By Arthur Hayes

Compiled by: TechFlow

(The opinions expressed in this article are solely those of the author and should not be relied upon for investment decisions nor should they be considered investment advice.)

Like Pavlov's dog, we all think the correct response to a rate cut is to "buy the f***ing dip" (BTFD). This behavioral response stems from the memory of low inflation during the Pax Americana era. Whenever there is a threat of deflation , which is bad news for financial asset holders (i.e. the rich), the Fed will decisively start printing money. As the global reserve currency, the US dollar creates an easy monetary environment for the world.

The global fiscal policy response to the COVID pandemic (or the hoax you believe it is) has ended the era of deflation and ushered in an era of inflation. Central banks belatedly acknowledged the inflationary impact of COVID-19, adjusted monetary and fiscal policies, and raised interest rates. Global bond markets, especially in the United States, believed in the central banks' resolve in controlling inflation and therefore did not push yields to extremely high levels. However, it is assumed that central banks will continue to meet bond market expectations by raising interest rates and reducing money supply, which is very uncertain in the current political environment.

I will focus on the US Treasury market because the US dollar is the world's reserve currency, making it the world's most important debt market. Debt instruments issued in any currency will be affected by US Treasury yields . Bond yields reflect the market's expectations of future economic growth and inflation. The ideal economic state is economic growth with low inflation, while the worst state is growth with high inflation.

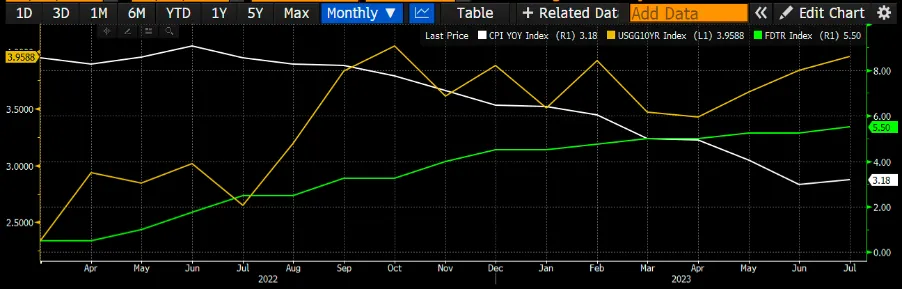

The Fed has managed to convince the Treasury market of its resolve to fight inflation by raising its policy rate at the fastest pace since the early 1980s. From March 2022 to July 2023, the Fed raised rates by at least 0.25% at each meeting. Even during this period, when the government's inflation index reached a 40-year high, the 10-year Treasury yield did not exceed 4%. The market believes that the Fed will continue to raise rates to curb inflation, so long-term yields have not surged.

U.S. Consumer Price Index (white), 10-year U.S. Treasury yield (gold), and the upper limit of the federal funds rate (green)

However, all this changed at the Jackson Hole meeting in August 2023. Powell hinted that the Fed may pause its rate hikes at the September meeting. However, the shadow of inflation still hangs over the market, mainly because increased government spending is the main factor driving inflation, and this trend shows no signs of abating.

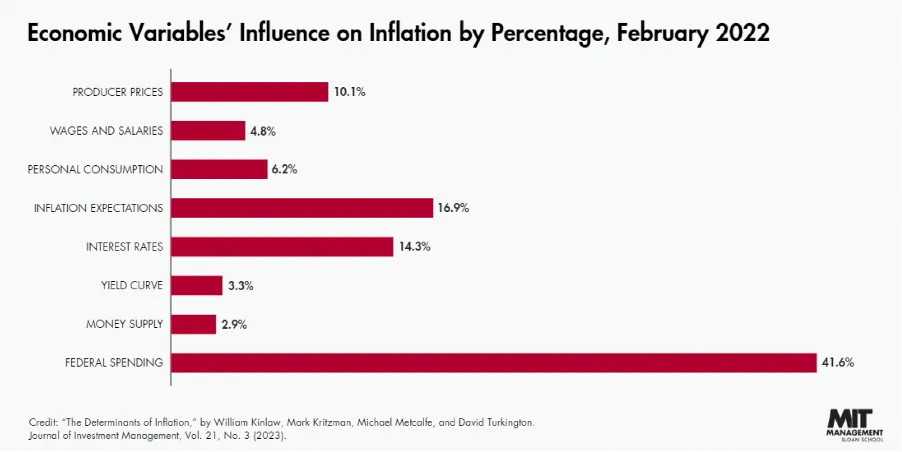

MIT economists found that government spending is one of the main reasons driving up inflation.

