Why did the non-agricultural data last night look good, but the US stock market and BTC both fell? To be honest, I have searched for a lot of channels and information and spent a lot of time but couldn’t find it. But I can say something more intuitive. It’s not just the US stock market and BTC that have fallen, but the US Treasury bonds have also fallen across the board, with the one-year, two-year, and three-year US Treasury bonds falling by more than 2%.

The US dollar index is rising, while gold and oil are falling. Seeing these data, my immediate feeling is "risk aversion" . The decline of US bonds shows that a large amount of funds have begun to flow into US bonds. From this perspective, investors should be extremely panicked about the interest rate cut, and they should think that the interest rate cut is the key to the decline of the risk market.

Therefore, funds have been withdrawn from US stocks, cryptocurrencies, and even gold, and directly bought US bonds with higher value preservation. The current return can still be maintained at more than 3.5%, and there can be a 4% return in one year. Why are users so pessimistic?

The first is that interest rate cuts are indeed accompanied by a decline in risk markets in the US history . Therefore, investors no longer try to distinguish between defensive and last-ditch measures. As long as the probability of interest rate cuts increases, they will run. It is hard to say that this is wrong, but often in the early stages of interest rate cuts, if the economy does not decline, risk markets can still perform well.

The second is that Nvidia's performance has made investors as a whole doubtful about their belief in AI . It is very likely that they are not just killing the high valuation, but panicking. After all, AI has been rising for too long as a defensive asset. So even though Nvidia's financial report is still good this time, it is hard to escape the market's overly high expectations.

BTC fell below 53K last night, and ETH fell below 2,200

I am greedy for lower-priced chips. I want to swim in the turbulent waves and seek to maximize profits. I know it is risky, but I can't control my greed.

Yesterday's drop just gave the mainstream an opportunity to get on board and take the low chips! The copycats have not entered the market yet, so continue to wait

I think the market may not rise immediately after the rate cut

Take the Fed’s most recent rate-cutting cycle, which began in July 2019 and ended in April 2020. During this period, the price of Bitcoin continued to fall from $13,000 to $3,800.

Here is a brief explanation of how interest rate cuts have a positive impact: the effect of interest rate cuts is similar to an "economic prescription", and the effect is often not immediate, and it takes some time to see significant improvement. The market recovery usually takes several months, perhaps 5 to 8 months

Therefore, I think a more reasonable strategy is to gradually buy low during the interest rate cut cycle

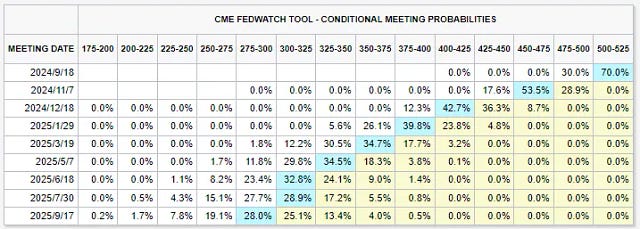

Next week's CPI will be the last major data release before the Federal Reserve's September 18 meeting.

70% of investors expect the Fed to cut interest rates by one basis point at its September meeting.

Behind the epic madness, no one knows what will happen...

Follow me and go through the super bull market together!!!

Create a high-quality circle

Spot mainly

I will share some content: as shown below:

The overall position is ≥ 5,000u. If you want to join, scan the QR code below!

This is the end of the article. I will do a more detailed analysis in the communication group. If you want to join my circle, please contact me directly through the WeChat below!

Note: If the QR code is invalid, please leave a message in the background