Highlights of this issue :

1. Can Japan breathe a sigh of relief after stopping interest rate hikes?

2. The secrets of the operations of the six major market makers

01

X Viewpoint

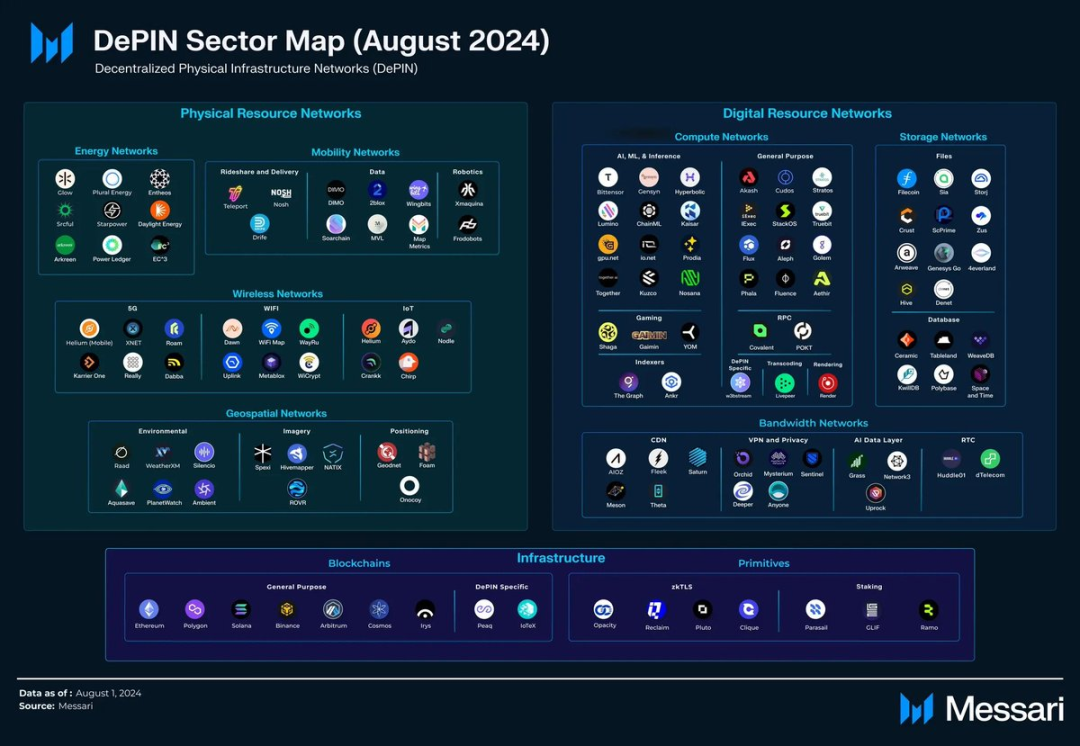

1. Bitwu.eth (@BTW0205): A look at the #DePIN industry map released by Messari

The scale of financing in the DePIN field is increasing at a rate of 296% year by year, with a total market value of more than US$20 billion, but the overall revenue growth is still relatively weak, indicating that demand is still limited.

Currently, most DePIN projects still rely on the traditional Web2 architecture and use token rewards to incentivize network contributors.

If you are just starting to deploy DePin now, the previous wide-ranging approach will no longer work. It is recommended to follow the following points to screen:

1. Rich and has recently raised a lot of funds. The core of the DePIN model is to use token incentives and flywheel effects, which means that it must be supported by large VCs and have sufficient financial strength to maintain the operation of the flywheel.

2. Have a relatively mature profit model, have already deployed applications on a certain scale, and have sub-products with stable revenue.

3. There are too many plug-ins. It is recommended to focus on projects that provide a complete solution, such as modular infrastructure with the ability to build Depin.

2. Bitwu.ETH (@BTW0205): Characteristics of past bull markets

(1) #BTC and #ETH both broke through the historical highs of the previous bull market, which marks the official start of the bull market.

(2) The daily K-line prices of Bitcoin and Ethereum deviated from the 60-day moving average by more than 30%, and the 60-day moving average continued to rise. This means that investors who entered the market at different time periods have made profits.

