Market Analysis

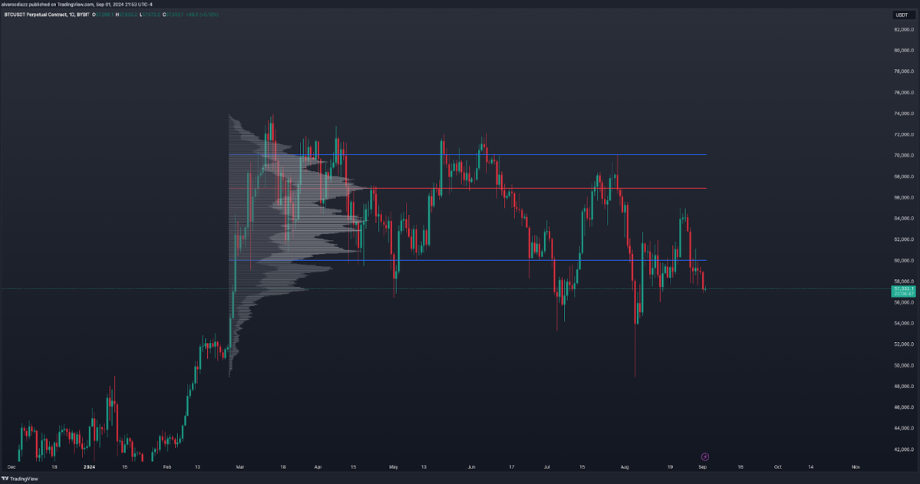

August was a challenging month for Bitcoin, with both price and sentiment taking a significant hit compared to the previous month. The BTC chart continues to show a pattern of lower highs and lower lows, with the current range’s value area low being breached. The monthly close was 8.79% lower than the monthly open.

Source: TradingView

This month’s decline lacks a clear catalyst. It doesn’t appear to be a spike in leverage — BTC futures open interest is down slightly but not worrisome. Liquidations have surged , exacerbating the decline but not reaching recent highs, while CME’s annualized basis has remained stable around 10%.

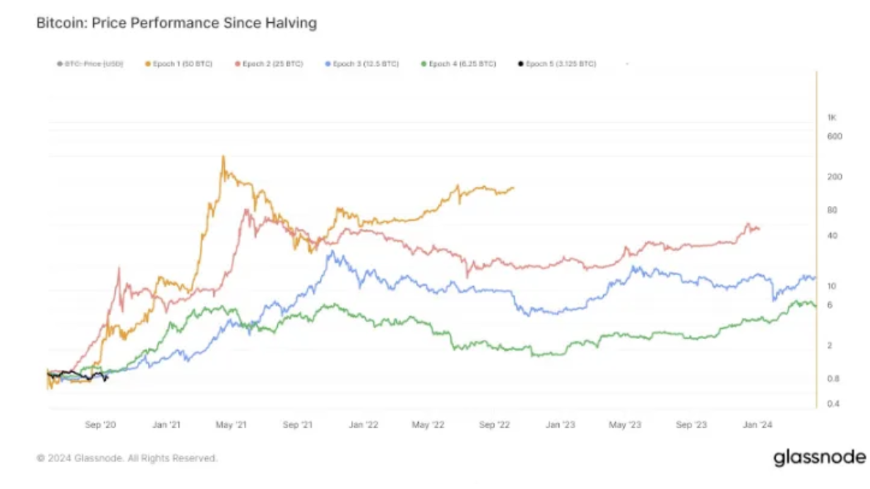

Bitcoin typically experiences a slow summer after a halving, but this cycle has been worse than expected. A chart from Glassnode shows that despite the support of the ETF, Bitcoin’s post-halving performance is the worst ever.

