As the U.S. presidential election campaign heats up, the televised debate between Republican candidate Donald Trump and Democratic candidate Kamala Harris is grabbing the attention of political and financial observers.

The discussion, scheduled for Tuesday, is expected to have significant ramifications across multiple sectors, including the cryptocurrency market.

Trump vs Harris Debate: What It Will Mean for Cryptocurrency Markets

The economic policies advocated by both candidates will be the focus. Trump has reaffirmed his plan to cut taxes and government spending , while Harris is advocating higher taxes on the wealthy , aimed at helping small businesses.

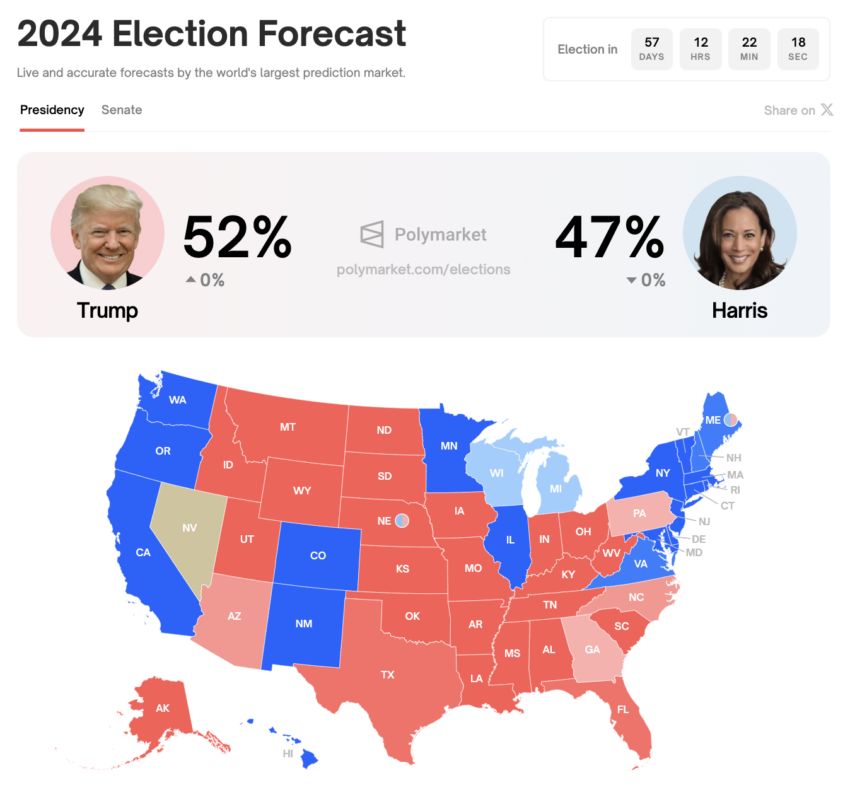

With voters deeply concerned about the economy and Trump leading in the polls, the debate could be crucial in shaping opinion and market reactions.

Cryptocurrency traders are particularly sensitive to the potential volatility this debate could create. Cryptocurrency markets are on the edge after last week’s declines raised concerns among investors.

“Cryptocurrencies have stabilized since last week’s moves, but implied volumes remain high. The market seems to be expecting some volatility ahead of this week’s events, particularly the Trump-Harris debate,” QCP Capital highlighted .

Timing is key. The market will also be watching key economic data , particularly the US Consumer Price Index (CPI) report, which is due to be released the day after the debate. As the Federal Reserve considers cutting interest rates at its upcoming meeting, economic signals from the CPI could influence market trends, further amplifying volatility in traditional and crypto assets.

Read more: How to Protect Yourself Against Inflation Using Cryptocurrencies

According to QCP Capital, crypto traders are closely monitoring Bitcoin and Ethereum. Risk reversals are biased towards puts, indicating caution in the face of further downside risks. Despite short-term uncertainty, long-term traders are bullish and signal buying opportunities as volatility persists.