(3) The 30-day, 60-day, 120-day and 200-day moving averages are dispersed, indicating that chips are beginning to be distributed in a dispersed manner and the market's money-making effect is significant.

(4) Exchanges are active, and project owners take advantage of the situation to launch new projects and seek to sell them at high prices.

(5) Moments and group chats are filled with stories of people showing off their earnings and getting rich quickly. Investors are in high spirits and are eager to get rich overnight.

(6) The market capitalization share of Bitcoin has dropped to around 30%, the market capitalization of Altcoin has soared, and market risks have gradually accumulated.

(7) Trading volume and turnover rate are extremely high, and the market is active.

(8) The Ethereum Foundation began to sell coins frequently, and its wallet assets gradually flowed into exchanges.

(9) Positive market news continues to emerge, and stories emerge one after another, each with its own unique charm.

This round of atypical bull market will not follow the above script, but the only thing that remains unchanged is that only those who have a long-term vision, do not pay attention to short-term corrections, focus on the bull market cycle, and hold on are the winners. In history, those who only paid attention to the rise and fall in the middle were picking up sesame seeds and throwing away watermelons.

3.0xbit (@0xBit90536646): Will the US stock market rise or fall before and after the US interest rate hike/cut?

(1) Historically, U.S. stocks generally experience a short-term decline before and after an interest rate hike, but they tend to rebound quickly after the hike, indicating a long-term bullish trend.

(2) The United States often cuts interest rates because it is forced to do so due to an economic crisis. Therefore, U.S. stocks often fall before and after a rate cut, and then continue their upward trend.

(3) The timing and strength of the rebound after a rate cut depends on the severity of the crisis and the extent of the rate cut.

02

On-chain data

@0xCryptoChan: Waiting for the big cycle return of Bitcoin MVRV indicator

03

Sector Interpretation

According to Coinmarketcap data, the top five currencies in terms of 24-hour popularity are BTC, XRP, NEIRO, ETH, and ONDO. According to Coingecko data, in the crypto market, the top five sectors with the highest growth are Ferrum Network, Retail, Logistics, Atomicas Ecosystem, and Binance Launchpad.

Focus: Data on the operations of the six major market makers before and after the "85" crash

GSR Markets: Continued selling of ETH. Before the "85" crash, according to ARKHAM data, the net value of the total holdings of the public address on the GSR Markets chain decreased from August 1 to August 5. The main changes are: ETH holdings decreased by more than 706, STETH holdings decreased by 300, stablecoin USDC holdings decreased by more than 3.34 million, and L3 holdings decreased by more than 8.56 million. The detailed data is shown in the figure below. After the "85" crash, according to ARKHAM data, the public address on the GSR Markets chain is still reducing its holdings by more than 100 ETH, but the reduction of other Altcoin is not obvious.

Amber Group: Panic selling of ETH during the crash. Before the "85" crash, according to ARKHAM data, the net value of the total holdings of the Amber Group's on-chain public addresses increased from August 1 to August 5. The main changes are: ETH holdings increased by more than 11,500, and stablecoin USDC holdings increased by 500,000. After the "85" crash, according to ARKHAM data, the Amber Group's on-chain public addresses sold a large amount of ETH, with a total of more than 13,000 ETH, of which nearly half were transferred to exchanges.

B2C 2 Group: Large-scale reduction of all tokens. Before the "85" crash, according to ARKHAM data, the total net value of the public address on the B2C 2 Group chain was increasing from August 1 to August 5. The main changes are: ETH holdings increased by 4,650, BTC holdings increased by 531.52, and 216,500 UNI, 23,000 COMP, and 32,000 DAI were also increased. After the "85" crash, according to ARKHAM data, B2C 2 Group reduced its holdings of almost all tokens and replaced them with stablecoin assets for risk hedging. Among them, BTC reduced holdings by more than 1,000, ETH reduced holdings by more than 19,000, BNB reduced holdings by more than 4,000, LINK reduced holdings by more than 59,000, and COMP reduced holdings by more than 23,000.

