has been comprehensively cracked down on in mainland China, from mining, trading, to other related services.

It can be said that this is the darkest moment for China’s crypto industry, and everything that could be taken away has been taken away.

Maybe it's time to bottom out and rebound?

05 Mining is back

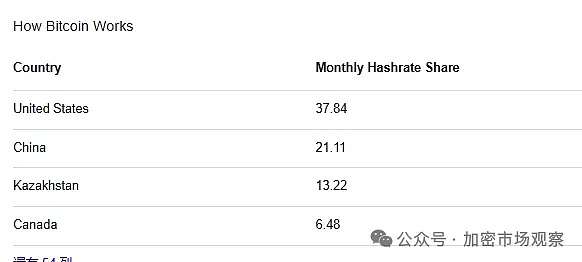

At the end of 2021, not long after the mining ban was issued, Bitcoin mining revived. Now the Bitcoin computing power in mainland China is actually ranked second in the world, second only to the United States:

It is said that these computing powers are provided by some mining farms that have good relations with the government. In places with abundant clean electricity resources such as Inner Mongolia, local governments have even issued some special "mining licenses"

After all, many places cannot access the Internet and cannot make money, which is a waste.

It would be better to use it to mine Bitcoin and make as much money as possible, but to do this kind of business you must have strong government relations.

06 Hong Kong opens up to encryption

As Singapore announced its support for encryption, Hong Kong, as part of China, could no longer hold back. In October 2022, the Financial Services and the Treasury Bureau of Hong Kong, China issued the "Policy Statement on the Development of Virtual Assets in Hong Kong".

You know, before Hong Kong announced its support for encryption, it was actually having a hard time. Because of things like "universal suffrage" and the "National Security Law", a large amount of foreign capital flowed out of Hong Kong and settled in Singapore.

However, Hong Kong's road to encryption has not been smooth. The VATP license of the exchange that has attracted the most attention from the market has once caused a lot of controversy. It is said that exchanges applying for Hong Kong licenses must clear out mainland users, causing mainstream exchanges to withdraw their applications.

While the major crypto exchage were being cleared out, traditional Internet giants entered the market one after another. For example, PantherTrade under Futu, YAX under Tiger Brokers, and xWhale under Sina all obtained the Hong Kong VATP license mentioned earlier.

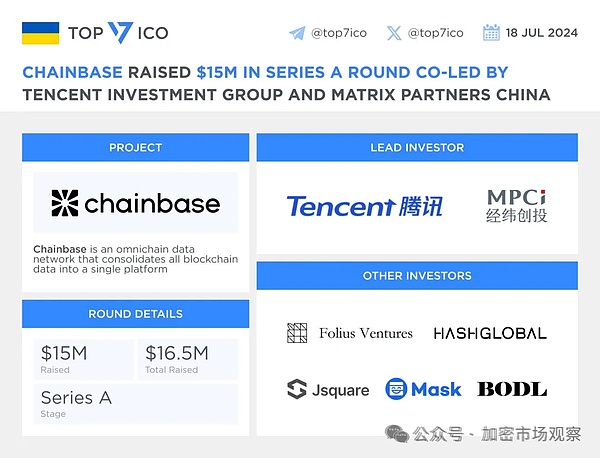

Tencent also teamed up with Matrix Partners China to invest $15 million in Chainbase, a full-chain data network developer.

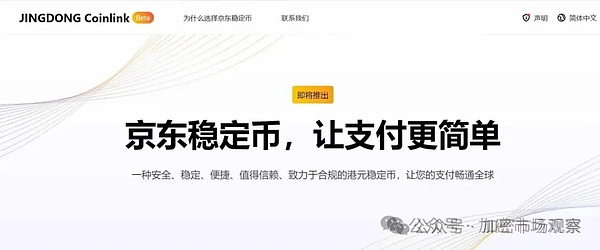

Another Internet giant, JD.com, also quietly entered the Hong Kong Monetary Authority's stablecoin "sandbox".

In April this year, ByteDance officially announced its cooperation with Sui through its technology solution subsidiary BytePlus, marking its first foray into blockchain.

Ant Financial, an Alibaba subsidiary, has partnered with Singapore's SingBank to launch a pilot program called "DBS Treasury Tokens."

After such a series of tricks,

Trump claimed that the reason for accepting this industry is that " if we don't do it, China will take over , or other countries, but it will probably be China. China takes this very seriously. "

Seeing this information, some friends will ask Da Piaoliang, what do you think? With so many Internet giants entering the encryption industry, will the domestic encryption control measures be relaxed?

I can responsibly tell you that it’s impossible!

The reason is actually very simple. Our country has strict foreign exchange control measures. We are afraid that everyone will convert the RMB in their hands into foreign currency and run away.

Because cryptocurrencies are circulated all over the world, the country will definitely not allow ordinary people to hold cryptocurrencies.

07 China also cannot do without encryption

Just as Zhou Xiaochuan said in 2009, the crypto industry is the industry with the greatest hope of weakening the hegemony of the U.S. dollar. After the outbreak of the Russo-Ukrainian war, the United States excluded Russia from SWIFT, resulting in Russia's foreign trade being almost 100% settled in RMB.

What if the RMB is kicked out of SWIFT? Do we have to settle in rubles?

You should know that the Russian ruble has depreciated 1 million times in the past 36 years!

Therefore, if encryption can ensure stable settlement of foreign trade, then the encryption industry will have great merit.