Bitcoin ’s market capitalization and height have raised questions about Ethereum’s relative weakness, but Ethereum’s innovative potential cannot be ignored. ETH price performance is affected by multiple factors, especially decentralization and Layer 2 operational issues.

We will focus our discussion on the value of decentralization on the Ethereum route, as well as analysis of the competitive advantages of platforms such as Layer 2 and Solana. In addition, analyze the bridging role of stablecoin issuers and centralized exchanges. Driven by these issues, we still need to observe closely how the future development of Ethereum will evolve.

TL;DR

Which one is better, Ethereum VS Bitcoin? : Ethereum’s $300 billion market capitalization faces a “gravity effect” on its growth, and the lack of clarity on the value capture mechanism further drags down performance. He advocates spreading value across productive assets rather than relying on unproductive assets like Bitcoin or gold. It also emphasizes that the global and permissionless consensus of blockchains such as Ethereum enable it to provide a unified API to manage multiple assets.

Layer 2 Adventure: Cracking the Interoperability Problem: Interoperability issues and independent standards between Ethereum Layer 2 solutions weaken the value capture ability of L1. It is a wrong decision for Ethereum to outsource MEV and execution to L2 . KyleKyle is skeptical of the Rollup-centered roadmap, believing that the growing L2 team will compete with L1 and lead to the breakdown of the partnership.

The Secret of Value Capture: Ryan believes that decentralization is crucial in terms of censorship resistance and inflation resistance, so he supports the Rollup-centric route. Kyle believes that Ethereum should focus more on building a permissionless financial system. Over-optimizing node decentralization is not the best strategy, especially when stablecoin issuers and centralized exchanges become critical moments in connecting encryption and traditional finance. .

Ethereum or Solana, who will win? : Discuss the differences in values between Ethereum and Solana. Solana aims to become the world's largest financial exchange, prioritizing user experience and permissionless access, while Ethereum focuses more on decentralization and validator distribution. Although Ethereum has advantages in regulatory status and human capital, System design limitations may prevent these advantages from being realized.

Original dialogue

David: Here, I want to imagine a scenario for Kyle: Suppose all your assets have magically turned into ETH, and now the only thing you hold is ETH. What will you do next? Welcome to Bankless, where we explore the front end of money and finance on the Internet. In today’s episode, we’ll explore a fascinating question: why ETH’s price performance has been lackluster for at least a year. This is indeed a worrying issue. According to data, the annual growth rate of SOL/ETH has reached 300% in the past year, but the ratio of ETH/BTC has fallen by 50% in the past two years, and the market value has been reduced by half relative to Bitcoin.

Left: The ratio of ETH/BTC has fallen by 50% in the past two years; Right: The annual growth rate of SOL/ETH has reached 300% in the past year

In order to find the answer to this question, Ryan and I asked around, thinking about who would be the most suitable guest to answer this question. Suddenly, it occurred to us that Kyle Samani might be the perfect candidate. When we asked Kyle this question, it showed that ETH holders were indeed in trouble.

This episode of Bankless Nation is more like an opportunity to listen. Ryan and I are going to relax for a moment, listen to Kyle's perspective and reasoning, and see what we can learn from it. The current price performance of Solana seems to indicate that Kyle's investment thesis about Solana is more correct than what we at Bankless predicted in the early years. We wanted to delve deeper into why.

Ryan: I said something at the end of the show, and I want to say it again: For ETH bulls, this show may bring some frustration on multiple fronts, but I think this is the one time Useful reflection. We created this episode because we felt it was important to hear the opposing side. I don't think this discussion is the end of the topic, so there may be more debate in the future, perhaps with Kyle, or with the community recommending others to delve into Kyle's points and provide further rebuttal.

Here, I am pleased to introduce Kyle Samani, the managing partner and co-founder of Multicoin Capital. Multicoin has been one of Solana's largest investors and supporters, and they were already promoting the investment philosophy of integrating blockchain long before Solana completely redefined the crypto space.

Kyle: Hey, everyone. It's a pleasure to be a part of this show.

What happened to Ethereum?

Ethereum’s “Midlife Crisis”

David: Let me briefly introduce the background. SOL/ETH has increased by 300% year-on-year, while ETH/BTC has dropped by 50% in the past two years . The ratio of Bitcoin to Ethereum seems to have fallen for more than 700 consecutive days. Although there have been some rebounds on some days, the overall trend remains clearly downward. First let’s talk about Ethereum, and then discuss how Solana impacts Ethereum’s valuation.

I want to start with Ethereum itself, assuming it exists in a vacuum. When you see Ethereum price performing weaker than its competitors, what is the first thing that comes to mind to explain this trend that has been going on for over a year?

Kyle: I think the most important variable is probably what I call "gravity." It is difficult to make a big asset rise. Ethereum's current market value is approximately US$300 billion. There are not many assets in the world with a market value of US$300 billion, maybe only 20 to 40. If you don't count commodities and just look at stocks, the amount is even less.

The law of large numbers is a phenomenon that exists, and like most companies or things, when they reach this size, it becomes more difficult to maintain massive revenue growth and profits.

Ryan: Let me give you a number. Ethereum is actually the 34th largest asset in the world, and Bitcoin is the 10th largest asset. There are only 33 assets in the world with a market capitalization larger than Ethereum’s current $320 billion. Just like Visa's market capitalization is about $400 to $500 billion, so they're roughly in the same range.

Kyle: I think what ETH holders may not realize is that growing at this scale is very difficult. But there are exceptions, such as NVIDIA, which has recently grown rapidly from US$200 billion to US$2 trillion. At this scale, you are fighting "gravity".

And then there's another part, I tweeted a few weeks ago, which is: the larger the market cap, the higher the market's expectation that you will produce incremental performance in the future. Or simply put, someone who makes $200,000 a year or $500,000 a year, you would expect them to be more economically productive than someone who makes $50,000 a year, that's obvious.

The same goes for a company's market capitalization, stock or token. You should hold it to a higher standard. So I think it's very unusual for Ethereum, which has a market cap of $300 billion, to be the 34th largest asset in the world right now, as Ryan just said.

