After Bitcoin dropped to a low of $57,116 early yesterday morning, it started a wave of shock and rebound. It reached a maximum of nearly $59,500 after 7 o'clock this morning (3rd), and returned to the transaction-intensive area of the past month. It was trading at $59,379 at the time of writing in the past 24 hours. up 3.44%.

Since the U.S. market did not open last night on Labor Day, it is expected that there will be greater fluctuations at the opening tonight. Can the current resistance be successfully transformed into support? It still takes time to continue to observe, but if it falls further, it cannot be ruled out that it will test $54,500.

Ethereum returns to $2,500

The trend of Ethereum is slightly stronger, reaching a maximum of US$2,565 this morning and currently trading at US$2,533 at the time of writing, up 4.34% in the past 24 hours.

The entire network liquidated $77.75 million in the past 24 hours

Under Bitcoin's narrow range of fluctuations, the liquidation data is relatively flat. According to data from Coinglass, in the past 24 hours, the entire cryptocurrency contract liquidation amount was approximately US$77.75 million, and a total of more than 32,000 people were liquidated.

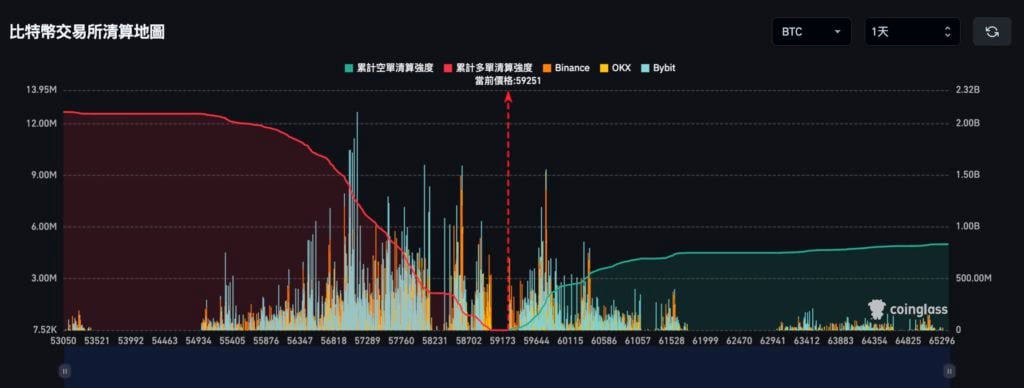

BTC liquidation map

In addition, according to the Coinglass liquidation map: Bitcoin within the community has a liquidation intensity of US$320 million at US$58,500, and a liquidation intensity of approximately US$320 million at US$59,800. It is difficult to judge which direction the main force will move.

However, when the price reached US$57,000, mainstream centralized exchanges such as Binance, OKX, Bybit, etc. accumulated multi-order liquidation intensity of up to US$1.4 billion. It can be seen that investors in the exchanges still seem to prefer long positions. .