Produced by | Vernacular Blockchain (ID: hellobtc)

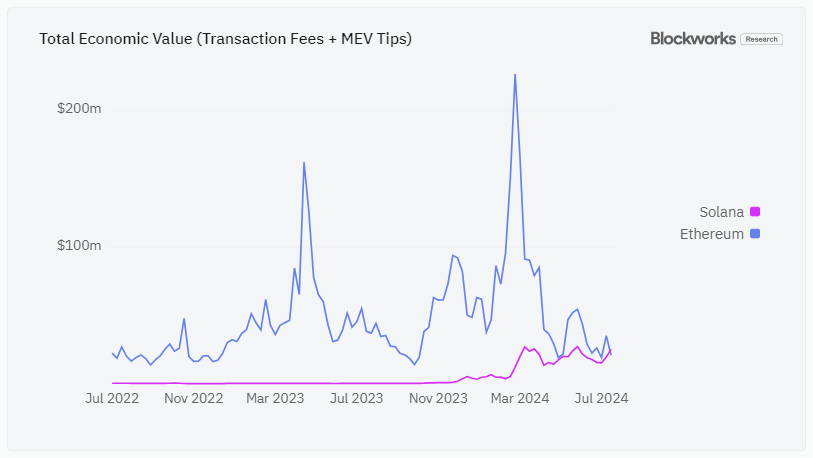

In 2024, the "Ethereum killer" Solana is unstoppable. In the week of July 22, Solana's main chain weekly total fees exceeded its competitor Ethereum for the first time, with revenue of about $25 million, while Ethereum's revenue was $21 million. On July 28, total fees exceeded $5.5 million, a three-month high. And just after the crypto market plummeted across the board on Black Monday this week, as the market regained its sanity, Solana's price soared by more than 35% in less than 48 hours, surpassing Bitcoin's increase.

Source: Blockworks Research

It can be said that after experiencing the ups and downs of the past two years, Solana and its ecosystem have once again become the focus of the market. This time, the momentum is about to surpass Ethereum. However, many projects that were previously called "Ethereum killers" have failed in their challenges. Can Solana finally succeed in its challenge? Today, let's review the birth and rise of Solana and the latest development status of Solana's ecosystem, and perhaps find some clues...

01

The Birth of Solana

Solana was born out of its founder’s thinking about the blockchain trilemma. Bitcoin was born in 2009. In 2013, Solana founder Anatoly Yakovenko became an early user of Bitcoin and began to pay attention to the blockchain’s Blockchain Trilemma. At that time, the blockchain gas fee was high and the network was very slow.

Therefore, Anatoly was determined to build a faster blockchain infrastructure. On a night when he worked overtime, Anatoly realized that the passage of time itself could become a data structure, forming ordered transactions and events on the blockchain. He immediately got up and wrote the initial Solana code. This idea was also the key idea that enabled it to run at lightning speed, and later became an important advantage of Solana compared to Bitcoin and Ethereum.

So, in 2016, Anatoly left Qualcomm, where he had worked for 13 years . In 2017, he brought together two former Qualcomm colleagues to co-found Solana, and Solana was born!

But when Solana was first launched, it was not called Solana. It was a prototype blockchain called Silk. Then in March 2017, the Silk project was renamed Solana. It was named Solana because the idea was born in Solana Beach, a small town located in the north of San Diego, California, where several partners of Solana lived and surfed during their work.

Then from 2017 to 2020, Anatoly led Solana's technical infrastructure to gradually improve, making great improvements in improving transaction throughput and network performance, and attracted a certain degree of attention and interest in the community.

However, at the beginning, the team also faced many development difficulties. Because the team had ordinary backgrounds and was in a bear market at the time, the entrepreneurial prospects were not very optimistic. After the white paper was released in January 2018, it was difficult to raise funds, and its technical security was considered questionable. Before Binance LaunchPad, only Binance Labs and Coinbase Ventures invested in them, and the total amount was probably less than 1 million US dollars.

Solana started to attract tens to hundreds of millions of dollars in investment only after the market started to improve in 2019. At the same time, the team was also conducting internal testing and technical verification, focusing on preparing for the official launch of the mainnet.

During this phase, the team also actively interacted with the developer community and blockchain enthusiasts to collect feedback and improve its technology and ecosystem. Therefore, in July 2020, Solana's mainnet was officially launched. Subsequently, due to its fast transactions and low handling fees, it made up for the shortcomings of Ethereum and was hailed as the "Ethereum Killer."

02

Growing dormant in a bear market

In the two years between the mainnet in 2020 and 2022, Solana began to flourish and became one of the most popular commodities in the crypto world at the time, and also attracted the attention of SBF, a heavyweight in the circle at the time. At that time, FTX was still one of the largest crypto CEXs in the world. As the founder of FTX, SBF once said: "I am optimistic that Solana will surpass Ethereum and become the next Bitcoin."