Source: Glassnode

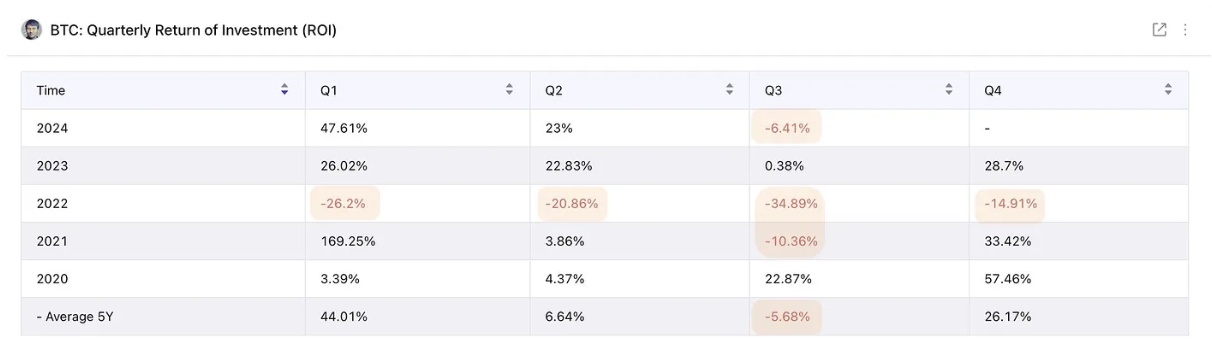

This decline is not entirely unexpected, though, as the third quarter is typically a weak period for BTC. Looking ahead to the fourth quarter, historical data shows an average growth rate of 26% over the past five years.

Source: Axel Adler Jr

Source: Axel Adler Jr

Currently, part of the focus is on the actions of the Federal Reserve, especially interest rates. With inflation trends turning positive, the Fed appears to be changing its priorities. However, continued market uncertainty and a cautious, risk-averse environment are likely to persist beyond the upcoming US election in November.

Elections are crucial because they greatly influence market sentiment, especially in the cryptocurrency space. Election results can affect regulatory policy, economic strategy, and overall investor confidence, all of which can directly affect Bitcoin and other digital assets. Trump's strong lead could create bullish momentum for Bitcoin ahead of the election, and if he wins, it could set the stage for further gains for Bitcoin.

On the other hand, if the race remains tight or Harris wins, Bitcoin’s performance could be more subdued and the market could fall. Uncertainty about the election outcome could lead to increased volatility and unpredictable moves in the cryptocurrency market.

SEC takes aim at NFTs: a controversial move

Before the end of the month, OpenSea revealed that it had received a Wells Notice from the U.S. Securities and Exchange Commission (SEC), indicating that the regulator may take legal action against the platform for allegedly selling unregistered securities.

The SEC’s move is surprising because defining digital art and collectibles as securities is a complex and untested idea. The case is unlikely to go to trial before the election, but even if it does, it will be difficult to convince a judge. The situation also complicates any efforts by the Harris campaign to win support from the crypto community.

Notably, recent financial disclosures show that Donald Trump holds between $1 million and $5 million in Ethereum assets. A wallet discovered by Arkham Intelligence believed to be Trump's contained more than $2.2 million in ETH. In addition, Trump also earned more than $7.15 million from a licensing agreement with "NFT INT", the company that issued his "Trump Card" NFT.

Meanwhile, OpenSea is not only preparing for a legal battle, but has also pledged $ 5 million to support other creators facing similar challenges. Hopefully, the court's ruling will bring some clarity, but for now, both sides are burning through resources, progress is slowing, and the Democratic Party may have missed a valuable opportunity to connect with the crypto community. The SEC's scrutiny of OpenSea and the Trump family's growing involvement in crypto highlight the ongoing challenges and political games in the regulatory and crypto fields.