Wintermute: We have been increasing our holdings before and after the crash. Before the "85" crash, according to ARKHAM data, the net value of the total holdings of public addresses on the Wintermute chain increased from August 1 to August 5. The main changes are: the holdings of stablecoins USDT and USDC increased by more than 104 million, the holdings of ETH increased by more than 14,930, the holdings of WBTC increased by 104.74, and 4 million PEPE were also increased. After the "85" crash, according to ARKHAM data, the public addresses on the Wintermute chain not only did not reduce their holdings in large quantities, but they were still increasing their holdings. The main changes are: the holdings of stablecoins USDT and USDC increased by more than 62 million, the holdings of WBTC increased by 131.5, and 329.8 trillion PEPE and 690,000 DAI were also increased.

Flow Traders: Selling ETH but buy the dips BTC at the bottom. Before the "85" crash, according to ARKHAM data, the net value of the total holdings of the public address on the Flow Traders chain was decreasing from August 1 to August 5. The main changes are: ETH holdings decreased by 633.93, BTC holdings decreased by 142.69, and stablecoin holdings decreased and changed significantly. After the "85" crash, according to ARKHAM data, the public address on the Flow Traders chain began to increase its holdings of BTC in large quantities, from 797.31 to 1,650, a total of 852.69; at the same time, it also increased its holdings by more than 750 MKR, while stablecoin holdings remained unchanged.

DWF Labs: Holding altcoins without moving. Before the "85" crash, according to ARKHAM data, the DWF Labs public on-chain addresses held mostly Altcoin, and the tokens with the largest positions were TRADE, GALA, DEXE, etc. Although the passive depreciation of the net asset value decreased, there was no obvious flow of tokens. Even after the "85" crash, according to ARKHAM data, the DWF Labs public on-chain addresses held little change or change of positions.

04

Macro Analysis

Wall Street Journal: The Bank of Japan has surrendered. Can we breathe a sigh of relief?

On Wednesday, markets cheered comments from a senior Bank of Japan official. Deputy Governor Shinichi Uchida said interest rates would not be raised amid financial market instability. The statement seemed to bring some comfort to the recently turbulent global stock markets, but some analysts believe the relief may be short-lived.

The yen weakened after Nada's statement, and both Japanese and U.S. stocks rebounded sharply. This reaction proves that investors "like the dovish remarks of central bank governors trying to calm the market," but it does not solve the fundamental problem, said Peter Boockvar, chief investment officer of Bleakley Financial Group, in his latest report.

The Bank of Japan’s policy board “always seems to be doing something wrong, and if they stop raising rates now, the carry trade will return, and inflation and a weak currency will continue to erode the spending power of the Japanese people,” Boockvar wrote, arguing that the central bank is caught between a rock and a hard place.

The unwinding of yen carry trades was not the only catalyst for the sell-off, as a string of weaker-than-expected economic data last week, including Friday’s July jobs report, stoked recession fears.

So the market action isn’t all about the yen, but it “remains a key component of risk and the yen’s correlation to global equities, and that correlation is not decreasing today,” Bob Savage, head of market strategy and insights at BNY, said in a note Wednesday morning.

Savage said the yen may still be stronger in the long run. But for now, "domestic markets are breathing a sigh of relief that the likelihood of further BoJ rate hikes has diminished. It's not such a clear signal to the rest of the world."

A key question for analysts is whether Uchida's comments will reignite the carry trade.

“This statement gives a green light for carry traders to resume short the yen and buying higher-yielding currencies and assets,” Matthew Weller, global head of research at Forex.com and City Index, said in a note.

Still, Weller acknowledged that Japan is only part of the carry trade, and that central banks like the Federal Reserve and the Bank of England could still cut rates aggressively in the coming months as other developed economies show clear signs of slowing in the second half of the year. That would limit the yen carry trade.

“Ultimately, the key question for traders centers on whether the U.S. and other advanced economies are sliding toward recession, a question that will determine future moves in foreign exchange, bond and equity markets,” he wrote.

