By: DeFi Warhol

Compiled by: TechFlow

I’ve been in the cryptocurrency space for 7 years and right now we are in one of the most bullish market environments I’ve ever seen. Here are 10 factors that could cause Altcoin prices to surge in the coming months:

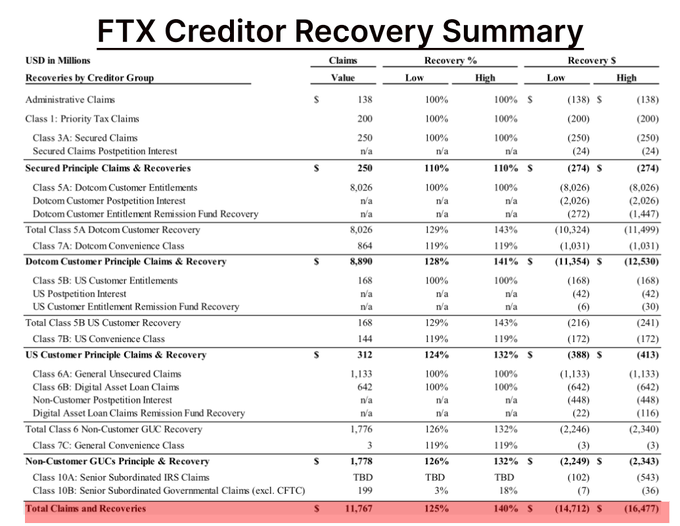

1. FTX’s $16 billion compensation

Recently, FTX is distributing a total of $16 billion, of which $12 billion is in cash. It is expected that many of those who received these funds will reinvest in the market, triggering a new round of buying.

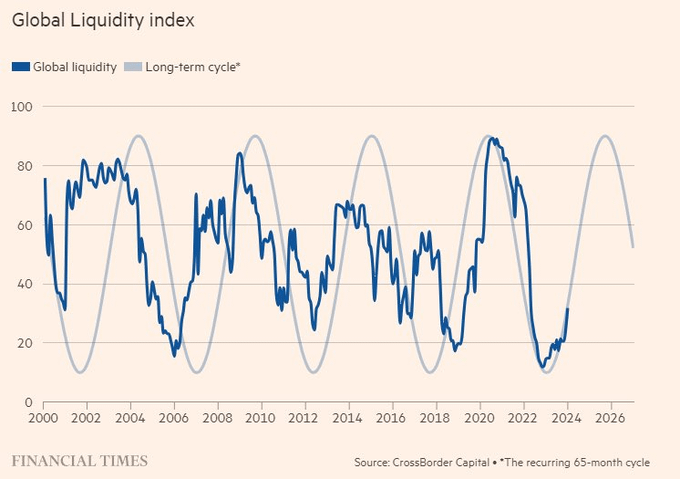

2. Global Liquidity Index

The correlation between the cryptocurrency market and global liquidity is very clear. Whenever this index reaches the current level, the market usually ushered in a strong rebound.

3. Ethereum ETF

Although Ethereum ETFs are currently developing slowly, I firmly believe that they will catch up soon. It is just a matter of time.

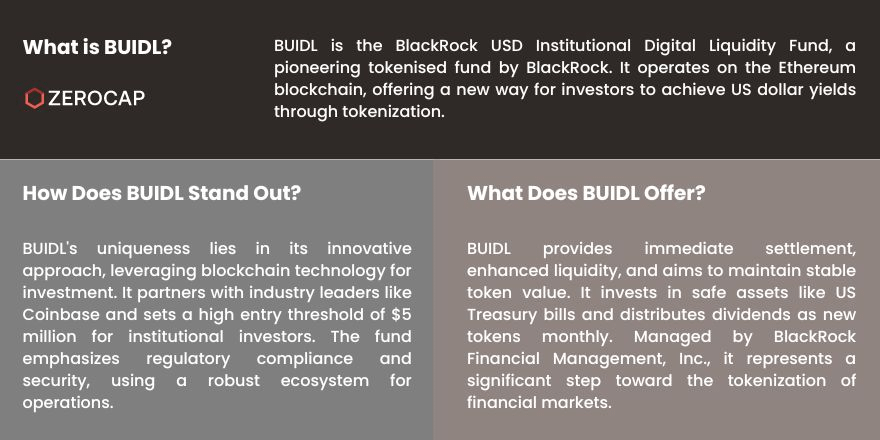

4. BlackRock’s BUILD Fund

In addition to ETFs, BlackRock, the world's largest asset management company, is very optimistic about blockchain technology. The BUILD fund has once again proved this, and this is just the beginning.

5. Goldman Sachs embraces tokenization

Think BlackRock is the only one taking action? Think again. Major institutions have already joined the ranks.