Coinbase’s potential move into the tokenized currency market

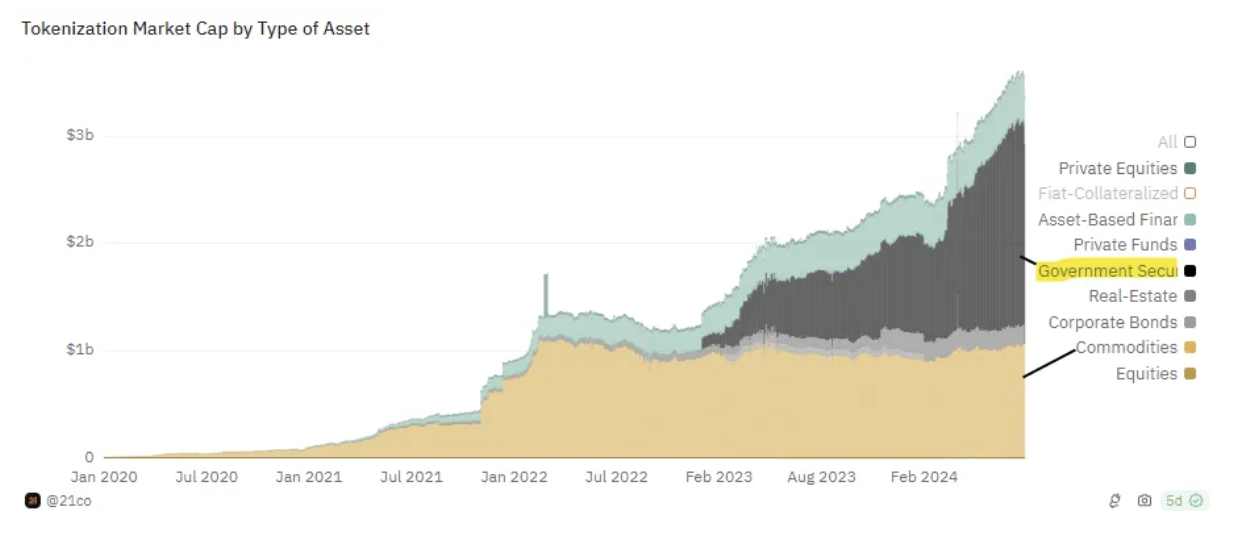

CoinDesk recently reported that Coinbase may launch a tokenized money market fund.

The Coinbase fund may stand out due to the company’s strong presence in the crypto space and its reliable infrastructure.

This development ties into the growing real-world asset RWA narrative, which is gaining traction as institutions explore tokenizing tangible assets for greater liquidity and transparency.

Source: Dune Analytics

Source: Dune Analytics

For more on this trend, check out our latest report on Maple Finance and its role in the RWA space.

While Coinbase has not confirmed these plans, they are in line with current market trends and a potentially relaxed regulatory environment in the U.S.

Altcoin: Mixed Performance and Sentiment

August has been a mixed month for Altcoin, with mixed performance and sentiment. While most Altcoin have mirrored Bitcoin’s downtrend, a Altcoin have stood out.

The hardest hit this month were $BRETT, $NOT, $MKR, $LDO, $BONK, and $ONDO, all with losses between 25% and 30%. In contrast, $HNT, $TRON, $SUI, $FET, $CLOUD, and $AAVE closed the month higher, with Helium standing out with a 61% gain. The performance of the DePIN sector was particularly notable, with a current market cap of $ 17.5 billion. The DePIN project has attracted attention for its real-world applications, with Messari predicting that the industry's total potential market will reach $3.5 trillion by 2028.

TRON, in particular, saw a surge in price due to the launch of the SunPump.meme , which created a lot of excitement and speculation within the community.

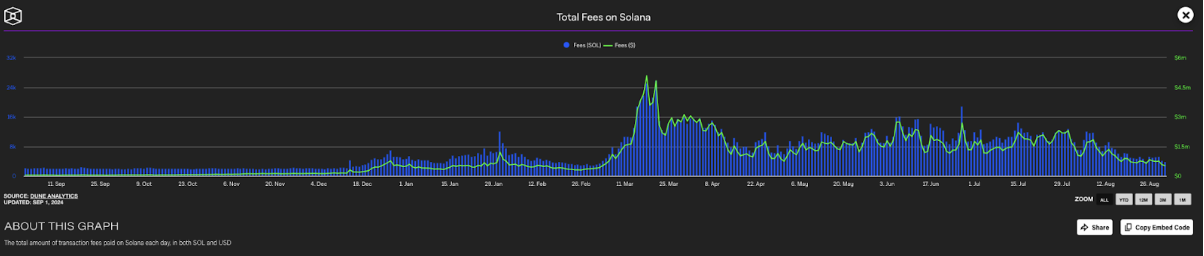

Meanwhile, Solana’s on-chain activity has dropped dramatically , with daily transaction fees falling to their lowest level in months, indicating reduced network participation.

