Author: Revc, Jinse Finance

Preface

According to data tracked by Lookonchain, frenulum.eth earned 274 ETH (about $696,700) in 2 days by trading VISTA, with a return rate of 134 times. Frenulum.eth only spent 2.05 ETH (about $5,100) to buy 52,822 VISTA and sold it at 276.5 ETH (about $701,800). At that time, VISTA's 24- hour increase was close to 1,100%.

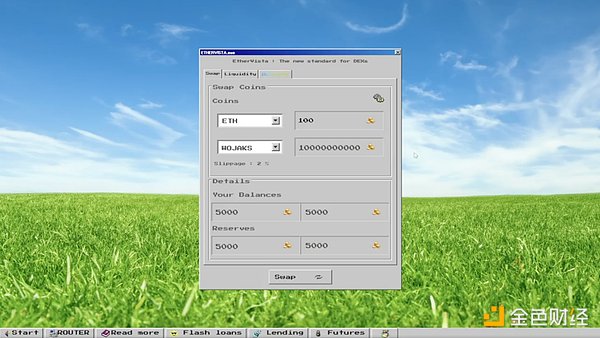

Ethervista is a new decentralized exchange (DEX) protocol that aims to address the shortcomings of the existing AMM model (short-term token price speculation and insufficient liquidity provider incentives). By introducing a custom fee structure and a new reward distribution mechanism, Ethervista seeks to promote the long-term growth and sustainability of blockchain projects.

Ethervista’s mechanism features ( brief version ):

Custom Fees: Ethervista uses a custom fee structure payable only in native ETH, allowing for more flexible fee distribution.

Rewards Distribution: The protocol distributes fees between liquidity providers and token creators based on trading volume, incentivizing long-termism and utility over short-term price action.

Protocol Fees: Part of the fees are allocated to the smart contracts specified by the protocol, thereby supporting various DeFi applications and providing sustainable income for creators.

Liquidity Provider Rewards: Liquidity providers are rewarded based on their contribution to the pool and total trading volume.

Creator capabilities: Creators can configure pool settings, define metadata, and even restrict token transfers.

VISTA Token: Ethervista’s native currency, with a capped supply and deflation mechanism.

Technical Overview:

Euler (Reward Calculation Unit): A series of increasing numbers used to calculate the rewards of liquidity providers based on their contribution and total trading volume.

Fee Distribution: Fees are distributed between liquidity providers and the protocol based on predefined variables.

Protocol Fee Distribution: Protocol fees can be distributed to smart contracts of various DeFi applications.

Ethervista Design Concept

Ethervista uses a custom fee structure that is only paid in native ETH, allowing for more flexible fee distribution. The current AMM standard charges a 0.3% token fee on each swap. The Ethervista standard is the first to set a custom fee that is only paid in native ETH. The fee is distributed to all liquidity providers and token creators in a specific pool, and each swap uses a new mechanism that allows Ethervista to distribute rewards to millions of users with minimal gas costs.

Creator fees are allocated to smart contracts and treasuries as part of the protocol fees. Various use cases include automated purchases, staking rewards, and many other DeFi applications. A key feature of this model is that market makers and creators benefit from trading volume rather than token prices, incentivizing long-term rather than short-term price action. Investors benefit from a delayed liquidity withdrawal mechanism that prevents developers from quickly "running away". This approach not only mitigates the risk of sudden market turmoil, but also increases the overall success rate of their investments. Eventually, Ethervista will move to building ETH-BTC-USDC pools to provide loans, futures, and flash loan without fees, aiming to become an all-in-one decentralized application.

How the Agreement Fees are Allocated

As mentioned before, each swap incurs a native ETH fee that is split between the liquidity providers and the protocol. Each pool must initialize four uint8 fee variables corresponding to the fee splits for buy and sell transactions. These variables correspond to the USDC amounts, with the corresponding ETH fees calculated for each swap using an on-chain oracle. For example, a pool could be initialized with a fee of $10 for buys and $15 for sells. If a user decides to sell his tokens, he now has to pay $15 worth of ETH to the protocol and liquidity providers.

The protocol’s distributed smart contracts can use the fees to increase perpetually locked liquidity, establish an ever-increasing floor price for the token, and provide sustainable income for creators. Liquidity providers can immediately claim their share of the rewards collected by the exchange.

How the Agreement Fee is Calculated

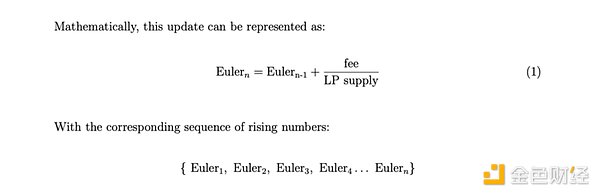

The Ethervista smart contract maintains an ascending sequence of numbers called Euler amounts. These values are updated every time native ETH is transferred into the smart contract. Each Euler amount is determined by adding the previous Euler amount plus the ratio of the fees to the current total supply of liquidity provider tokens (LP). The initial Euler amount is set to zero.