If you're at this size, you need to have a very clear understanding of the risks of backing an asset of this size. Ethereum's lack of clarity on fundamental value capture mechanisms is, to me, a very vulnerable point. I think this is also an important reason that has dragged down ETH's performance in the past year or two.

David: Yes, assets that reach $300 billion or $500 billion, no matter what they are, are going to have some degree of difficulty growing, and it's not just an Ethereum problem. It just happens that Ethereum is at this "trough", and all assets will eventually go through this test of trying to break through the first trillion market capitalization.

Kyle: Yeah, but I don't want to think of it as a "trough," but growing from a base of 300 billion is harder than growing from a base of 5 billion. This is mathematically obvious. The only truly special example is Bitcoin, because the whole thing about Bitcoin is that it's a "store of value." If you agree with the value proposition of Bitcoin, then it is indeed partially exempt from the impact of the "gravity theory", not completely, but at least partially.

Ryan: Okay, so I want to dig into this a little bit. While it is an exception to the rule, I would say this is what many ETH holders expected, including perhaps ETH long supporters like David and myself. Bitcoin is now the 10th largest asset in the world, and Ethereum is the 34th largest asset. Its current market capitalization is $1.2 trillion. Bitcoin defies external forces such as gravity or entropy that affect large-cap assets, reaching multi-trillion-dollar scale.

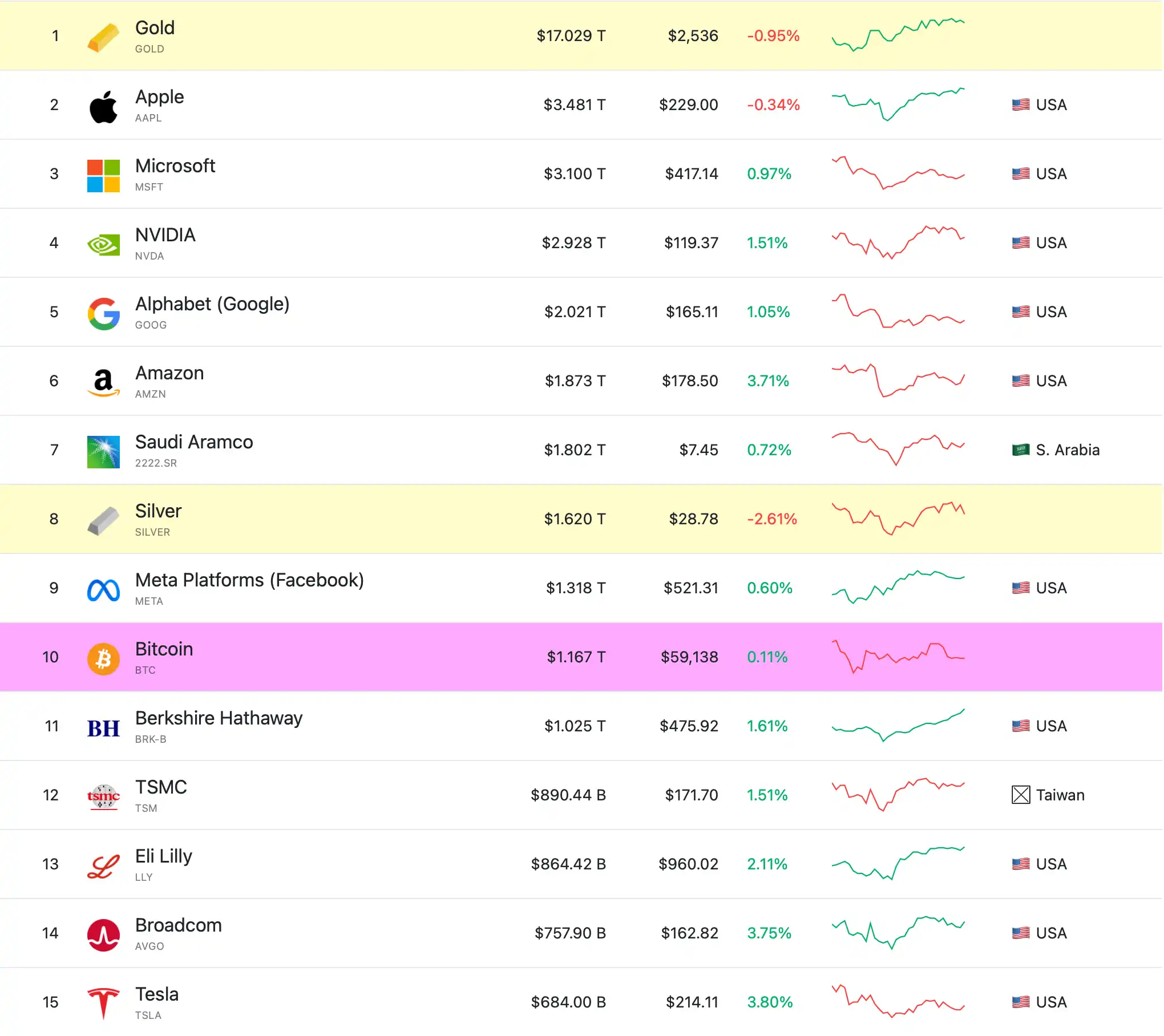

Ranking of the top 15 assets in the world by market capitalization, data source: Global ranking

Bitcoin bulls believe it is actually on track to surpass the world's largest asset, gold with a market capitalization of $16.7 trillion. I think a lot of ETH bulls are thinking, if Bitcoin can reach these heights, why can't Ethereum? Because Ethereum is like Bitcoin, but better and more programmatic. I guess this may relate to your opinion on whether Bitcoin is really worth $1.2 trillion. But I still throw this question here and ask you to respond. Why is this possible for Bitcoin but not Ethereum?

Bitcoin ≠ public chain

Kyle: The whole value proposition of Bitcoin is that it is something special. It's "sound money", it's the first one to appear, it's simple, it doesn't do anything redundant, and the risk of making mistakes is low. Proof-of-work is objective, while proof-of-stake is subjective in nature. You can analyze this problem from many angles, but the summary is that Bitcoin is special.