Source: The Block

Source: The Block

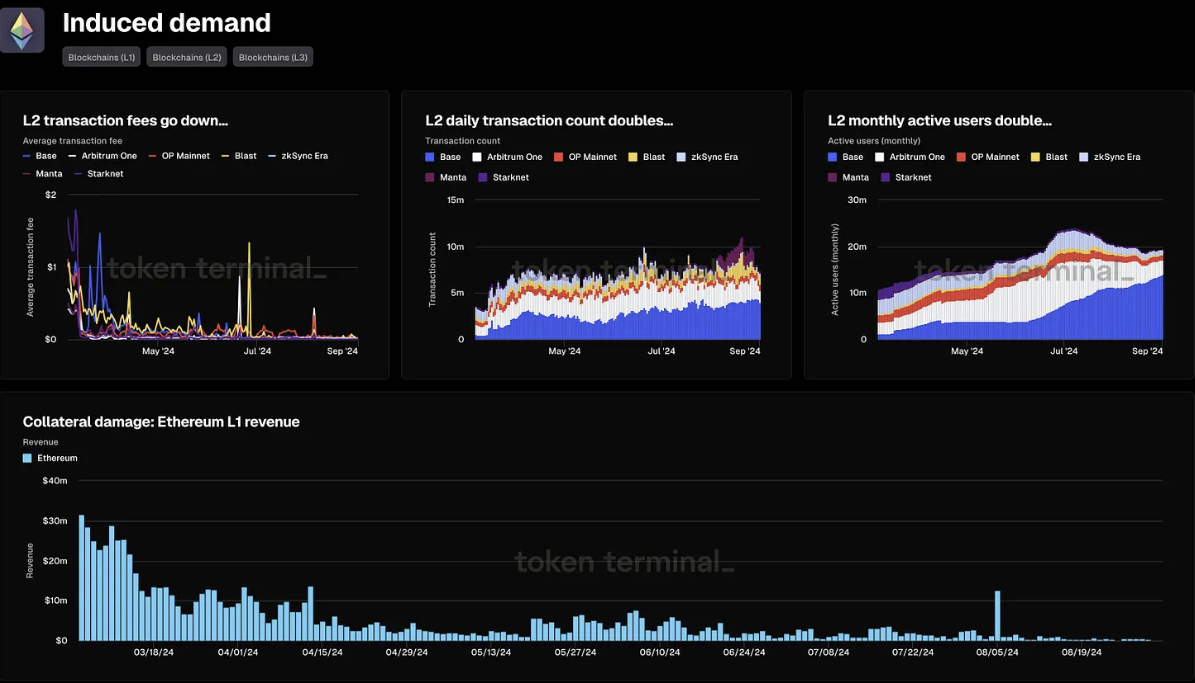

Ethereum faces a similar situation, being one of the worst performing tokens this cycle in terms of both price and user activity, with its layer 1 revenues plummeting by 99% over the past six months.

Source: The Block

Source: The Block

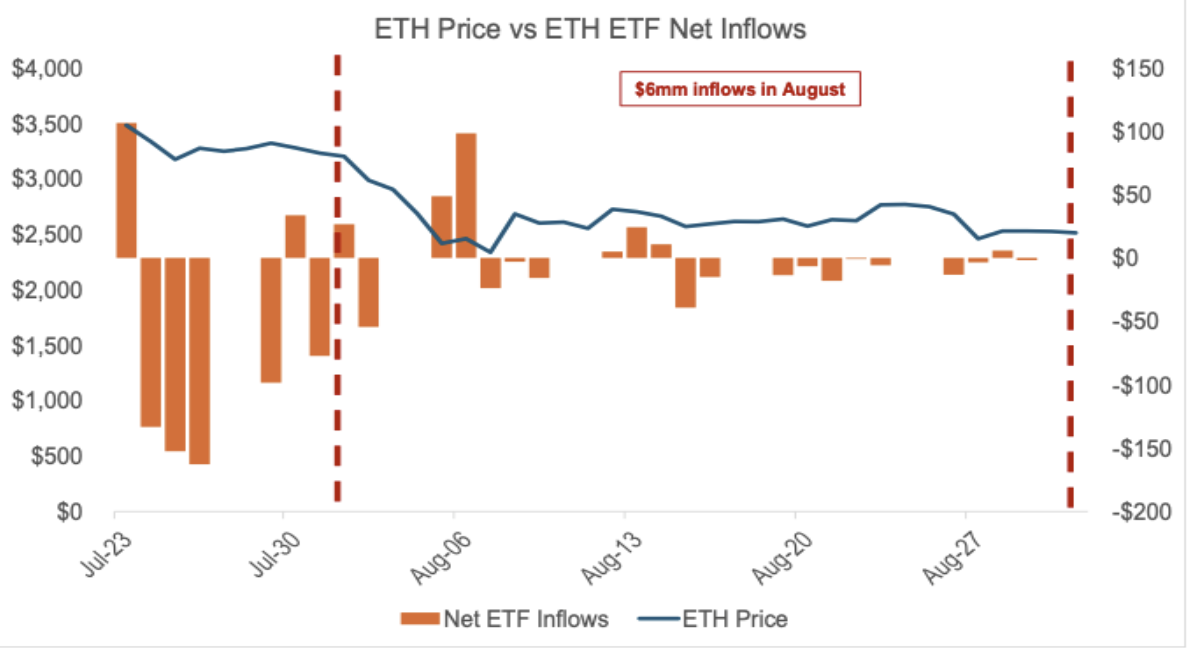

In August, ETH ETFs saw inflows of $6 million, but this momentum appears to have quickly faded. ETHE outflows and other ETH ETF inflows have declined since their launch, and future trends remain unclear.