05

Research Reports

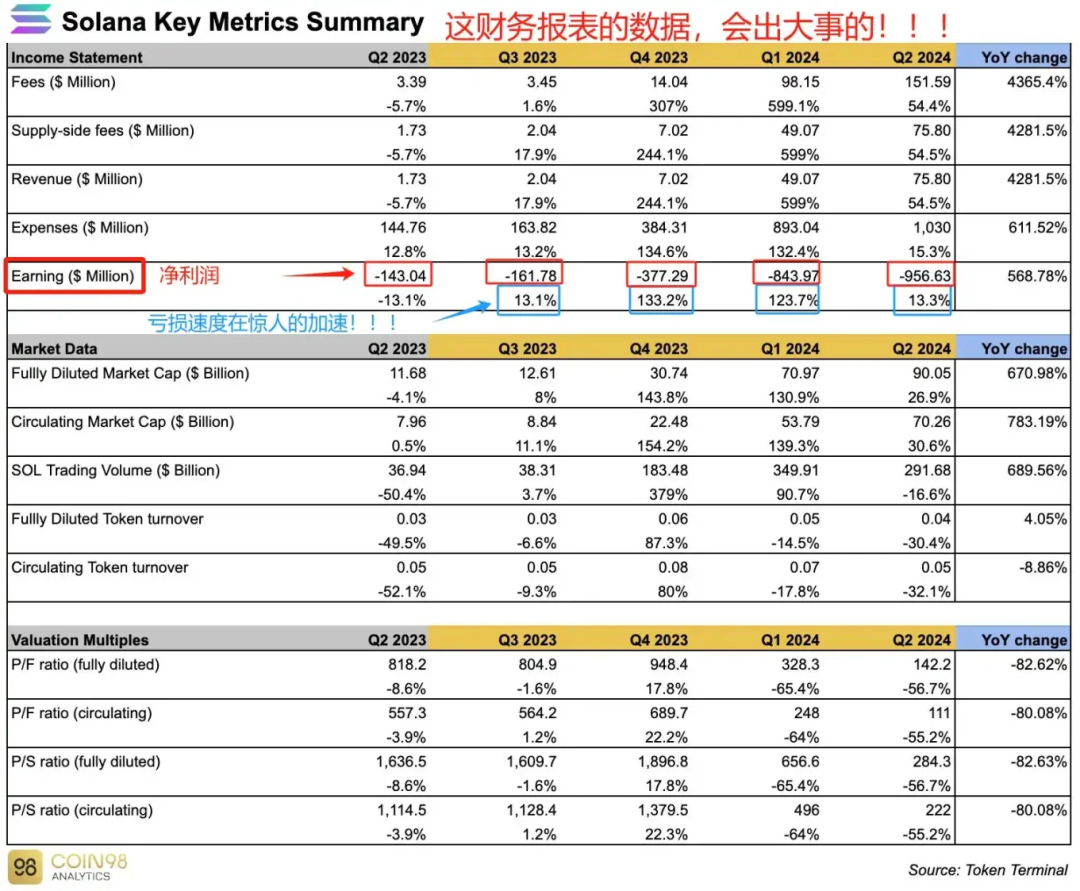

Solana financial report debate, real loss or misunderstanding?

Recently, crypto KOL Bear Biscuit.eth posted an article on the X platform saying that Solana may face major risks and that the price of SOL will hardly return to $200. The article pointed out the continuous quarterly losses and unlimited issuance of SOL exposed in Solana's financial report. The article caused a lot of retail investors to have FUD about SOL. Last night, crypto KOL Riyue Xiaochu refuted Bear Biscuit.eth's view. He believed that SOL's inflation was within a reasonable range and would not hinder the rise in the price of the currency, and the loss was just a data illusion caused by the dollar denominated price. This article reproduces the articles of the two KOLs as follows:

1. Bear Biscuits.eth: It is difficult for SOL to reach 200 again

$SOL may have a big problem. 90U is not the bottom. Don’t buy the dips at the bottom!!! Jump liquidated its Solana token position when the market plummeted yesterday. Did everyone know that? The Solana chain, which is in its heyday, has a bright future. Why would such a powerful high-frequency quantitative institution like Jump choose to liquidate its position? ? ?