But I don’t think Bitcoin is special, my understanding at this point is that I’m in the minority and the rest of the world thinks Bitcoin is special. So for now, I'm not going to convince the world that Bitcoin isn't special. I will challenge this view at some point, but now is not the time. But what I understand so far is that everyone thinks Bitcoin is special, and that's the reality. Don't hate the gamer, hate the game itself.

Ethereum and Solana are clearly not Bitcoin, they are not as special as Bitcoin, that is very clear. Ethereum and Solana are often described as functional things, we're talking about finance, or we're reinventing global finance and democratizing access, and other fun things like asset issuance and tokens and so on. So, fundamentally, the perspective of discussing Ethereum and Solana is that they are changing finance and changing the trajectory of payments. So if you look at companies like BlackRock, Visa, Stripe, they are clearly relevant to the discussion in these two major areas of the economy. So, it makes sense to think of Ethereum and Solana as tech stocks or growth assets that compete to some degree with these companies and others I mentioned.

Therefore, I think it is fundamentally correct to regard Ethereum and Solana as stock-like assets. Although not in the true sense of the company, CEO, compensation structure, etc., in terms of functions, products and meeting user needs, and therefore generating cash flow In the sense that they do look like stocks.

Ryan: The same framework that David and I have used in the past is that you have capital assets that generate cash flow, like stocks, or real estate that has rental income, and those assets are productive assets, they are capital assets. And then you have other types of assets, like commodities, which are consumer goods that are typically used in the production of other products. Finally, you have store-of-value assets that are special in the world.

So you could say that gold is a special entity because it does not generate cash flow, it is not a capital asset, and it is not a particularly important raw material in the production of other commodities. Its primary value comes from people thinking it has value. I want to discuss this in depth quickly.

It sounds like you are bearish on Bitcoin's $1.2 trillion market cap, and I would assume you would be even more bearish if Bitcoin reached a $10 trillion market cap. So my question is: Kyle, for an asset like Bitcoin, if enough people believe it is something special, is that narrative and story enough?

If the cryptocurrency world believes it's special, if Larry Fink starts believing it's special, if the new President of the United States starts believing it's special and puts it permanently on the U.S. Treasury's balance sheet and starts buying it, if enough people When people think an asset is special, it actually becomes special. It’s a reflexive circle that seems hard to deny, right? Could this explain Bitcoin’s current market capitalization of $1.2 trillion? Do you question this pattern that we see in asset markets? Do you think there's any problem there?

About Bitcoin Value Investment

Kyle: I need to counter one part of what you said, which is the discussion about commodities, capital assets, and stores of value. Commodities are different, such as oil, wheat, etc., which are obvious inputs to the basic economy. We have capital assets, things that generate income, right? Then you mentioned that the store of value is independent.

I don't agree that there should be a third category of assets because I don't think we need unproductive assets. The only exception is cash, since you need a unit of account to measure the price of the item. People need to know that coffee costs $2 and not 4 bushels of wheat. It is useful to have an abstract, universal unit of account, which is usually dictated by governments. I’m not going to fight the government, but I don’t buy the premise that a store of value should exist independently.

The basic argument for gold or Bitcoin being valuable is that governments can't print more of them. I understand the argument, but I think this way of looking at a store of value is ridiculous because there are many assets that are naturally resistant to inflation and generate income.

The most obvious examples are Walmart and Amazon. If the price of a commodity increases, they will increase the price of the commodity. Here I'm referring to the retail business, not the AWS business. This is not a perfect hedge as they may become more or less competitive with other retailers.

But if you believe that, you can buy a basket of retailer stocks that are inherently inflation-proof within the scope of their operations.

I think the anti-inflation properties of things like gold or Bitcoin are mainly based on memes. Indeed, there is usually some positive correlation between the price of gold and inflation, while Bitcoin has almost no such long-term correlation. While gold may have this correlation, I can't explain why this correlation has to hold unless we want the same trades to be repeated in the market to the tune of trillions, but I think this operation will eventually collapse. Therefore, I reject the premise of a store of value as a separate asset class.

Left: Correlation between gold and long-term inflation, source: GoldPriceForcast;

Right: Correlation between Bitcoin and ten-year Treasury bond interest rates, source from CoinDesk

I understand that others believe in the value of Bitcoin, it's just that I personally don't believe it has such high value when it comes to managing a balance sheet. Having said that, I do hold some Bitcoin, and so does the Multicoin Fund. But intellectually, I'm bearish on Bitcoin, I'm not short on it physically, but intellectually, I'm bearish on $1.2 trillion of Bitcoin, even if it reaches At $10 trillion, I would still remain intellectually bearish.

David: This investment strategy is a bit like Buffett’s, focusing very much on value. I think you lean more toward the productive asset type, you understand value, and you invest with that frame of reference. You think the framework of a productive asset can eat up the framework of a store of value, right?

Kyle: Yes. By the way, I wrote a blog article in 2018, probably titled "The Path to 100 Trillions" or "The Path to Tens of Trillions". That article discussed the storage of value theory and utility theory. Or stablecoin theory, the path to how to get cryptoassets to that scale. It would be interesting to reflect on this question from the perspective of six years ago.

David: Another way to understand what you're saying is that you still believe that humans will want to store their value, but they will spread that value across the other two types of assets, such as capital assets, and this will also be reflected in capital assets. and commodity asset prices. We don't need a separate category dedicated to storing value. I understand that this is your and Kyle's perspective on this issue, and this is Warren Buffett's perspective as well.

But it's a bit like atheists going to tell all religious believers there is no God, you have to convince them. I think that because store of value is a very memetic game that relies on human consensus, we may always have such a need. This may be a human hardware setting. Even if you don't like it personally, I guess what that shows up in your fund is that you're not going to short Bitcoin's store of value, right? You can also understand why it goes up.

Kyle: I think at some point we will indeed be heavily short Bitcoin. While this won't happen in the foreseeable future, over a long enough period of time I expect we'll have a massive Bitcoin short operation. But that's still a long way off. I just sent you a link to the "Practical Hypothesis" blog post so you can include it when the podcast is released. It's six years old, so I'm sure a lot of the terminology might read a little weird because the article is older, but I think it really captures the core belief, which is that what's interesting about cryptocurrencies is that we have a weird path dependency.