source:

source:

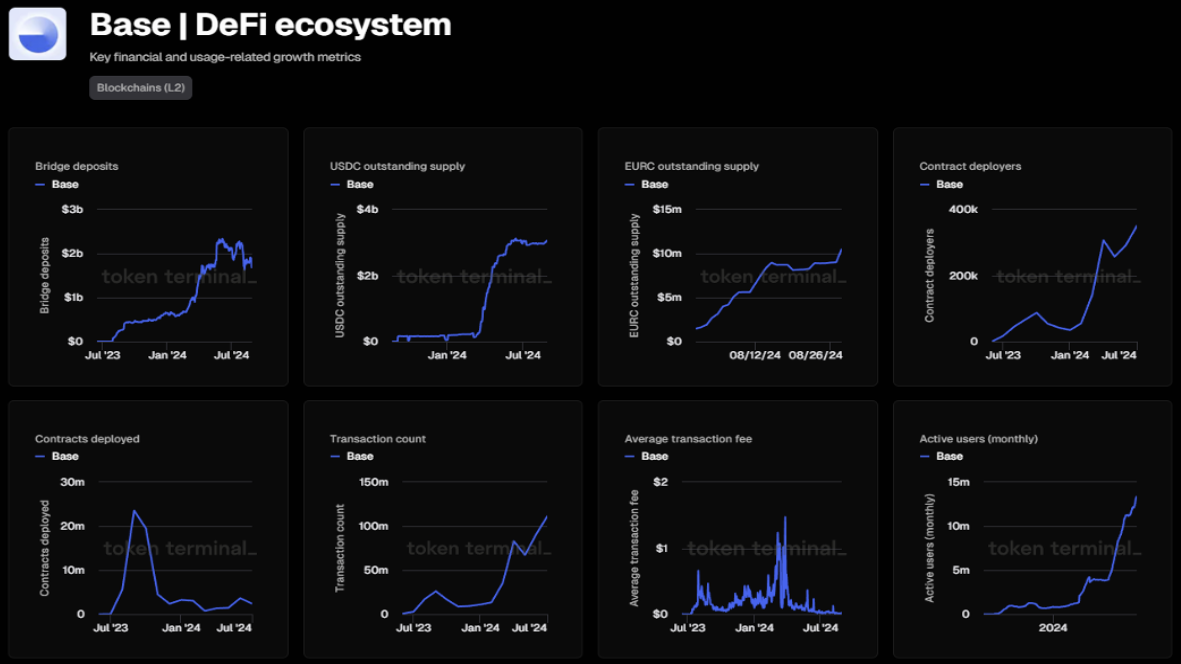

Despite this, Coinbase’s Layer 2 solution, Base, has still experienced significant growth in activity so far this year.

