Table of Contents

ToggleBitcoin spot ETF capital outflows suspended

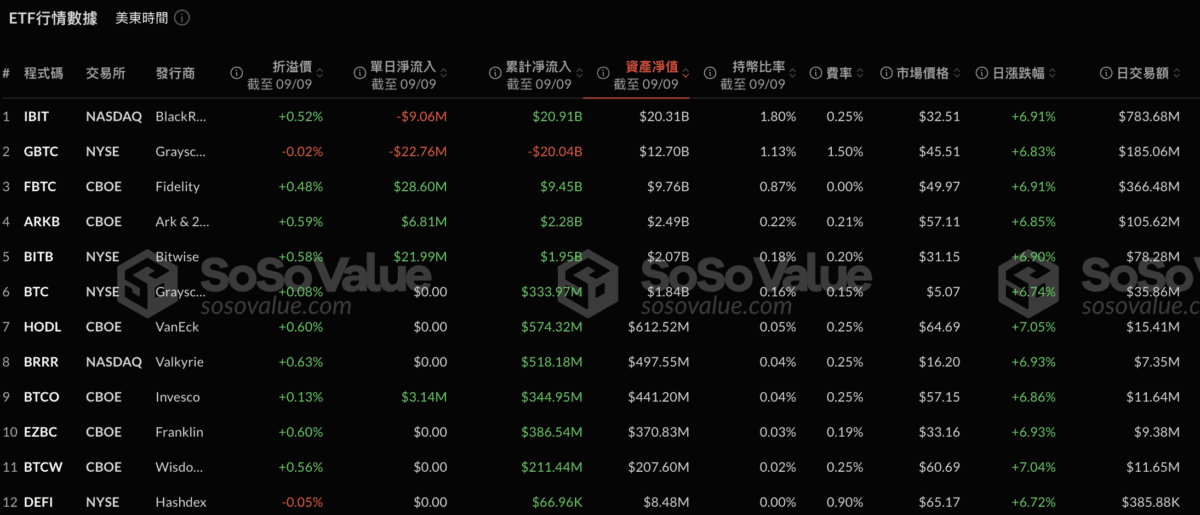

The U.S. Bitcoin spot ETF ended eight consecutive days of outflows on Monday, reporting net inflows of $28.72 million.

According to data from SoSoValue, Fidelity's FBTC ranked first in net inflows yesterday with $28.6 million, followed by Bitwise's BITB with an inflow of $21.99 million. Ark Invest and 21Share’s ARKB recorded smaller inflows of $6.81 million, while Invesco’s BTCO saw $3.14 million.

However, some of these inflows were offset by Grayscale's GBTC and BlackRock's IBIT, which recorded net outflows of $22.76 million and $9.06 million respectively. IBIT has been experiencing outflows or zero inflows since August 26.

Ethereum ETF continues outflows

Compared with Bitcoin ETFs, Ethereum ETFs continue to maintain capital outflows. Yesterday, the U.S. Ethereum spot ETF once again recorded a net outflow of US$5.2 million, reaching the fifth consecutive day.

Data from SoSoValue showed that Grayscale’s ETHE reported a net outflow of $22.64 million, the only ether spot ETF to record an outflow yesterday.

Total daily trading volume for the nine Ethereum ETFs fell to $124.51 million on Monday, down from $210.43 million on Friday. The cumulative net flows of these ETFs since their listing are still negative, with cumulative net outflows reaching US$573.49 million.