Bitcoin appeared, but it was functionally incomplete, with low transaction throughput, no features such as DeFi, and proof-of-work that could not complete transactions quickly, which made it very difficult to build a functional financial system on Bitcoin. As a result, the story of Bitcoin became "digital currency", "hard gold", "an immutable and stable thing", so everyone thought that Bitcoin was a special existence, while Ethereum only appeared a few years later. .

The idea behind Ethereum is: we can make finance better because it turns out there are benefits to having heterogeneous financial rails for payments of different sizes, whether it's ACH or credit cards or wire transfers, and different FX between countries. Influence. And then you have all the asset markets, bonds, stocks, commodities, all the things I just mentioned, they're all managed on different tracks. Each has its own database server and API, is very heterogeneous and complex, and none of them operate 24/7.

Obviously, time zones are an issue. So when you need to transfer assets across time zones, the process becomes very slow, painful, and terrible. And cryptocurrencies are inherently global, APIs are permissionless, and you realize the core concept of ownership through cryptography. It turns out that when you have this kind of permissionless consensus cryptography, you can use any API to represent assets, whether those assets are commodities, bonds, stocks, equity, fake tokens or meme coins, it doesn't matter. It turns out that it is much simpler to have a unified API to manage all assets, which is true by definition.

So I think when we look back at the history of cryptocurrency 20 years from now, we'll find that when Bitcoin first came out, we thought it was "digital gold," which was cool. But the real story is that we built a better financial trajectory. It could take 10 to 20 years for the rest of the world to acknowledge that we do have a better financial trajectory and start moving assets over. We are now starting to see some signs, such as BlackRock's BUIDL fund, Hamilton Lane and PayPal's actions. You will notice that these signs are gradually increasing.

At the same time I think this is going to be a story over the next 20 years because the trajectory of cryptocurrencies is objectively much better than the traditional trajectory. As more and more activity moves into the crypto orbit, there may be emerging areas like crypto gaming, or maybe something like DePIN, I think that's definitely here to stay, and most of these things are going to happen On Ethereum and Solana, or on some DeFi smart contract platforms such as Aptos and Sui.

At some point, maybe 5 or 10 years from now, most of the world will look at platforms like Ethereum, Solana, Sui, Aptos, etc., and say, “Wow, these platforms are clearly performing in a very real sense. The entire world will be represented. Global assets and finance will be represented on these systems. "And when they look at Bitcoin, it will still be the same as it is today, just a digital stone under your bed and nothing else. Do. They will start to question why these systems have something in common, such as the fact that their assets are no longer dependent on the DTCC (Depository Trust and Clearing Corporation) or the traditional financial world. They use the same terminology, such as cryptography, permissionless consensus, etc. So people may ask, why is Bitcoin special, it does nothing but is worth 2 trillion, 5 trillion or 10 trillion US dollars, while Solana or Ethereum is only about 300 billion or 50 billion? I think eventually people will realize that one of these systems is a superset of the other, that one is stupid and the other is useful. Eventually, this view will become the consensus. I don’t think we’re anywhere near that point yet.

Ryan: Back then, you would have short Bitcoin instead of now, right?

Kyle: Yeah, I'll have to see how the discussion evolves. But I do expect to be heavily short Bitcoin at some point.

David: Based on this valuation framework and understanding of the future development of cryptocurrencies, why has the price of ETH performed so poorly over the past two years? There are many shortcomings of Ethereum that may be relevant here.

The L2 Dilemma: Solving the Interoperability Conundrum

Ethereum’s shortcomings

Kyle: I think the issue that may have the most direct impact on price is interoperability. The derivative effect of this is that many people use Ethereum and they hate cross-chain bridges, hate paying high fees, and hate waiting for confirmation time to complete cross-chain transfers.

Moreover, each asset ledger is independent. Your asset ledger on Binance is different from Coinbase, different from Ethereum L1, and different from Arbitrum, Base, and Solana. These are independent asset ledgers, and each system records what you own. On Solana, everything is convenient, but on Ethereum, this is not the case.

Of course, we have systems like Li-Fi that try to solve these problems, but to people who understand how Li-Fi or other bridge aggregators work, it feels like they're paying slippage fees for it . So I think the experience of most crypto users today is that the interoperability is poor and they don't like it, and on Solana they don't have to deal with those issues. I think this may be the root cause of many people moving their ETH positions to SOL, their actual experience with both systems.

Ethereum mainnet funds frequently move to various L2s every week. Source: Dune

Ryan: ETH proponents might respond by saying, "Yeah, Kyle, Ethereum is going to solve this problem. There's actually a roadmap to solving this problem." They might list some different ideas on the roadmap, For example, different Layer 2 establishes their own "super chain", integration between Layer 2, shared sequencer, and Rollup-based solutions. Vitalik once tweeted that we are actually close to solving this problem, we just need to adopt some EIP-type standards to make the wallet experience smooth and make it feel like the same Ethereum chain. What is your response to this? Do you think Ethereum will solve this problem? Most ETH proponents would probably admit that this is a current problem, but not a future problem.

L2 interoperability conundrum

Kyle: First of all, I don't think there is a solution to this problem, because teams like Polygon, Optimism, Starkware, and Arbitrum are all building their own interoperability standards within their respective ecosystems, which is obviously true. I don't see any standard that is universal across all these ecosystems.

I'm not sure if it would actually be possible even if Vitalik proposed a standard, considering the way assets are stored in underlying cross-chain contracts in systems like ZK-Sync, Starkware, Optimism, Arbitrum, etc. To make the interoperability of all these systems as smooth as Solana. I could be wrong here, but it's really difficult.

Even if such a proposal exists, there is no guarantee that it will be implemented, because you need all teams to agree to implement it, and there is no guarantee that they will agree. So this is essentially a standard issue.

The problem with standards is that you have to get everyone to agree on the standard. However, it is clear that there are some obvious incentives for people to be reluctant to reach consensus. So I don't take it for granted, and even if it's theoretically possible, in practice it's very difficult because there are very clear divergent economic interests that hinder the implementation of the standard.

