The U.S. Department of Commerce announced the July Personal Consumption Expenditure Index (PCE) last night (30th): the annual increase was 2.5%, which was the same as in June, slightly lower than the market expectation of 2.6%, and the monthly increase was 0.2%, although it was higher than the 0.1% in June. A slight increase, but still in line with expectations.

The core PCE price index excluding energy and food increased by 2.6% in July, which was the same as in June, and slightly lower than the market expectation of 2.7%. The monthly increase was 0.2%, which was the same as the previous value and in line with market expectations. Data shows that U.S. inflation growth continues to slow and consumer spending remains strong.

Is there any suspense about a rate cut in September?

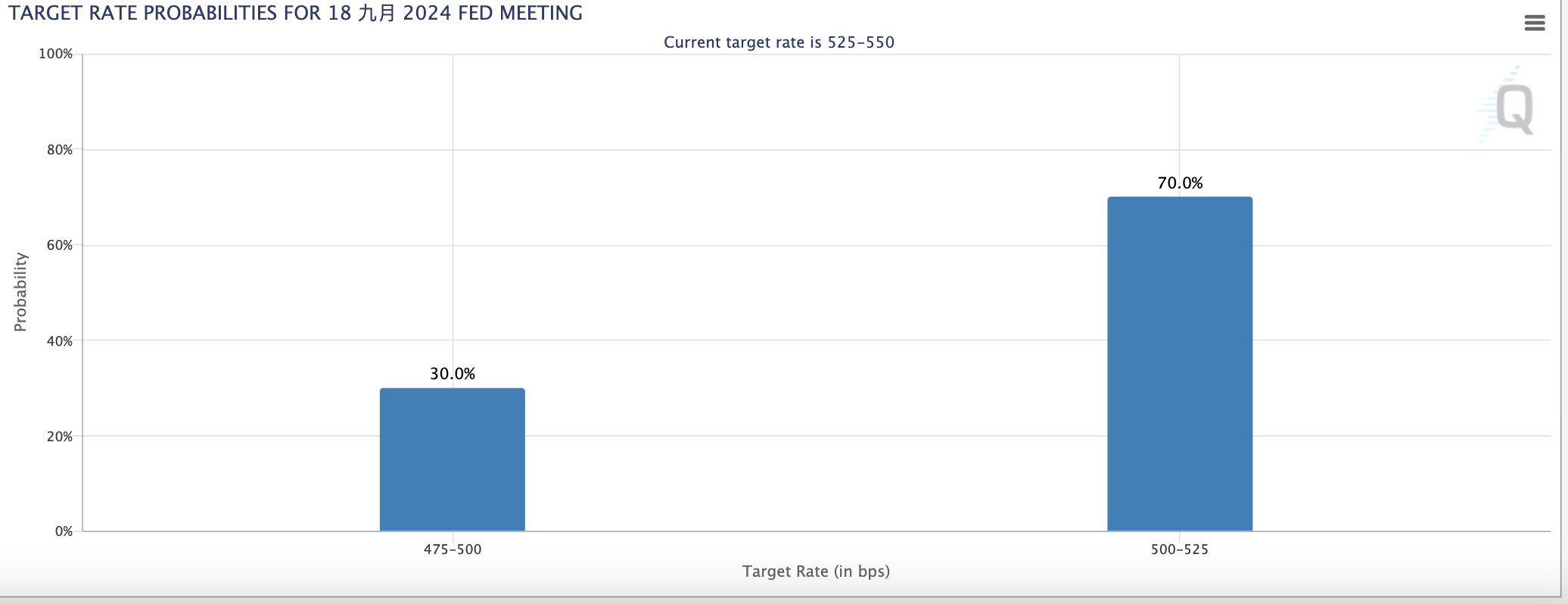

Last week, U.S. Federal Reserve Chairman Jerome Powell said at the Jack Hall annual meeting of global central banks that "the time has come" to adjust policy. The timing and pace of interest rate cuts depend on subsequent data, the changing outlook and the balance of risks. As data this week showed that inflation continues to be under control, the market is more confident that the Federal Reserve will cut interest rates by at least 1 point in September.

According to the CME Group's Fed Watch tool, the probability of a 1-digit rate cut in September has risen to 70%, and the probability of a 2-digit rate cut is 30%.