Mathematically, this update can be expressed as:

fee Eulern=Eulern-1+ LP supply

Formula (1) is shown in the figure below, with the corresponding ascending sequence:

Euler, Euler2, Euler3, Euler...Eulern}

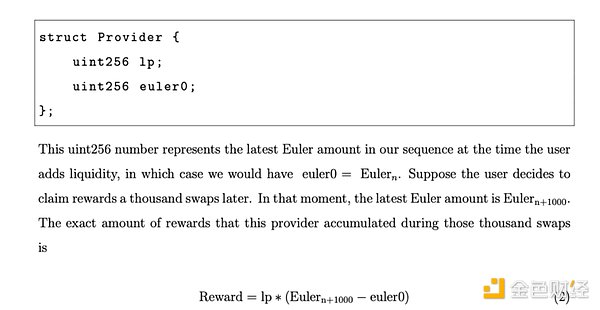

Each provider is represented by a structure that stores each user’s LP holdings and a variable called euler0, which is named after the Euler amount in the sequence.

struct Provider { uint256 1p;

uint256 eulero; };

As shown in the figure, the uint256 number represents the latest Euler amount in the sequence when the user adds liquidity. Suppose the user decides to claim the reward after 1000 exchanges. At that moment, the latest Euler amount is Eulern+1000. The exact amount of rewards accumulated by this provider during this period is Reward lp *(Eulern+1000-euler0).

Formula (2) in the figure above This approach assumes that the LP balance remains unchanged throughout the period. Therefore, whenever the provider takes any action, such as adding/removing liquidity, the variable euler0 will be refreshed to reflect the latest Euler amount in the sequence. This measure prevents liquidity providers from manipulating their own reward share. Therefore, it is recommended that liquidity providers always claim rewards before adjusting the LP balance. LP tokens are not transferable unless they are destroyed or added/removed from liquidity.

The essence of this mathematical approach is that it accurately determines the share each user receives in each swap, regardless of ongoing changes in the total supply of LP tokens due to liquidity providers adding or removing liquidity.

Liquidity pool configuration and incentives

The person who initiates the liquidity provision becomes the creator, giving them write access to configure the pool settings. This includes determining the pool fee, protocol address, and metadata. The key parameter is the smart contract address assigned by the protocol. While this parameter is optional, it defaults to the creator's address. This address subsequently receives ETH from the protocol fees, which is managed through the custom logic of the smart contract, enabling a variety of DeFi applications that were not possible before with current AMM standards. This new way of generating income shifts the focus from primarily prioritizing short-term gains and price action to primarily prioritizing activity, long-termism, and utility.

Creators can define on-chain metadata for their tokens, including details such as website URL, logo, project description, social media handles, and chat URL. Users can access this information through the explorer window of Ethervista DEX, along with other relevant details. This enables creators to effectively showcase their projects while ensuring that users have access to verified and secure information, reducing the risk of phishing attacks. Developers can seamlessly launch their projects on Ethervista using the integrated launcher window. Ethervista also features SuperChat, a global real-time chat integrated directly into the DEX platform that enables users to quickly exchange information. Access to Super Chat is level-based, depending on the number of VISTA tokens held by the user.

Creators can also choose to give up their write access, effectively locking all settings permanently. Creators who wish to restrict transactions of their tokens to only Ethervista can restrict the ERC20 transferFrom function to the Ethervista router address.

In addition to pool and protocol fees, there is a fixed fee of $1 allocated to the continued development of Ethervista DEX and SVISTA. This fee will be used to implement fee-free flash loan, futures, and lending features, as well as to support potential CEX listings and marketing activities.

VISTA Token Economic Model

SVISTA is the native currency of the DEX, with a total supply of 1 million tokens. Ethervista is a value-compounding deflationary token. The smart contracts of the Ethervista protocol implement an on-chain process where each destruction event not only reduces the circulating supply, but also gradually increases the floor price of the token. This effect is maintained by the continuous acquisition and destruction of tokens, which are funded by the fees generated by the protocol on each transaction. Therefore, VISTA's mechanism acts as a hedge against inflation by combining activity with supply reductions and floor price growth, thereby strengthening the value of VISTA with each transaction, driving continuous growth and scarcity.

According to the latest data disclosed by Ethervista , 2.17% of the total supply of VISTA has been permanently repurchased and destroyed .

Ethervista's future plans:

Expansion of funding pools: Ethervista plans to offer lending, futures, and fee-free flash loan.

Integration with CEX: Ethervista aims to be listed on centralized exchanges.

summary

The design of Ethervista is mainly based on repurchase and lock-up. It collects transaction fees and distributes dividends to liquidity providers, which reduces selling pressure. However, the premise of dividends is that the protocol has a large number of transactions. Such designs can trigger Fomo sentiment in the short term, but are not enough to support the value of the protocol in the long term. At present, DeFi protocols should not only focus on the optimization of price curve formulas, but also combine innovations at the scenario and asset levels. In addition, developers of the Ethervista pool can reserve tokens, and investors should be cautious when choosing. The risk of contracts not yet open source should also be vigilant.

Since liquidity cannot be freely traded during the lock-up period, if holders sell in large quantities after unlocking, it may lead to liquidity depletion, which in turn may lead to the risk of a sharp drop in prices .

According to the latest data from Dexscreener , Ethervista 's circulating market value has fallen back to $ 17.4 million , the token has increased by 76% in 24 hours , and the 24- hour trading volume has exceeded $ 53 million . The trading volume exceeds its market value, indicating that the project is very popular and has a frequent turnover rate , and it is also necessary to be vigilant about the risk of market volatility.