The trend of the crypto market in August was not friendly. The global asset plunge on August 5 also affected Bitcoin. The price of Bitcoin fell below $50,000 at its lowest point, and then began to fluctuate and rebound. After the Federal Reserve released a signal of a rate cut, it rebounded to a high of $65,000, but it is still hovering around $59,000.

The crypto market is similar to the stock market, with investors hesitating amidst the uncertainty of the macro environment. However, prices do not reflect the real environment of the market. The number of Bitcoin addresses holding at least 10 BTC has declined in 2024. At the beginning of this year, the number of such addresses was about 155,500, and it declined in the first quarter, reaching a low of about 152,600 in late March. This decline runs counter to the price trend of Bitcoin during the same period, reflecting profit-taking by smart money.

For more information, please visit Tuanzi Finance VX: TTZS6308

However, as the price of Bitcoin stabilized around $60,000, the number of addresses holding more than 10 BTC reversed in August and rebounded to 153,500, indicating that some addresses have begun to buy the dips and build positions during the volatility. The US Bitcoin spot ETF also continued to have net inflows.

There is no new narrative in the crypto market itself, so the price trend of Bitcoin is moving closer to the macro environment, and the US economic situation determines the short-term trend of Bitcoin. The US economic situation is not easy to predict, but the huge amount of money released by the US's preventive interest rate cut is likely to make the price of a fixed amount of assets such as Bitcoin go up. After all, inflation cannot be diluted by quantity, so the only way is to get a higher increase than inflation.

However, Ethereum's performance is not as good as Bitcoin. As of the 29th, the US Ethereum spot ETF has experienced net outflows for 9 consecutive days:

At present, the ETH/BTC exchange rate has reached the 0.4 mark, setting a new low since 2021. There are many factors that lead to the continued weakness of Ethereum, among which Grayscale's continued selling is one of the core reasons.

ETH is very suitable for building a position in the second half of this year. After ETH began trading on Nasdaq on July 23 this year, it has been repeating the process of Grayscale selling BTC at the beginning of this year. The selling process may last for half a month to one month until the market can take over Grayscale's selling. Once this critical point is reached, it is a very good time to build a position.

Pay attention to the BTC/ETH exchange rate in the second half of this year. Once Grayscale’s net outflow ends, it will be time to build a position.

Therefore, since encryption is currently tied to the macro, we only need to sit tight and hold on, and reduce operations. At the same time, pay attention to the trend of oversold assets represented by ETH, which often have stronger rebound momentum.

The Fed's interest rate cut decision ignited market enthusiasm and brought positive changes to the cryptocurrency field. With inflation slowing and the job market stabilizing, investor sentiment has shifted from pessimism to optimism, and it is expected that asset prices will rebound strongly after a brief adjustment.

Bitcoin has demonstrated its appeal as a safe-haven asset, and has been increasingly held by institutions even amid volatility, indicating that its value will be further confirmed and enhanced. In particular, as Grayscale's selling of ETH ends, changes in the ETH/BTC exchange rate will become a signal for investors to build positions that cannot be missed. In this wave of monetary easing, the cryptocurrency market, especially Bitcoin and Ethereum, will usher in a new growth cycle.

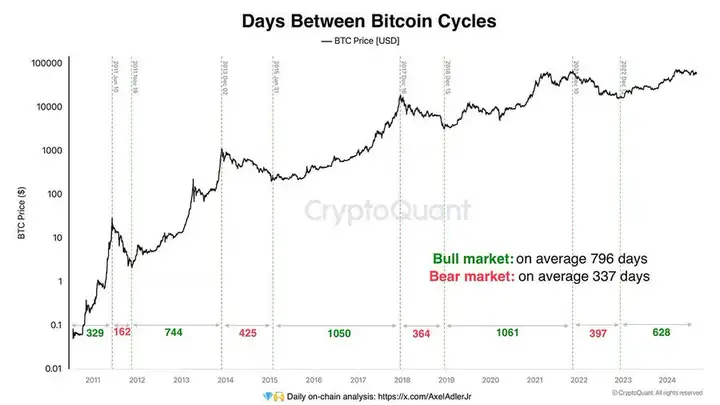

Historically, Bitcoin bull runs last about 796 days, and since the market has yet to reach its typical peak, ongoing corrections could present buying opportunities.

Currently, Bitcoin is struggling to reclaim the $60,000 mark, which is a key psychological level for many investors.

ETFs could become a new buying force in September.

Data from Bitcoin options trading shows a clear concentration of bullish bets on Bitcoin, reaching $90,000 by the end of September. The total open interest in Bitcoin options shows that optimism is growing, with a large number of call options with a strike price of $90,000. This suggests that some traders expect Bitcoin prices to rise sharply.

Looking ahead, December options data also reflects strong bullish sentiment, with many traders betting that Bitcoin could reach $100,000 by the end of the year. The market’s growing confidence in Bitcoin’s fourth quarter performance can be seen in the concentration of open interest at these higher strike prices.

Despite the challenges, there are reasons to be optimistic about Bitcoin’s performance in September.

While the “September effect” suggests Bitcoin could face another difficult month, factors including potential rate cuts, strong support levels, and bullish sentiment in the options market could help Bitcoin reverse its historical trend.

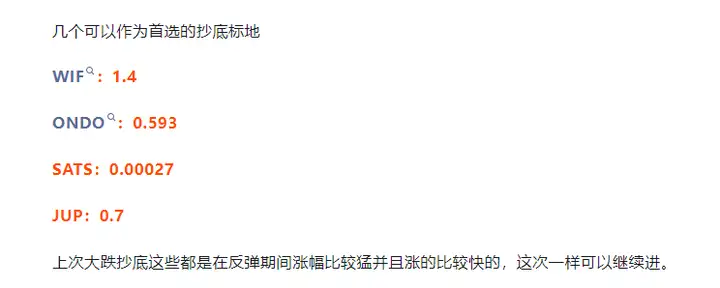

Several coins that were recommended for buy the dips in yesterday’s article also saw good gains today, especially SATS and WIF. Today, we can pay attention to whether Bitcoin can recover from 60,000. If not, we can sell first and buy again when the opportunity arises.

I plan to accept two more one-on-one classes at the end, but I won’t accept any more. To be honest, I can’t handle too many. After all, my energy is limited.

Currently, there are basically no good opportunities for retail investors to get on board BTC. The focus is to lay out high-quality copycats in the later stage and strive to achieve an overall return of no less than 10 times this year.

If you are fully invested or your position is heavy, and you don’t know what to do, you can contact me to help you see if your position needs to be adjusted.