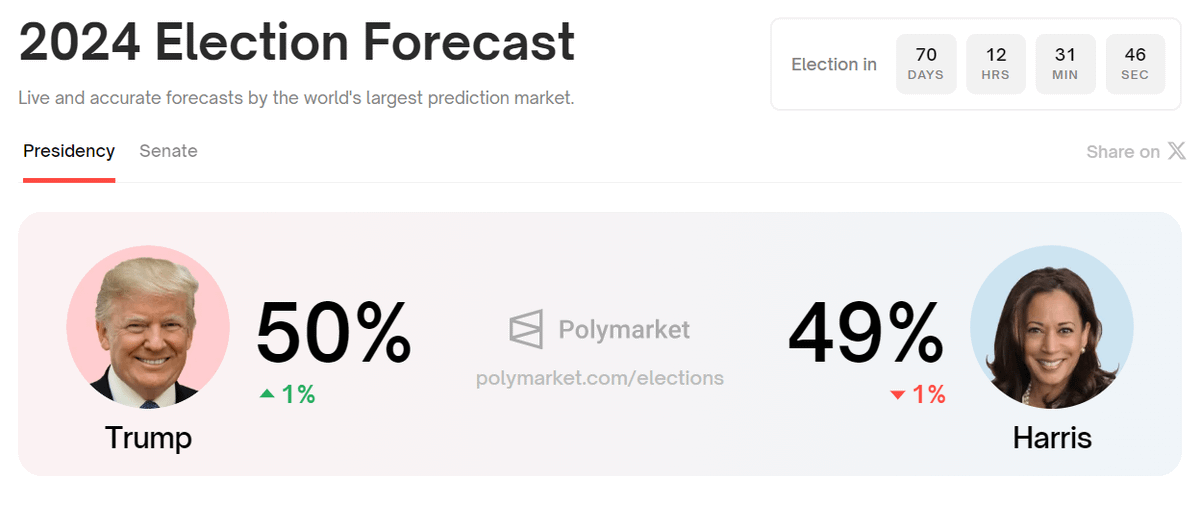

6. US election

Trump’s presidency is a positive for cryptocurrencies as his administration is supportive of the industry. Currently, he is slightly ahead in the race, so it will be worth keeping an eye on.

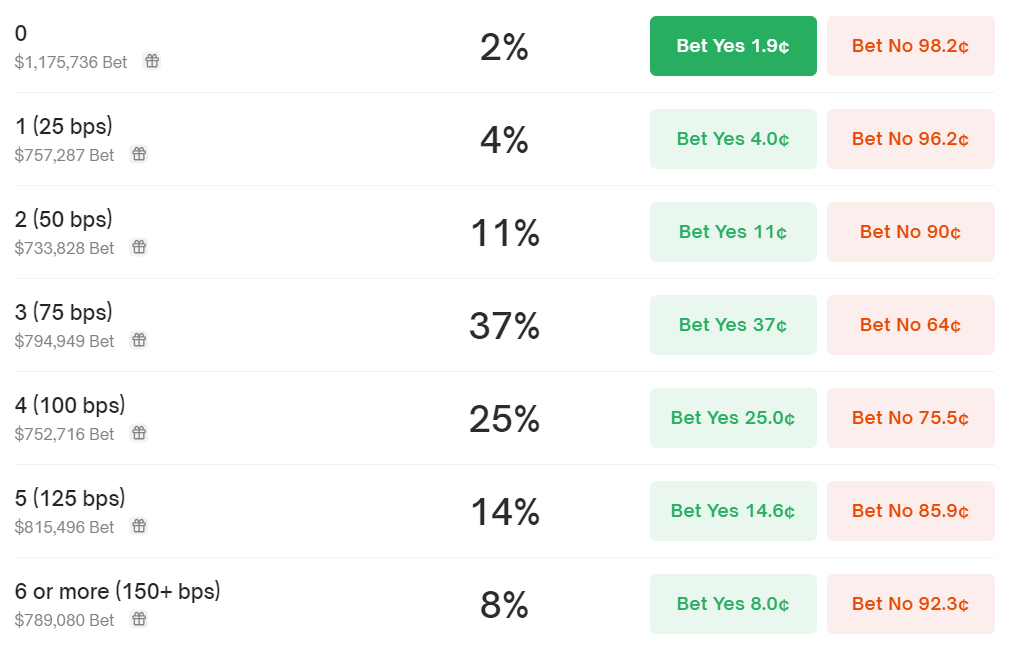

7. Rate cuts

The market currently expects that there may be three interest rate cuts this year, with the probability of a 25 basis point cut in September as high as 90%.

