Last Friday marked five days since the successful completion of the Chang hard fork, but the day was overshadowed by a massive sell-off and a drop in the price of Cardano (ADA). Despite this, the number of active addresses on the blockchain surged to a six-month high, signaling a potential bullish outlook as ADA briefly touched $0.35.

However, things have changed since then, and the coin now faces challenges that may prevent it from moving higher in the near term.

Cardano users slow to adopt latest changes

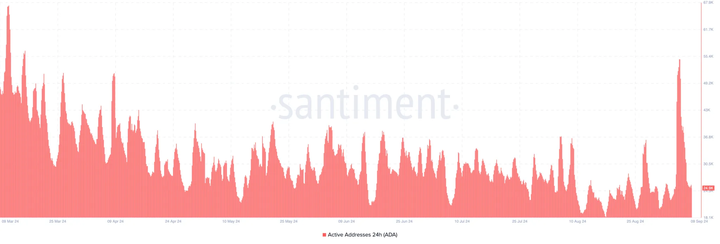

BeInCrypto, using on-chain data from Santiment, reports that on September 6, Cardano’s active addresses surged to 54,800, indicating a delayed positive response to the Chang hard fork and sparking predictions that ADA prices could approach $0.40. However, the 24-hour active address count has dropped to 24,900, reflecting a decline in user interest and engagement in the Cardano ecosystem. This sharp drop suggests that improvements to the network have yet to resonate with users. If this trend continues, it could cause Cardano’s price to fall further.

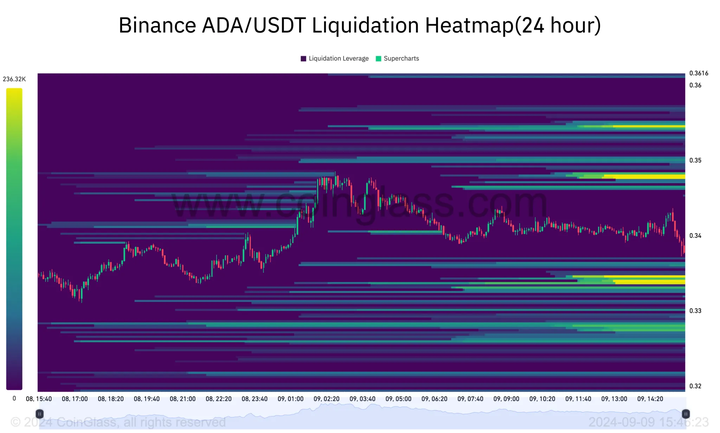

Liquidation heatmaps support this view by marking specific levels where price may fluctuate. In short, the heatmap identifies these high liquidity levels by changing from purple to yellow. Therefore, if there is a high concentration of liquidity at a certain moment, the price of the cryptocurrency may exert significant pressure to reach that level. In the case of Cardano, the liquidation heatmap shows many buy and sell orders at prices of $0.33, $0.34, and $0.35. However, the image below shows that the $0.33 area seems to have the highest liquidity. Therefore, the price of Cardano is likely to fall in this area.

Cardano (ADA) is in turbulent times

Cardano’s price has been in a volatile phase, with high volatility in recent times. After hitting a low of $0.3054 on September 7, ADA’s price has shown some bullish trends, breaking above $0.34, hinting at a possible recovery in the market. The cryptocurrency’s price has surged and is currently trading at around $0.3397, reflecting a general recovery in digital currencies. This positive price action has been accompanied by an increase in trading volumes and open interest, indicating growing investor confidence.

However, there are concerns about the impact of recently revealed mysterious wallet transactions involving a top Cardano wallet that initiated a large transaction that happened to occur during severe network congestion associated with the launch of the new platform.

The trouble continues

On the daily chart, Cardano’s price has formed a bearish divergence with the Moving Average Convergence Divergence (MACD) indicator, which measures momentum. Bearish divergence occurs when the trend of the MACD is inconsistent with the price action. Recently, ADA jumped to $0.34 after rising between August 25 and September 6. However, the negative MACD reading suggests that buying volume does not support the uptrend. Therefore, the price may reverse next. Using the Fibonacci retracement indicator, ADA’s price may once again try to retest $0.35. This is likely to face resistance in the same area.

Therefore, a drop to $0.30 could become a reality. However, this prediction will be invalidated if the momentum turns extremely bullish. If this happens, Cardano could climb to $0.39.

in short

ADA's active addresses surged on September 6, but have been declining since then, indicating waning interest and a potential downtrend. At the same time, ADA's liquidity heatmap shows that liquidity is dense at $0.33, which may be the key to influencing its price trend. Despite the recent price jump to $0.34, the bearish MACD divergence suggests that the price may reverse to $0.30. Currently, the price of ADA is rubbing around $0.34. In the short term, the price has risen as the market recovers, but it is worth noting that technical indicators and other indicators indicate a potential downtrend. It is expected that it will experience a period of consolidation and accumulation after the price rise in preparation for a breakthrough of $0.4.