U.S. stocks soar

After the PCE news came out, all four major U.S. stock indexes rose, with Philadelphia Semiconductor having the largest increase:

- Dow Jones Industrial Average: up 0.55%, or 228.03, to 41,563.08 points

- S&P: Up 1.01%, or 56.44, at 5,648.4

- Nasdaq: up 1.13%, or 197.2, to 17,713.62 points

- Philadelphia Semiconductor Index: rose 2.58% or 129.57 to 5,158.82 points

Bitcoin rebounds after falling below 58,000 again

However, on the cryptocurrency side, the PCE news failed to save Bitcoin's recent decline. It only briefly stimulated Bitcoin to surge to US$59,944.07. Then selling pressure emerged, all the way to a minimum of US$57,701, a drop of 3.7% in 4 hours.

At the time of writing, Bitcoin rebounded to $59,160, slightly down 0.05% in the past 24 hours. As can be seen in the chart below, the intensive trading area in August is at the level of $59,200. If BTC can hold this level in the future, it may become a short-term support level and stimulate the next wave of gains.

However, if it fails to hold, it may backtest $55,000, which requires continued attention.

Ethereum briefly fell below $2,500

The trend of Ethereum is similar to that of Bitcoin. Its price briefly shot up to US$2,552.17 and then plummeted to US$2,431.14. As of this writing, it has rebounded and is now trading at US$2,526.22, a slight increase of 0.01% in the past 24 hours.

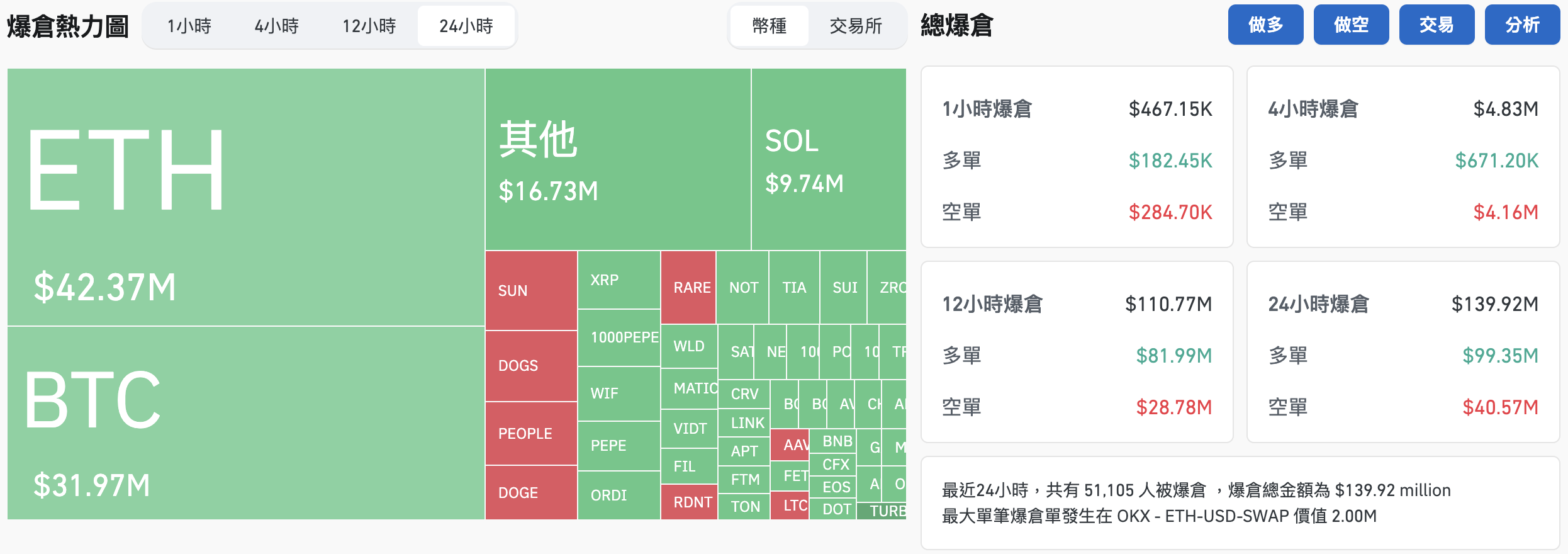

The entire network liquidated $139 million in the past 24 hours

The entire network liquidated $139 million in the past 24 hours

According to Coinglass data, in the past 24 hours, the liquidation amount of cryptocurrency across the entire network reached US$139 million, of which long positions were liquidated at US$99.35 million, short positions were liquidated at US$40.57 million, and a total of 51,100 people were liquidated.

Why was Durov arrested and what impact will it have on the TON ecosystem?

Why was Durov arrested and what impact will it have on the TON ecosystem?