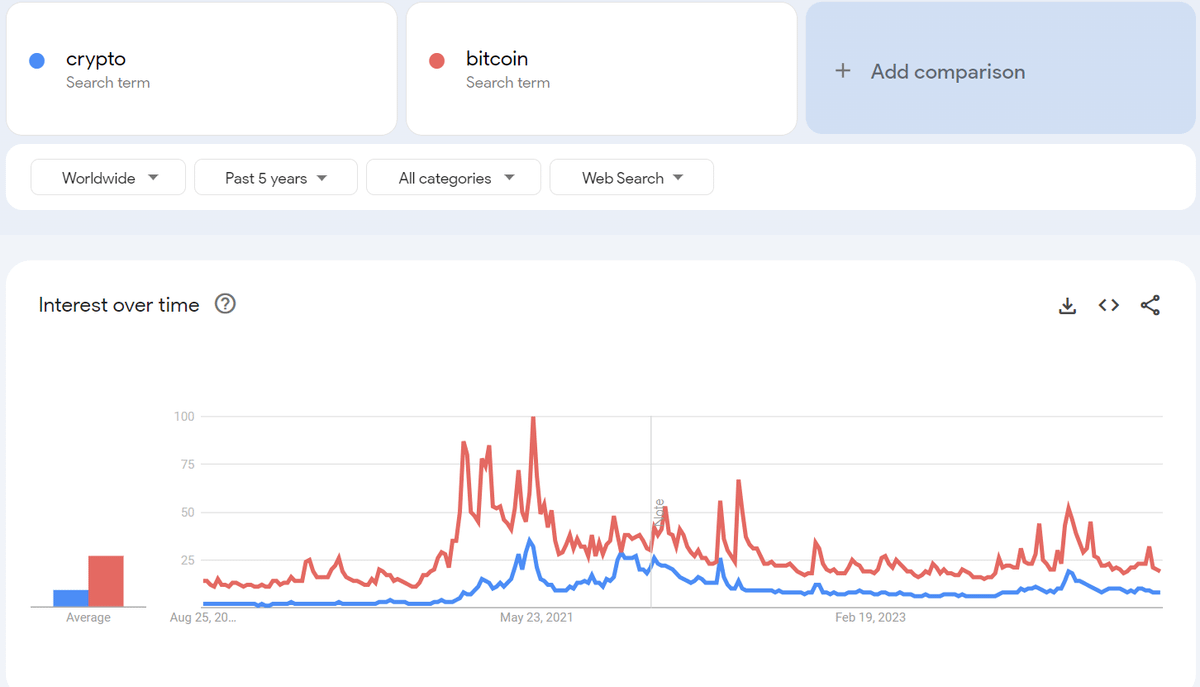

8. Ordinary investors are still on the sidelines

Google searches for “cryptocurrency” and “bitcoin” remain at bear market levels, and the Coinbase app is ranked only 416th.

9. US Dollar Index

DXY has been falling over the past few months and is currently trading at a critical support level. If this support level is breached, it could be extremely bullish for the cryptocurrency.

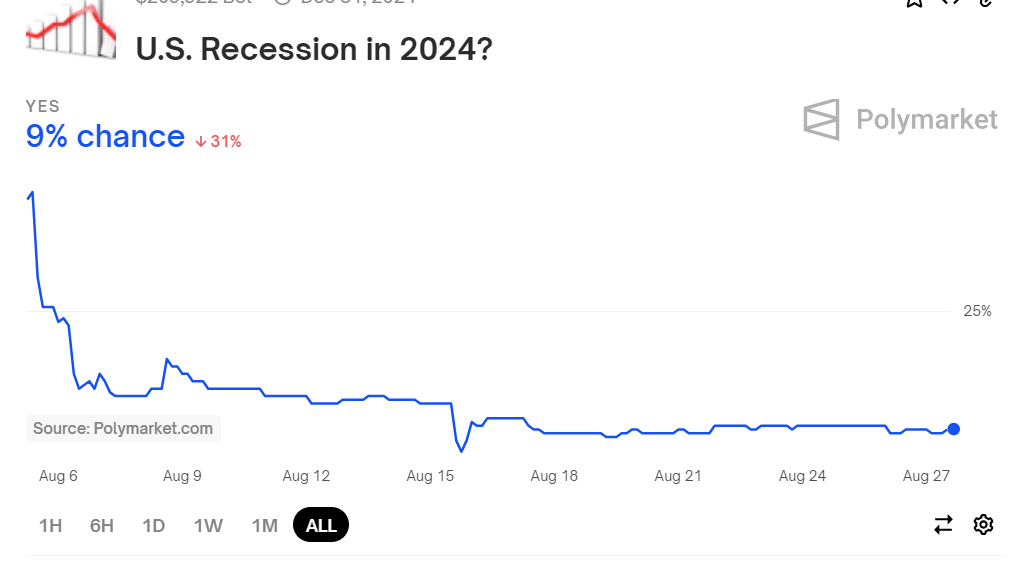

10. Bearish factors are fading

The main reasons for the market sell-off, including the MtGox incident, the German sell-off of Bitcoin, jump trading, recession fears and war, seem to be gradually subsiding and these factors are weakening.