Amid the ongoing downturn in Bitcoin (BTC) and cryptocurrency markets, traders should brace for potential price action this week driven by U.S. economic updates.

Bitcoin is trading around $54,000 and experts predict the downtrend will continue. Historically, September is the worst month for BTC, but there is hope for a rebound in October.

US economic events to watch this week

Risk asset Bitcoin has had a quiet start to the week. The largest cryptocurrency is currently trading at $54,800, up 0.7% over the past 24 hours.

However, the upcoming US macroeconomic events and the anticipated debate between Donald Trump and Kamala Harris could influence market sentiment and trigger portfolio changes. Let’s take a closer look at how these events will impact the markets.

Donald Trump vs Kamala Harris Debate

As BeInCrypto previously reported, the upcoming presidential debate between Donald Trump and Kamala Harris has put cryptocurrencies in the spotlight. Both candidates have made the topic a central topic in their campaigns. Recent reports suggest that Harris is taking a more pro-crypto stance.

Meanwhile, Trump has made positive comments about Bitcoin and the cryptocurrency market , which has won him support within the industry . Pennsylvania Senator John Fetterman predicted a “close” debate, acknowledging that both Trump and Harris are capable of holding their own.

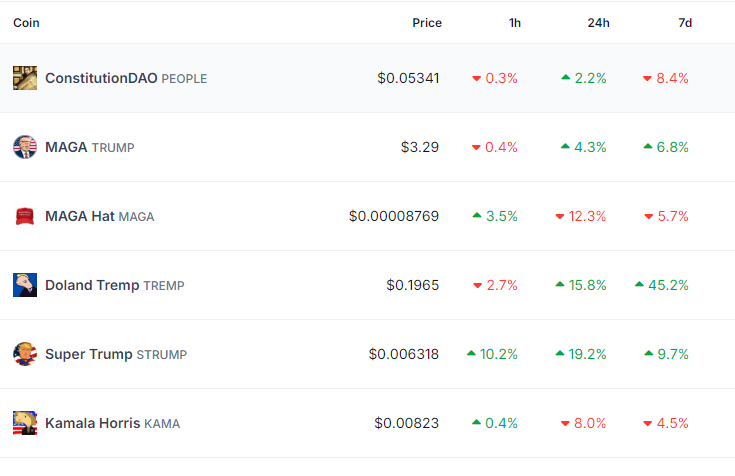

According to CoinGecko data, PolitiFi meme coins are already showing volatility ahead of the debate, with some Trump-inspired coins seeing double-digit gains.

Read more: How could blockchain be used for voting in 2024?

US CPI

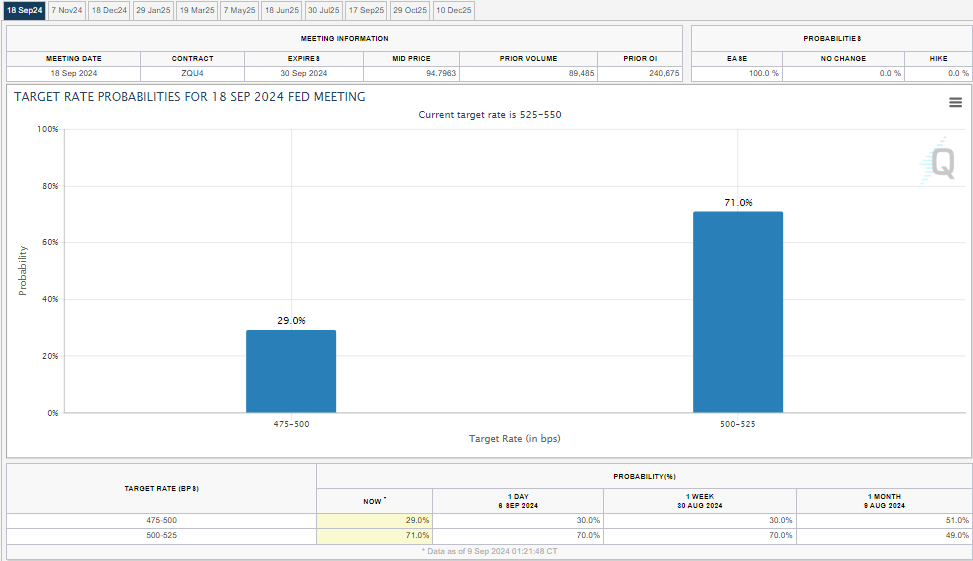

Inflation is in focus this week with the release of the August Consumer Price Index (CPI) and the less important Producer Price Index (PPI), which could play a key role in the Federal Reserve’s interest rate decisions .

The Bureau of Labor Statistics (BLS) is scheduled to release the August CPI on Wednesday, September 11. In July, inflation eased to 2.9% from 3% in June, boosting Bitcoin’s performance.

Economists now expect inflation to fall further to 2.7%, which could support Bitcoin’s bullishness if realized. Core CPI, which excludes volatile items such as food and energy, is expected to cool to 3.1% from 3.2% in August. Both overall and core CPI are expected to grow by 0.2% month-on-month in August.

“Amid anticipation of CPI data and Trump-Harris debate, traders argue that Bitcoin is significantly undervalued at the moment. Crypto markets are waiting for the impact of US economic and political news,” one user commented .

Consumer sentiment

Markets will also be watching the preliminary consumer sentiment report due out on September 13. The University of Michigan consumer confidence data will highlight the gap between the overall strength of the U.S. economy and how households perceive their finances.

While consumer sentiment is more sensitive to inflation, consumer confidence is closely tied to the labor market. Strong consumer confidence can encourage investment in assets like Bitcoin if they are optimistic about the economy. However, if Friday’s data shows consumers still struggling with inflation, high interest rates, and job insecurity, the cryptocurrency market could react unpredictably.

Read more: How to Protect Yourself Against Inflation Using Cryptocurrencies

Additionally, Thursday’s initial jobless claims report could impact cryptocurrency volatility. This employment data could influence market sentiment by shaping economic health perceptions and expectations about monetary policy, which could indirectly impact Bitcoin.