Bitcoin (BTC) led the way with a net outflow of $643 million in crypto investments last week. Ethereum followed with an outflow of $98 million, while Solana stood out with a net inflow of $6.2 million.

Traders and investors remain nervous as they prepare for major U.S. economic events this week and throughout September, which could have a major impact on market sentiment.

Bitcoin Leads Crypto Investment Outflows

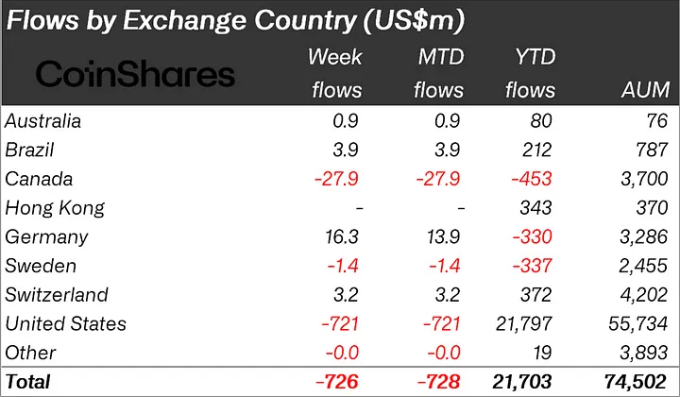

Last week, crypto investment products saw $726 million in outflows, the highest level since March. The US was the largest outflow, with $721 million, highlighting regional concerns ahead of a major economic event.

A recent CoinShares report attributes these negative outflows to the uncertainty surrounding a rate cut, which followed last week’s weak jobs report and other U.S. economic data , making traders and investors cautious about future market conditions.

“The negative sentiment was triggered by stronger-than-expected macroeconomic data last week, which raised the odds of a 25bp rate cut by the Fed. However, the daily outflows slowed after the jobs data fell short of expectations later in the week, and market sentiment diverged sharply on whether a 50bp cut would be possible. The market now awaits Tuesday’s Consumer Price Index (CPI) inflation report, where a weaker-than-expected inflation reading would further increase the odds of a 50bp cut,” the report said.

Read more: How to Trade Bitcoin ETFs: A Step-by-Step Approach

The CME Fed Watchtool's moves reflect this trend: The odds of a 50bp rate cut have risen to 55% since last Friday's jobs report, while the odds of a 25bp cut are now at 45%.

But on Monday, the tool showed a 75% chance of a 25bp cut and a 25% chance of a 50bp cut. The change underscores the ongoing uncertainty, with most expecting a rate cut at the Fed’s September 17-18 meeting, but the size of the cut is unclear.

This week’s US economic calendar, especially the August Consumer Price Index (CPI) report on Wednesday, could add to the uncertainty. The CPI data from the Bureau of Labor Statistics (BLS) will be crucial in shaping the Federal Reserve’s upcoming interest rate decision. Some experts argue that a rate cut could have a negative impact on Bitcoin .

Read more: How to invest in Ethereum ETFs?

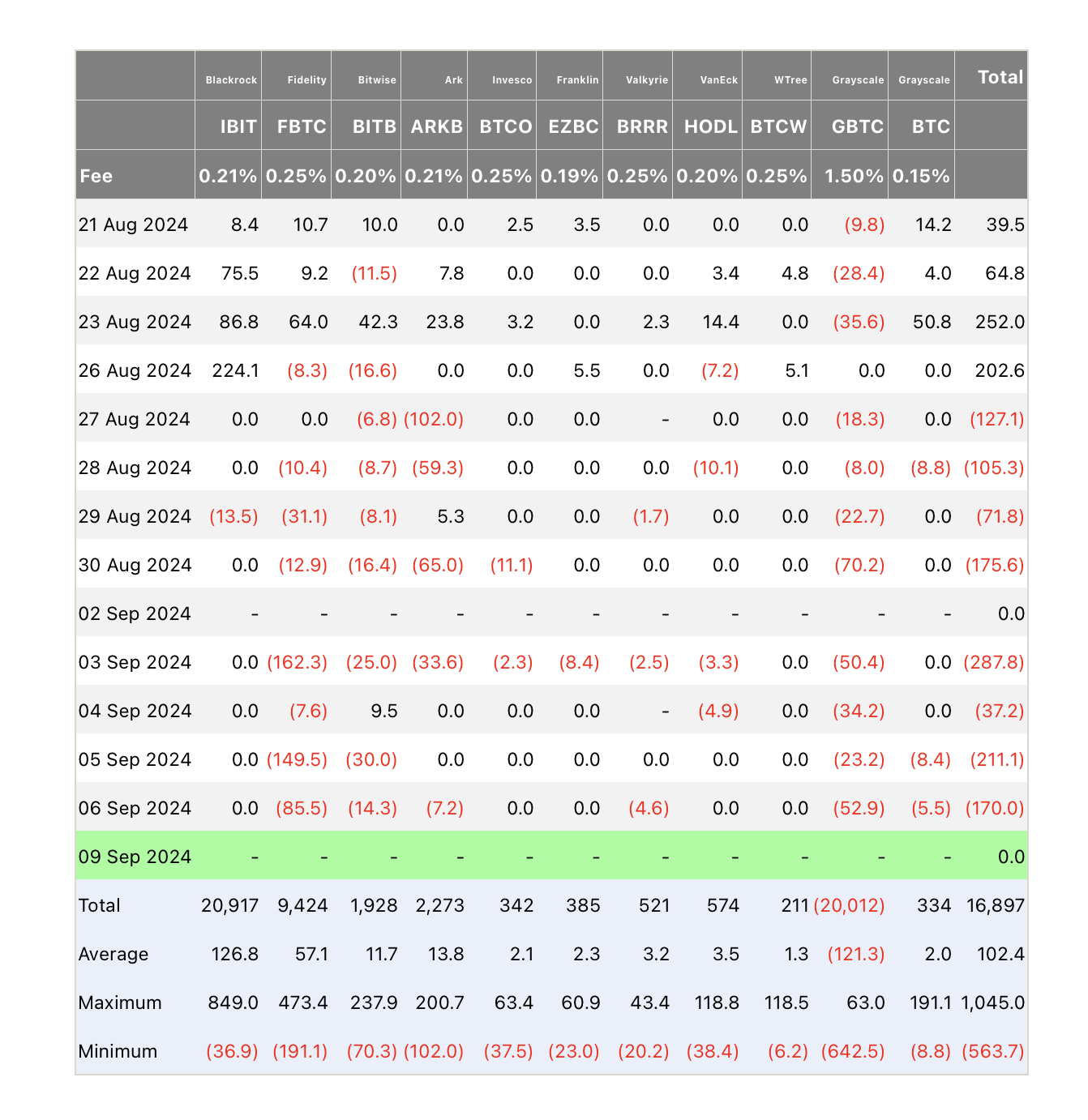

Meanwhile, according to a Bloomberg report , U.S. Bitcoin ETFs have seen their longest streak of net outflows since their listing, with investors pulling out nearly $1.2 billion over eight consecutive trading days through September 6.

Ethereum is also mirroring Bitcoin’s struggles, with institutional interest declining. According to Farside data, most Ethereum ETFs have seen near-zero inflows, while Grayscale reports negative outflows, accounting for Ethereum’s $98 million outflow last week.