On the one hand, politicians know that high inflation will reduce their chances of reelection; on the other hand, providing benefits to voters through currency devaluation can increase their chances of reelection. If they only give benefits to their supporters, and these benefits are paid for by the savings of opponents and supporters, then it is politically beneficial to increase government spending. Therefore, they are difficult to be voted out of office. This is exactly the strategy adopted by US President Biden's administration.

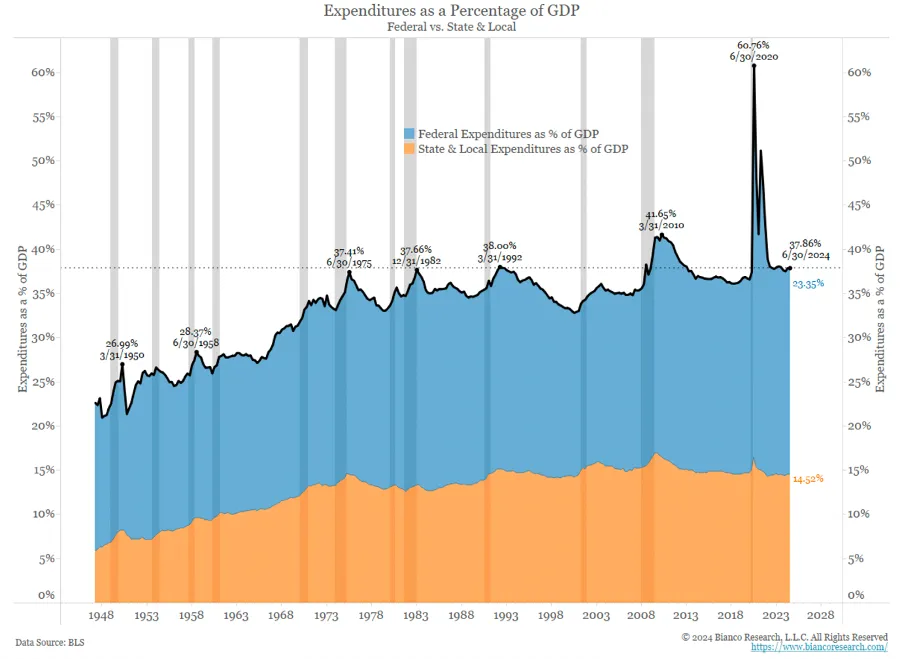

Overall government spending has reached an all-time high during peacetime. Of course, “peace” here is relative, referring only to the feelings of the Empire’s citizens; for those who have lost their lives to American weapons, recent years have hardly been peaceful.

This would be less of a problem if these expenditures were paid for by raising taxes. However, raising taxes is so unpopular with current politicians that it is not happening.

Against this fiscal backdrop, at the Jackson Hole conference on August 23, 2023, Fed Chairman Powell said that interest rate hikes would be paused at the September meeting. The more the Fed raises interest rates, the more it costs the government to finance the deficit. By raising the cost of deficit financing, the Fed can curb unbridled spending. Spending is the main factor driving inflation, and the Fed wanted to curb it by raising interest rates, but ultimately chose to pause, so the market will adjust on its own.

After Powell's speech, the 10-year Treasury yield quickly rose from about 4.4% to 5%. This is surprising because even when inflation was as high as 9% in 2022, the 10-year yield was only around 2%; 18 months later, inflation fell to about 3%, but the yield was close to 5%. Higher interest rates caused the stock market to fall by 10%, and more importantly, raised concerns that regional banks in the United States might fail due to losses in their Treasury bond portfolios. Faced with higher deficit financing costs, reduced capital gains tax revenue due to falling stock markets, and a potential banking crisis, "bad girl" Yellen stepped in to provide dollar liquidity to stabilize the situation.

As I mentioned in the article Bad Gurl As mentioned in the report, Yellen said the U.S. Treasury will issue more T-bills. This will shift funds from the Fed's reverse repurchase program (RRP) to T-bills and re-leverage the financial system. The statement was released on November 1, 2024, driving a bull market in stocks, bonds, and cryptocurrencies.

From late August to late October 2023, the price of Bitcoin fluctuated. However, as Yellen injected liquidity, Bitcoin began to rise and hit an all-time high in March of this year.