The third and probably most important point is that Ethereum is nine years old. Just had my ninth birthday a few weeks ago. In terms of time, this is already a long time. For example, SpaceX launched its first successful rocket in six years. I remember that the first three times failed, but the fourth time was successful. It took about six or six and a half years, and the total investment was about US$100 million or US$80 million. Musk only had $180 million at the time, and he was the only investor in SpaceX. Ethereum has been around for nine years, with an estimated billions of dollars invested in cryptocurrency research and development. So I think there's a basic sense of anxiety: Guys, why is this taking so long? We've been waiting here for so long.

Secondly, some features of Ethereum are not yet in production. I think if you're a $300 billion asset, don't just tell me, show it. Why should I believe you? When you have $300 billion in market capitalization behind you, that's the standard you have to live up to. This is no longer a “Devcon Phase Zero” thing with five researchers running around London.

David: You mentioned the actual user experience. This broken Layer 2 interoperability problem is one of the first problems users encounter when they come into contact with the chain. This is what is before them, this is the choice they must face.

So it's as obvious as the part of an iceberg that emerges from the water. How much of a role do you think this user experience plays in actual pricing, such as the ETH/BTC ratio, the ETH/SOL ratio, and the USD price of ETH? What is the actual slippage and cross-chain bridging friction experienced by users on Ethereum, and how much impact do these have on price?

Kyle: I think that’s the biggest factor. Money in cryptocurrencies, or wealth in the crypto space, is using Ethereum and Solana. Obviously, in a sense, 100% of the capital was originally in Ethereum, not Solana. If you go back to the situation before the Solana chain went online, the ratio has basically been adjusting in one direction since the Solana chain went online. I think the reason for the relative wealth distribution that capital moved from initially being 100% Ethereum to now being about 80% Ethereum and 20% Solana is obviously because of the actual user experience.

I think it took a long time for people to come to two conclusions. One, go use Solana, there are enough NFTs there, enough assets, enough stuff to play with that it makes it worth getting up, setting up a wallet and getting started. Everyone has different thresholds for experimentation and different motivations for doing these things. Second, it was finally clear that the experience on one platform was significantly better than the other.

Then look at the roadmap of Ethereum. Although we can see that Ethereum has many advantages, we cannot understand how it can compete with Solana in the actual user experience. I think over the past four years, more and more people have realized this at various points.

Ryan: As for Bitcoin, obviously different rules apply. I'm not sure how many users are actually using the Bitcoin chain or Bitcoin wallets, but the experience is clearly not great. But people buy Bitcoin for other reasons.

Kyle: Yes, Bitcoin is something special. While I don't agree with it intellectually, I understand why socially it is special.

We can delve deeper into Bitcoin’s Layer 2 issues, which I think are interesting and do have some impact. But I don't see how any Layer 2 solution for Bitcoin can compete with Solana or Ethereum in the long term.

David: This is a discussion about Layer 2 interoperability issues. Do you know which of these is probably the second issue that has the biggest impact on overall price lag?

Kyle: I think the second issue is that of data availability (DA) as a value capture mechanism, or you might express it as L2 capturing value instead of L1, or even a "parasitic" issue. I have publicly stated many times that I believe L2 is harmful to L1, and I still stand by this view. We use software every day. If you're listening to this podcast, you're obviously using an iPhone or a computer or some other software. The actual experience that each of us uses software every day is that the marginal cost of software is almost zero. Software is free, beautiful, and accessible. This is the economic revolution of software - the marginal cost of software is zero - we All understand this instinctively.

Then the blockchain appeared, and we discovered that due to the scarcity of throughput, there cannot be marginally free software, there must be a fee market. This was obviously a financial necessity in the earliest days, especially when expansion kit sex was absolutely terrible. Bitcoin can only handle about 4 transactions per second, L1 is probably around 7. So given that the V1 versions of these systems were extremely technically inefficient, this was a given at the time.

Today, obviously we have not reached some theoretical perfection, transaction costs still exist, but transaction costs are clearly approaching zero. And the whole point of L2 is "it's cheaper than L1", which is obviously approaching zero. I think from a valuation perspective, I would model transaction costs as zero. Obviously today on Solana, Sui, Aptos, ETH or other L2, transaction costs are not zero. But from a valuation perspective, the intellectually conservative approach is to model it as zero, because that's the history of software, and the experience of using software every day is that the marginal cost of software is zero.

Comparison of Ethereum Call Data cost and EIP-4844 post-blob cost, data source: Dune

Therefore, I don't think Execution or DA are valuable in this context. Maybe I'm exaggerating a little, costs may not necessarily drop completely to zero, but they are asymptotically getting closer to zero. Whatever the cost is, being close to zero means it is financially negligible.

If you are a market maker, you need to know how much gas fees are paid on your balance sheet, and that's okay. But for Solana and ETH holders and the valuation models for these assets, the conservative assumption is to model transaction costs as zero.

The only input that has a fundamental impact on valuation is MEV (Maximum Extractable Value). MEV is nothing more than a function of entropy in financial markets, which is always present in financial markets. The more assets you own, the more assets you trade, the more entropy and MEV you have, and this will always be true. Obviously, there are ways to mitigate the impact of MEV, and depending on the system design, you can direct the value capture of MEV to different places. Today, in the fields of Ethereum and Solana, many people are studying these issues.

But MEV will always be there, and I think MEV is the only value driver for L1 or L2 assets. Ethereum's L2 centralization roadmap very clearly abandons MEV.

You might say that a Rollup-based solution would solve the problem. I don't fully understand how Rollup-based works, but from a path dependency perspective, I think it's unlikely to be implemented. Because now we have these large Layer 2 teams that have raised a lot of money, have resources, brands and assets, and they are attracting customers, whether it's Base, Arbitrum or other teams. It is unlikely that they will give back MEV (Maximum Extractable Value) to Ethereum L1. Therefore, even if the Ethereum Foundation has launched a Rollup-based solution and provided some excellent libraries and called on everyone to use these Rollups, the leading teams currently building L2 will not choose to join this solution because it will destroy their own income. So to answer your valuation question, this is the core.

