Bitcoin (BTC) and the broader cryptocurrency markets are navigating a historically difficult September season.

In a recent report, Kaiko researchers explored the impact of a possible U.S. rate cut and other major economic events on Bitcoin. These four charts explain what to expect from Bitcoin in the coming weeks.

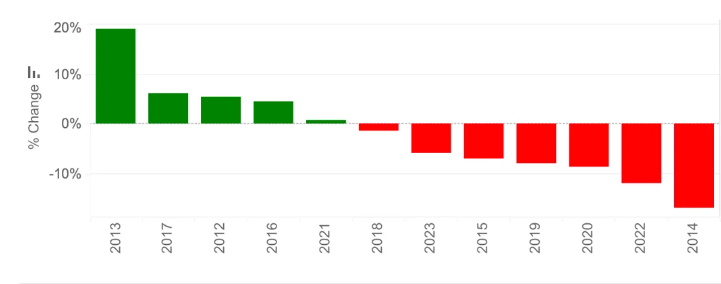

Bitcoin price monthly fluctuations in September

As BeInCrypto reported, the third quarter has historically been challenging for Bitcoin and the broader cryptocurrency markets , with September often bringing the worst returns. Kaiko notes that Bitcoin has fallen in September seven times in the past 12 years.

This pattern has continued into 2024 , with a 7.5% drop in August and a 6.3% drop so far in September . At the time of writing, Bitcoin is trading more than 20% below its recent high of nearly $73,500, which was reached five months ago.

Read more: How to Buy Bitcoin (BTC) and All You Need to Know

However, according to Kaiko Research, the upcoming U.S. rate cut could help riskier assets like Bitcoin, a view shared by Alvin Kahn, COO of Bitget Wallet.

“At the Jackson Hole meeting, Federal Reserve Chairman Jerome Powell suggested that policy adjustments may be necessary. This has increased expectations of a rate cut in the future. The US dollar index has plunged and is currently hovering around 100. Once the September rate cuts officially begin, overall market liquidity will improve, which will benefit crypto assets,” Khan told BeInCrypto.

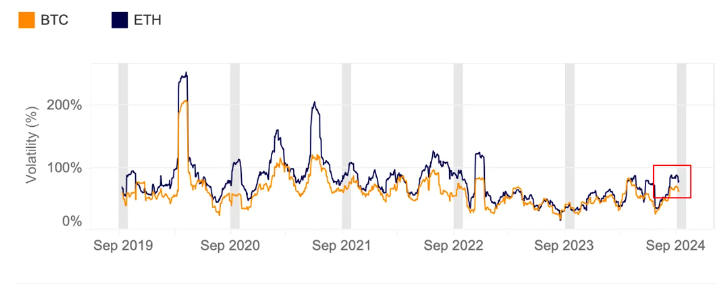

30-day historical volatility

According to the report, September is expected to be extremely volatile, with Bitcoin’s 30-day historical volatility soaring to 70%. This indicator measures the price movement of an asset over the past 30 days, reflecting how dramatically the price has changed during that period.

Bitcoin's current volatility is nearly double last year's levels and is approaching its peak in March, when Bitcoin hit a high of over $73,000.

Ethereum (ETH) has also seen increased volatility, driven by ETH-specific events such as the liquidation of jump trades and the launch of an Ethereum ETF .

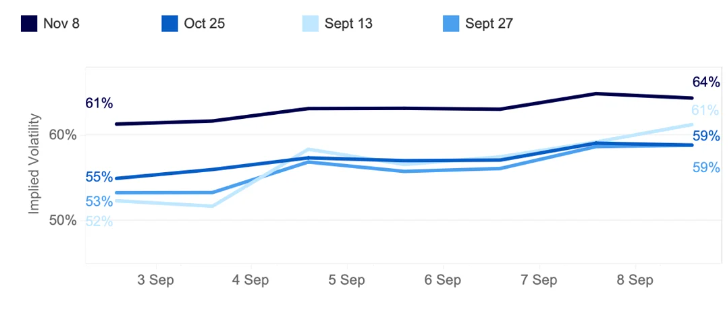

BTC Implied Volatility by Maturity

Since early September, Bitcoin’s implied volatility (IV) has been rising after a decline in late August. The IV indicator measures market expectations of future price movements based on current options trading activity. A high IV suggests that traders expect a large price move ahead, but does not specify the direction of the move.

In particular, short-term option expirations saw the largest increase, with September 13 expirations rising from 52% to 61%, exceeding the end-of-month contract. Typically, when short-term implied volatility exceeds longer-term indicators, this is considered an “inversion” that signals heightened market stress.

Risk managers often interpret inversion patterns as a sign of high uncertainty or market stress. As a result, they may interpret it as reducing exposure to highly volatile assets or hedging their portfolios to hedge against potential downside.

“These market expectations are consistent with last week’s US jobs report, which dampened hopes for a 50bp contraction. However, the upcoming US CPI data could still change the odds,” the Kaiko researchers note.

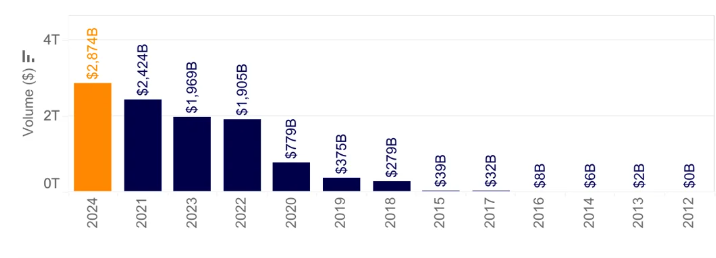

Trading volume

The Bitcoin trading volume chart highlights the current market volatility, with increasing trader participation. Cumulative trading volume is approaching $3 trillion, up nearly 20% in the first eight months of 2024 since the last peak in 2021.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

Traditionally, Bitcoin investors view rate cuts as a positive market catalyst. However, concerns remain about how a larger-than-expected cut will be interpreted by the market. Marcus Thielen, founder of 10X Research, warns that a 50 basis point rate cut could be interpreted as a signal of urgency , which could trigger a pullback in riskier assets like Bitcoin.

“A 50 basis point cut by the Fed would signal deeper concerns in the market, but the Fed’s primary focus is to mitigate economic risks, not manage market reactions,” Thielen told clients.

The upcoming US elections, along with speculation about a rate cut, are also contributing factors to the cryptocurrency market volatility. As BeInCrypto reports, the Donald Trump vs. Kamala Harris debate is expected to trigger moves in Bitcoin and Ethereum in particular.