Just two days into the month, there have been no signs of a rebound for XRP as the broader market struggles to find its footing. XRP has trailed in showcasing an impressive price outlook in the past few weeks, and at the moment, its price is at $0.5698, up 0.92% in 24 hours but still down 6.91% over the trailing seven-day period.

Historical outlook for XRP, What to expect

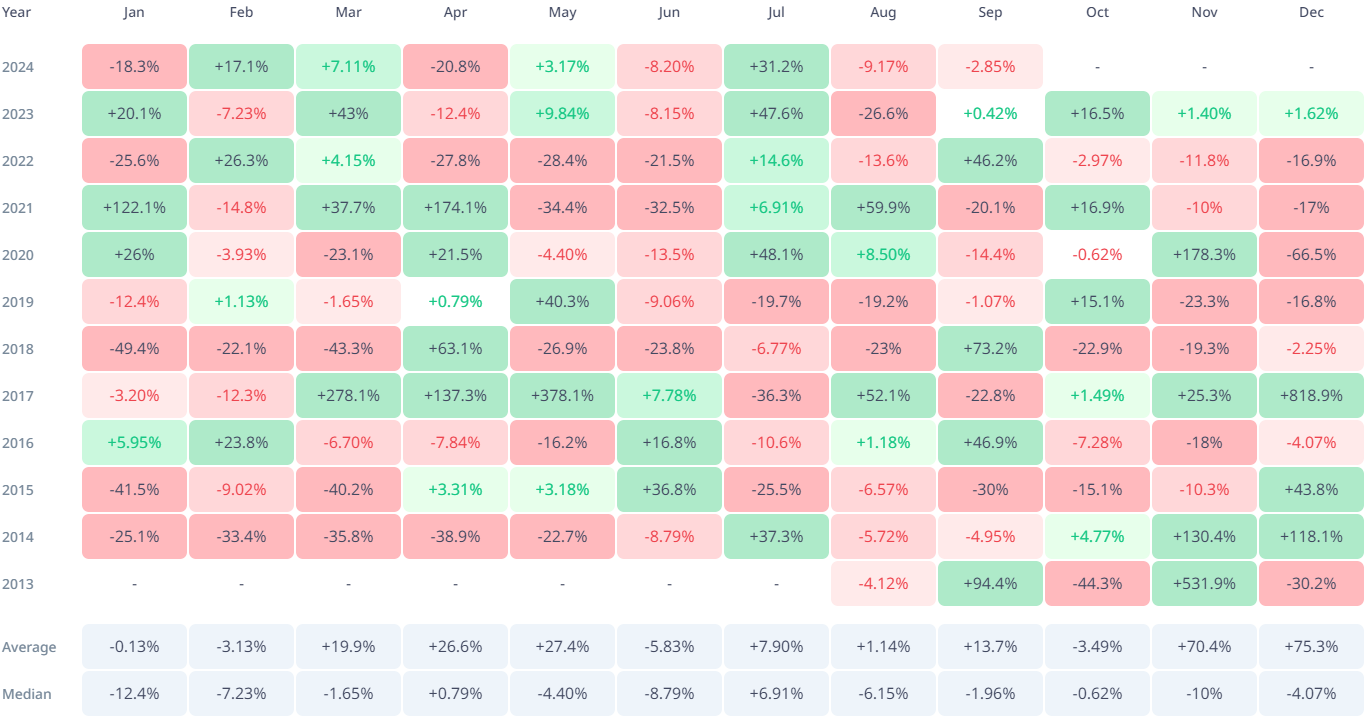

According to data from Cryptorank, XRP has recorded a 2.88% fall this month. While September's performance remains mixed, the coin has recorded higher percentage growth rates than sell-offs.

XRP’s biggest September jump was recorded in 2013, when it grew by 94.4%. While it has not recorded such a massive leap in recent times, in 2016, 2018 and 2022, the price of XRP rallied 46.9%, 73.2% and 46.2%, respectively.

The actual price history of XRP also involves some intense sell-offs. For instance, a more than 20% slump was recorded in 2017 and 2021. However, when collated, the coin had an average positive growth rate of 13.7% in September.

If this trend continues, XRP may rebound from its current bearish setup to at least a 13% surge.

Can Ripple's ecosystem aid rebound?

It is not debatable that XRP's growth is tied to the blockchain payments firm Ripple Labs Inc. First, the lawsuit that engulfed the firm for more than three years caused XRP to lose out on the past few bullish cycles on the market.

Now that the case is assumed over with the $125 million penalty payment, stakeholders are focused on what the firm has in store to boost the coin's attractiveness and demand. Beyond injecting liquidity onto the market through its escrow releases, developing the XRP Ledger and expanding the XRP-linked DeFi offering might boost the asset's price.

While there are signs that point to XRP’s bullish traits, investors would like to see the coin form sustained support around $0.60 in the short term.