Solana [SOL] is in a bearish pennant pattern on higher timeframes and the price is expected to consolidate in a tight range for the next 4-6 weeks. This expectation seems to be coming true.

Once again, the coin is heading towards range lows, but the price could bounce back in the short term. Bitcoin [BTC] liquidity is expected to increase in the near term, which could help SOL bulls.

A Closer Look at the Current Market

Solana (SOL) has been a major player in the cryptocurrency space, known for its high transaction speeds and strong community support. However, the last few months have not been smooth for Solana (SOL). The once high-flying coin has been stuck in a consolidation phase with high price volatility. In September, Solana (SOL) is expected to continue this trend and remain below $160 as market conditions remain bearish.

The $122 to $187 range structure is still in play, with the range low yet to be breached. The OBV has been steadily declining over the past ten days, indicating strong selling pressure.

Solana is down 21.7% since August 25, but opened on a positive note on Monday, up 2.58% at press time. However, OBV is near local lows, a worrying sign that SOL bulls lack strength.

The RSI on the daily chart is also at 38, which suggests strong downside momentum. A move back towards the $120 area could present a buying opportunity, but traders and investors must be careful. A deeper price correction could be brewing.

Despite early optimism for Solana (SOL), the coin has now suffered massive outflows from institutional investors, with large wallet holders steadily withdrawing funds throughout August. By the end of the month, Solana (SOL) had seen $34.3 million in outflows, making it one of the least favored cryptocurrencies among institutional investors during this time.

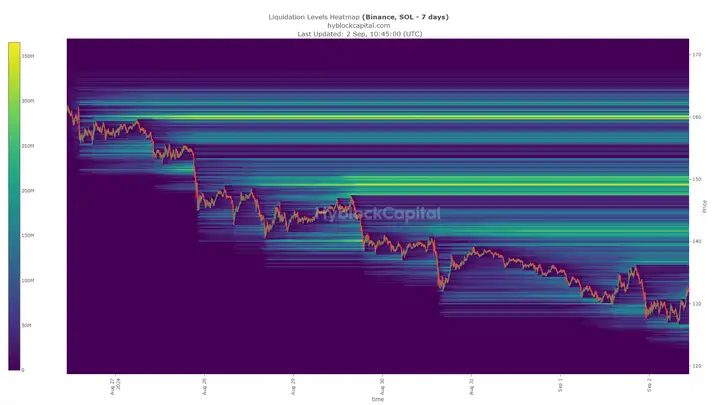

Do magnetic zones drive up prices?

Liquidation levels north of $140 and $150 could attract price gains in the short term, especially if Bitcoin embarks on a liquidity run in the coming hours.

However, this is not guaranteed, and a small liquidation level has also been established at $126. This means that if the overall market sentiment continues its bearish trend, Solana could face more volatility and fall to $126 again or even lower.

Solana’s (SOL) Recovery Potential

The withdrawal of institutional funds has put additional pressure on SOL, which is already struggling with high volatility. SOL may underperform in the coming months and may even lag behind Ethereum (ETH), which is also facing a series of challenges.

SOL has not yet been fully integrated into the portfolios of traditional market investors, which may limit its ability to maintain liquidity compared to more established cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH). Reduced liquidity makes it more susceptible to market fluctuations, further increasing its volatility.

But despite the current bearish outlook, there are still scenarios where Solana (SOL) could rebound. For instance, if it can break above the $160 resistance, a rally to $169 or even higher is possible. However, the broader consolidation area between $126 and $186 might prevent any major breakout in the short term.

The potential for a Solana (SOL) spot ETF, while still speculative, could also provide a much-needed boost to the token price. However, this is not expected to materialize in the near term, so the near-term outlook for Solana (SOL) remains uncertain.

In simple terms

The liquidity of Bitcoin is expected to stimulate the price of Solana. And the local high of $160 is a strong magnetic area, which may attract price increases in the short term. Technical indicators in the short term support the bearish outlook of SOL, and the upside potential is limited. In the long run, the market is currently in a correction phase. Under factors such as the low liquidity of SOL and the lack of strength of long positions, SOL is expected to continue to consolidate and accumulate to lay the foundation for subsequent increases.