David: Exactly, I don't think anyone can deny the cash flow that's flowing into places like Arbitrum's treasury or Optimism Collective. We discuss the revenue Coinbase makes from Base at least once a month in our weekly newsletter. As to whether these revenues were "stolen" from Ethereum L1, this may be a question worth discussing. ETH bulls may explain it this way: We are creating induced demand. For these Layer 2, this is newly created economic activity, and Ethereum cannot capture this value. But there is undoubtedly a one-way flow.

ETH bulls may think that we have Base, Arbitrum, Optimism, and soon we will have all ZK EVMs, such as Polygon and ZK Sync. Eventually Ethereum will become a "blockchain of blockchains" and generate A lot of entropy. If you look at Optimism and Arbitrum, they may be fragmented, but they are still growing revenue and have positive cash flow. Simply by generating this network, ETH has value. This may be a simplified version of Ethereum's argument, although it is not perfectly expressed, but how would you refute it? Or do you disagree with this idea?

How does L2 suck ETH?

Kyle: Yeah, first of all, you're not capturing MEV. MEV flows to all L2s, and that's my fundamental problem. I think transaction costs will eventually drop to zero. What are Ethereum transactions? About 50 bytes of data? 100 bytes of data? Judging from the price you can buy a 1TB drive, this is almost a rounding error, close to zero. Yes, you have a 1000x or even 10,000x replication factor on the network, but it doesn't matter because the cost is still close to zero. So I don't see how transaction fees support $300 billion in asset value.

The common answer is "ETH is money," and I'd say, okay, but you're not telling me that it's something special, like Bitcoin is. While this argument is not entirely self-consistent, the problem is that there is enough social consensus that Bitcoin is something special, while Ethereum faces competition. Solana, Aptos, Sui, etc. are all saying, “Look, my system is better.” You may not agree that they are better, but the problem is that there are enough other systems out there that explicitly reject “ETH is a This framework exists in particular because these systems are functionally equivalent. This proves that ETH is not a special existence. I don't think anyone thinks ETH is a special entity like Bitcoin.

David: I was going to mention the theory developed by Polenya, which is that all execution will be moved to Layer 2, and then ETH will become the unit of account in all these Layer 2s. Even if the value capture of Ethereum L1 is not high, the value of the unit of account still exists as currency. They would say money is the greatest value. But we've been talking about this for 20 minutes and you clearly don't accept this valuation. So are you opposed to a Rollup-centric roadmap as an architecture?

False proposition of Rollup-Centric?

Kyle: People can use Rollup, and Rollup may indeed have its uses, and the most obvious use may be on PerpDex (perpetual contract decentralized exchange). So I'm not fundamentally opposed to their existence. There may be some very specific applications that take advantage of them intelligently. Whether this is the case remains to be seen. To me, the most obvious category is PerpDex. So they may exist. But betting all-in on a Rollup-centric Ethereum roadmap, and specifically making a series of design decisions to abandon extension suite L1 and push activity to L2, I think is a catastrophically wrong decision.

We don’t know if the Ethereum Foundation will try to retract this decision or try to reverse the direction slightly, now that the issue is obviously being discussed in the public eye.

But even assuming they take relatively aggressive steps and really try to turn things around and say, "Come back to L1 and we're going to fix all these problems," I think the ship has sailed away from the dock anyway. Now these other teams have a clear incentive mechanism. If the Ethereum Foundation says "come back to L1, the L2 roadmap is no longer implemented", then all L2 teams will now directly compete with L1. At present, they may still pretend to be in peace, such as "ETH is our common goal" and so on, but I always think this is nonsense, and I don't think this is true. But indeed, they are still pretending to be friendly. If L1 were to regain lost ground, that semblance of harmony would disappear.

Ryan: Kyle, I just want to summarize your point, and from my perspective, what you're saying is internally consistent. You're basically saying that Ethereum L1 outsourced all MEV and execution to L2, and that was a bad decision.

Kyle: Yes, sorry, I want to add an important point, not just MEV, but also state. The source of MEV is state, and state is directly linked to fungible assets. This includes stablecoins, Aave, ETH, as well as NFTs, liquidity provider positions, lending, and more.

Ryan: The state of Ethereum, especially the execution state, is clearly leaving L1 and moving to L2. This includes smart contracts and assets, all of which are sources of MEV. Ethereum outsources these to Layer 2, which is a wrong decision because if you think of these assets as cash flow assets, all the value comes from block ordering, which is MEV and execution. So the core of this game is which chain can obtain the most status to extract "rent", that is, MEV, and give it back to asset holders. This is what makes an asset valuable. Ethereum woke up one day and decided to hand over this "money tree" to other chains. This seems to you to be a bad decision.

Even though they're trying to turn things around now and Ethereum decides "we did the L2 thing, now we're going to bring execution back to mainnet, we're going to embed some ZK EVM and stuff like that." Your point is, now you've empowered the other The chain has enough power that they actually don't want this to happen, and they form an adversarial relationship with L1. So this is going to be a difficult problem to solve. Then again, this is not something on the short-term roadmap. And you don't believe that ETH is a currency, you don't believe that any asset has a currency premium, whether it's gold, crypto or anything else, you won't accept the ETH bulls' argument that Ethereum has given up on this temporary cash flow position , in exchange for the status of a currency unit in the Ethereum economy. So what is the Ethereum economy?

are all these Layer 2s, and ETH as an asset will have a special status in these Layer 2s because they must pay settlement fees and DA fees in ETH. In other words, it's like a tax. This is the only neutral currency that is decentralized in these systems, so it will be elevated to the position of receiving a currency premium. You think this is all bullshit because there is no such thing as a store of value or monetary premium. Is my understanding correct?

Kyle: Yeah, and just to add to that, currency is what you use to buy coffee. If you ask an ordinary person, what is currency? Forget all the intellectual explanations of “unit of account,” “medium of exchange,” and “store of value,” they say, “I don’t know, when I go to the coffee shop and buy my coffee, it’s currency.” In this very basic In the sense that ETH will never be a currency because ETH fluctuates relative to the US dollar. If we were talking about a world where the dollar no longer existed, I would say, "Well, that's a different world." You can talk about the state of that world, but I'm not interested in that world and I don't want to live in it. in that world. I think we would have a lot of big problems in that world.