The tokens of $SOL that were cleared entered the wallets of you and me, and we gave the stablecoins to Jump. At such a low price, when else would you buy the dips? Who is the idiot? Today, I, Xiao Biscuit, will tell you the shocking truth: $SOL will hardly return to 200. The information I judged comes from public data:

Solana lost $1.8 billion in the first half of the year alone, and the losses are accelerating

Solana has unlimited additional issuance, with 161 million additional issuances in three years, and institutions are cashing out crazily

Financial Data

Solana has been losing money every quarter: from 160 million, 370 million, 840 million, to the second quarter of this year, it lost 950 million in just 3 months! The loss is still accelerating and there is no way to stop it!

Has anyone told you these amazing statistics? Wake up, leeks, and be cautious when buying!

Unlimited issuance

Since August 2023, the supply of SOL tokens has increased by 60 million. At the current price of 140U/coin, it is equivalent to selling 8.4 billion US dollars to the market, all of which we have taken. In October 2021, the total supply of SOL was only 301 million, and three years later it was 462 million. This is an annual increase of 15%. With such a high inflation rate, do you still dare to take over?

In this bull market of 2024, VCs are all smiling and counting money and going on vacation. Only the leeks are still fantasizing that SOL will return to $200. I hope this article can help everyone have an independent, objective, calm and clear understanding. I wish everyone less pitfalls and more money!

2. Riyue Xiaochu: Losses are a data illusion

This is another case of incorrect analysis of data, leading to incorrect conclusions.

Many people are optimistic about SOL, and this article has made people panic. So many people have privately chatted about this issue. So I wrote some answers into an article.

First of all, I have no intention of disrespecting the original author of the article. On the contrary, the KOL who is willing to selflessly share high-quality articles deserves everyone's praise. The error in data analysis here is because the data dimension itself is very easy to be misunderstood.

Let me first talk about inflation. In the article, the author cited data from Messari, pointing out that SOL issued 60 million more coins last year, worth 8.4 billion, and dumped them into the market. However, in fact, this newly added circulation is not entirely an increase in the SOL network. First of all, the Messari screenshot shows the newly added circulation. Secondly, in my red screenshot, you can see a step-by-step increase, and the increase must increase at the same speed. This kind of increase is impossible.

Newly added circulation includes not only the network’s additional issuance, but also the unlocked part. Since the SOL institutions and teams have already unlocked all of them, the unlocked part now should be the foundation or the ecological fund. This part of the chips is often only unlocked, but will not be circulated. Because the foundation cannot arbitrarily use this part of SOL.

What we are concerned about is inflation. In fact, it has been given in the official documents that Solana is now in its fifth year of launch, with an annual inflation of 3.5%, and inflation will decrease by 15% every year. In comparison, the inflation rate of ETH in 2020 was 4.5%, and the market value of ETH at that time was between 20 billion and 70 billion US dollars.

Therefore, SOL inflation is not a big problem. Historically, additional issuance will not have a big impact on the price of the currency in an upward market, because many people will continue to hold the currency. Reasonable inflation will not hinder the rise in the price of the currency. Similarly, deflation cannot cause the price of the currency to rise (such as ETH).

The second point raised by the original author is that SOL has huge losses and they are expanding rapidly. From the financial statements, we can see that the losses started in Q2 of 2023, and then reached 160 million, 370 million, 840 million, and 950 million in Q2 of this year.

In reality, it is not that losses are increasing. But it is just an illusion of data due to the use of US dollars. Nothing is actually happening.

Because the expenses here include daily operations and SOL paid to nodes (that is, the network issuance discussed in the previous section), and the latter accounts for a large proportion.

Let's do a simple calculation. The average price of SOL in Q2 of 2023 was around $25. The price in Q4 was relatively large due to the pull-up, so we calculated it based on an average price of $50. This year's Q2 was basically $160. I roughly calculated that SOL will issue 6 million more coins per quarter. So simply multiplying, it was $150 million in Q2 of 2023, $300 million in Q4, and $960 million in Q2 of this year.

(Of course, if you think the value of inflation in US dollars is expanding, you can refer to the previous discussion on inflation.)

Seeing this, everyone should understand that the financial statements seem to show that the huge losses are expanding rapidly, but this is just a data illusion caused by the rise in SOL coin prices. In fact, nothing happened, nothing happened, nothing happened.

All right, let’s continue the music and dancing.