The proportion of Bitcoin Unspent Transaction Output (UTXOs) that are profitable has dropped to a yearly low. The decline in this metric is consistent with the current bearish momentum of BTC and the downward trend of the cryptocurrency market in general.

According to a report by CryptoQuant analyst EgyHash, this could be a sign of a strong bull run to come.

Bitcoin UTXO refers to the amount of cryptocurrency left after a transaction on the network. UTXO analysis is often important in understanding investor behavior during different periods.

Source: CryptoQuant

In June, 99% of Bitcoin UTXOs were in profit but this has now dropped to 68.5% in September. EgyHash said this drop shows that some market participants have realized profits on their BTC investments and their actions, coupled with ongoing selling pressure, have contributed to the decline in the value of the world's largest cryptocurrency.

The last time the profitable UTXO saw a similar drop, the price of Bitcoin skyrocketed to a new record high, rising 273% from $26,700 to $73,000. This means that a drop in this metric would pave the way for BTC to rally and possibly hit new highs. EgyHash’s analysis aligns with onchain experts’ predictions of a second BTC bull run in the coming months.

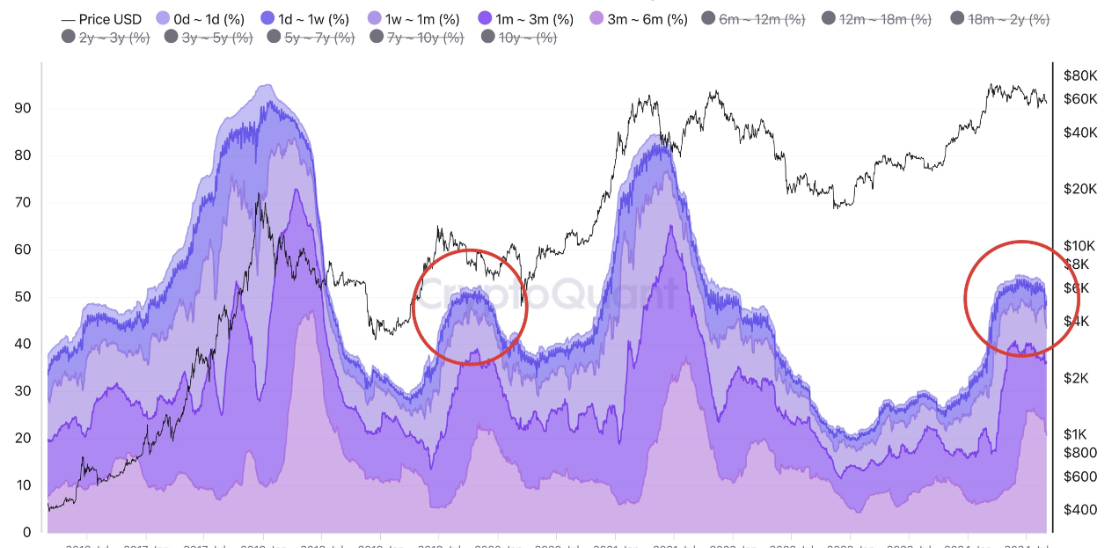

Another anonymous CryptoQuant analyst, Avocado, observed a slight increase in Bitcoin UTXO under six months, suggesting that new investors have recently entered the market. This increase is related to Bitcoin's All-Time-High around March of this year, suggesting that many new investors may have bought in during that period.

Source: CryptoQuant

Comparing Bitcoin UTXOs under six months to previous cycles, Avocado identified a similar pattern in 2019. At that time, some investors exited the market due to losses, while others held BTC and transferred their holdings to the UTXO pool of six months or more.

Although some investors suffered short-term losses and left the market, the Bitcoin price eventually rose to a new All-Time-High in about 490 days. This historical pattern may suggest that the current period could also lead to significant price volatility.

In addition to the decline in profitable UTXOs, Bitcoin prices have been stagnant for a long time. Avocado attributes this stagnation to reduced price volatility stemming from the relative increase in OTC trading compared to exchange trading.

Join Telegram: https://t.me/tapchibitcoinvn

Follow Twitter: https://twitter.com/tapchibtc_io

Follow Tiktok: https://www.tiktok.com/@tapchibitcoin

Itadori

According to CryptoPotato