FTX once promoted its rise. The first rapid development point was in July 2020, when it chose Solana as the preferred blockchain for building DEX Serum. In addition, it also helped Solana raise about $300 million to incentivize developers and develop the Solana ecosystem. It can be said that FTX not only invested in Solana, but also invested in many projects built on it, which attracted a large number of users, especially the rapidly growing DeFi and NFT ecosystems.

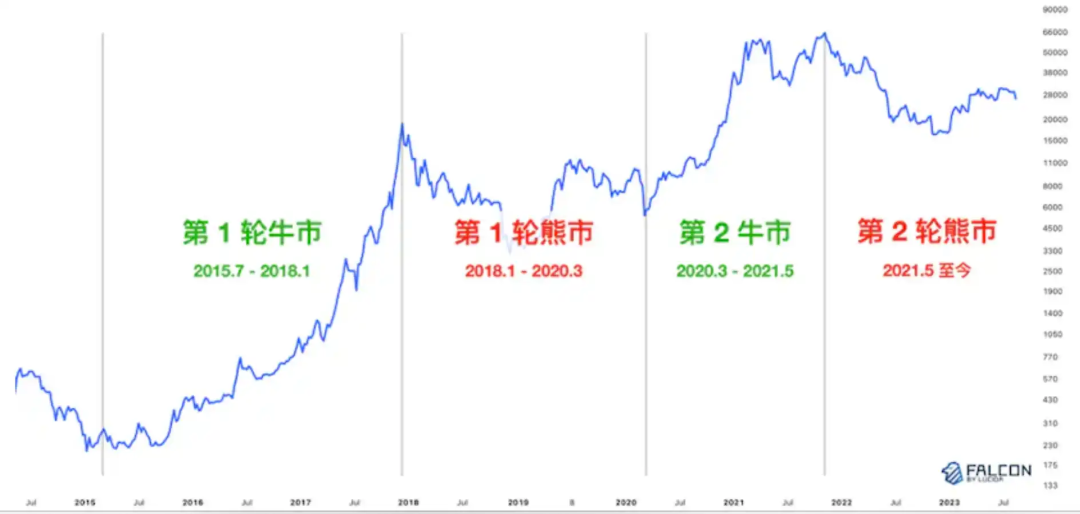

From the summer of 2020 to the end of 2021, DeFi hit a record high. In addition, in just over a year, the price of SOL soared from 0.51U to 259.9U, an increase of 510 times. Although SOL began at the conceptual stage at the end of the 2017 bull market, it was not launched until the 2020 bull market, resulting in the relatively late participation of primary and secondary participants and a period of being unpopular. This helped it filter out the valuation bubble and become its value.

This is Solana’s first hot cycle. Solana relied on its own advantages, combined with the prosperity of the market cycle, the support of crypto giants and enterprises to form a Matthew effect, enabling it to successfully complete the leap from 0 to 1.

However, Solana's rapid rise has also been accompanied by some problems, such as decentralizationists accusing it of predatory token economics, high verification requirements, and risk capital allocation, which they believe is not very fair to retail investors. In addition, especially between 2021 and 2022, the Solana network had multiple outages, which put it in serious trouble, damaging the reputation of the Solana network, which aims to pursue "high performance" , and is often criticized by the community.

However, compared with the pressure brought by FTX, this is nothing. DeFi experienced its first major decline in 2022. In November 2022, the collapse of FTX directly brought down Solana. After the collapse of FTX, a large amount of SOL held was liquidated, causing Solana to face asset shrinkage, capital outflow and market selling pressure. SOL plummeted by about 75% in a few days, falling to a minimum of about $10, and the total locked value on the chain fell to about $200 million and continued to maintain.

Source: Coinmarketcap

This dilemma lasted for a year, during which Solana on-chain applications also suffered capital outflows and multiple hacker attacks, including the emptying of more than 8,000 Phantom wallet assets and CEX Mango's loss of up to $116 million. In addition, for most of 2022 to 2023, the entire crypto industry was hit hard, and the advantages of the external market environment faded.

Rather than a blow, the bear market is more like a great opportunity for Solana, especially since the Solana community has been actively working to solve the two major challenges facing the Solana blockchain: network outages and decentralization. Subsequently, a series of upgrades have greatly improved the stability of the network and opened up new areas of development.