Reverse reflection

History doesn’t repeat itself, but it does. I failed to fully appreciate this in my previous article, Sugar High , when I discussed the impact of Powell’s shift in wage policy. I was a little uneasy that I shared the same view as most people regarding the positive impact of the upcoming rate cut on risk markets. On my way to Seoul, I happened to check my Bloomberg Watchlist, which records the daily changes in RRP. I noticed that RRP had risen, which puzzled me because I would have thought it would continue to fall due to the US Treasury’s net Treasury issuance. I dug deeper and found that the rise began on August 23, the day of Powell’s policy shift. I also considered whether the surge in RRP could be due to end-of-quarter window dressing. Financial institutions usually deposit funds into RRP at the end of the quarter and withdraw them the next week. But the third quarter does not end until September 30, so window dressing cannot explain this phenomenon.

Next, I considered whether money market funds (MMFs) chose to sell T-bills and deposit cash into RRPs in pursuit of higher short-term USD yields as T-bill yields fell. I drew a chart showing the yields of 1-month (white), 3-month (yellow), and 6-month (green) T-bills. The vertical lines in the chart mark several key dates: the red line represents the day when the Bank of Japan raised interest rates, the blue line represents the day when the Bank of Japan announced that it would not consider future rate hikes when the market reacted poorly, and the purple line represents the day of the Jackson Hole speech.

Money market fund managers need to decide how to get the best yield between new deposits and expiring Treasury bills. The yield on RRP is 5.3%, and if the yield on Treasury bills is slightly higher, funds will flow to Treasury bills. Starting in mid-July, the yield on 3-month and 6-month Treasury bills was lower than the yield on RRP. However, this was mainly due to the unwinding of carry trades caused by the market's expectation of a stronger yen, prompting the Federal Reserve to possibly ease policy. The yield on 1-month Treasury bills is still slightly higher than the yield on RRP, which makes sense because the Federal Reserve has not yet clearly stated that it will cut interest rates in September. To test my guess, I plotted a chart of RRP balances.

RRP balances typically fall before Powell’s speech at Jackson Hole on August 23. In that speech, he announced a rate cut in September (marked by the vertical white line in the figure). The Fed plans to cut the federal funds rate to at least 5.00% to 5.25% at its September 18 meeting. This confirms the market’s expectations for the direction of the 3-month and 6-month Treasury bills, while the yield on the 1-month Treasury bill also begins to narrow the gap with the RRP. The yield on the RRP does not fall until the day after the rate cut. Therefore, between now and September 18, the RRP provides the highest return among various income instruments. As expected, RRP balances rise immediately after Powell’s speech, as money market fund managers are working to maximize current and future interest income.

Although Bitcoin rose to $64,000 on the day of Powell's policy shift, its price has fallen back 10% over the past week. I believe that Bitcoin is the most sensitive indicator of the liquidity conditions of the US dollar. When the RRP balance rose to about $120 billion, the price of Bitcoin fell. The increase in RRP caused funds to stay on the Fed's balance sheet and could not be re-used in the global financial system.

Bitcoin is extremely volatile, so I admit that I may be reading too much into one week’s price action. But my interpretation of events fits so well with the actual observed price action that it is hard to explain it with just random fluctuations. Testing my theory is actually quite simple. Assuming the Fed does not cut rates before the September meeting, I expect Treasuries to continue to yield less than RRP. Therefore, RRP balances may continue to increase, and Bitcoin may hover around current levels, with a worst-case scenario of a slow decline to $50,000. Let’s wait and see. My shifting view on the market made me hesitate on the buy button. I did not sell cryptocurrencies because I was bearish on the short-term market. As I will explain, my pessimism was only temporary.

