After the high-level shock, Bitcoin continued to fall over the weekend, and then continued pessimism spread. The panic and greed index dropped to 26, a significant drop from 55 last week. Such emotions appeared because everyone was worried about liquidity issues. After ICO and VC, everyone began to embrace the pvp model meme. Then, when the meme performed poorly recently, everyone was even more pessimistic. At the macro level, they were worried about the US economic recession, and at the micro level, they were worried that the industry would not innovate and could not continue to bring growth.

Although panic is spreading, if you look at the whale on the chain, you will know that they are not selling, but continue to buy. Every time there is general fear in the market, it is often accompanied by opportunities.

Bitcoin's next daily level focus will be on the 120-day moving average. If it can stand above 64,000 again , it is obvious that a large wave of market minutes is coming. Before it fails to stand above it, it can be understood as a shock adjustment.

Continuing from yesterday’s article:

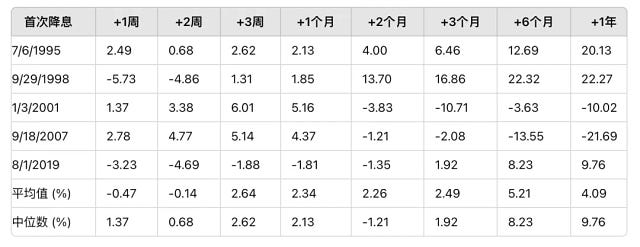

Another point we are most concerned about is whether there will be an interest rate cut in September and how the market will perform?

First of all, let’s look at the big market. How will U.S. stocks perform?

The performance of the US stock market is more important to our crypto. Some time ago, BTC fell with the US stock market, but did not rise with it, but at least it stayed flat; recently it has been completely rotten, and whether the US stock market rises or not has nothing to do with me, but fortunately, the US stock market is still strong now, and Nvidia’s decline did not bring down the Nasdaq, and small stocks are starting to work.

But there is still a feeling of life hanging by a thread. If the US stock market falls, there is still a possibility that BTC will test the market again. Currently, the VIX panic index of the US stock market is 15, which is still in a relatively optimistic and stable state.

In addition, the premise of the interest rate cut: is it a rate cut due to economic recession or a defensive rate cut? Is the Fed's rate cut out of celebration or desperation?

If it is out of desperation, although the interest rate cut has brought about a decline in borrowing rates, investors' pessimism about the market will not directly lead to a boom in the stock market. Instead, investors are more inclined to make conservative and stable investments.

If it is for celebration, then the borrowing cost will indeed be reduced, corporate spending will be reduced and income will be increased, which will stimulate the economy. At the same time, the downward trend of bond yields will make funds more inclined to risky investments, so the US stock market can continue to play music and dance, which is also good for us.

The current market of the crypto

The trading volume shows that everyone is lying flat, and the cottage industry has also fallen to the freezing point. What will happen next depends on the interest rate cut in September and how the US stock market reacts. After all, it is still worrying that it is at a high level.

The theme of the market this week is that the main force will determine the trend of the US stock market in the next stage based on the non-agricultural data.

The non-farm payrolls data is one of the five major financial report data of the US stock market. Every time it is released, it will bring great fluctuations to the market.

Because the market expects the Fed to decide to cut interest rates in September, employment data will be the focus of market attention. There is no impact of any financial report data this week, so one dimension of variables is reduced.

So I'm just staying put lately and watching what happens.

Follow me and go through the super bull market together!!!

Create a high-quality circle

Spot mainly

I will share some content: as shown below:

The overall position is ≥ 5,000u. If you want to join, scan the QR code below!

This is the end of the article. I will do a more detailed analysis in the communication group. If you want to join my circle, please contact me directly through the WeChat below!

Note: If the QR code is invalid, please leave a message in the background