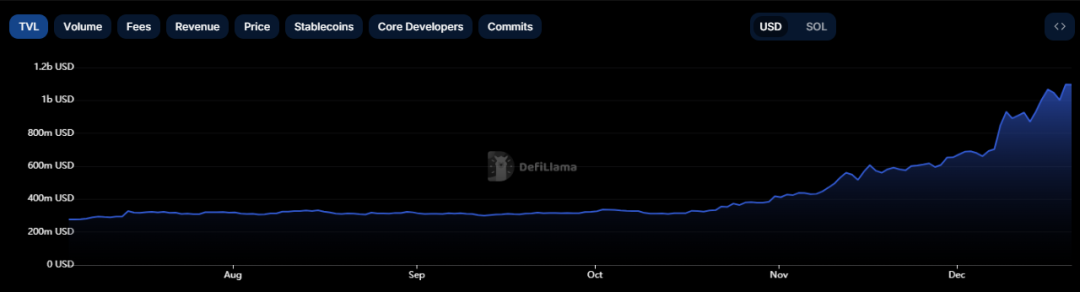

In December 2023, the Airdrop story of the Solana ecosystem project brought hope, the ecosystem began to recover, and the locked amount increased from about US$300 million to the current nearly US$1 billion within two months.

Source: DeFillama

At that time, there was news online that Solana was not simply led by retail investors, but because Wall Street wanted to restart FTX, and Solana was the largest asset held by FTX. Therefore, promoting the rise of Solana would help increase FTX's valuation and promote restart. Therefore, Solana only began to recover at the end of 2023. The authenticity of the news cannot be confirmed for the time being.

03 Development Status

But no matter what, the Solana community is full of expectations for this year, and with the improvement of ecological performance, Solana has become one of the mainstays of encryption. Its functions are constantly being improved, and ecological applications are also advancing explosively.

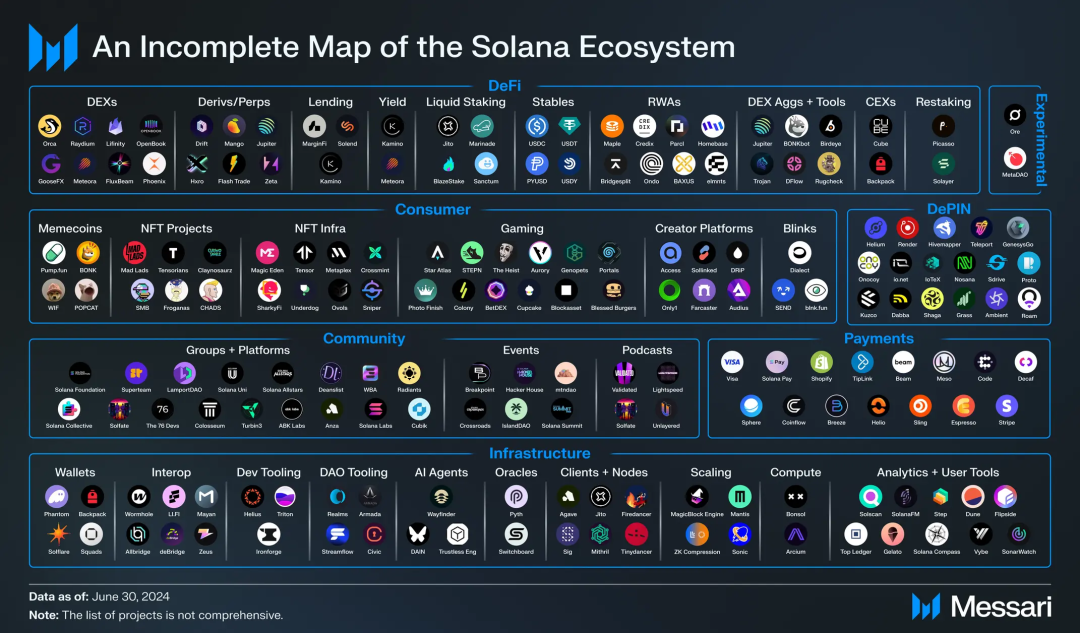

According to public data statistics, as of April 28, 2024, an ecosystem has been formed covering eight major areas: DeFi, tools, infrastructure, NFT, games, wallets, DApp applications, and development. The sub-sectors involved include DEX, derivatives, transaction analysis visualization, borrowing, synthetic assets, stablecoins, and nearly 15 other sub-sectors. This number continues to grow almost every week, and on the basis of the original, this year involves the expansion of DePIN, AI and other tracks.

It can be said that in the entire L0/L1/L2 public chain competition, Solana is second only to Ethereum. In all the tracks we can think of, except ZK and L2, Solana has developed very good results. In addition, with its performance advantages, Solana can also undertake some functions that cannot be developed on Ethereum.

Next, let’s take a closer look at some of the thriving sectors in the Solana ecosystem:

1) Memecoin

We all know that the Meme track is an important track in the market this year. In addition, the article "Memecoin: Is Base ready to challenge Solana's throne?" wrote that several waves of Meme's market were brought about by Pepe, BRC20 and Solana ecology.