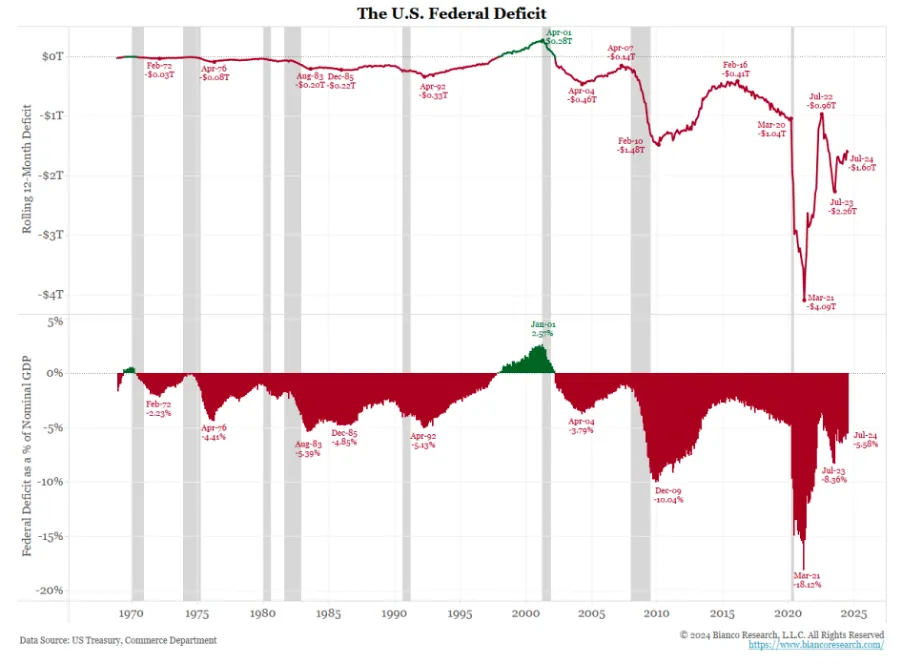

Out-of-control fiscal deficit

The Fed has done nothing to control the main driver of inflation: government spending. Only when the cost of financing deficits becomes too high will the government reduce spending or raise taxes. The Fed’s so-called “restrictive policy” is just empty talk, and its independence is just a nice story told to credulous disciples of economics.

If the Fed doesn’t tighten policy, the bond market will correct itself. Just as the 10-year Treasury yield unexpectedly rose after the Fed paused in 2023, a Fed rate cut in 2024 could push yields dangerously close to 5%.

Why is a 5% 10-year yield so dangerous to the fake financial system of “Pax Americana”? Because this is exactly the point where Yellen felt the need to step in and inject liquidity last year. She knows better than I do how fragile the banking system is when bond yields rise sharply; I can only guess at the extent of the problem based on her actions.

She conditioned me, like a dog, to expect a certain reaction in response to a particular stimulus. A 5% 10-year Treasury yield would put a stop to the bull run in the stock market. It would also rekindle concerns about the health of the balance sheets of banks that are not “too big to fail.” Rising mortgage rates would reduce housing affordability, a major issue for American voters in this election cycle. All of this could happen before the Fed cuts rates. In this case, given Yellen’s unwavering support for Democratic “puppet candidate” Kamala Harris, the market could be hit hard.

Apparently, Yellen will not stop until she has done everything she can to ensure Kamala Harris is elected President of the United States. First, she may start reducing the funds in the Treasury General Account (TGA). Yellen may even indicate her intention to drain the TGA in advance so that the market can quickly react as she expects and get the market active! Next, she may instruct Powell to stop quantitative tightening (QT) and possibly even restart quantitative easing (QE). All of these monetary operations are bullish for risky assets, especially Bitcoin. If the Fed continues to cut interest rates, the amount of money injected must be large enough to offset the rising RRP balance.

Yellen must act quickly or the situation could deteriorate into a full-blown crisis of voter loss of confidence in the U.S. economy. This would be bad for Harris unless by some miracle a batch of mail-in ballots are discovered. As Stalin might have said, “It’s not the people who vote, but the people who count the votes that count.” I’m just kidding, don’t take it seriously.

If this happens, I expect market intervention to begin by the end of September. Until then, Bitcoin is likely to continue to fluctuate, while Altcoin are likely to fall further.

I once publicly said that the bull market would restart in September, but I have changed my mind now, but this does not affect my investment strategy. I am still firmly holding and not using leverage. I will only increase my holdings in some high-quality Altcoin projects in the portfolio, whose prices are at a greater discount to what I think is fair value. Once the fiat currency liquidity is expected to increase, the tokens of projects whose users are willing to pay actual fees to use their products will rise sharply.

For those professional traders with monthly P&L targets or weekend investors using leverage, I'm sorry, but my short-term market predictions are as unreliable as a coin flip. I tend to believe that those who control the system will eventually solve all problems by printing money. I write these articles to provide context for current financial and political events and to test whether my long-term assumptions still hold true, hoping that one day my short-term predictions will be more accurate.