ETH is not a currency, assuming at least USD exists. It is psychologically incongruous for ordinary people to measure their daily living expenses with an asset that fluctuates relative to the asset in which they consider their wealth (the U.S. dollar) to be denominated. This is actually further entrenched in long-term contracts, where the liability is measured in a fixed unit of account. The existence of long-term contracts actually creates a currency network effect. This is why we see efforts like China’s attempt to denominated oil contracts in yuan.

Daily living expenses, especially major commodity inputs, are not denominated in ETH, which means that even if you choose to say that ETH is the currency, denominating your wealth in ETH is not correct from a financial perspective. Because you are ignoring all the other realities going on around you.

David: So I think the two topics we have discussed, the first is the issue of Layer 2 interoperability, that is, the actual user experience; the second is that Layer 2 does not belong to Ethereum, they are not for ETH Contributing to value capture, these two topics actually go well together as they relate to user perception and investor valuation respectively. When you combine these two factors, how much of the overall story do you think they explain? I also listed four other factors, but if we just talk about these two, do you think they explain 80% of the ETH price lag over the past two years? What proportion do you think these two factors account for?

Kyle: Yeah, between 80% and 90%, those two variables probably explain that much. This sounds about right.

David: Okay, Kyle, I want to give you a simulation. All your assets magically turn into ETH. The only thing you hold now is ETH. This is not a dream, but a nightmare. What will you do next? What changes would you like to see happen to Ethereum’s roadmap? How do you hope the future trajectory of Ethereum changes?

David: Wait, Kyle, are your assets locked in this simulation? Do you have to hold them?

Ryan: Yeah, he's locked up and can't be sold. You can't sell, Kyle, with ten years of lock-in.

Kyle: In that case, I would ask Vitalik to retake the role of "benevolent dictator" and try to establish an interoperability standard and find a way to get all L2 teams to agree on a common interoperability standard. This will be the primary goal. And then I would-- No, I take that back, that's not true. I will find a way to expand kit L1. I don't know how Vitalik and the Ethereum Foundation core team will handle this issue technically, and I won't give them a technical prescription here because they know more about it technically than I do. But I would tell them, figure it out, you need to fix this now.

And then I would tell them, go talk to your customers. Mark Zeller seems to have been on the Bell Curve Podcast recently, I just listened to it yesterday. He said in the podcast that he never spoke to anyone from the Ethereum Foundation, never spoke to Vitalik, and they never contacted him. Today, he is the person who mainly manages Aave, and Aave is the largest application on Ethereum. Calculated based on the total amount of funds in the system, it has about 20 billion US dollars in TVL, which is a very huge number. I find this completely incredible. How can the core people who are supposed to be building the future of Ethereum do it without communicating with the core users?

In my opinion, Aave and Uniswap are the two most important projects. The Solana Foundation has very obvious teams, such as the DeFi team, the decentralized infrastructure team and the stablecoin team. They have a clear division of labor in designing interfaces with various stakeholder groups. They listen and determine what needs to be built. You can see very clearly that the token expansion suites and other things launched by these functional teams are a direct reflection of the achievements of the Solana Foundation. So I would tell the Ethereum Foundation, go talk to your customers, listen to them, figure out what they want.

I can definitely say that if you did this in 2020, Aave would say, "Wait a minute, are you going to have 10, 20, 50 Aave instances? Are they going to have their own separate collateral pools? That will Very weird and confusing. "If you tell Uniswap, they will say: "Wait, I will have an ETH/USDC XYK curve, but I will have 50 of these curves instead of one."

They may say: "What are you talking about? This is not good." Maybe you will eventually choose to follow the L2 roadmap, I don't know, but I can tell you very objectively, from the perspective of these two applications, They may feel this is detrimental to their app functionality. Now, you can choose to ignore their opinion, but the thing is, that interaction isn't even happening, and I think that's a very serious problem.

The secret to value capture

Decentralized finance vs open finance

Ryan: Kyle, I think there's a key reason behind this, and maybe I'd love to hear your take on it, and that's the word "decentralization." I totally agree, it's a highly emotive word and sometimes comes with a bit of a "purity test". However, it is not a useless word because it does have some functionality in terms of maintaining censorship resistance, inflation resistance, or some kind of corruption resistance. These are the really valuable properties that I think derive from the concept of "decentralization."

If you talk to an Ethereum backer or the Ethereum Foundation about the decisions they made when choosing a Rollup-centric roadmap, their answer will be related to "decentralization." They will say that we are trying to maintain a decentralized set of validators and not let the node requirements become too large. Tasks such as execution and status are very heavy, so we have to outsource these tasks to Layer 2 and have them use Ethereum as the data availability layer. We all know how it got to where we are today.

When we discussed Bitcoin previously, you described use cases for blockchain, and Ethereum has promised a similar world. I remember when I was chatting with David, one of the phrases that popped into my head was, “Kyle believes a lot in open finance, but I’m not sure he believes in decentralized finance.” I mean, we were talking about an open finance A world of financial APIs where all applications and underlying units can communicate with each other, but I'm not sure if the world you describe is decentralized and has the kind of embedded property rights that Bitcoin holders describe, It cannot be censored or taken away by the state. I think what you're describing is more like a "NASDAQ + all traditional finance" world, with a permissionless API that anyone can connect to.

So I feel like there might be some differences in vision here, but I'd like to hear your response to that line of thinking. What do you think about the decentralization embedded in Ethereum and the concept of decentralized finance (DeFi)? What are your thoughts on true decentralized finance and open finance?

DeFi, fiat currency and inflation

Kyle: I agree with your basic diagnosis that this is a difference in values. Both Ethereum and Bitcoin have a set of values. Bitcoin has many promises, such as censorship resistance, transaction inclusion, etc., but the core promise of Bitcoin is the fixed supply of 21 million. If you were to sum up Bitcoin in one word, it would be 21 million. Bitcoin clearly provides the strongest guarantee of future money supply and inflation policy. If you put it in quantitative terms, Bitcoin provides close to 100% certainty of future supply plans. Of course, it cannot reach 100%, because the system may have loopholes or some unexpected situations may occur, but we can say that it provides a very high degree of certainty.

