Although the July Personal Consumption Expenditure Index (PCE) released on August 30 in the United States slowed down , which strengthened the market’s confidence in the Federal Reserve’s interest rate cut in September, the cryptocurrency market has shown no improvement in recent days. Bitcoin has been all the way since 6:00 this morning. It fell from around US$59,000 to as low as US$57,777 at 1 p.m., a drop of more than 2%.

As of the time of writing, Bitcoin has rebounded slightly, trading at $58,150, down 1.8% in the past 24 hours.

Ethereum loses $2,500

The trend of Ethereum also plummeted today. Its price fell from around US$2,520 at 6 o'clock this morning. It fell as low as US$2,458 at 1 o'clock in the afternoon, falling below the US$2,500 mark in one fell swoop. As of the time of writing, it had recovered slightly and is now trading at 2,472 US dollars, down 2% in the past 24 hours.

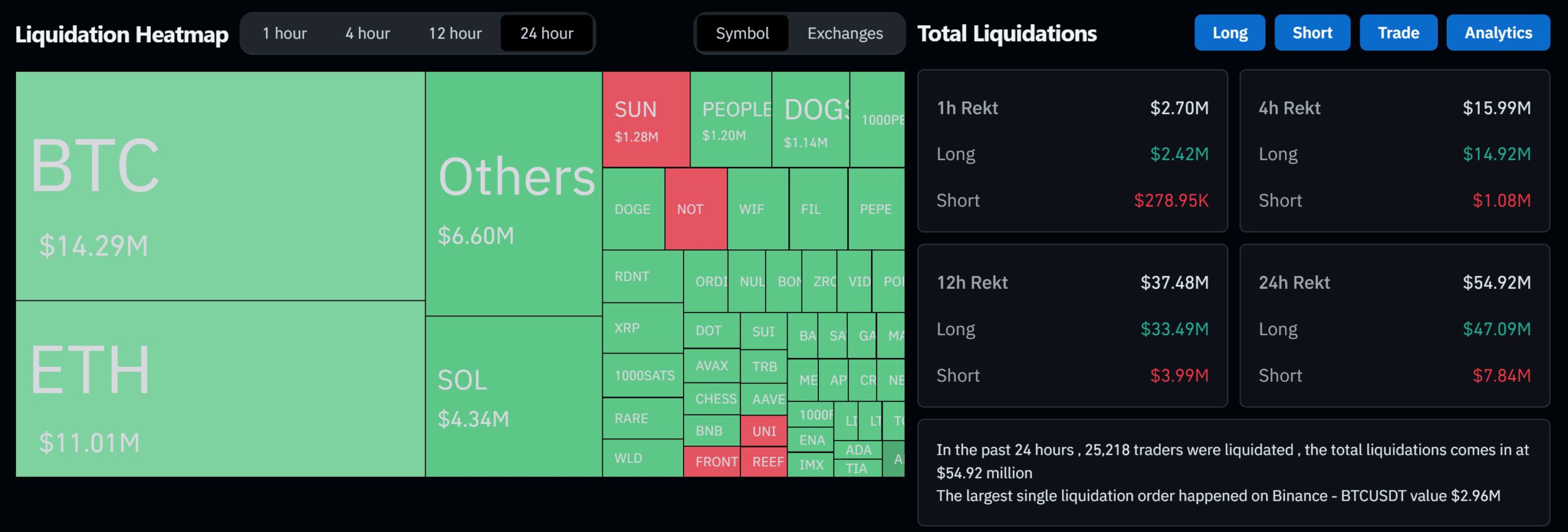

The entire network liquidated $54.99 million in the past 24 hours

According to Coinglass data, in the past 24 hours, the liquidation amount of cryptocurrency contracts across the entire network reached US$54.99 million, and the scale of liquidation is still relatively flat. Among them, long positions were liquidated at US$47.09 million, short positions were liquidated at US$7.84 million, and a total of 25,218 people Being liquidated.

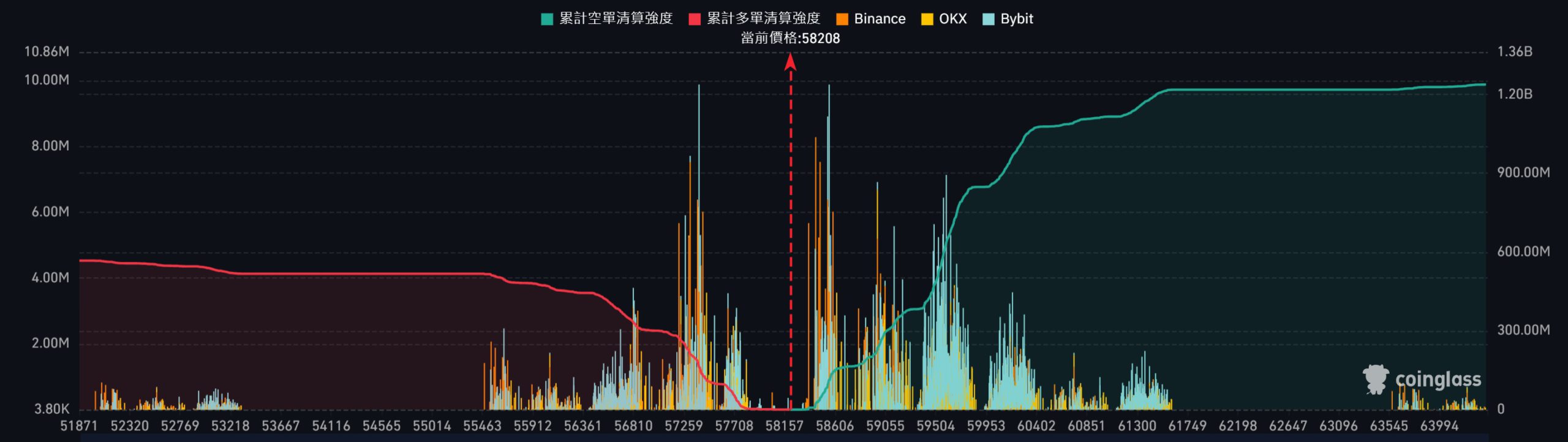

If Bitcoin falls below $56,000, it will trigger huge liquidations

It is worth noting that Coinglass data shows that if Bitcoin falls below US$56,000, the cumulative multi-order liquidation intensity of mainstream centralized exchanges such as Binance, OKX, and Bybit will reach US$465 million. If Bitcoin rebounds and exceeds US$60,000, The cumulative short order liquidation intensity of mainstream centralized exchanges will reach 860 million US dollars, so the next trend will be worth paying attention to.

Coinglass pointed out that the liquidation map provides a visual chart of the liquidations of traders in the futures crypto market. The map predicts the liquidations that will be carried out based on previous price movements. When a small number of position clusters are liquidated, they will have less impact on the market, but if there are thousands of them, The liquidation prices of the position clusters are close to each other. If these orders are liquidated at the same time, the impact on the market price will be huge.

Coinglass reminds that the liquidation chart does not show the precise number of contracts to be liquidated, or the precise value of the contracts to be liquidated. The cylinders on the liquidation chart show the importance, that is, the strength, of each liquidation cluster relative to adjacent liquidation clusters.

Therefore, the liquidation chart shows the extent to which the underlying price will be affected when it reaches a certain price. A higher liquidation cylinder means that after the price reaches that point, it will react more strongly due to the liquidity wave.