Source: Token Terminal

Source: Token Terminal

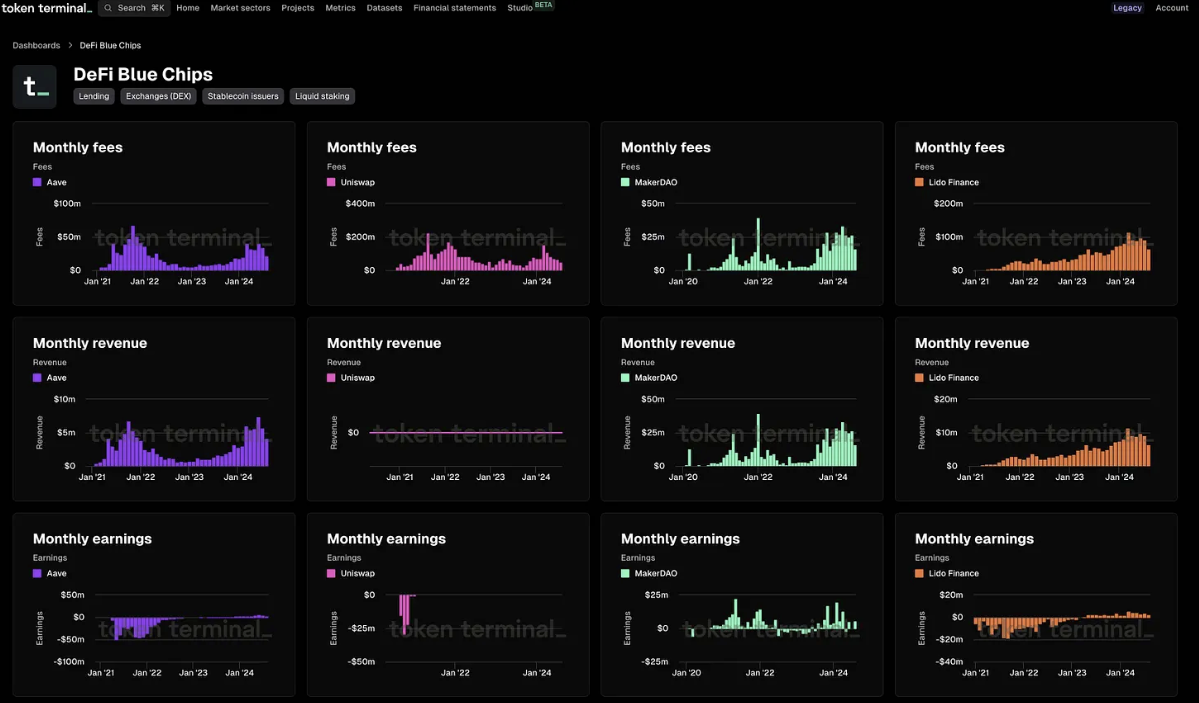

Some top DeFi projects also performed strongly . Among AAVE, UNI, MKR, and LDO, all showed growth, but only AAVE's token performance rose by more than 20% in the past month. Other projects fell by more than 20%.

Source: TokenTerminal

Source: TokenTerminal

Macro Insights

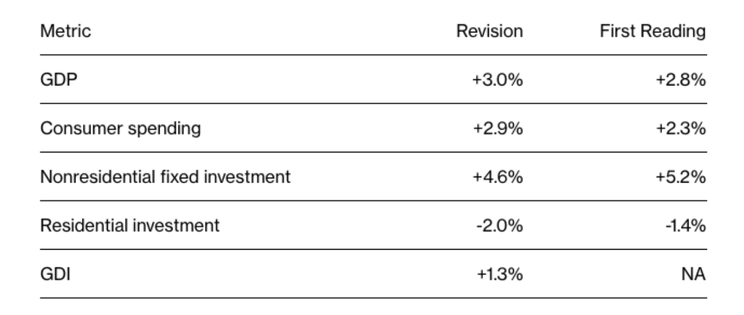

Second-quarter GDP growth was revised up to 3.0 % from an initial 2.8% , up from 1.4% in the first quarter. Real consumer spending was also revised up sharply in the second quarter, from 2.3% to 2.9%, compared with 1.5% in the first quarter. While these data look back at past performance, they do not mean a recession is imminent.

Source: Bloomberg

Source: Bloomberg

In addition, the core personal consumption expenditures (PCE) index, the Fed's most closely watched inflation indicator, fell slightly to 2.8% in the second quarter from 3.7% in the first quarter and from 2.9% to 2.8%, suggesting that inflation may be cooling.

For the market, this could mean less focus on inflation concerns and more attention on economic growth and employment data. As inflation concerns fade, investors will look for clues on the Fed's next move, and employment-related reports are expected to receive more attention.

Compared to the cryptocurrency market, the S&P 500 presents a different picture. After a brief dip earlier this month, the index is now trading near all-time highs.

While Bitcoin doesn’t always correlate with the stock market, the two sometimes move in similar directions. If the S&P 500 continues to rise, it could signal a broader risk-on environment, with investors becoming more confident in riskier assets.