Bitcoin provides a stronger guarantee of certainty of supply schedule than any asset in human history, including gold, because we don’t know how much gold is in reserve on Earth or whether we will ever mine it from an asteroid. Therefore, Bitcoin offers a higher guarantee on supply schedule than any other asset, and this promise is very clear.

Left: Growth trend of gold supply to M2, source from Vaulted;

Right: BTC supply growth trend, picture source from newhedge

However, I take issue with this because I don't think optimizing to near 100% supply plan guarantee is necessary. Each additional nine of certainty you provide is 10 times less important than the previous nine because you are asymptotically approaching 100%. I don't know whether the correct answer is two nines, three nines, or four nines, and I don't care.

I think both Ethereum and Solana today provide certainty about future supply plans between two nines and four nines. Yes, Ethereum probably offers higher certainty of future inflation, given the burning mechanism and other factors, although you can't be sure of what's going on on the other side, but if we ignore the burning part and just talk about the inflation part, Ethereum May provide higher guarantees than Solana. I agree with this statement. I think they're all between two nines and four nines, which I think is enough. It is not necessary to re-optimize the supply plan guarantee, which is the wrong optimization direction.

A basic level of certainty is indeed needed, otherwise we will return to the state of fiat currency, and printing money at will is obviously a bad situation. We have to put all of this into the context of values. The value of Bitcoin is clear. Ethereum and Solana, I think, are also within this range, two "nine" to four "nine". The next question is, besides supply planning, what are the core values? It seems that the core value driving Ethereum is decentralization of the validator set. If you wanted to sum it up in one word, you might call it "independent mortgage" or "family mortgage" or something like that. I'm not sure if this is entirely correct, but from what I understand it's probably a fair description.

Ryan: I might also add that features related to this might be things like censorship resistance and invalid state changes.

Kyle: Of course, censorship resistance and invalid state changes are mechanically very different. L2 today is apparently a single entity controlling all censorship, and while they may change that to see if they can figure out decentralized clusters of sequencers, etc., as of today L2 is clearly an N-to-1 structure. I don't want to get bogged down in these semantic details, my point is that it looks like Ethereum's core value proposition is to maximize the number of nodes, and this includes home staking for L1 chain verification. This is a value that can be optimized. If your goal is to win, I think this is the wrong value to optimize for.

At the core of these systems are financial systems. From day one, we’ve been building decentralized NASDAQ, where we build the best, most permissionless, most accessible financial market in the world. A by-product is that you can also make payments, because what are financial markets? It is like a transaction consisting of two atomic payments. So payments are implicitly included in financial markets that are accessible to everyone around the world.

Solana was designed with the very clear intention of becoming the world's largest global financial exchange, offering permissionless access and cryptographically secured asset ownership. These are two different values. One is about the set of validators, which might provide some guarantees, possibly about censorship resistance, although that's not the case given the L2 roadmap. Probably about guarantees of efficient state transfers, which is fundamentally and correctly rooted in the goal of increasing the number of validators.

The other is our goal to build the best atomic state machine so that everything in all financial markets works magically in a single state. So, one is a user-centered functional perspective, focusing on what users want or what we think they might want; the other is a more abstract concept of censorship resistance and state transition effectiveness.

The last thing I want to say is that Bitcoin provides the so-called "nine nines" certainty of future supply plans, which I think is unnecessary. You can say that Ethereum is optimizing the so-called "nine nines" state transition validity guarantee. It's an intellectual and academic way of thinking about the world, but I think it's the wrong way.

The point is that the most important actor relevant to the validity of any chain's state is the centralized entity that interacts with the chain.

A bridge between stablecoin issuers and CEX

Mainly stablecoin issuers and centralized exchanges, because they are entities that accept user deposits, credit user accounts, and then allow users to withdraw fiat currency or other off-chain assets. So these entities occupy a very important position in the operation of these systems, because the traditional fiat currency system will still exist for a while. Maybe not 50 years, but at least for the foreseeable future, like at least 5 years, maybe 10 years, maybe even 20 years, maybe even longer, these systems will be around. And most of the world's wealth will still be denominated in these systems. We have this cryptocurrency thing and obviously cryptocurrencies are growing. And the bridges that connect these two things are very important, and the two most important stakeholder groups are stablecoin issuers and CeFi exchanges that obviously provide these bridges.

Coinbase execution nodes are there to accept your deposits and ultimately allow you to withdraw USD to your bank account; or Circle execution nodes are there to accept stablecoins and if you want to exchange the stablecoins for USD, they will send the USD to you. Coinbase and Circle don't care how many other nodes exist, they only care about how the state of their local nodes behaves in the consensus. The business logic of all these organizations is clear. They have some Web2 database that records everything, and then they say, "Wait a minute, what does my local blockchain node tell me about the state of the Solana network, or the Ethereum network, or the Arbitrum network?" They use those Information to determine what assets will be entered and exited.

Of course, they care about consensus because the state needs to be updated, so you do care about the 2/3 threshold to get consensus finality, but once you get consensus finality, they don't care if there's one other person, or five people, or five thousand, five Millions of people agree with them, as long as they know they are at the tip of the chain, and that these people are the actual bridge to the real world.

So I think optimizing my ability to know where I'm at at home is the wrong variable to go in, especially given the need for a bridge back to traditional finance.

David: Kyle, I remember I went to the Solana Breakpoint event in Amsterdam not long ago. It was the first time I got to know the Solana community deeply and saw what a Solana developer was like. One of the most interesting things this crypto industry has to offer is getting to know the prototypes of these different cryptocurrency tribes, such as the Bitcoin community, the Ethereum community, and now the Solana community. The Solana developers are more business oriented, they understand their customers and communicate with their customers, and as you said, they do a really good job at that.

However, developers on Ethereum, such as Rune Christensen, for example, part of the "Endgame" of the new path he proposed for MakerDAO is to launch a new blockchain and tend to be centralized.