The rise of Memecoin has also brought a wave of traffic to Solana. From "dogwifhat" to "Bonk" to "Slerf", Memecoin on Solana has also triggered unprecedented hype and excitement. Driven by the surge in internal funds from Airdrops such as Jito, Jupiter, Kamino, Parcl and Tensor, Memecoin's market value reached $1 billion in a week. According to a data report from node service provider Syndica, as many as 92% of transactions on Solana's on-chain DEX Raydium previously came from Memecoin.

In the second quarter, the crypto market was sluggish and most token prices were falling, but Memecoin on Solana became a hot spot. Low transaction costs and the emergence of Pump.fun lowered the threshold for issuing tokens, making Solana the most active casino on the chain. Memecoin on Solana also performed better than Memecoin on Ethereum. It can be said that a key factor in Solana becoming the darling of this cycle is its Memecoin activity.

2) DeFi

Solana is currently the fourth largest DeFi ecosystem, with a total TVL of around $5 billion. Its layout covers many sub-tracks, including DEX, derivatives, oracles, insurance, prediction markets, stablecoins, IDO platforms, trading and liquidity, returns and aggregators, synthetic assets, and lending.

Among them, DEX trading volume continues to grow. Jupiter is Solana's key liquidity aggregator, providing the widest range of tokens and the best routes between any token pairs. The borrowing and yield agreement Kamino has become the largest DeFi agreement on Solana. As of the second quarter, about 63% of the SOL supply was staked. Marinade is Solana's first native liquid staking solution. The leading staking agreement is Jito, and Sanctum LST has a significant increase in market share in the second quarter.

Source: DeFi llama (as of August 9, 2024)

3) Web3 Games

Solana has a 400 millisecond block time and lightning-fast confirmation speeds, making it perfect for game developers. Game developers can build games using Javascript and Canvas, Flutter, or use one of the Solana game SDKs to develop for the two major game engines: UnitySDK and UnrealSDK.

Stepn, the leading play-to-earn game on Solana, also announced a $30 million airdrop in April this year.

Additionally, Solana’s The Hunger Games (based on the hit book and film series The Hunger Games) quickly gained over 100,000 followers on Twitter in the first quarter and received over 2 million page views in the first 24 hours, causing its website to crash.

4) Payment Infrastructure

A recent research report from Alliance Bernstein shows that Solana has become the most popular stablecoin transfer network, especially for cross-border payments.

In March of this year, Solana processed approximately $1.4 trillion in stablecoin transfers. According to Artemis’ report, Solana has a dominant market share of 43% in terms of stablecoin transfer value, far exceeding Ethereum.

It can be said that PayFi has already arrived, and the Helio Solana Pay plugin on Shopify has saved Solana Labs more than $1 million in Chapter 2 sales fees compared to traditional payment methods. Now, it has become more universal: users can pay with their favorite tokens, which can be immediately converted into the merchant’s preferred currency through Jupiter.

As of the second quarter of 2024, Solana’s native payment infrastructure companies include Stripe crypto payments, Solana Pay Shopify plug-in payments, etc. It is worth mentioning that the Solana Pay Shopify plug-in has helped Solana Labs save more than US$1 million in fees. It supports USDC payments on Solana, Ethereum, and Polygon.

There are also some other developments including the on/offramp launch of Decaf, the launch of Code on Google Play, Phantom integration with Meso for onramp, Brazilian digital bank Nubank’s support for Solana, and the integration of XPOS with Solana.

5) DePin

Solana is well suited for the DePIN (Decentralized Physical Infrastructure Network) project due to its low transaction costs, high throughput speed, and scalability. It is currently becoming a hub for DePIN applications, hosting cloud computing projects iot.net, wireless network Helium, map Hivemapper, decentralized computing Render, communication Teleport, and storage GenesysGo.

In addition, Solana is also involved in mobile phones. Its first Web3 mobile phone Saga, which was released in May 2023, was sold out in the US market. On January 17, 2024, Solana Mobile plans to launch its second smartphone SAGA CHAPTER 2. The new phone will be equipped with a crypto wallet, customized Android software, and a crypto app store. Compared with the first Solana phone Saga, the price may be lower, and the pre-order deposit is US$450. It is expected to be shipped in the first half of 2025.

In addition, Solana’s remarkable achievements in some fields include:

RWA: Maple Finance

NFT: Magiceden

Hardware & Meme: Sage & Bonk

Inscription: Nos-20 (Neon)

Wallet: Backpack/Atomic Wallet/Exodus/Phantom Wallet

04 Summary

In general, Solana's growth story can be summarized in one sentence: moving forward in twists and turns. According to CoinGecko data, Solana has become CoinGecko's most popular blockchain in 2024, which means that Solana's influence in the industry is increasing.