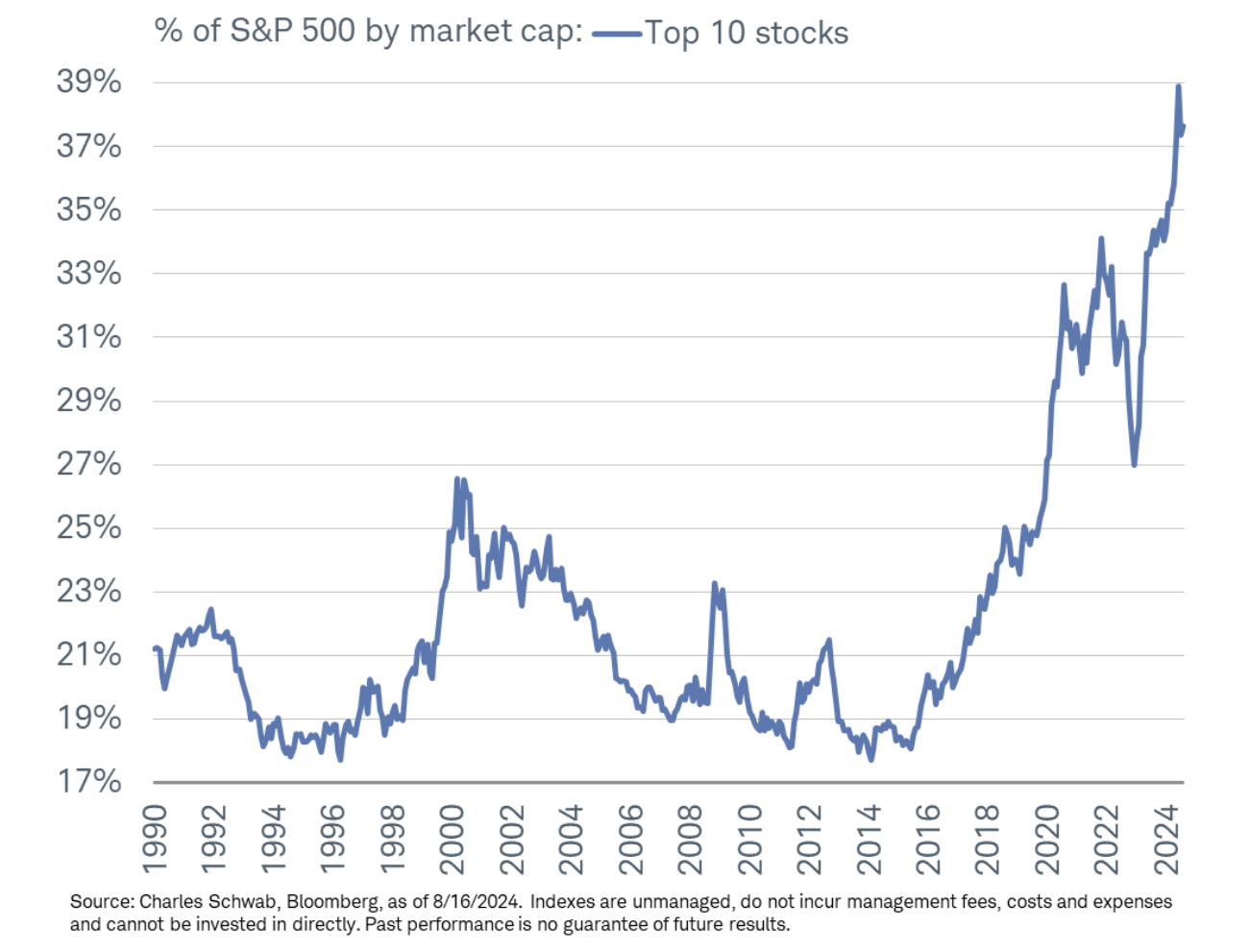

Market reaction to NVIDIA earnings and market concentration

Nvidia released its earnings report on August 23 , and the data showed that the company exceeded consensus expectations on almost all indicators , including a third-quarter revenue forecast that was higher than the average expectation. However, the market reaction was not good, and the stock price fell more than 5% in pre-market trading.

The reaction highlights the significant impact that large technology companies such as NVIDIA have on market sentiment and financial conditions. The Chicago Fed said the performance of top technology stocks has been a major driver of the stock market's gains this year and has helped ease financial conditions.

The concentration of market weight in the top 10 S&P 500 stocks is now higher than it was before the dot-com bubble burst, which could pose risks if expectations for artificial intelligence or rate cuts fail to materialize.

Source: @KevRGordon

Source: @KevRGordon

Despite the sharp drop in Nvidia's stock price, market sentiment remained relatively positive, with U.S. futures opening stronger. Bitcoin, often seen as a proxy for risk assets, showed little reaction to the Nvidia news, despite an increase in trading volume.

