Although Bitcoin has seen several rebounds recently, it has quickly fallen back. The current price is still hovering below $60,000. Bitfinex analysts warned that the lack of liquidity unique to the summer may extend into September, which will make Bitcoin is struggling to break above the $63,900 pressure level. Bitfinex analysts said in an interview with Cointelegraph:

“The price reflects historical market trading; we have to dig deeper. The price is currently bouncing back to ~$63,900 of short-term holder (STH) realized price, so we are also seeing some profit-taking from the STH community.”

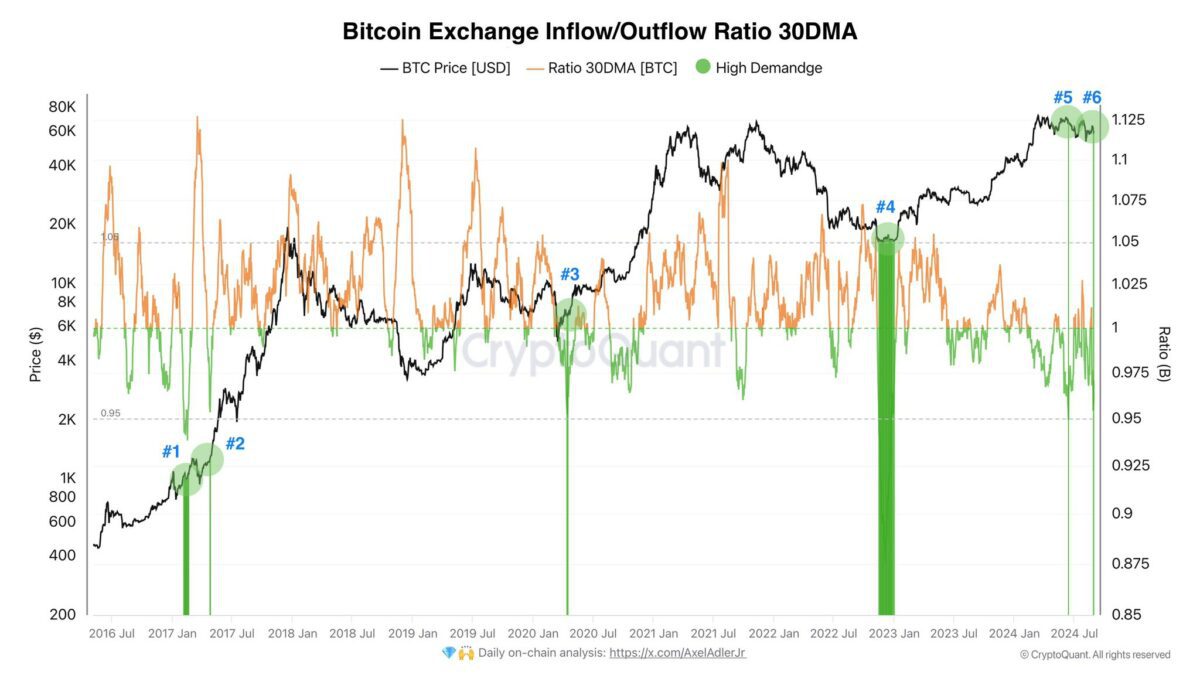

However, other analysts made opposite predictions based on different data. Bitcoin data analyst Axel noted that the average exchange inflow/outflow ratio shows strong buying pressure. This is the sixth time this has happened in the past decade, and each time it has been accompanied by strong gains.

On the other hand, CryptoQuant analyst Woominkyu also pointed out that there is a close correlation between the Bitcoin hash price (Hash Price) and the price of Bitcoin. The current sluggish hash price may imply that the Bitcoin price is approaching a bottom. Woominkyu explained that the price of computing power reflects the profitability of miners, and historically when the price of computing power falls to a lower level, it is often the low point of Bitcoin. This suggests that current low hashrate prices may signal similar entry opportunities.