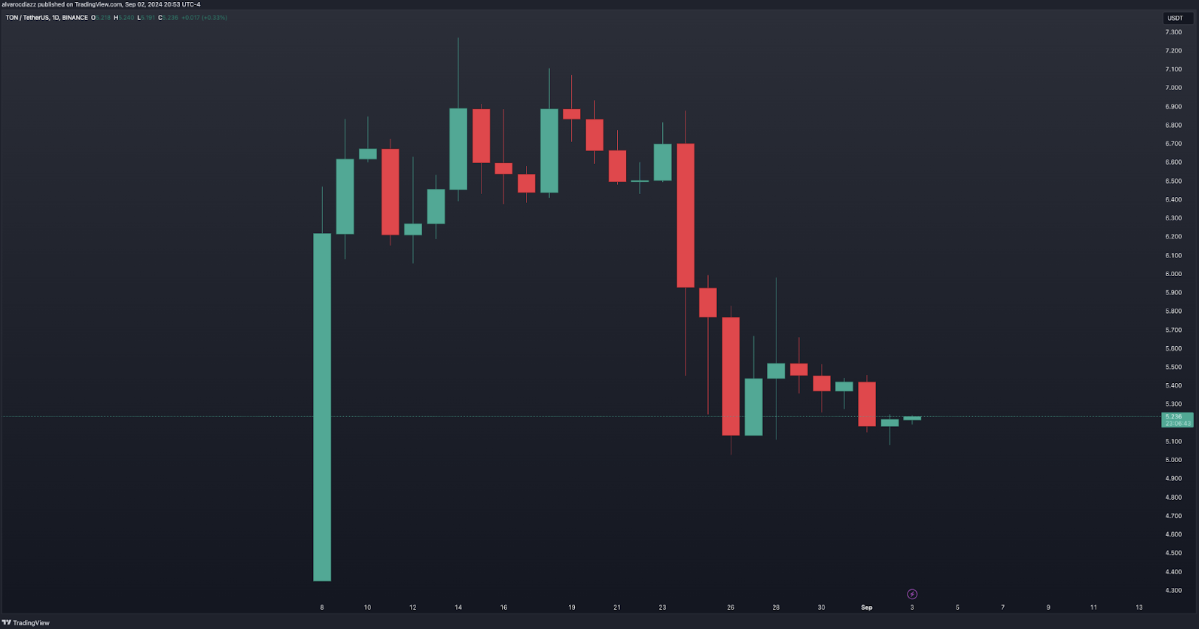

Pavel Durov’s arrest: legal disputes and market impact of $TON

On August 24, 2024, Telegram founder and CEO Pavel Durov was arrested, sparking widespread controversy. While many initially believed his arrest was due to censorship, the real issue was legal liability for activity on Telegram. French authorities held Durov accountable for the lack of oversight of the platform, saying that Telegram rejected government surveillance and was therefore responsible for any criminal activity that occurred on the platform.

The price of TON fell by more than 20% on the day Durov was arrested. Although TON has more than 2x since Q1 2024, it has now lost almost all of its gains in Q2. This negative news could present a buying opportunity, but the uncertainty of Durov's situation adds significant risk.

Source: TradingView

Source: TradingView

Despite recent FUD, TON remains the leading layer 1 blockchain with over 500,000 daily active users, according to Token Terminal. In May 2024, Pantera Capital announced its largest investment yet in TON.

Durov was released on bail on August 28, 2024 , and is currently awaiting further court proceedings. The case raises broader questions of privacy, state control, and the responsibility of private companies in law enforcement, and may have implications for how other platforms are treated in the future.

Russia’s Cryptocurrency Experiments and Tether’s Expansion

Russia will begin trials next week to use cryptocurrencies for cross-border trade to bypass sanctions, according to Bloomberg . This follows Russia's recent efforts to develop CBDC and cryptocurrency regulations to allow limited use of cryptocurrencies in international trade. The trials will link the national payment system with cryptocurrency exchanges to swap rubles for cryptocurrencies, with a focus likely on dollar-based stablecoins such as USDT. Tether is not expected to work with sanctioned entities, but may facilitate transactions for businesses affected by banking restrictions.

Separately, Tether, which issues the largest stablecoin USDT, plans to double its headcount after reporting a second-quarter net operating profit of $1.3 billion. The company is expanding in the financial and compliance sectors and is diversifying into areas such as artificial intelligence, privacy and tokenization, with plans to launch a stablecoin backed by the UAE dirham.

Meanwhile, Singapore’s DBS Bank has partnered with Ant International on a pilot to test “funding tokens,” a blockchain-based solution that enables faster and cheaper cross-border liquidity management. These tokens could streamline internal fund flows for multinational companies, reduce costs, and speed up transactions with 24/7 transfer capabilities on a permissioned Ethereum-compatible blockchain.

Conclusion

As we approach the end of August 2024, it is clear that the market is facing some challenges, especially the poor performance of Bitcoin and the uncertainty of the regulatory environment. However, there is still potential for rebounds in the coming months, especially towards the end of the year, with occasional Christmas rallies.

In the Altcoin space, we’ve seen mixed results, with some projects struggling while others, like Helium, have shown strong momentum. Continued innovation in areas like tokenized money markets and real-world assets continues to offer promising opportunities.

At Greythorn Asset Management, we focus on identifying these opportunities and are robustly positioned to navigate the ups and downs of the market. Thank you for reading our Monthly Market Update for August 2024. Stay tuned for more insights in the coming months.